Royal Caribbean Cruises Ltd. — RCL

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $310.96 | $84.80B | 19.9 | 15.0 | 11.1% | 8.1% | $4.25 1.4% | 8.4 |

Latest Headlines

- · Royal Caribbean Group announces completion of offering of $1.25 billion senior unsecured notes due 2033 and $1.25 billion senior unsecured notes due 2038

- · Royal Caribbean shares huge expansion plan

- · Is Royal Caribbean Stock a Buy, Sell, or Hold in 2026?

- · CCL Sees Record Pricing Despite Weak Sentiment: What's Driving Demand?

- · THE CORMORANT AT 55 SOUTH: SILVERSEA UNVEILS ALL PUBLIC SPACES OF HIGHLY ANTICIPATED SOUTHERNMOST HOTEL

- · Royal Caribbean (RCL) Recently Broke Out Above the 50-Day Moving Average

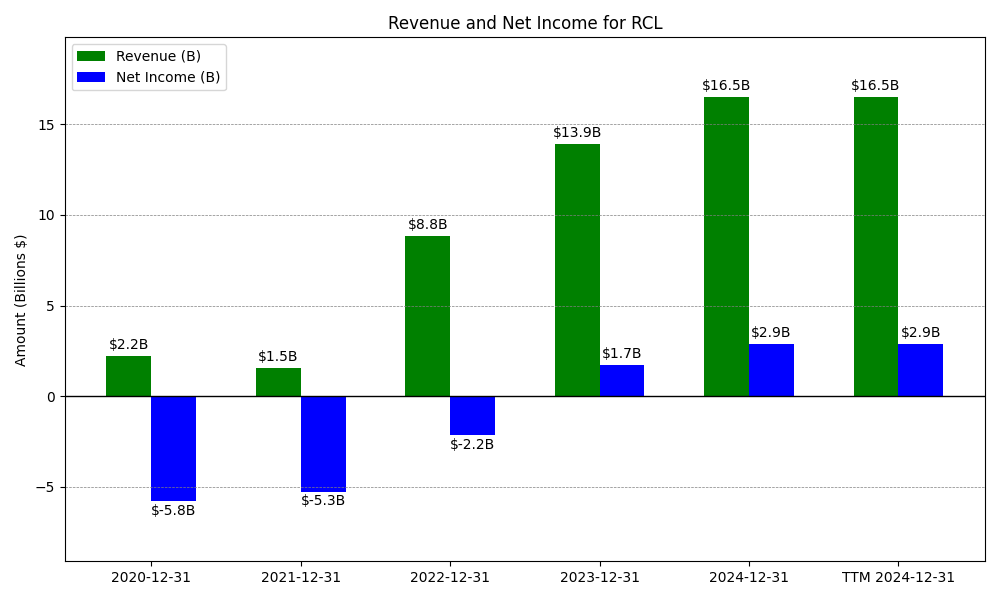

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

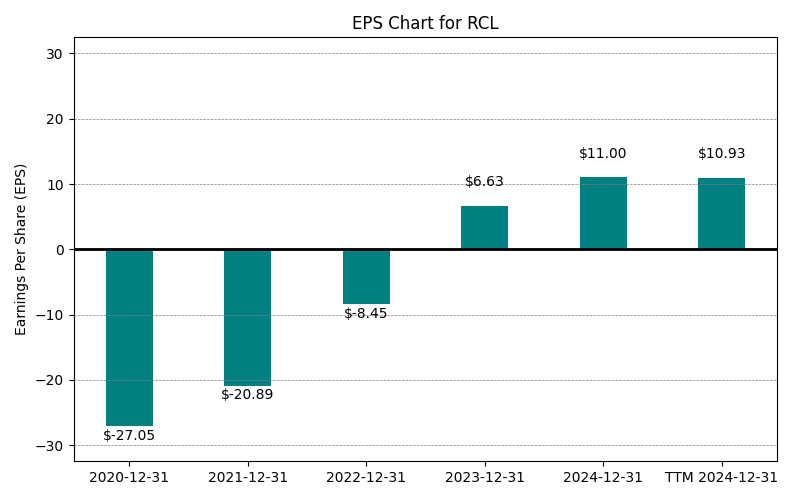

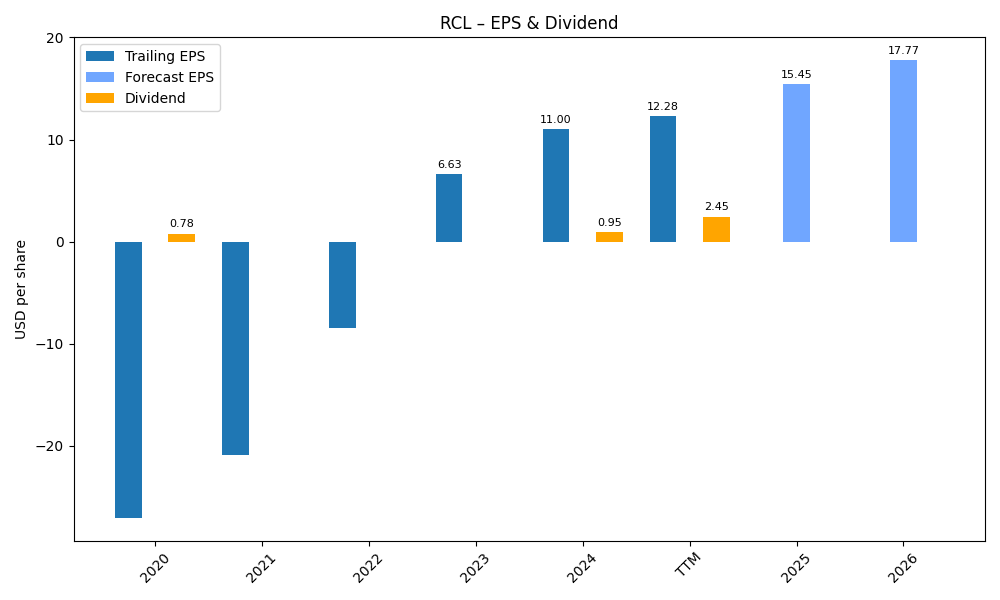

| 0 | 2020-12-31 | $2,209M | $-5,797M | $-27.05 | 2024-02-03 03:17:10 | N/A | N/A | N/A |

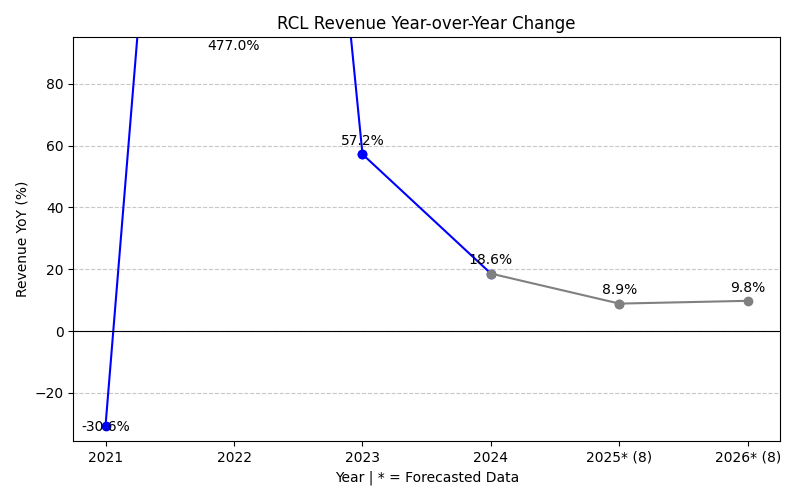

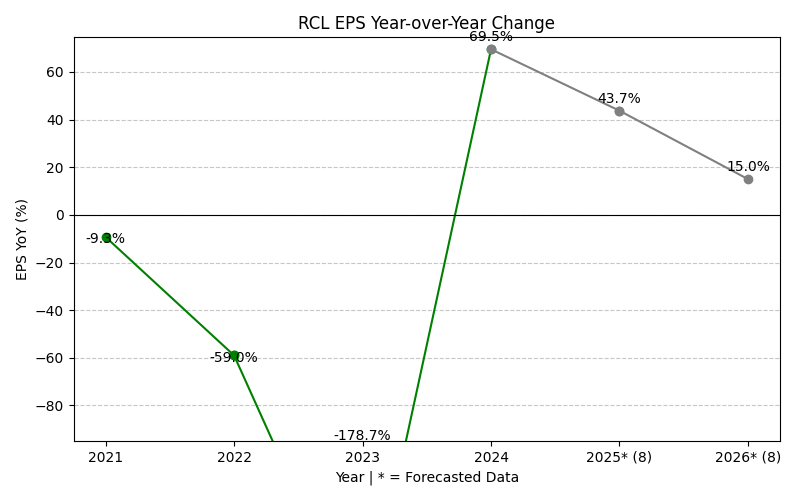

| 1 | 2021-12-31 | $1,532M | $-5,260M | $-20.89 | 2026-02-13 08:44:33 | -30.6% | -9.3% | -22.8% |

| 2 | 2022-12-31 | $8,840M | $-2,156M | $-8.45 | 2026-02-27 22:04:54 | 477.0% | -59.0% | -59.6% |

