Charles Schwab Corporation (The — SCHW

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $95.20 | $172.81B | 20.5 | 14.0 | 11.4% | 7.4% | $1.28 1.3% | 3.9 |

Latest Headlines

- · Crypto Sell-Off Pulls Robinhood Stock Down: Buy Before It Takes Off?

- · Charles Schwab Stock: Is SCHW Outperforming the Financial Services Sector?

- · Jim Cramer on Charles Schwab: “I Think It’s a Steal Because the AI Threat Here Is a Borderline Non-Existent Threat”

- · Trader Bullishness Ticks Downward as Younger Traders Take a More Cautious Stance

- · Here is Why Growth Investors Should Buy Charles Schwab (SCHW) Now

- · 5 industries that have gotten rocked by the AI 'scare trade' defining markets this year

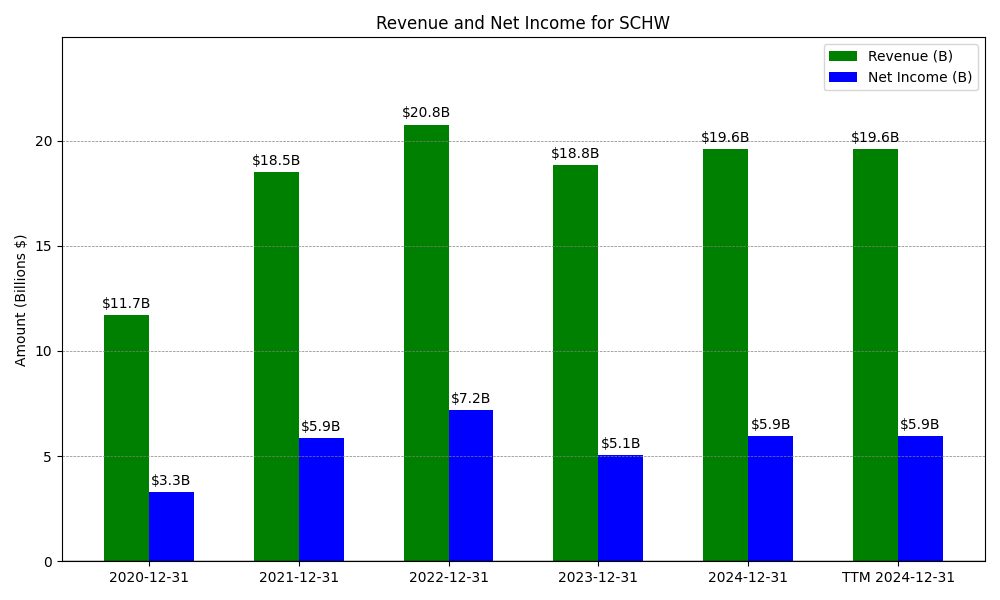

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

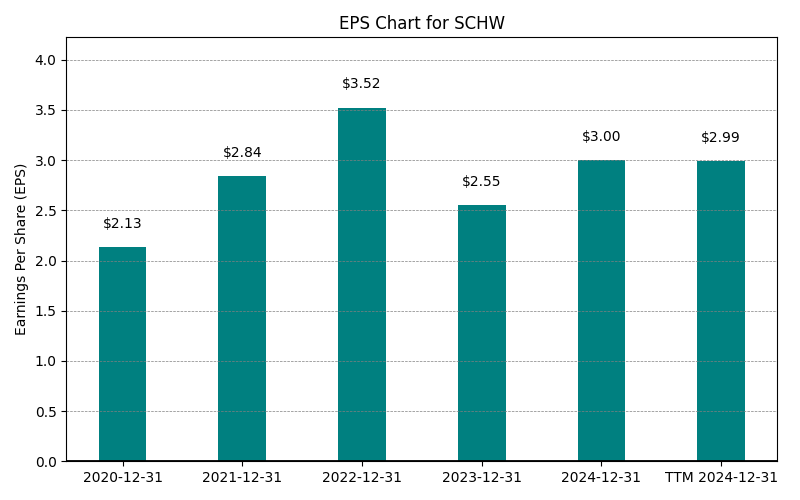

| 0 | 2020-12-31 | $11,691M | $3,299M | $2.13 | 2024-02-03 03:17:10 | N/A | N/A | N/A |

| 1 | 2021-12-31 | $18,520M | $5,855M | $3.52 | 2026-02-27 22:05:35 | 58.4% | 77.5% | 65.3% |

| 2 | 2022-12-31 | $20,762M | $7,183M | $3.52 | 2026-02-27 22:05:35 | 12.1% | 22.7% | 0.0% |

| 3 | 2023-12-31 | $18,837M | $5,067M | $2.55 | 2026-02-27 22:05:35 | -9.3% | -29.5% | -27.6% |

| 4 | 2024-12-31 | $19,606M | $5,942M | $3.00 | 2026-02-27 22:05:35 | 4.1% | 17.3% | 17.6% |

| 5 | 2025-12-31 | $19,606M | $5,942M | $4.67 | 2026-02-27 22:05:35 | 0.0% | 0.0% | 55.7% |

