United Airlines Holdings, Inc. — UAL

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $106.30 | $34.41B | 10.4 | 7.0 | 4.4% | 0.4% | - | 2.3 |

Latest Headlines

- · Is It Too Late To Consider United Airlines Holdings (UAL) After Its Strong 1‑Year Run?

- · United Airlines, Delta Stocks Fall. Why Airlines Are Getting Crushed.

- · Stock Market Leaders Tend To Have Bullish Relative Strength Lines. Here's How To Find Them.

- · Jefferies Cuts United Airlines (UAL) Target to $148, Sees Strong Travel Demand

- · American Airlines (AAL) Down 0.9% Since Last Earnings Report: Can It Rebound?

- · Here's Why United Airlines (UAL) is a Strong Momentum Stock

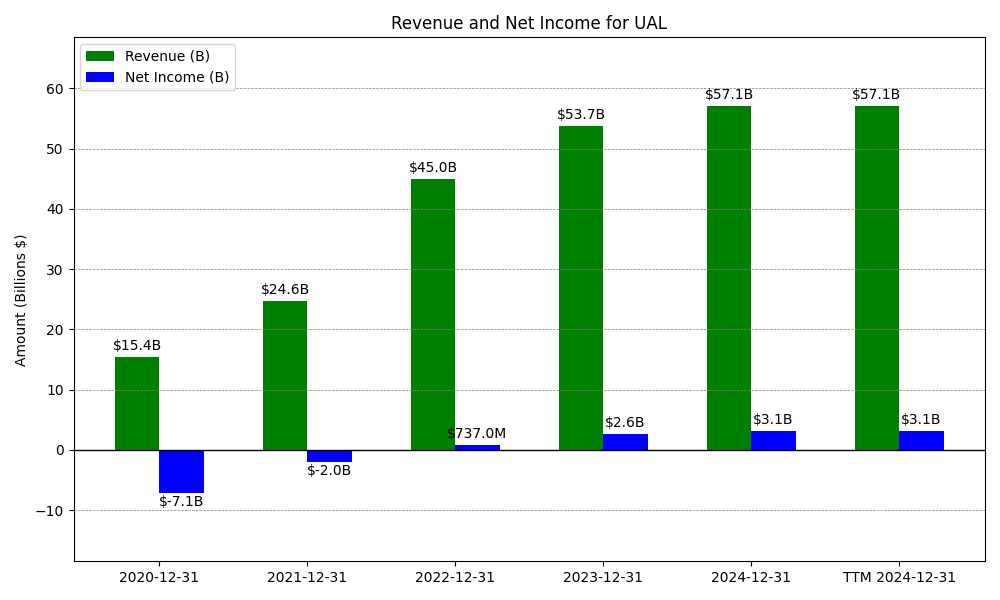

