Walmart Inc. — WMT

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $127.95 | $1.02T | 47.0 | 38.9 | 20.7% | 18.5% | $0.99 0.8% | 10.2 |

Latest Headlines

- · Walmart FTC Settlement Reshapes Driver Pay Transparency And Delivery Economics

- · Walmart to pay $100M to settle claims it misled delivery drivers

- · How to Fight AI? The ‘Rolex Effect’ Could Lift Apple and Other Consumer Brands.

- · Walmart's Sales and Profit Growth Should Boost EPS and Valuation, BofA Says

- · Block upgraded, Duolingo downgraded: Wall Street's top analyst calls

- · Mama’s Creations price target raised to $24 from $20 at Maxim

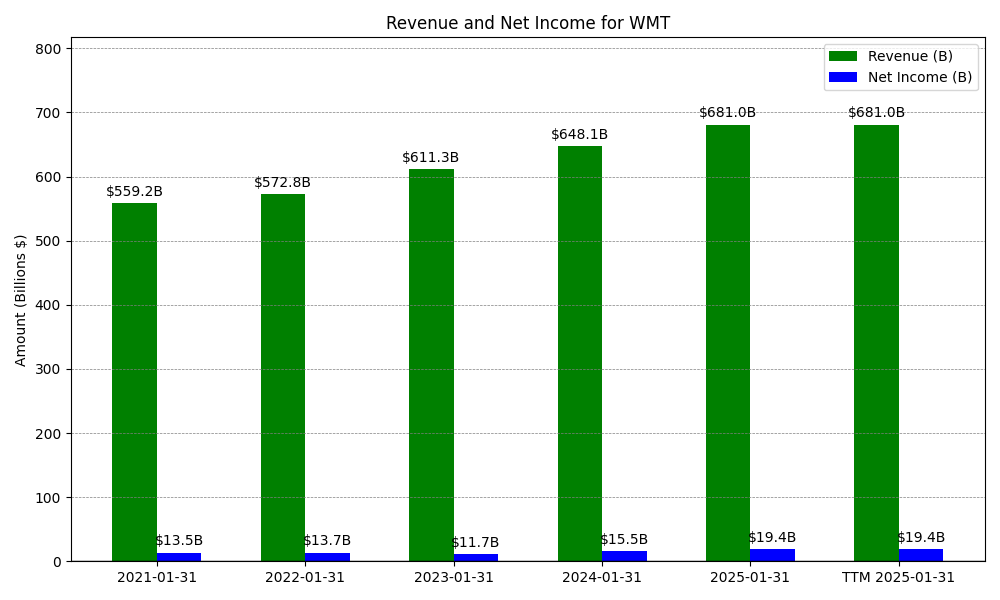

