Snap Inc. — SNAP

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $5.22 | $8.82B | - | 8.9 | N/A | 3.0% | - | 3.9 |

Latest Headlines

- · Earnings live: Amazon, Reddit stocks sink to cap jam-packed earnings week

- · Stifel upgrades Snap as sharp selloff balances risk despite user, ad concerns

- · Amazon, Roku, Snap: Top Analyst Calls

- · Amazon downgraded, Roblox upgraded: Wall Street's top analyst calls

- · Here Are Friday’s Top Wall Street Analyst Research Calls: Amazon.com, Caterpillar, Estee Lauder, JPMorgan, Norfolk Southern, Roku, Snap, Vistra, and More

- · Is Snap (SNAP) Offering A Chance After Sharp Multi Year Share Price Declines

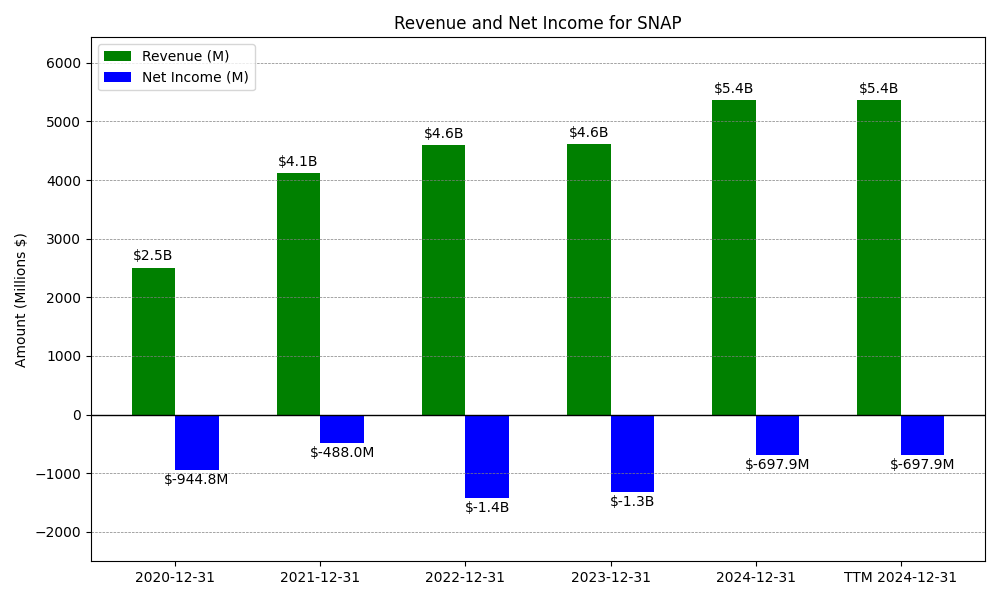

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

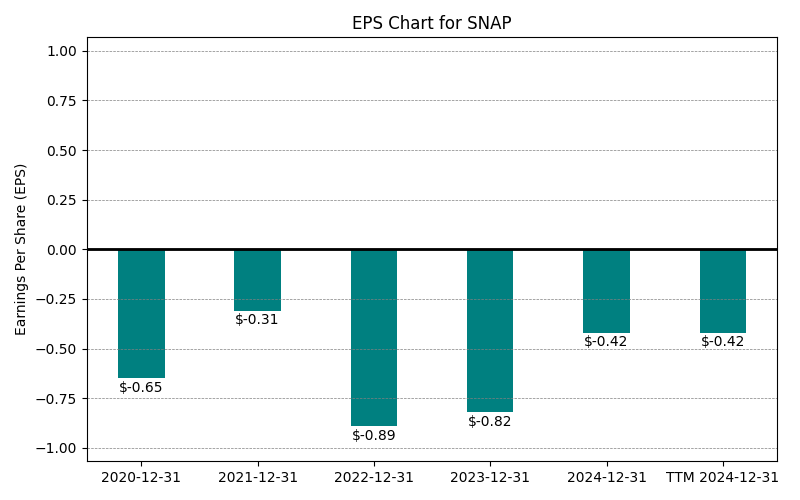

| 0 | 2020-12-31 | $2,507M | $-945M | $-0.65 | 2024-02-03 03:17:10 | N/A | N/A | N/A |

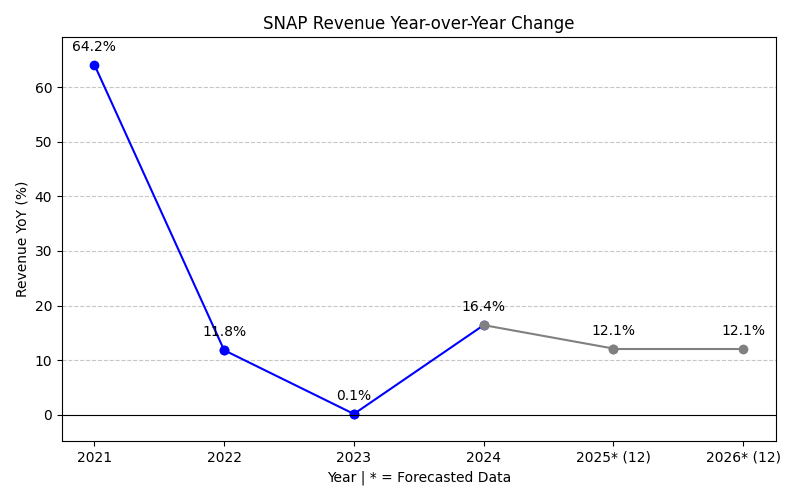

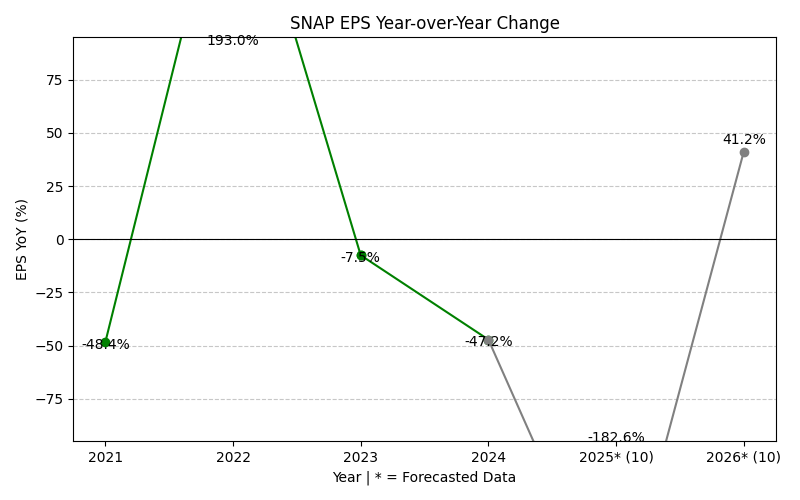

| 1 | 2021-12-31 | $4,117M | $-488M | $-0.31 | 2026-02-06 22:07:54 | 64.2% | -48.4% | -52.3% |

| 2 | 2022-12-31 | $4,602M | $-1,430M | $-0.89 | 2026-02-06 22:07:54 | 11.8% | 193.0% | 187.1% |

| 3 | 2023-12-31 | $4,606M | $-1,322M | $-0.82 | 2026-02-06 22:07:54 | 0.1% | -7.5% | -7.9% |