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

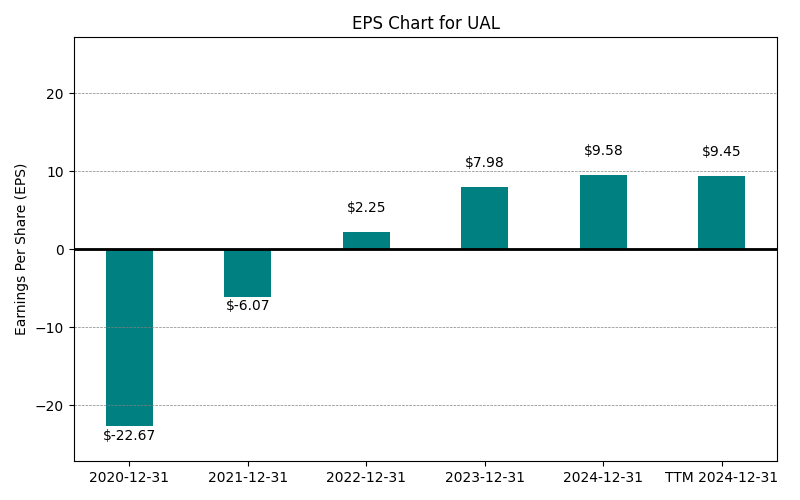

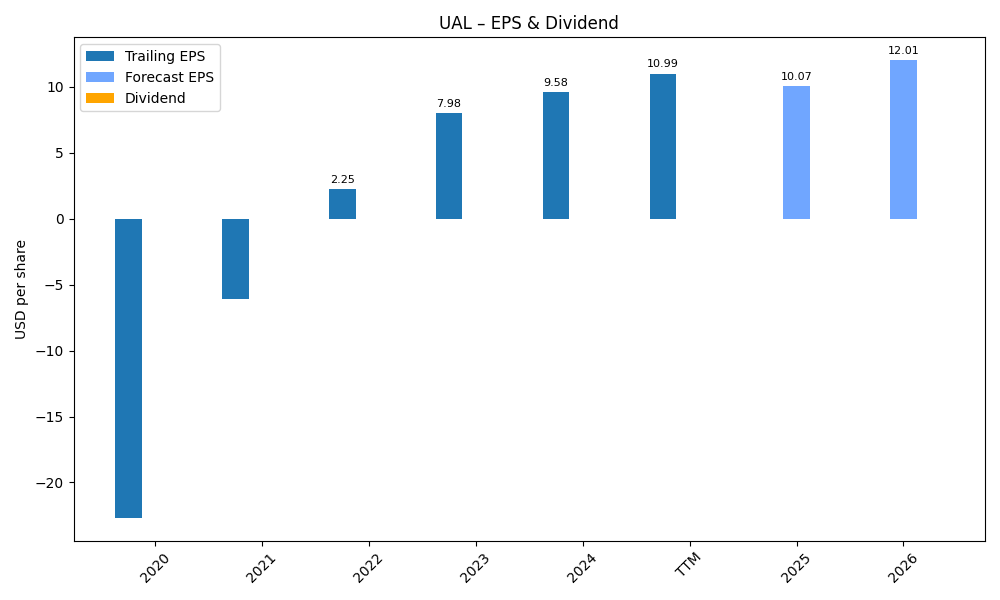

| 0 | 2020-12-31 | $15,355M | $-7,069M | $-22.67 | 2024-02-08 22:12:48 | N/A | N/A | N/A |

| 1 | 2021-12-31 | $24,634M | $-1,964M | $-6.07 | 2026-02-13 08:46:28 | 60.4% | -72.2% | -73.2% |

| 2 | 2022-12-31 | $44,955M | $737M | $2.25 | 2026-02-27 22:06:42 | 82.5% | -137.5% | -137.2% |

| 3 | 2023-12-31 | $53,717M | $2,618M | $7.98 | 2026-02-27 22:06:42 | 19.5% | 255.2% | 254.0% |

| 4 | 2024-12-31 | $57,063M | $3,149M | $9.60 | 2026-02-27 22:06:42 | 6.2% | 20.3% | 20.3% |

| 5 | 2025-12-31 | $59,070M | $3,353M | $10.37 | 2026-02-27 22:06:42 | 3.5% | 6.5% | 7.9% |