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

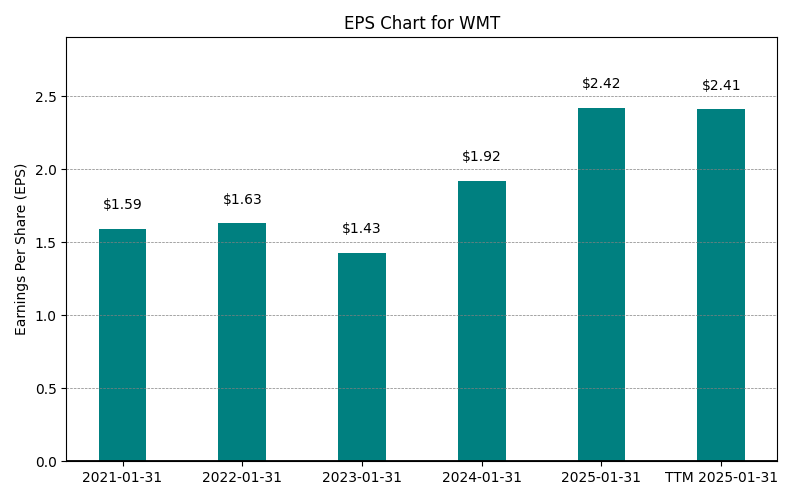

| 0 | 2021-01-31 | $559,151M | $13,510M | $1.59 | 2024-04-16 21:20:22 | N/A | N/A | N/A |

| 1 | 2022-01-31 | $572,754M | $13,673M | $1.63 | 2026-02-27 22:07:53 | 2.4% | 1.2% | 2.7% |

| 2 | 2023-01-31 | $611,289M | $11,680M | $1.43 | 2026-02-27 22:07:53 | 6.7% | -14.6% | -12.4% |

| 3 | 2024-01-31 | $648,125M | $15,511M | $1.92 | 2026-02-27 22:07:53 | 6.0% | 32.8% | 34.3% |

| 4 | 2025-01-31 | $680,985M | $19,436M | $2.42 | 2026-02-27 22:07:53 | 5.1% | 25.3% | 26.0% |

| 5 | TTM 2026-01-31 | $522,507M | $17,656M | $2.72 | 2026-02-23 08:51:02 | -23.3% | -9.2% | 12.4% |