| 4 | 2024-12-31 | $5,361M | $-698M | $-0.42 | 2026-02-06 22:07:54 | 16.4% | -47.2% | -48.8% |

| 5 | TTM 2025-09-30 | $5,772M | $-497M | $-0.27 | 2026-02-05 08:33:36 | 7.7% | -28.8% | -35.7% |

EPS

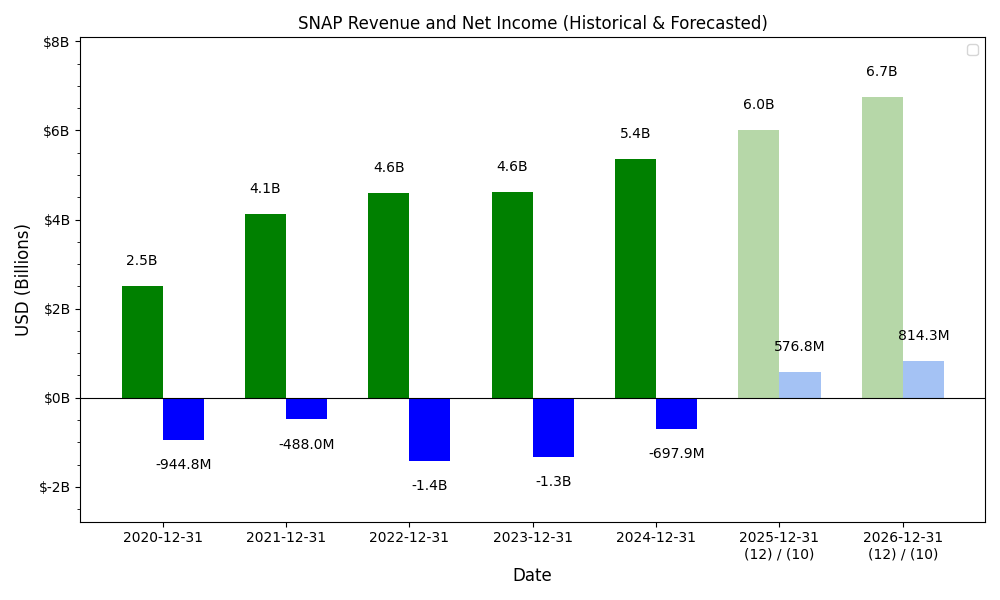

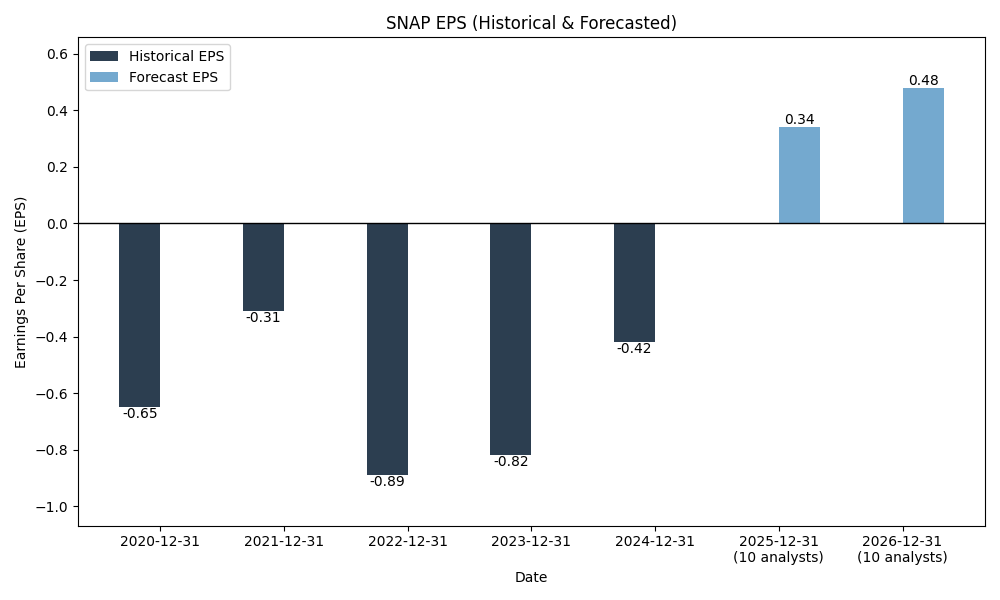

Forecasts

Y/Y % Change

SNAP Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 64.2% | 11.8% | 0.1% | 16.4% | 25.3% | 9.4% | 21.2% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 12 | 12 | |

| EPS Growth (%) | -48.4% | 193.0% | -7.5% | -47.2% | -216.2% | 14.6% | -18.6% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 7 | 7 |