| 3 | 2023-12-31 | $13,900M | $1,697M | $6.63 | 2026-02-27 22:04:54 | 57.2% | -178.7% | -178.5% |

| 4 | 2024-12-31 | $16,485M | $2,877M | $11.00 | 2026-02-27 22:04:54 | 18.6% | 69.5% | 65.9% |

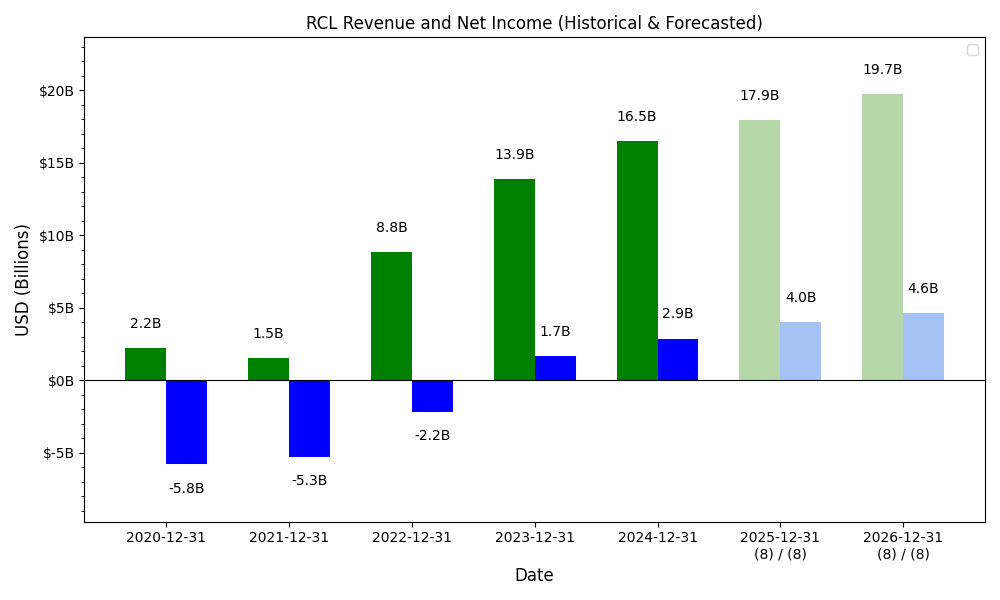

| 5 | 2025-12-31 | $17,934M | $4,268M | $15.75 | 2026-02-27 22:04:54 | 8.8% | 48.3% | 43.2% |

| 6 | TTM 2025-12-31 | $17,934M | $4,269M | $15.60 | 2026-02-02 08:33:36 | 0.0% | 0.0% | -1.0% |

EPS

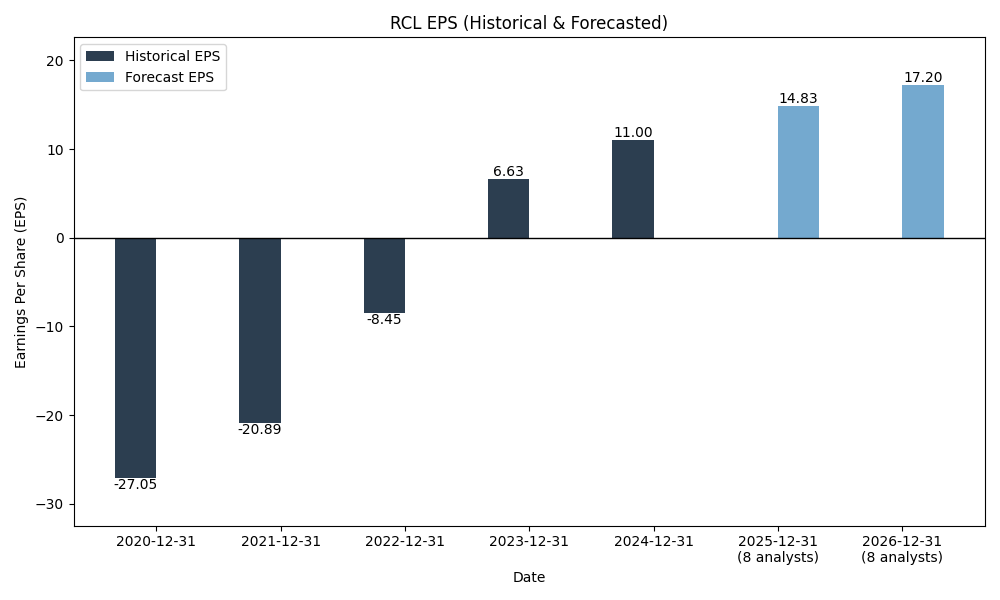

Forecasts

Y/Y % Change

RCL Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | -30.6% | 477.0% | 57.2% | 18.6% | 8.8% | 10.2% | 7.1% | 78.3% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 8 | 8 | |