| 6 | TTM 2025-12-31 | $17,585M | $6,393M | $4.65 | 2026-01-23 08:30:27 | -10.3% | 7.6% | -0.4% |

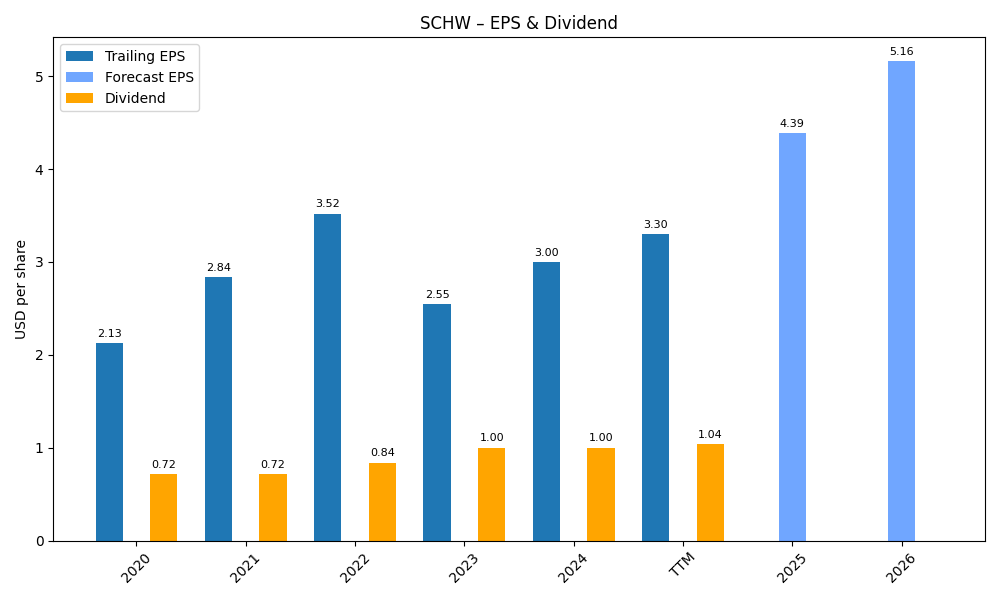

EPS

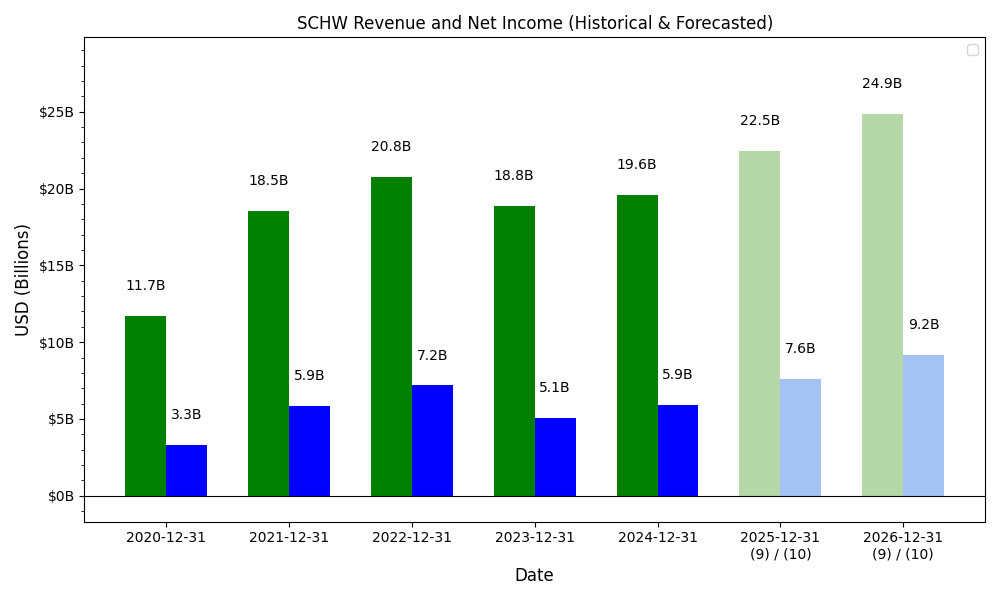

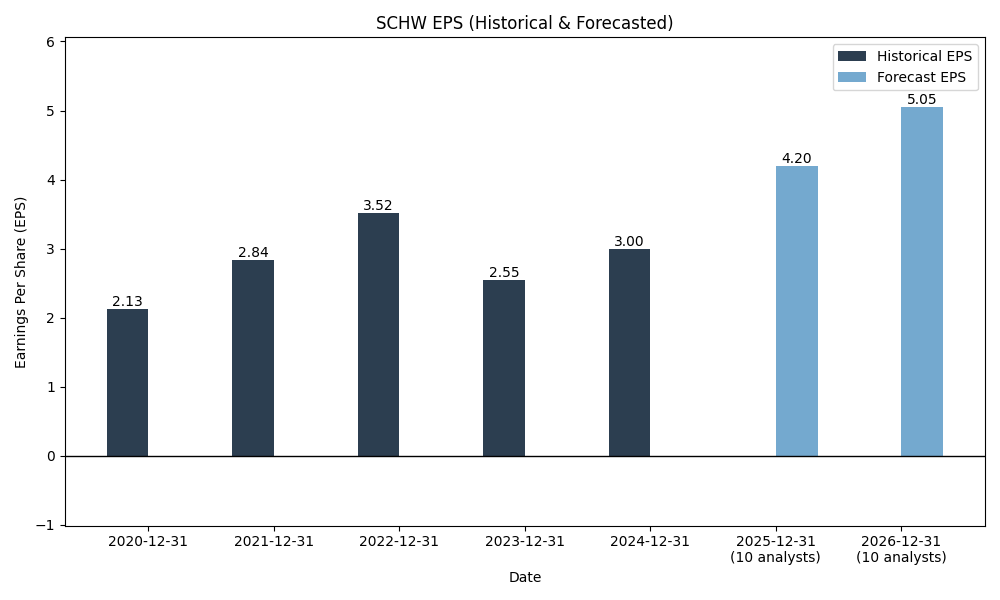

Forecasts

Y/Y % Change

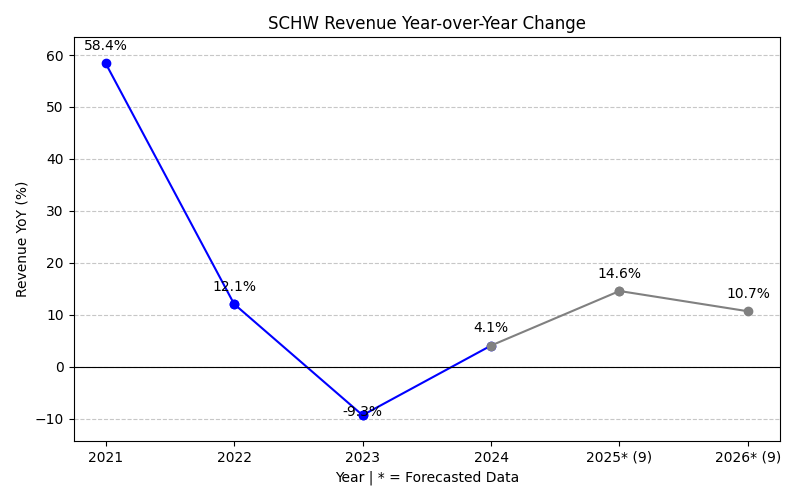

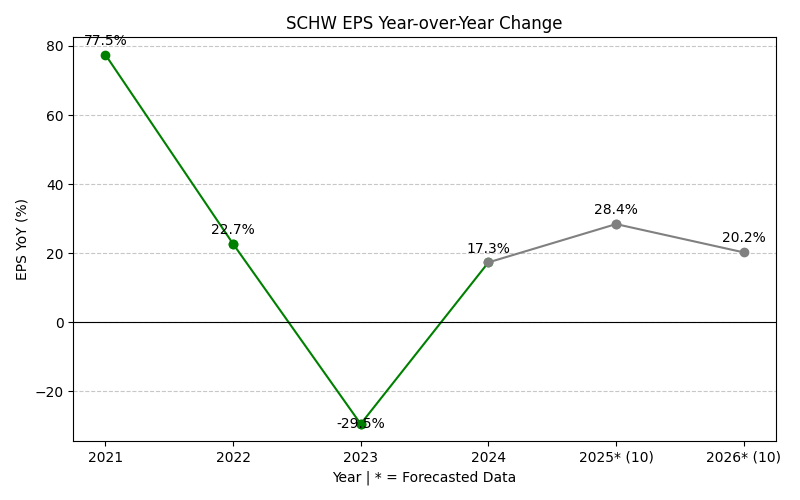

SCHW Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 58.4% | 12.1% | -9.3% | 4.1% | 0.0% | 34.7% | 9.0% | 15.6% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 8 | 8 | |

| EPS Growth (%) | 77.5% | 22.7% | -29.5% | 17.3% | 0.0% | 76.9% | 15.9% | 25.8% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 11 | 11 |

