VeriSign, Inc. — VRSN

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $227.94 | $21.13B | 25.9 | 22.4 | 13.9% | 12.4% | $3.24 1.4% | -9.7 |

Latest Headlines

- · Warren Buffett Avoided Tech Stocks for 60 Years — His Last Move as CEO Was Buying This Stock

- · Why Citi Views VeriSign, Inc. (VRSN)’s Dip as an Attractive Entry Point

- · VeriSign Stock: Is Wall Street Bullish or Bearish?

- · US Stock Market Today S&P 500 Futures Edge Higher As Chip Demand Strengthens

- · The VeriSign, Inc. (NASDAQ:VRSN) Full-Year Results Are Out And Analysts Have Published New Forecasts

- · VeriSign (VRSN) Valuation Check After Recent Share Price Softness And Mixed Momentum

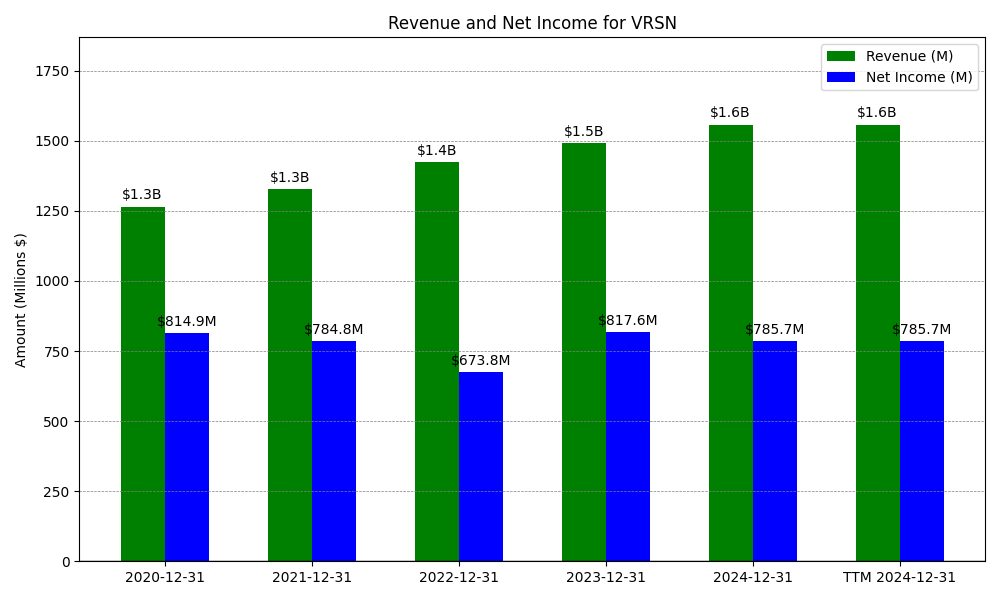

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

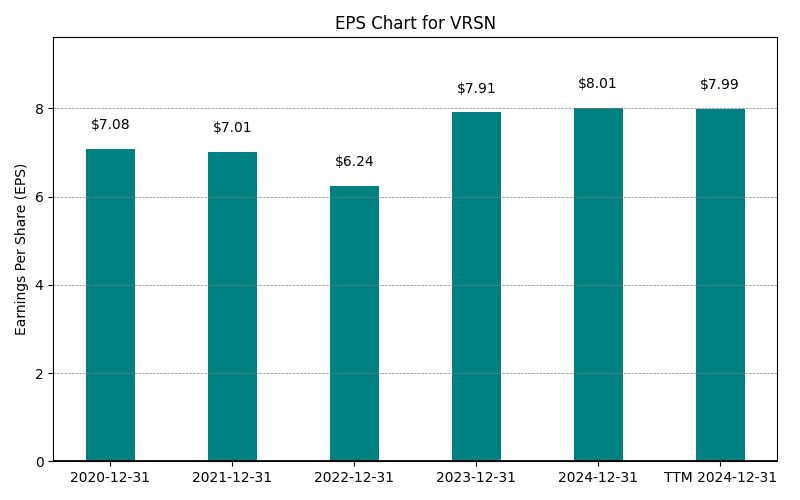

| 0 | 2020-12-31 | $1,265M | $815M | $7.08 | 2024-02-09 04:07:31 | N/A | N/A | N/A |