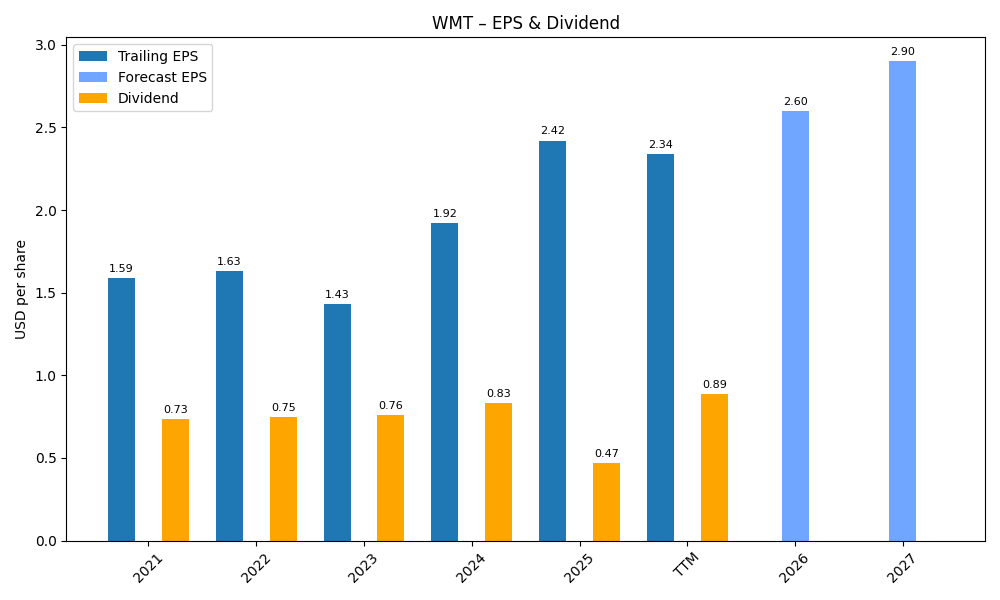

EPS

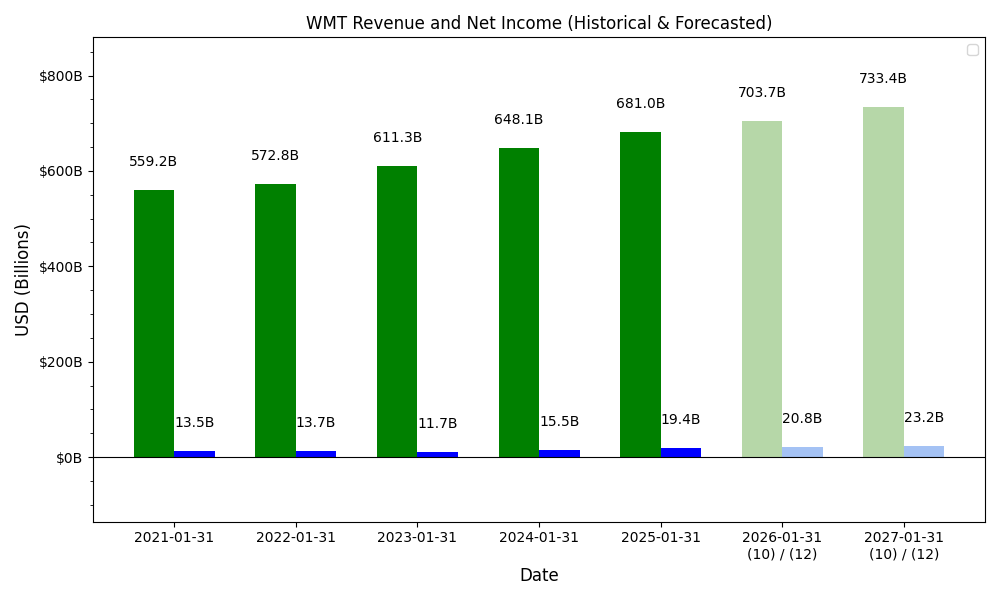

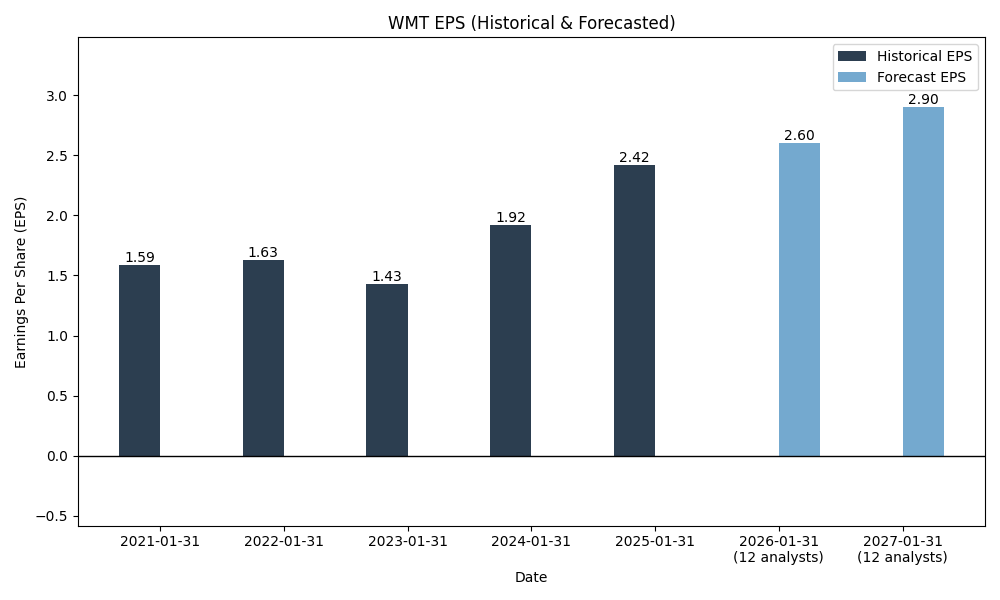

Forecasts

Y/Y % Change

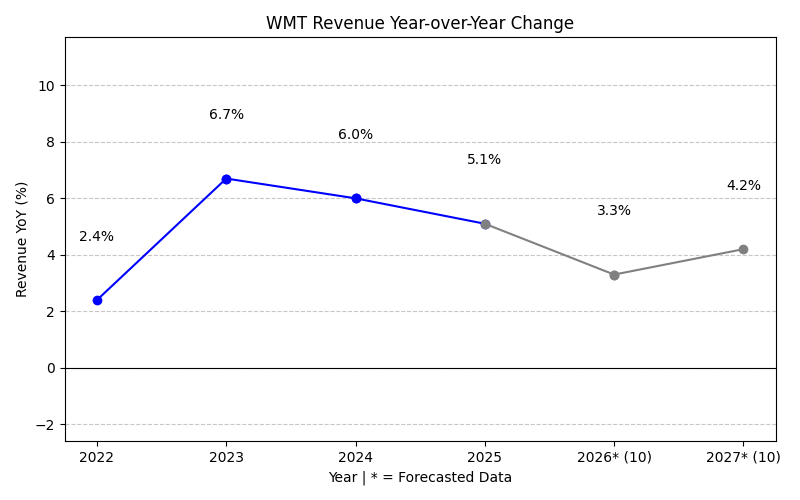

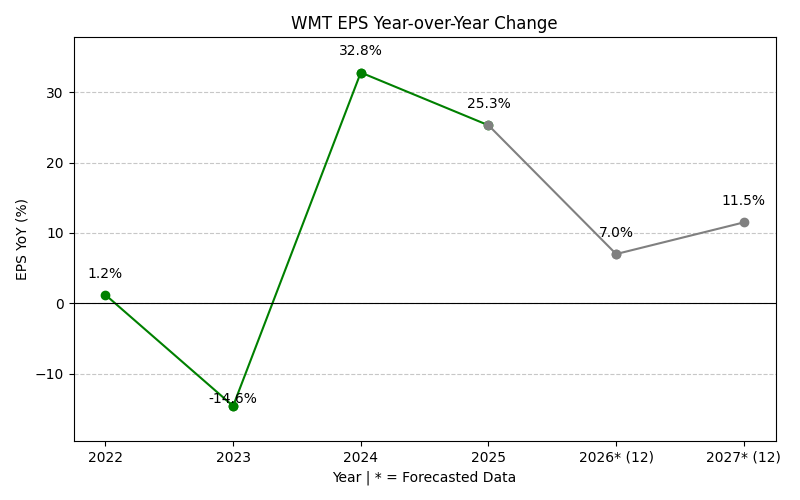

WMT Year-over-Year Growth

| 2021 | 2022 | 2023 | 2024 | 2025 | 2027 | 2028 | Average | |

|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 2.4% | 6.7% | 6.0% | 5.1% | 9.5% | 4.7% | 5.7% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 8 | 8 | |

| EPS Growth (%) | 1.2% | -14.6% | 32.8% | 25.3% | 17.7% | 12.9% | 12.6% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 11 | 11 |