| EPS Growth (%) | -9.3% | -59.0% | -178.7% | 69.5% | 48.3% | 15.6% | 14.4% | -14.2% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 7 | 7 |

Expenses

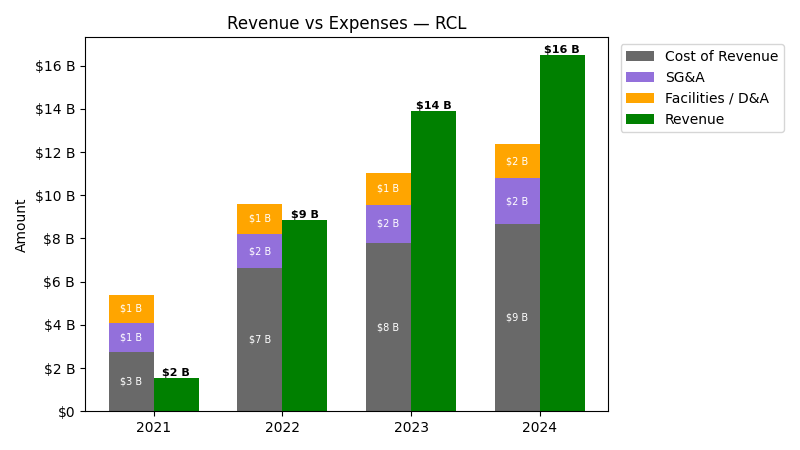

| Year | Revenue ($) | Cost of Revenue ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|

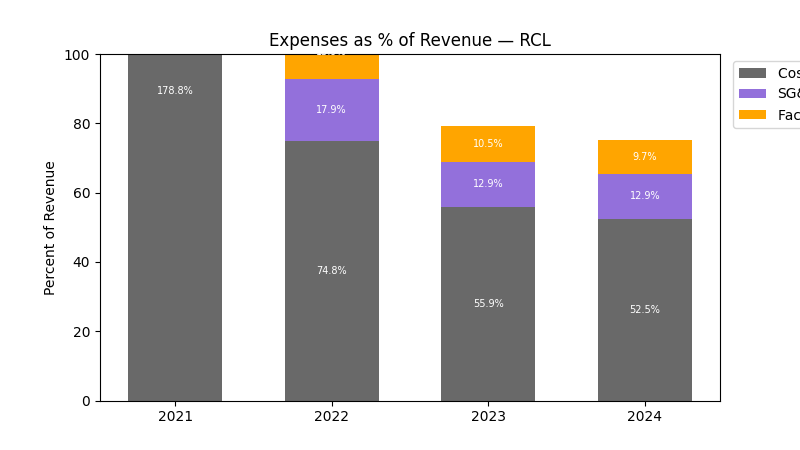

| 2022 | $8.8B | $5.2B | $1.6B | $1.4B |

| 2023 | $13.9B | $6.3B | $1.8B | $1.5B |

| 2024 | $16.5B | $7.1B | $2.1B | $1.6B |

| 2025 | $17.9B | $7.4B | $2.2B | $1.7B |

| TTM | $17.9B | $7.4B | $2.2B | $1.7B |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|