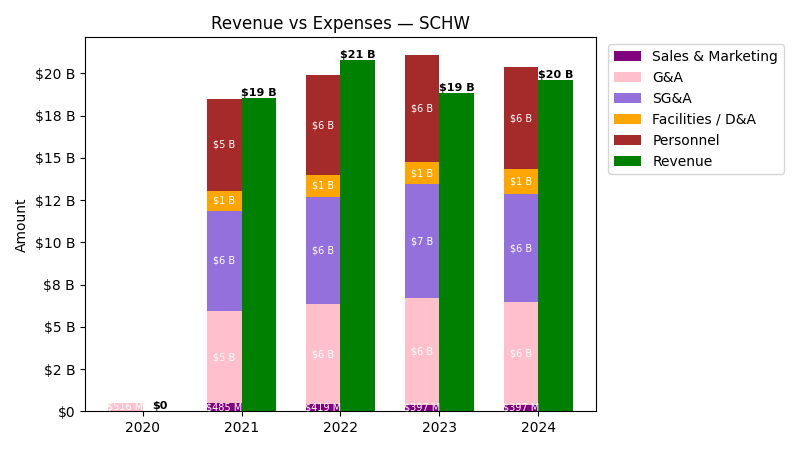

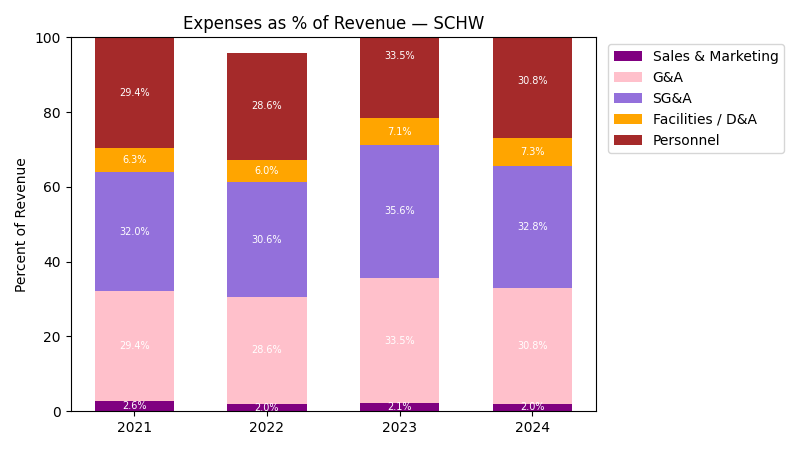

Expenses

| Year | Revenue ($) | Sales & Marketing ($) | G&A ($) | SG&A ($) | Facilities / D&A ($) | Personnel ($) |

|---|---|---|---|---|---|---|

| 2021 | $18.5B | $485.0M | $5.5B | $5.9B | $1.2B | $5.5B |

| 2022 | $20.8B | $419.0M | $5.9B | $6.4B | $1.2B | $5.9B |

| 2023 | $18.8B | $397.0M | $6.3B | $6.7B | $1.3B | $6.3B |

| 2024 | $19.6B | $397.0M | $6.0B | $6.4B | $1.4B | $6.0B |

| TTM | $17.6B | $305.0M | $4.9B | $5.2B | $1.0B | $4.9B |

| Year | Revenue Change (%) | Sales & Marketing Change (%) | G&A Change (%) | SG&A Change (%) | Facilities / D&A Change (%) | Personnel Change (%) |