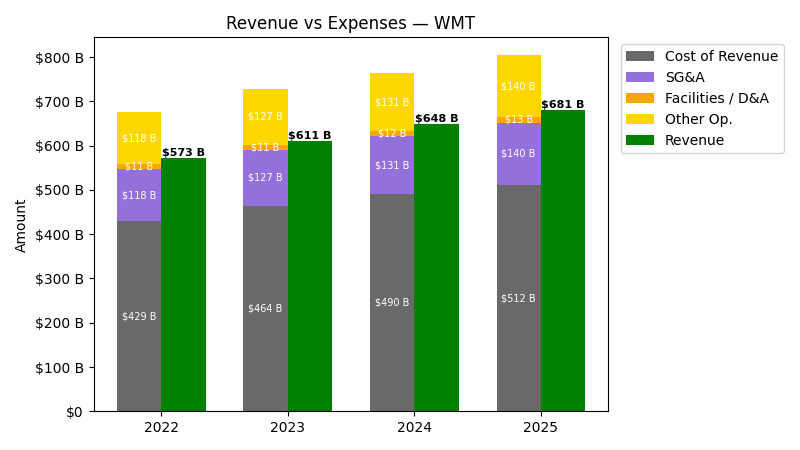

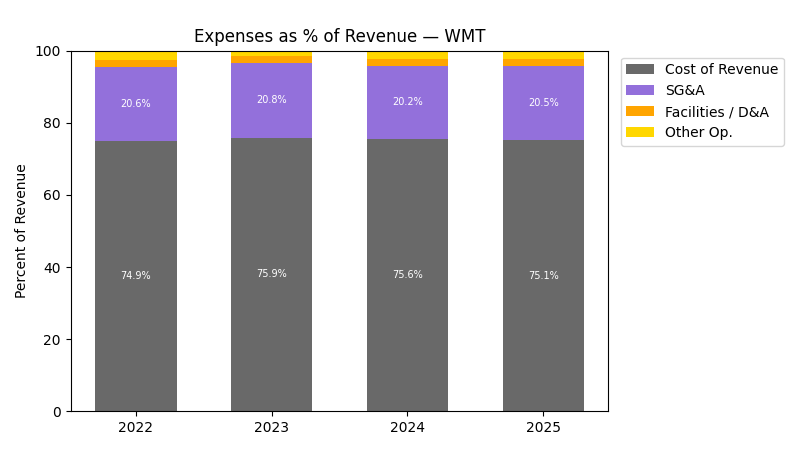

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|

| 2022 | $572.8B | $418.3B | $117.8B | $10.7B |

| 2023 | $611.3B | $452.8B | $127.1B | $10.9B |

| 2024 | $648.1B | $478.3B | $131.0B | $11.9B |

| 2025 | $681.0B | $498.8B | $139.9B | $13.0B |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|

| 2023 | 6.73 | 8.23 | 7.92 | 2.69 |

| 2024 | 6.03 | 5.63 | 3.01 | 8.30 |

| 2025 | 5.07 | 4.28 | 6.81 | 9.45 |

No unmapped expenses.