| 6 | TTM 2025-12-31 | $59,069M | $3,353M | $10.20 | 2026-01-22 08:31:19 | -0.0% | 0.0% | -1.6% |

EPS

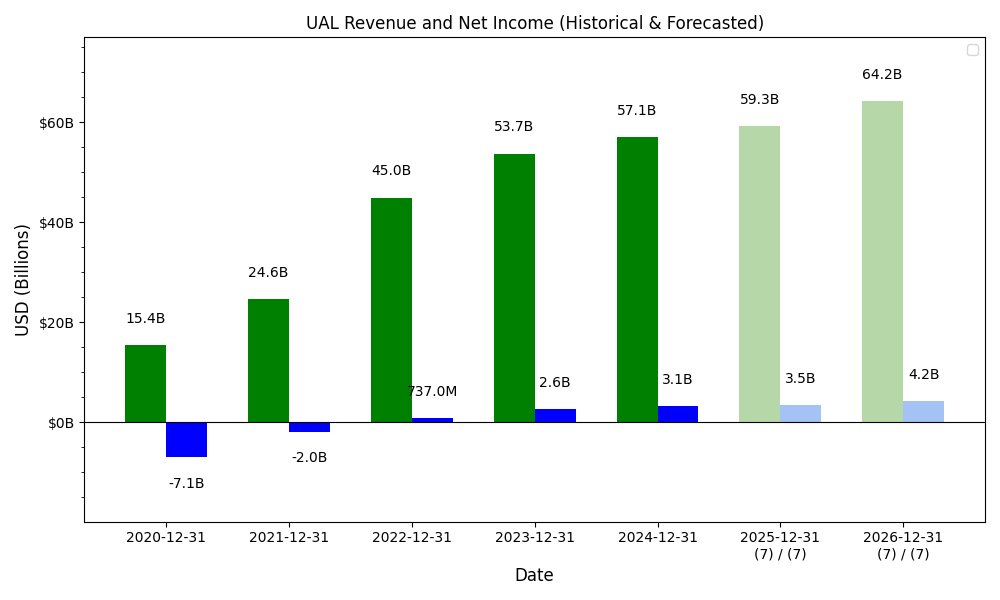

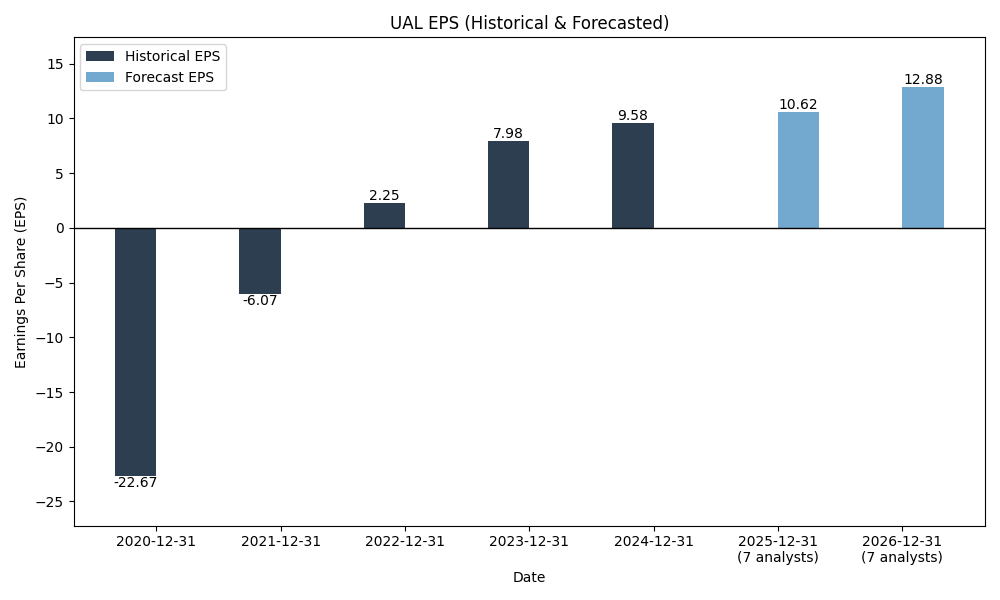

Forecasts

Y/Y % Change

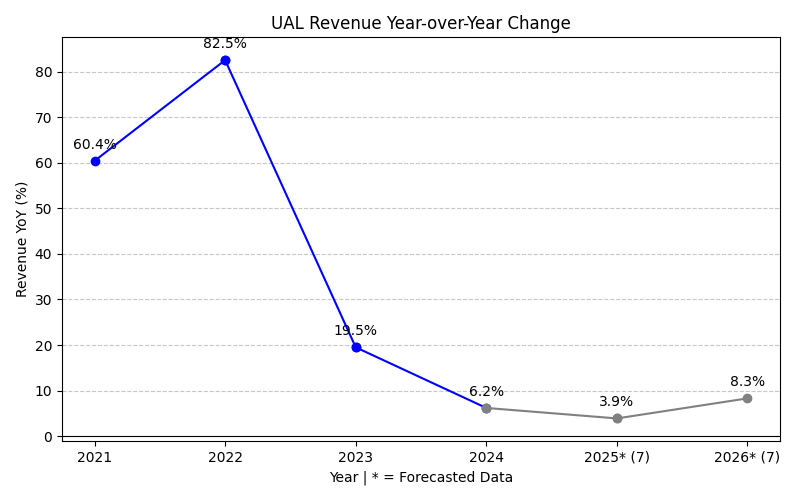

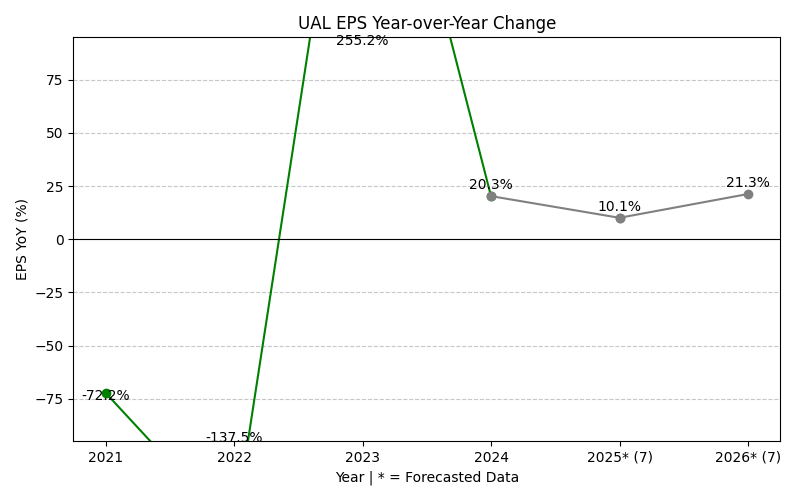

UAL Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 60.4% | 82.5% | 19.5% | 6.2% | 3.5% | 8.0% | 6.5% | 26.7% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 7 | 7 | |

| EPS Growth (%) | -72.2% | -137.5% | 255.2% | 20.3% | 6.5% | 28.8% | 10.6% | 16.0% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 9 | 9 |

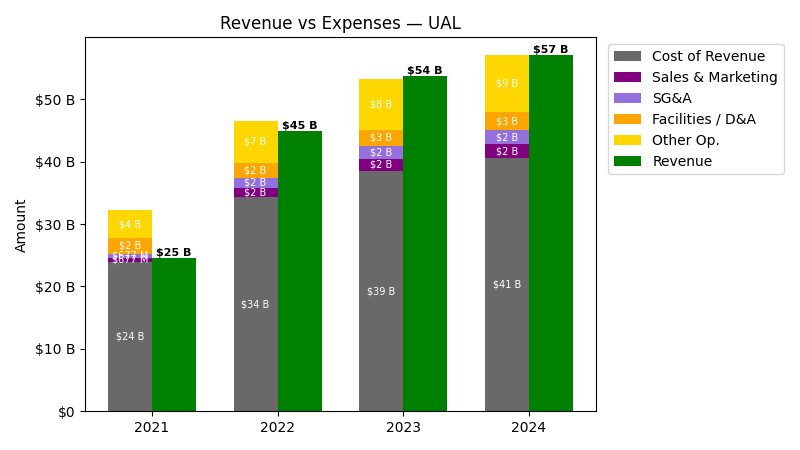

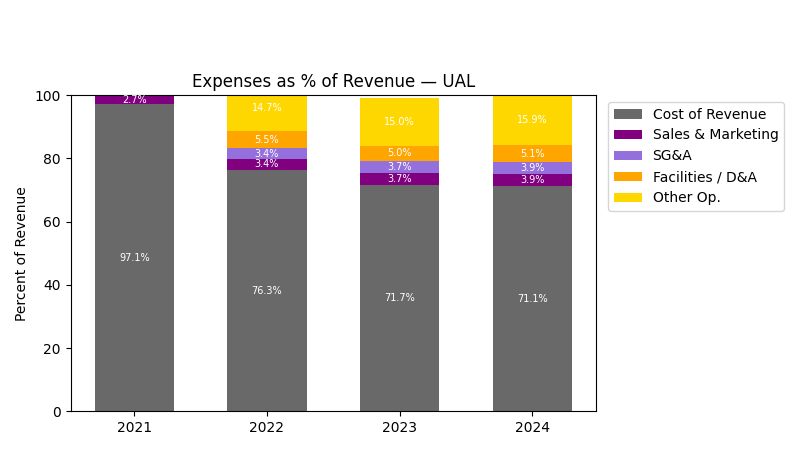

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | Sales & Marketing ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|---|

| 2022 | $45.0B | $31.9B | $1.5B | $1.5B | $2.5B |

| 2023 | $53.7B | $35.8B | $2.0B | $2.0B | $2.7B |

| 2024 | $57.1B | $37.6B | $2.2B | $2.2B | $2.9B |

| 2025 | $59.1B | $39.1B | $2.1B | $2.1B | $2.9B |

| TTM | $59.1B | $38.0B | $2.1B | $2.1B | $4.1B |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | Sales & Marketing Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|---|

| 2023 | 19.49 | 12.52 | 28.79 | 28.79 | 8.75 |

| 2024 | 6.23 | 5.01 | 12.85 | 12.85 | 9.62 |

| 2025 | 3.52 | 3.95 | -5.47 | -5.47 | 0.38 |

| TTM | -0.00 | -2.97 | 0.00 | 0.00 | 39.54 |

No unmapped expenses.