|---|---|---|---|---|---|---|

| 2022 | 12.11 | -13.61 | 8.92 | 7.08 | 7.22 | 8.92 |

| 2023 | -9.27 | -5.25 | 6.38 | 5.62 | 7.21 | 6.38 |

| 2024 | 4.08 | 0.00 | -4.31 | -4.05 | 7.25 | -4.31 |

| TTM | -10.31 | -23.17 | -19.56 | -19.78 | -28.29 | -19.56 |

No unmapped expenses.

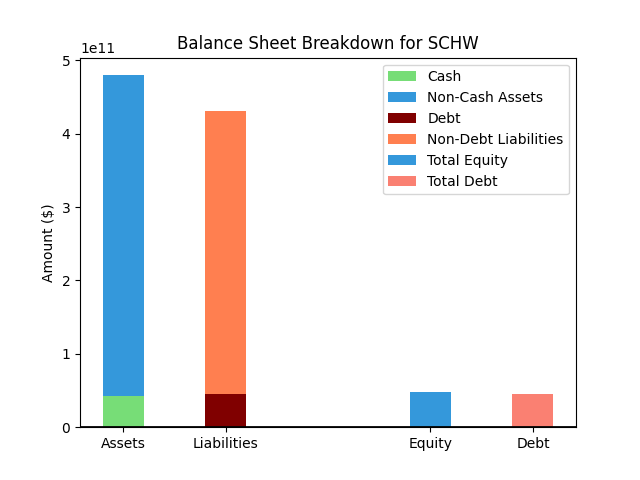

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $465,255M |

| 1 | Cash | $30,572M |

| 2 | Total Liabilities | $415,871M |

| 3 | Total Debt | $27,584M |

| 4 | Total Equity | $49,384M |

| 5 | Debt to Equity Ratio | 0.56 |

EPS & Dividend

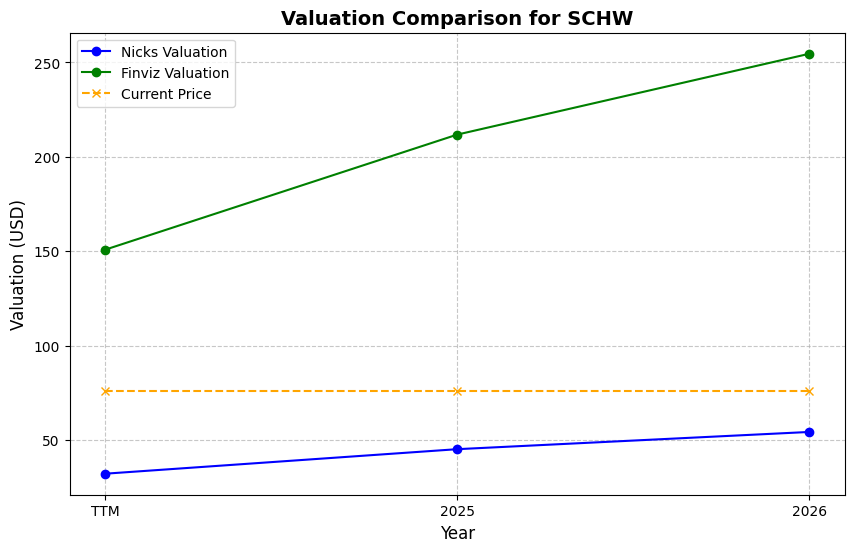

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $95.20 | 4.0% | Nicks Growth: 5% Nick's Expected Margin: 30% FINVIZ Growth: 18% |