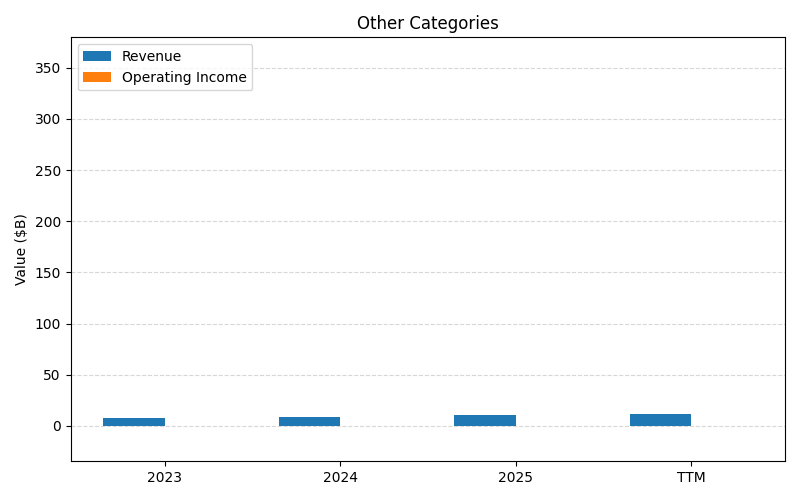

Segment Performance

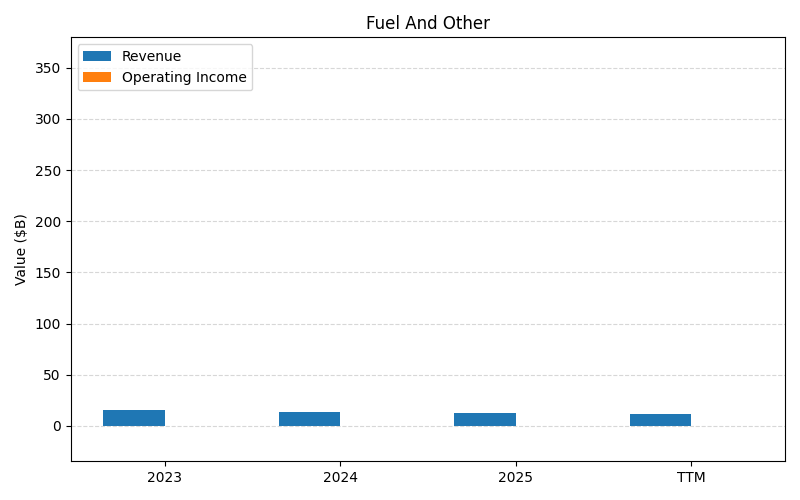

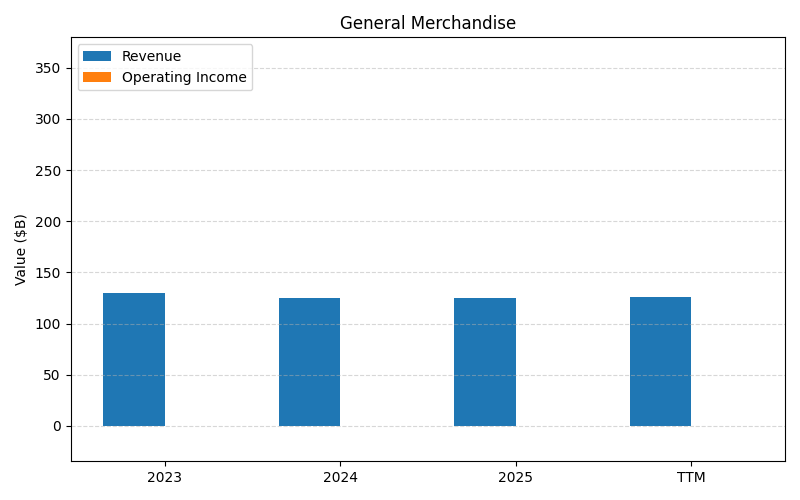

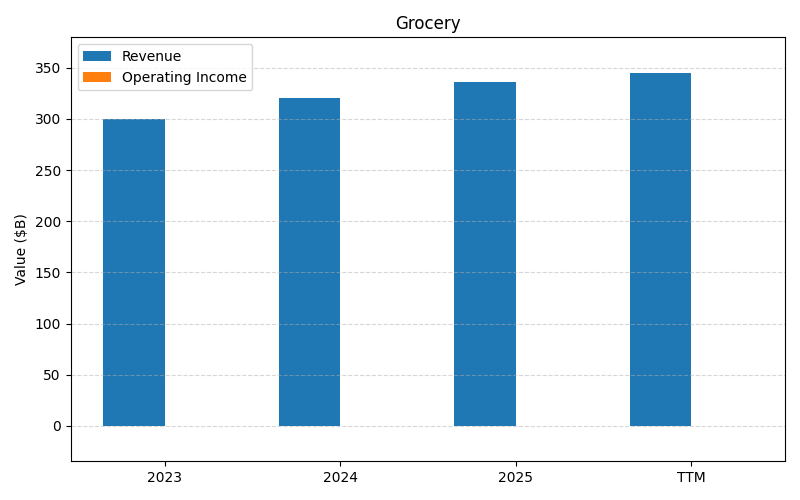

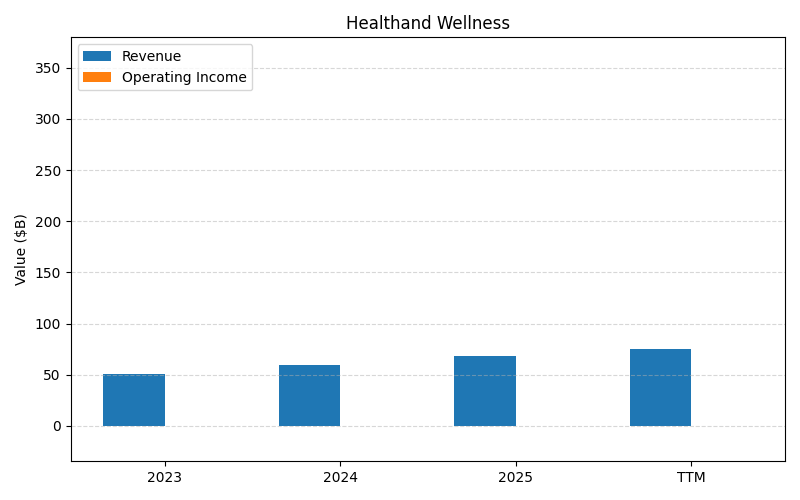

SEGMENTS v2025-09-09 · 2026-02-27 22:08 UTC — Units: $T. Rows list fiscal years (last 3 + TTM) with revenue for each segment; the final row shows the TTM revenue mix (operating income columns display “—” where mix is not applicable).