| 1 | 2021-12-31 | $1,328M | $785M | $7.01 | 2026-02-06 08:43:52 | 4.9% | -3.7% | -1.0% |

| 2 | 2022-12-31 | $1,425M | $674M | $6.24 | 2026-02-27 22:07:34 | 7.3% | -14.1% | -11.0% |

| 3 | 2023-12-31 | $1,493M | $818M | $7.91 | 2026-02-27 22:07:34 | 4.8% | 21.3% | 26.8% |

| 4 | 2024-12-31 | $1,557M | $786M | $8.01 | 2026-02-27 22:07:34 | 4.3% | -3.9% | 1.3% |

| 5 | 2025-12-31 | $1,657M | $826M | $8.83 | 2026-02-27 22:07:34 | 6.4% | 5.1% | 10.2% |

| 6 | TTM 2025-12-31 | $1,657M | $826M | $8.81 | 2026-02-09 08:52:34 | 0.0% | 0.0% | -0.2% |

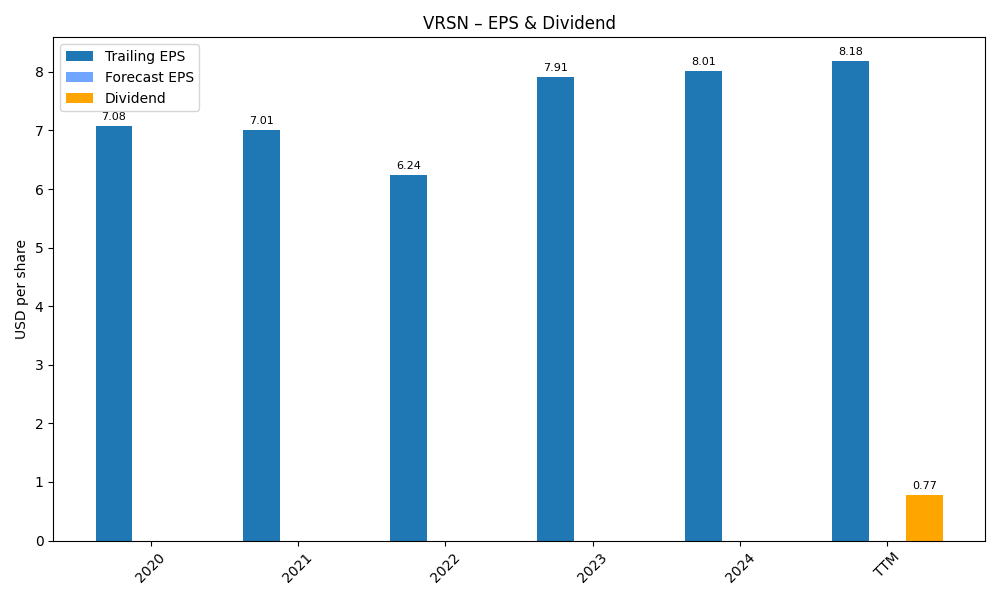

EPS

Forecasts

Y/Y % Change

VRSN Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 4.9% | 7.3% | 4.8% | 4.3% | 6.4% | 5.0% | 5.7% | 5.5% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | |

| EPS Growth (%) | -3.7% | -14.1% | 21.3% | -3.9% | 5.1% | 4.1% | 9.8% | 2.7% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