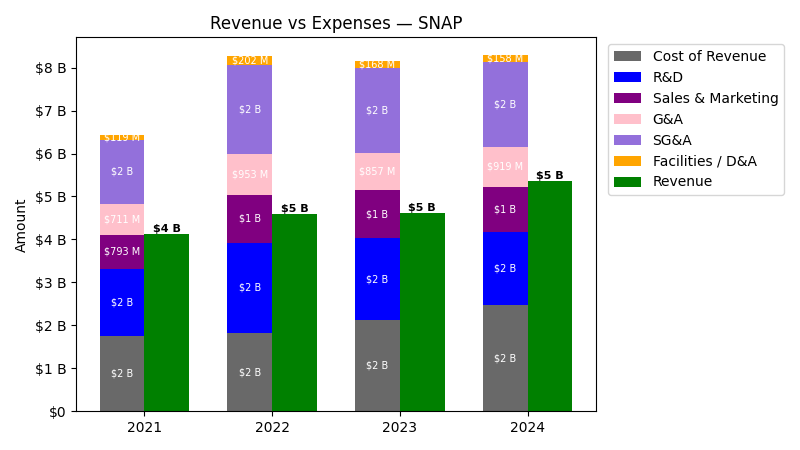

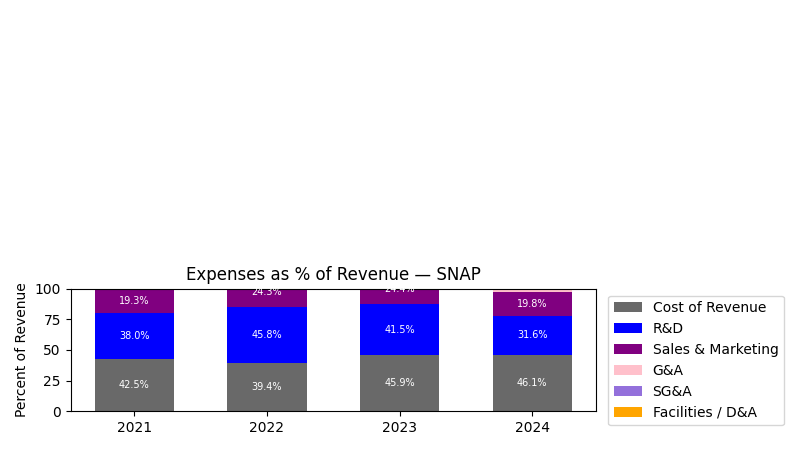

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | R&D ($) | Sales & Marketing ($) | G&A ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|---|---|---|

| 2021 | $4.1B | $1.6B | $1.6B | $792.8M | $710.6M | $1.5B | $119.1M |

| 2022 | $4.6B | $1.6B | $2.1B | $1.1B | $953.3M | $2.1B | $202.2M |

| 2023 | $4.6B | $1.9B | $1.9B | $1.1B | $857.4M | $2.0B | $168.4M |

| 2024 | $5.4B | $2.3B | $1.7B | $1.1B | $919.1M | $2.0B | $158.1M |

| TTM | $5.8B | $2.4B | $1.7B | $1.0B | $960.8M | $2.0B | $159.8M |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | R&D Change (%) | Sales & Marketing Change (%) | G&A Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|---|---|---|

| 2022 | 11.78 | -1.10 | 34.77 | 41.12 | 34.14 | 37.82 | 69.69 |

| 2023 | 0.09 | 20.61 | -9.43 | 0.30 | -10.05 | -4.46 | -16.68 |

| 2024 | 16.40 | 19.04 | -11.47 | -5.21 | 7.19 | 0.16 | -6.15 |

| TTM | 7.66 | 4.76 | 3.08 | -5.05 | 4.54 | -0.61 | 1.11 |

No unmapped expenses.