| Year | Grocery Rev | General Merchandise Rev | Healthand Wellness Rev | Fuel And Other Rev | Other Categories Rev | Total Rev |

|---|---|---|---|---|---|---|

| 2023 | 0.30T | 0.13T | 0.05T | 0.02T | 0.01T | 0.50T |

| 2024 | 0.32T | 0.13T | 0.06T | 0.01T | 0.01T | 0.53T |

| 2025 | 0.34T | 0.13T | 0.07T | 0.01T | 0.01T | 0.55T |

| TTM | 1.34T | 0.49T | 0.27T | 0.05T | 0.04T | 2.19T |

| % of Total (TTM) | 61.1% | 22.3% | 12.3% | 2.4% | 1.9% | 100% |

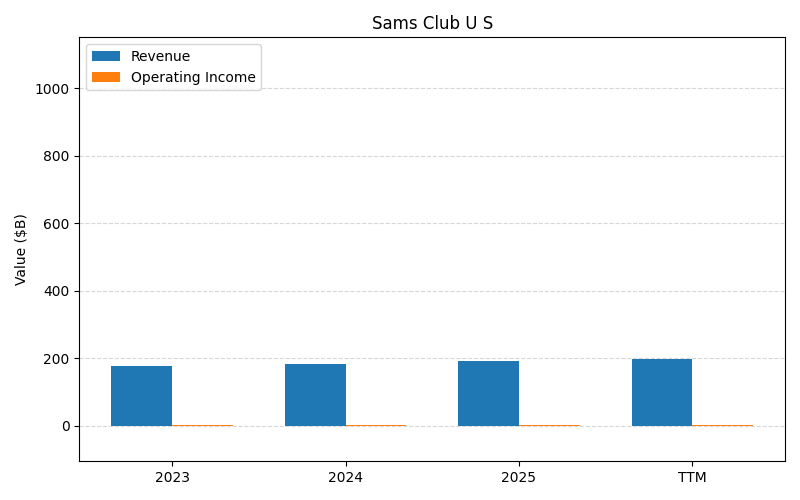

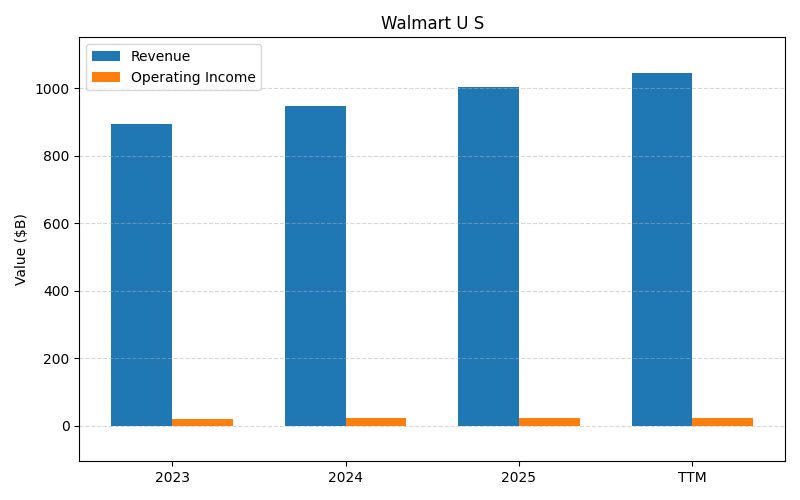

Segment Performance (Axis 2)

