Perion Network Ltd — PERI

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $8.55 | $354.14M | - | 5.9 | N/A | -1.1% | - | 0.5 |

Latest Headlines

- · Perion Network Ltd. Q4 2025 Earnings Call Summary

- · Perion Network Ltd (PERI) Q4 2025 Earnings Call Highlights: Strong Growth in Key Segments ...

- · Perion Network Q4 Earnings Call Highlights

- · Perion Network (PERI) Meets Q4 Earnings Estimates

- · Perion Network: Q4 Earnings Snapshot

- · Perion Reports Fourth Quarter Results

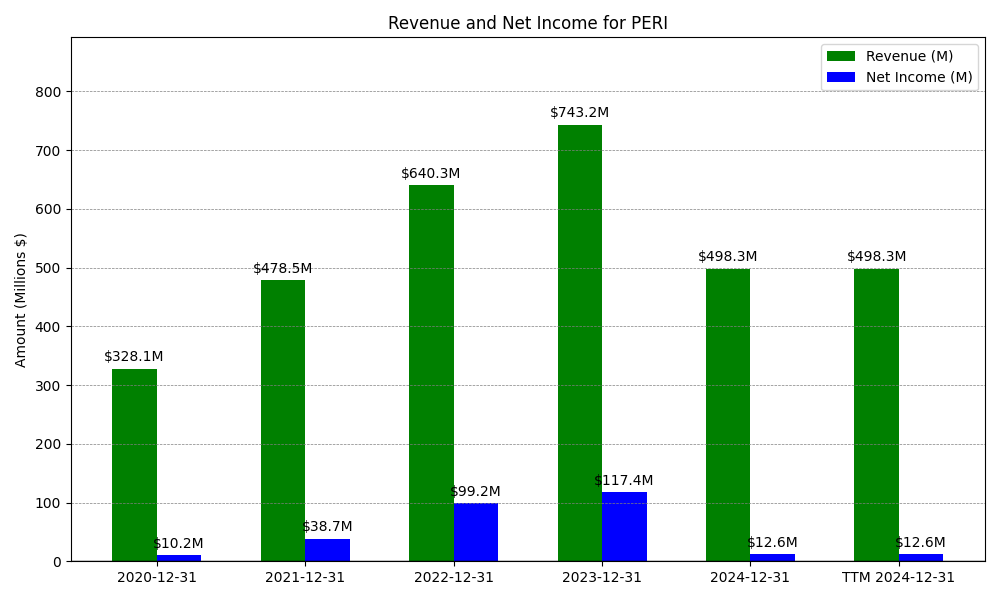

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

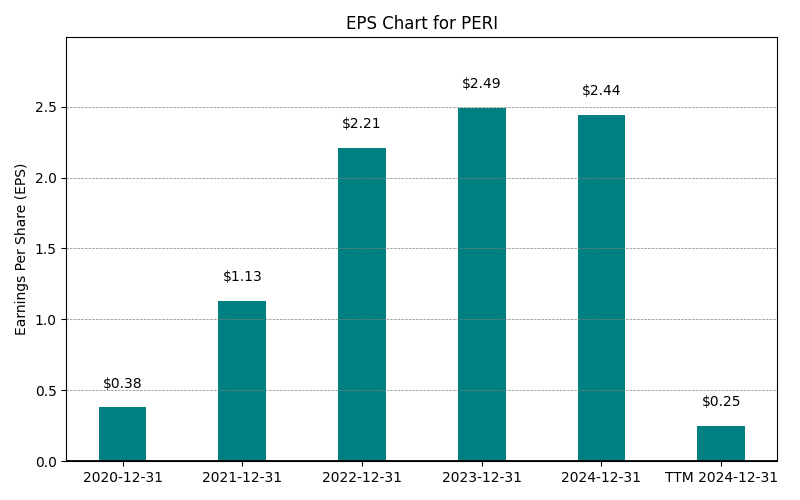

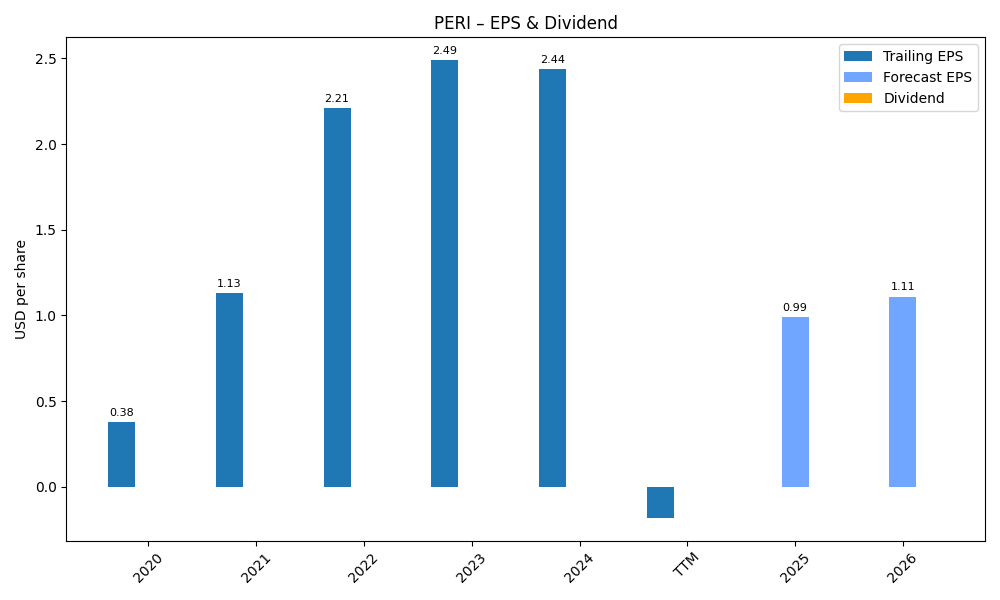

| 0 | 2020-12-31 | $328M | $10M | $0.38 | 2024-03-30 02:04:47 | N/A | N/A | N/A |

| 1 | 2021-12-31 | $478M | $39M | $1.13 | 2026-02-27 22:04:03 | 45.9% | 278.5% | 197.4% |

| 2 | 2022-12-31 | $640M | $97M | $2.21 | 2026-02-27 22:04:03 | 33.8% | 151.8% | 95.6% |