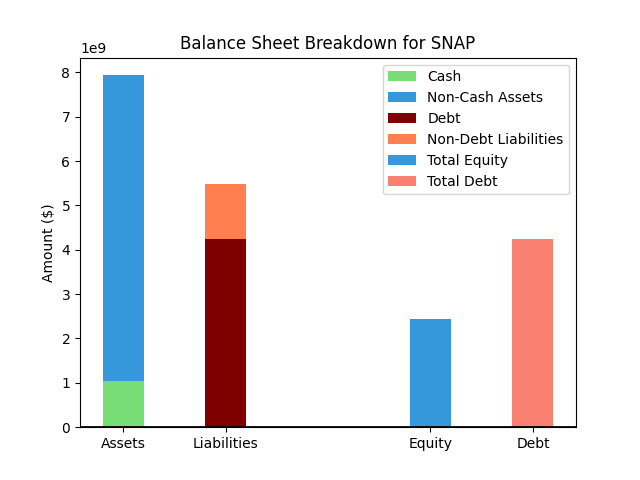

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $7,578M |

| 1 | Cash | $953M |

| 2 | Total Liabilities | $5,351M |

| 3 | Total Debt | $4,154M |

| 4 | Total Equity | $2,227M |

| 5 | Debt to Equity Ratio | 1.86 |

EPS & Dividend

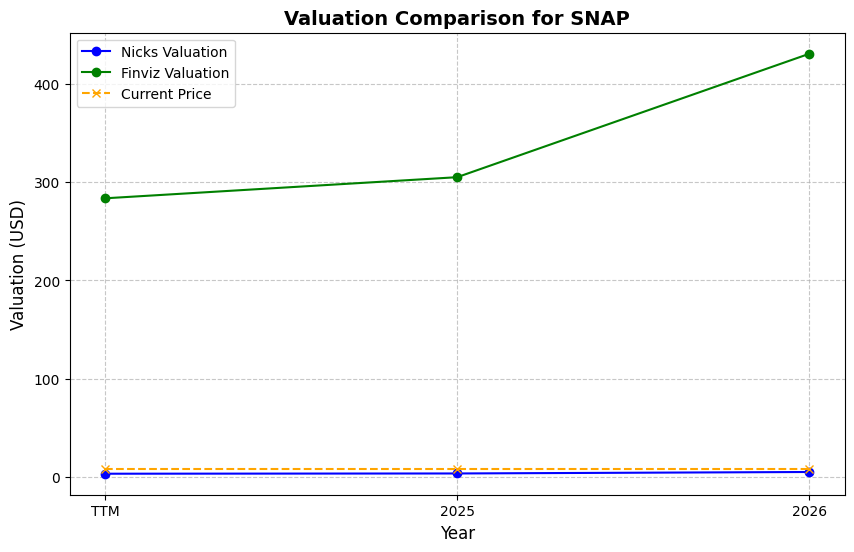

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $5.22 | 4.2% | Nicks Growth: 5% Nick's Expected Margin: 10% FINVIZ Growth: 42% |

Nicks: 11 Finviz: 254 |

Nick's: 1.082 | 1.5 | - |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $3.42 Revenue | TTM | $3.70 | -29.1% | $86.76 | 1562.0% |