SEGMENTS v2025-09-09 · 2026-02-27 22:08 UTC — Units: $T. Rows list fiscal years (last 3 + TTM) with revenue and operating income for each segment; the final row shows the TTM revenue mix (operating income columns display “—” where mix is not applicable).

| Year | Walmart U S Rev | Walmart U S OI | Walmart International Rev | Walmart International OI | Sams Club U S Rev | Sams Club U S OI | Total Rev | Total OI |

|---|---|---|---|---|---|---|---|---|

| 2023 | 0.89T | 0.02T | 0.32T | 0.00T | 0.18T | 0.00T | 1.39T | 0.03T |

| 2024 | 0.95T | 0.02T | 0.37T | 0.00T | 0.18T | 0.00T | 1.50T | 0.03T |

| 2025 | 1.00T | 0.02T | 0.40T | 0.01T | 0.19T | 0.00T | 1.59T | 0.03T |

| TTM | 3.98T | 0.09T | 1.57T | 0.02T | 0.77T | 0.01T | 6.32T | 0.12T |

| % of Total (TTM) | 63.0% | — | 24.9% | — | 12.1% | — | 100% | — |

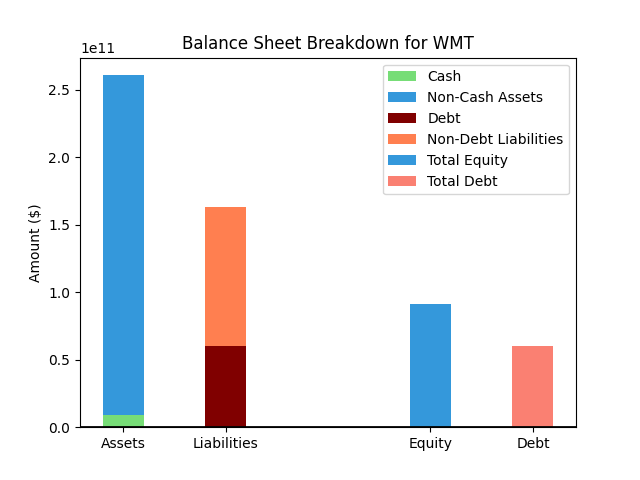

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $288,655M |

| 1 | Cash | $10,582M |

| 2 | Total Liabilities | $186,143M |

| 3 | Total Debt | $68,424M |

| 4 | Total Equity | $96,094M |

| 5 | Debt to Equity Ratio | 0.71 |

EPS & Dividend

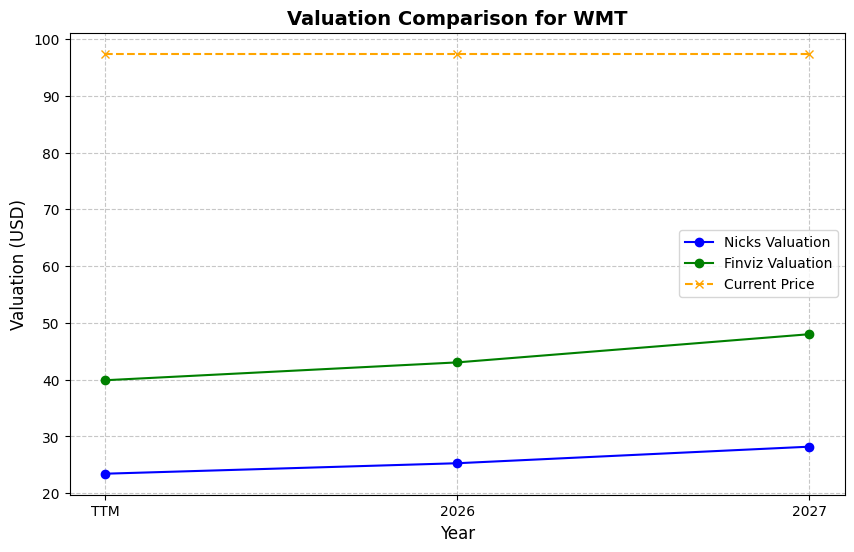

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $127.95 | 4.0% | Nicks Growth: 4% Nick's Expected Margin: 2% FINVIZ Growth: 12% |