| 2023 | 57.24 | 21.33 | 13.20 | 3.41 |

| 2024 | 18.60 | 11.58 | 18.58 | 9.97 |

| 2025 | 8.79 | 4.44 | 4.61 | 7.37 |

| TTM | 0.00 | -0.03 | -0.04 | 0.00 |

No unmapped expenses.

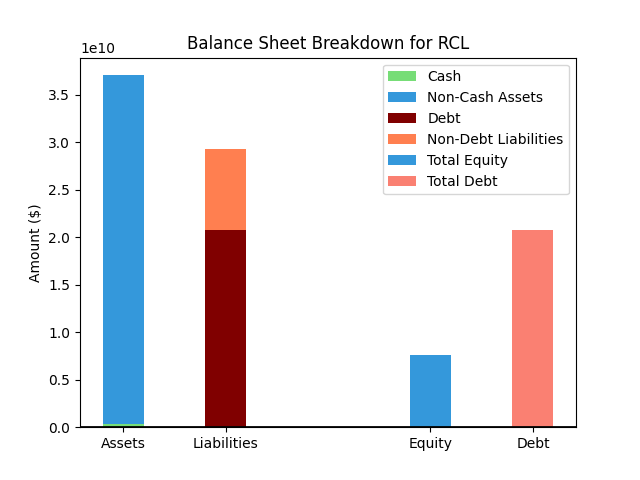

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $40,109M |

| 1 | Cash | $432M |

| 2 | Total Liabilities | $29,821M |

| 3 | Total Debt | $20,975M |

| 4 | Total Equity | $10,092M |

| 5 | Debt to Equity Ratio | 2.08 |

EPS & Dividend

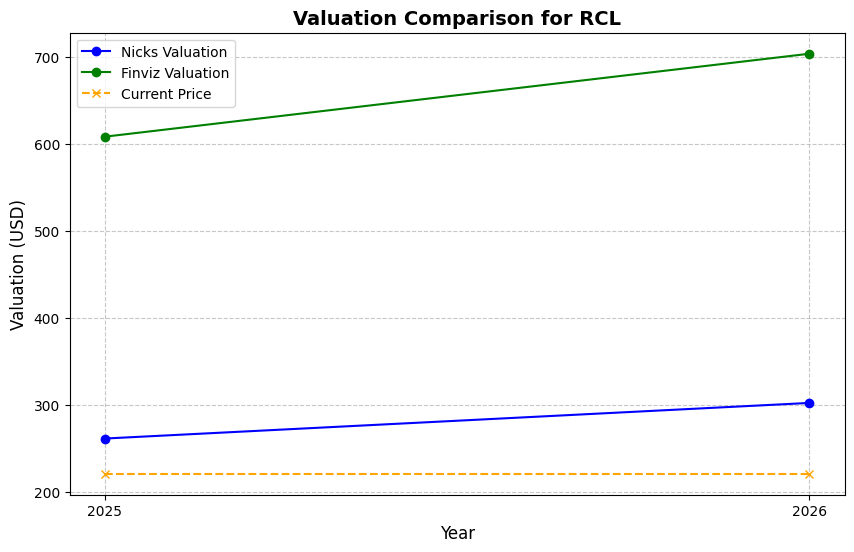

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $310.96 | 4.0% | Nicks Growth: 10% Nick's Expected Margin: 12% FINVIZ Growth: 15% |