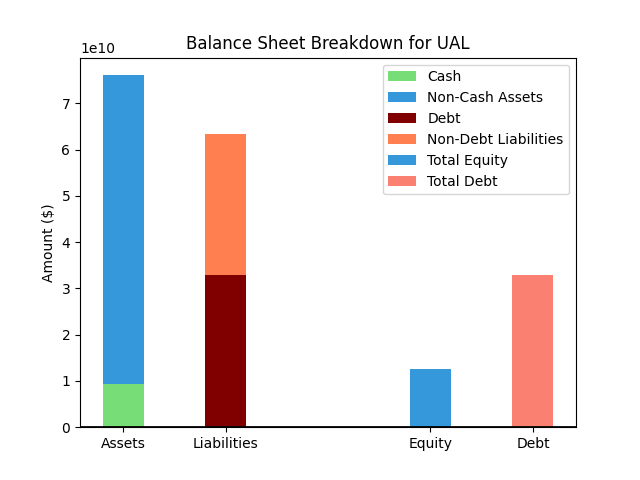

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $76,313M |

| 1 | Cash | $6,730M |

| 2 | Total Liabilities | $62,004M |

| 3 | Total Debt | $31,322M |

| 4 | Total Equity | $14,309M |

| 5 | Debt to Equity Ratio | 2.19 |

EPS & Dividend

Valuation

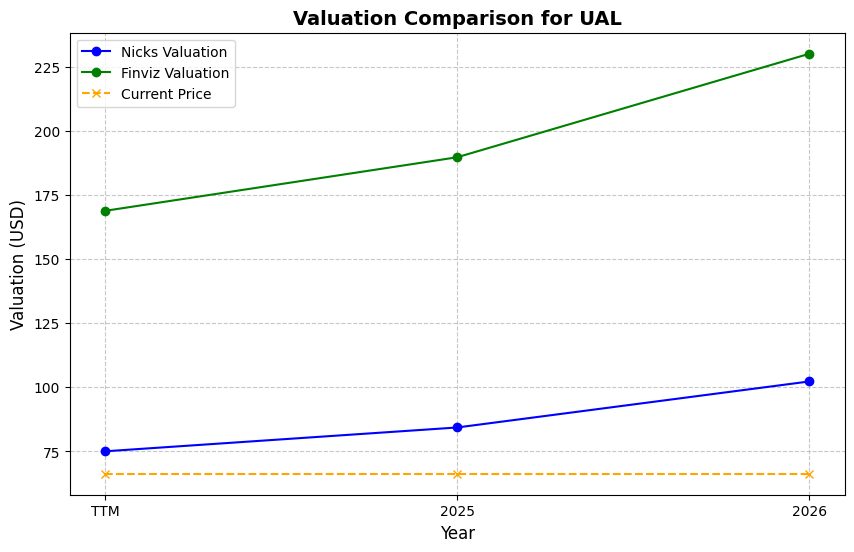

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $106.30 | 4.0% | Nicks Growth: 2% Nick's Expected Margin: 7% FINVIZ Growth: 17% |