Nicks: 10 Finviz: 22 |

Nick's: 0.201 | 2.0 | 47.0 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $2.72 EPS | TTM | $27.30 | -78.7% | $58.93 | -53.9% |

| $2.87 EPS | 2027 | $28.81 | -77.5% | $62.18 | -51.4% |

| $3.24 EPS | 2028 | $32.52 | -74.6% | $70.20 | -45.1% |

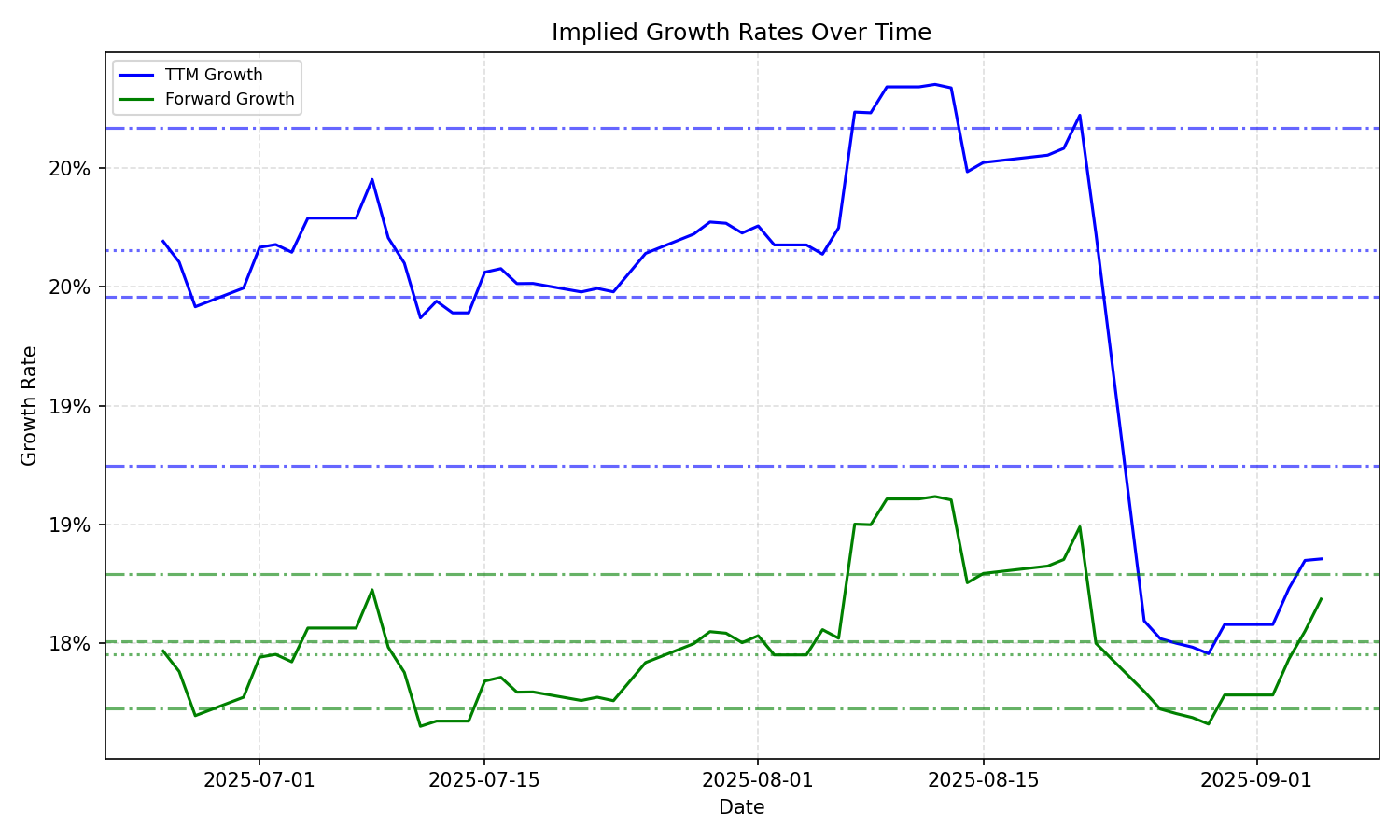

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 19.16% | 18.46% | 19.02% | 18.33% | 0.72% | 0.58% | 20.44% | 18.23% | 95.5% | 36.2% |

| 3 Years | 19.16% | 18.46% | 19.02% | 18.33% | 0.72% | 0.58% | 20.44% | 18.23% | 95.5% | 36.2% |

| 5 Years | 19.16% | 18.46% | 19.02% | 18.33% | 0.72% | 0.58% | 20.44% | 18.23% | 95.5% | 36.2% |

| 10 Years | 19.16% | 18.46% | 19.02% | 18.33% | 0.72% | 0.58% | 20.44% | 18.23% | 95.5% | 36.2% |