Nicks: 11 Finviz: 37 |

Nick's: 3.326 | 9.8 | 20.5 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $4.65 EPS | TTM | $51.56 | -45.8% | $170.25 | 78.8% |

| $5.79 EPS | 2026 | $64.20 | -32.6% | $211.99 | 122.7% |

| $6.71 EPS | 2027 | $74.40 | -21.8% | $245.67 | 158.1% |

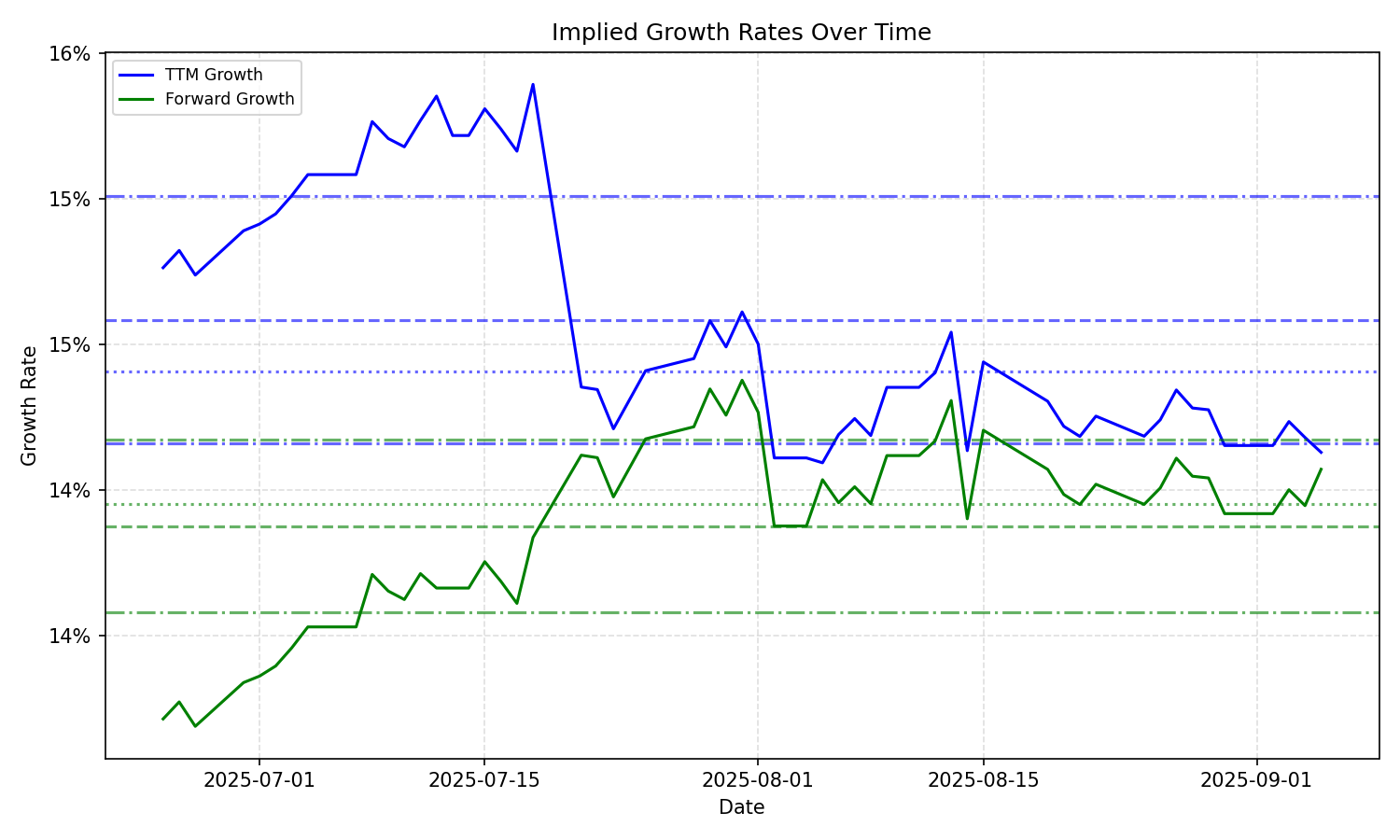

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 13.38% | 12.49% | 13.52% | 13.50% | 1.09% | 2.11% | 11.70% | 7.70% | 6.8% | 6.8% |

| 3 Years | 13.38% | 12.49% | 13.52% | 13.50% | 1.09% | 2.11% | 11.70% | 7.70% | 6.8% | 6.8% |

| 5 Years | 13.38% | 12.49% | 13.52% | 13.50% | 1.09% | 2.11% | 11.70% | 7.70% | 6.8% | 6.8% |

| 10 Years | 13.38% | 12.49% | 13.52% | 13.50% | 1.09% | 2.11% | 11.70% | 7.70% | 6.8% | 6.8% |