Nicks: 8 Finviz: 34 |

Nick's: 0.574 | 0.6 | 10.4 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $10.20 EPS | TTM | $83.67 | -21.3% | $342.53 | 222.2% |

| $13.34 EPS | 2026 | $109.42 | 2.9% | $447.97 | 321.4% |

| $14.76 EPS | 2027 | $121.07 | 13.9% | $495.65 | 366.3% |

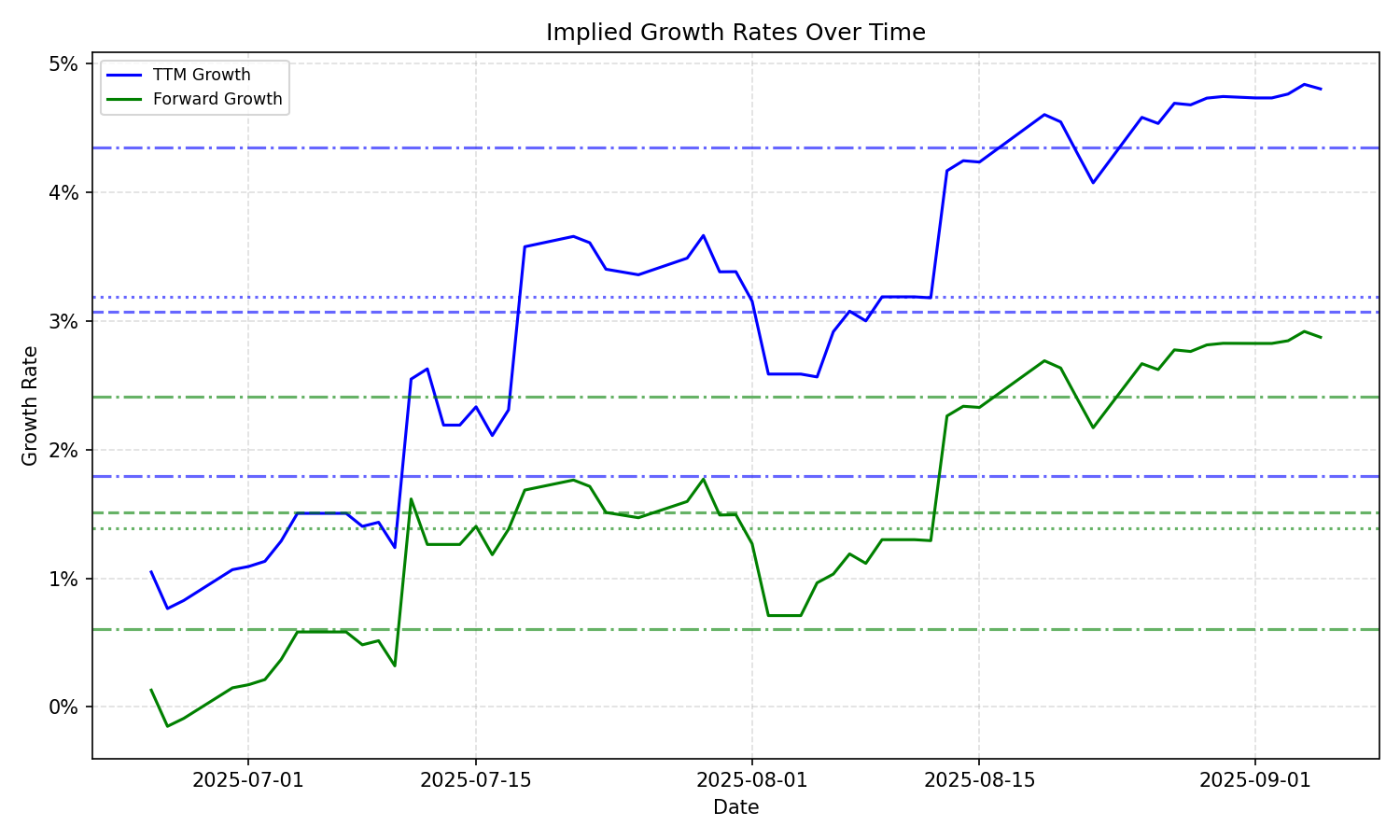

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 4.05% | 1.92% | 4.23% | 1.94% | 1.17% | 0.82% | 5.35% | 1.34% | 87.6% | 26.0% |

| 3 Years | 4.05% | 1.92% | 4.23% | 1.94% | 1.17% | 0.82% | 5.35% | 1.34% | 87.6% | 26.0% |

| 5 Years | 4.05% | 1.92% | 4.23% | 1.94% | 1.17% | 0.82% | 5.35% | 1.34% | 87.6% | 26.0% |

| 10 Years | 4.05% | 1.92% | 4.23% | 1.94% | 1.17% | 0.82% | 5.35% | 1.34% | 87.6% | 26.0% |