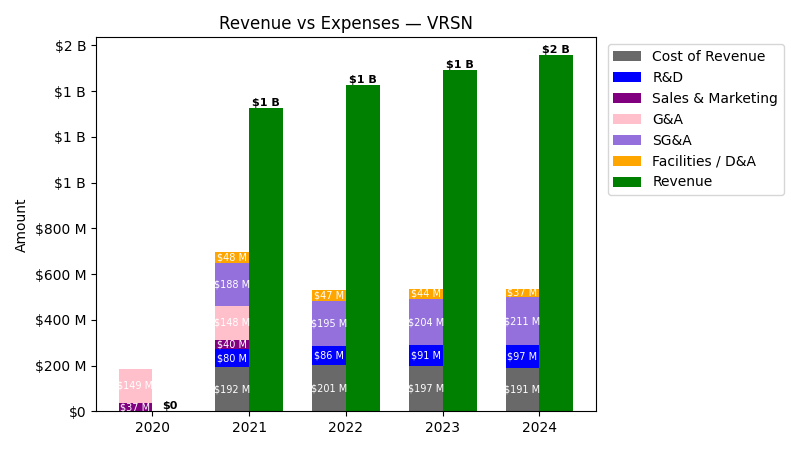

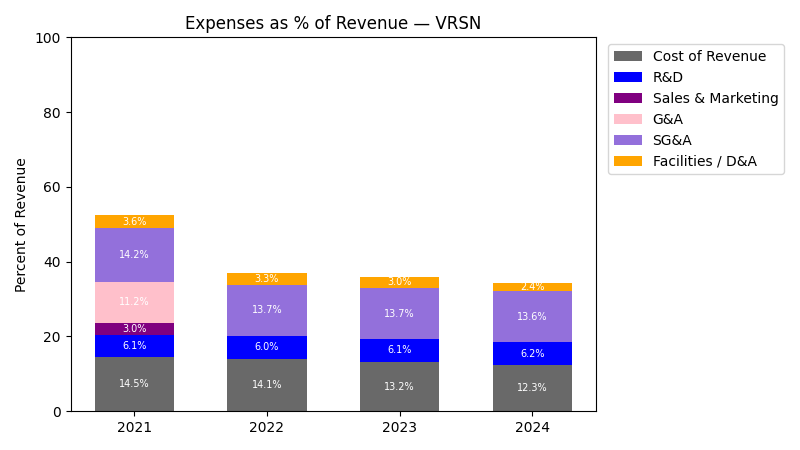

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | R&D ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|---|

| 2022 | $1.4B | $153.8M | $85.7M | $195.4M | $46.9M |

| 2023 | $1.5B | $153.2M | $91.0M | $204.2M | $44.1M |

| 2024 | $1.6B | $154.5M | $96.7M | $211.1M | $36.9M |

| 2025 | $1.7B | $165.1M | $103.6M | $235.7M | $31.2M |

| TTM | $1.7B | $165.1M | $103.6M | $235.7M | $31.2M |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | R&D Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|---|

| 2023 | 4.79 | -0.39 | 6.18 | 4.50 | -5.97 |

| 2024 | 4.31 | 0.85 | 6.26 | 3.38 | -16.33 |

| 2025 | 6.37 | 6.86 | 7.14 | 11.65 | -15.45 |

| TTM | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

No unmapped expenses.

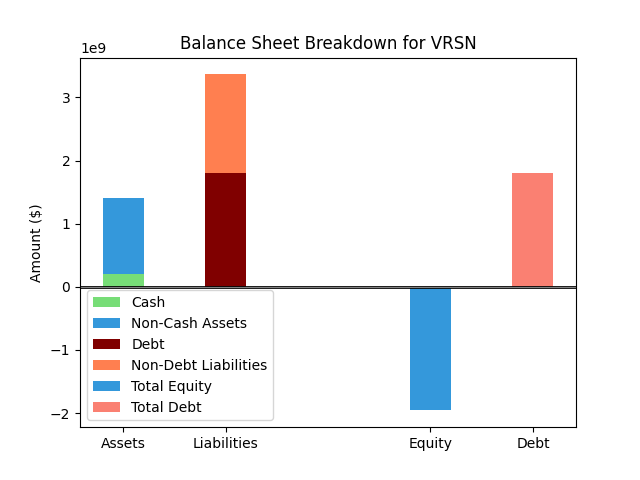

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $1,404M |

| 1 | Cash | $235M |

| 2 | Total Liabilities | $3,454M |

| 3 | Total Debt | $1,794M |

| 4 | Total Equity | $-2,050M |

| 5 | Debt to Equity Ratio | -0.87 |

EPS & Dividend

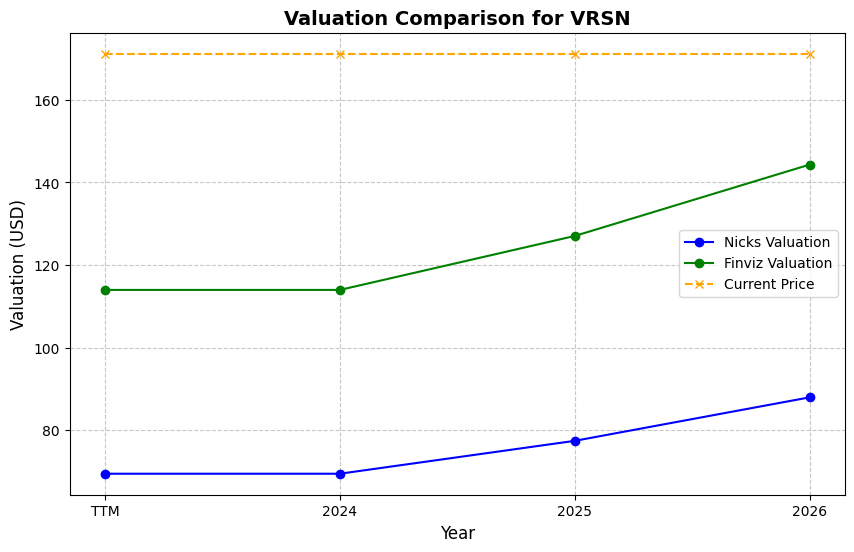

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $227.94 | 4.0% | Nicks Growth: 3% Nick's Expected Margin: 55% FINVIZ Growth: 10% |