| $0.48 EPS | 2026 | $5.20 | -0.5% | $121.85 | 2234.3% |

| $0.55 EPS | 2027 | $5.95 | 14.0% | $139.62 | 2574.7% |

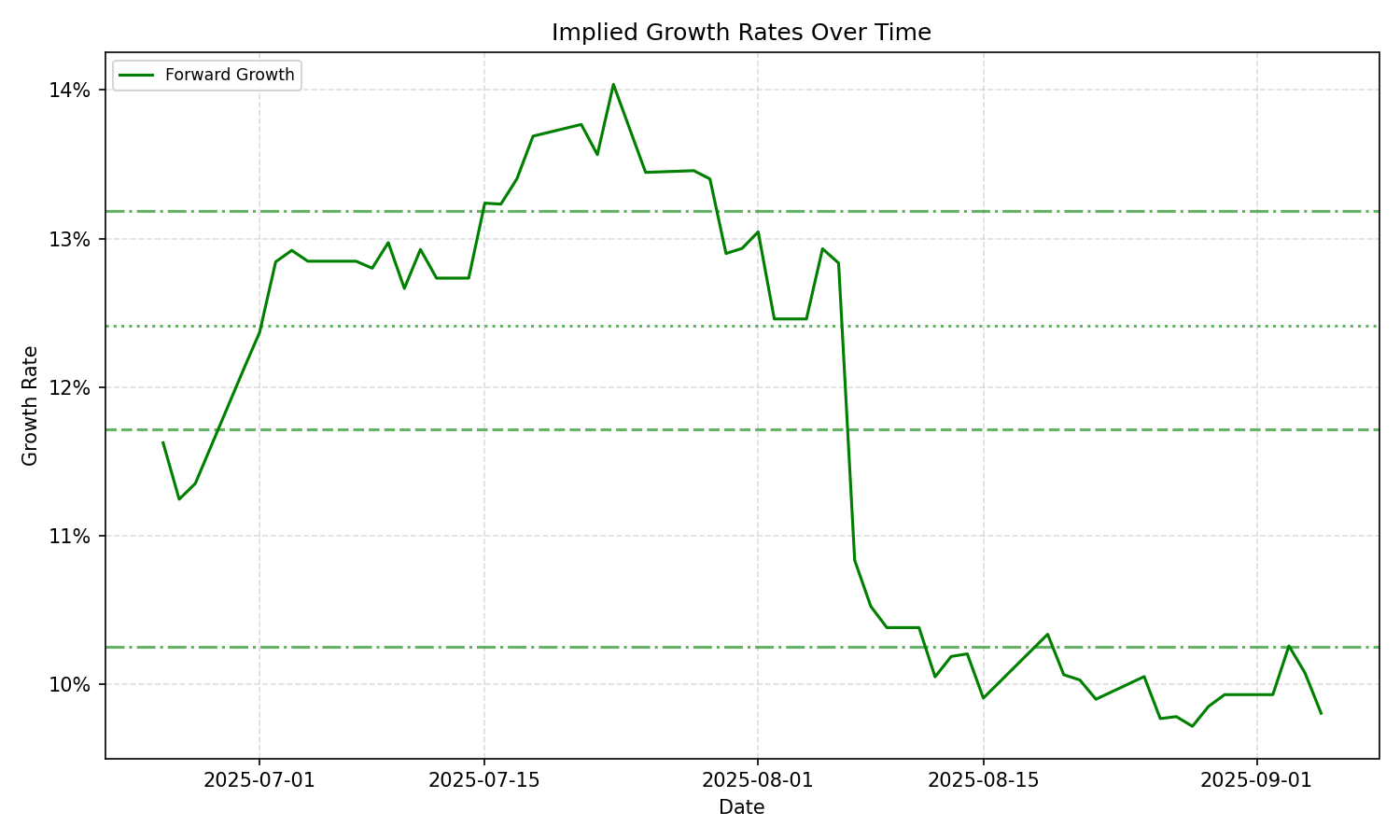

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | – | 10.82% | – | 10.56% | – | 1.45% | – | 2.84% | – | 0.6% |

| 3 Years | – | 10.82% | – | 10.56% | – | 1.45% | – | 2.84% | – | 0.6% |

| 5 Years | – | 10.82% | – | 10.56% | – | 1.45% | – | 2.84% | – | 0.6% |

| 10 Years | – | 10.82% | – | 10.56% | – | 1.45% | – | 2.84% | – | 0.6% |