Nicks: 18 Finviz: 29 |

Nick's: 2.157 | 4.7 | 19.9 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $15.60 EPS | TTM | $280.38 | -9.8% | $451.32 | 45.1% |

| $18.09 EPS | 2026 | $325.13 | 4.6% | $523.36 | 68.3% |

| $20.69 EPS | 2027 | $371.86 | 19.6% | $598.58 | 92.5% |

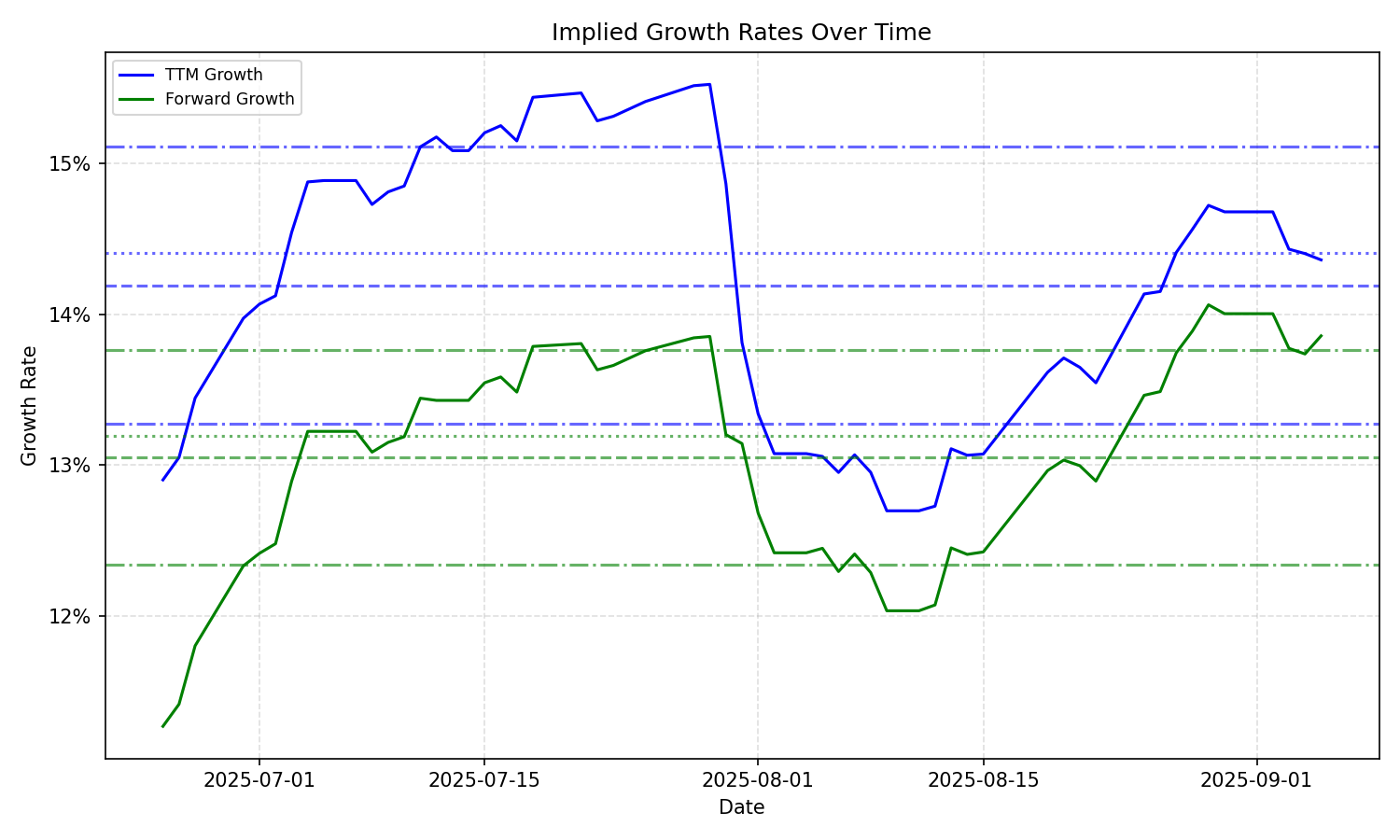

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 12.43% | 11.39% | 12.75% | 12.03% | 1.77% | 1.82% | 11.43% | 8.42% | 35.6% | 3.4% |

| 3 Years | 12.43% | 11.39% | 12.75% | 12.03% | 1.77% | 1.82% | 11.43% | 8.42% | 35.6% | 3.4% |

| 5 Years | 12.43% | 11.39% | 12.75% | 12.03% | 1.77% | 1.82% | 11.43% | 8.42% | 35.6% | 3.4% |

| 10 Years | 12.43% | 11.39% | 12.75% | 12.03% | 1.77% | 1.82% | 11.43% | 8.42% | 35.6% | 3.4% |