Nicks: 9 Finviz: 17 |

Nick's: 4.993 | 12.8 | 25.9 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $8.81 EPS | TTM | $79.98 | -64.9% | $153.63 | -32.6% |

| $9.27 EPS | 2026 | $84.16 | -63.1% | $161.65 | -29.1% |

| $10.18 EPS | 2027 | $92.42 | -59.5% | $177.52 | -22.1% |

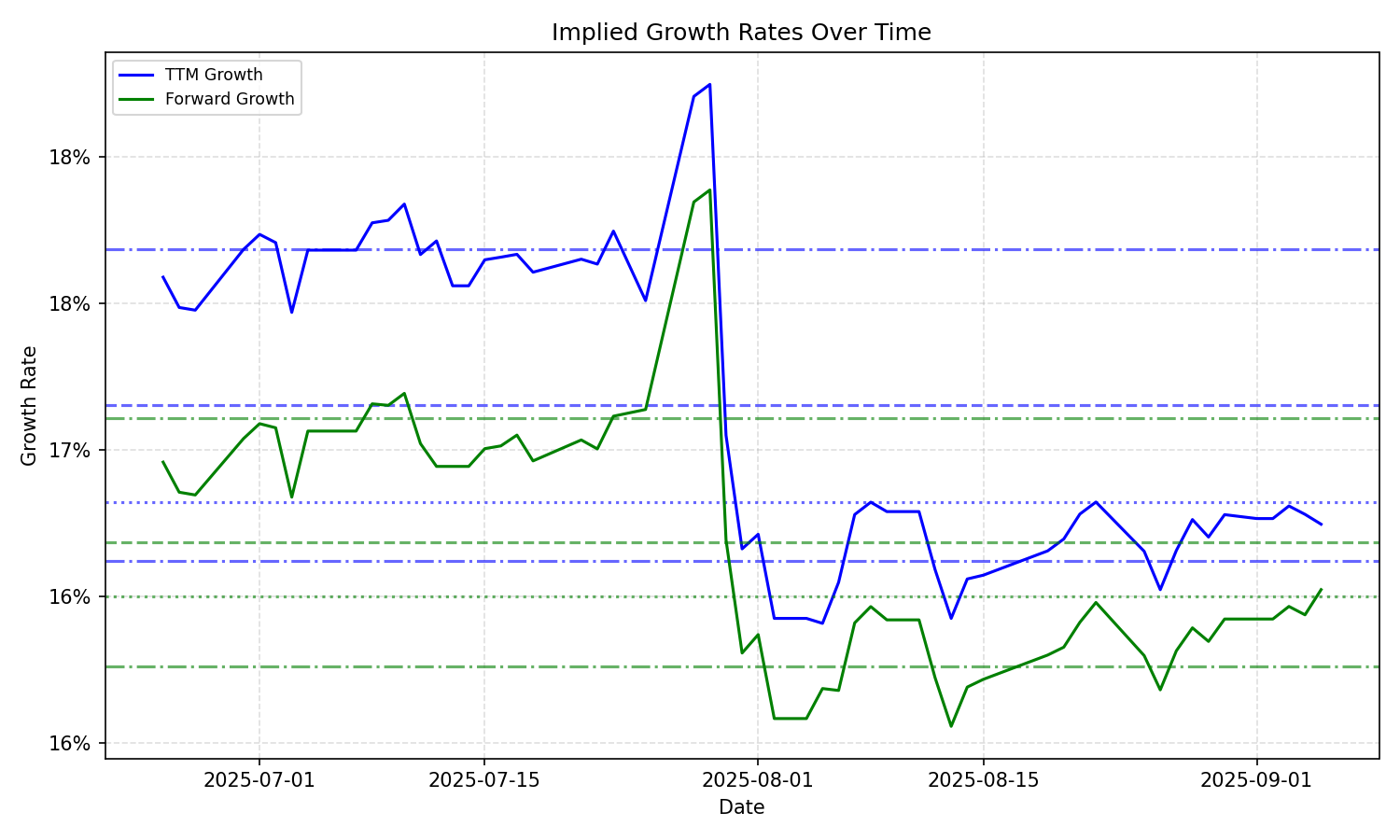

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 16.07% | 15.45% | 16.24% | 15.87% | 1.19% | 1.51% | 13.86% | 12.28% | 8.0% | 8.5% |

| 3 Years | 16.07% | 15.45% | 16.24% | 15.87% | 1.19% | 1.51% | 13.86% | 12.28% | 8.0% | 8.5% |

| 5 Years | 16.07% | 15.45% | 16.24% | 15.87% | 1.19% | 1.51% | 13.86% | 12.28% | 8.0% | 8.5% |

| 10 Years | 16.07% | 15.45% | 16.24% | 15.87% | 1.19% | 1.51% | 13.86% | 12.28% | 8.0% | 8.5% |