| 3 | 2023-12-31 | $743M | $115M | $2.49 | 2026-02-27 22:04:03 | 16.1% | 17.9% | 12.7% |

| 4 | 2024-12-31 | $498M | $13M | $0.27 | 2026-02-27 22:04:03 | -32.9% | -89.0% | -89.2% |

| 5 | TTM 2025-12-31 | $303M | $-16M | $-0.19 | 2026-02-27 22:04:04 | -39.2% | -226.0% | -170.4% |

EPS

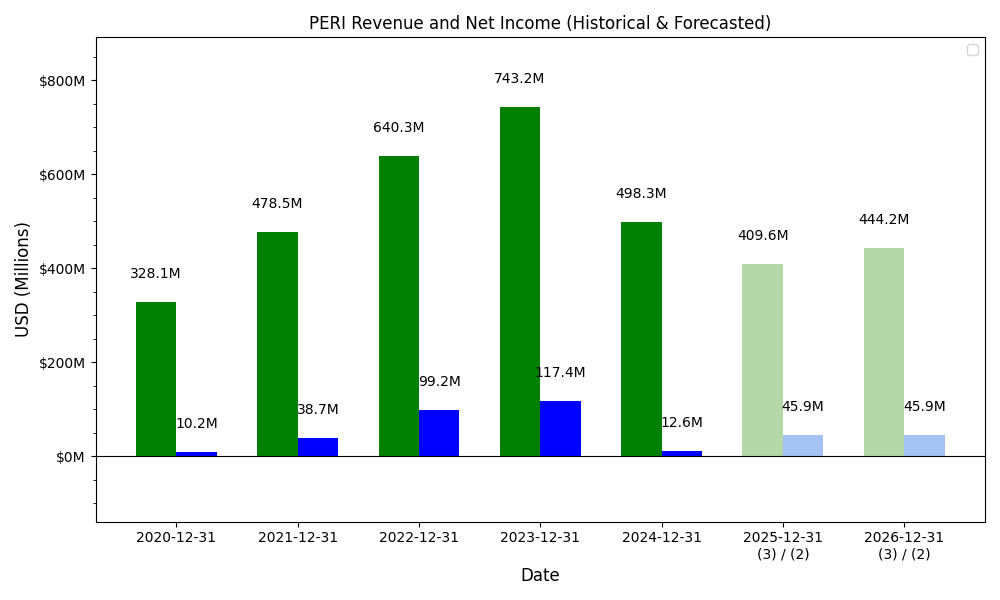

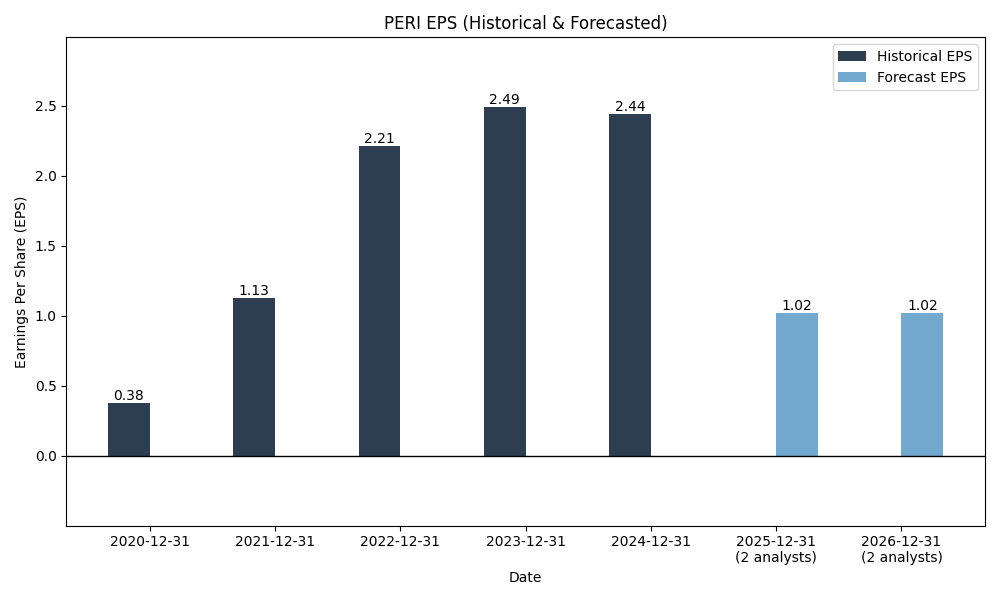

Forecasts

Y/Y % Change

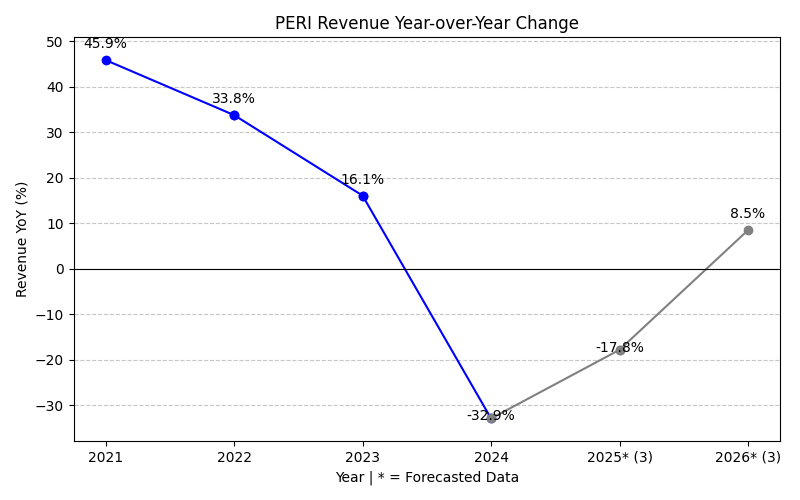

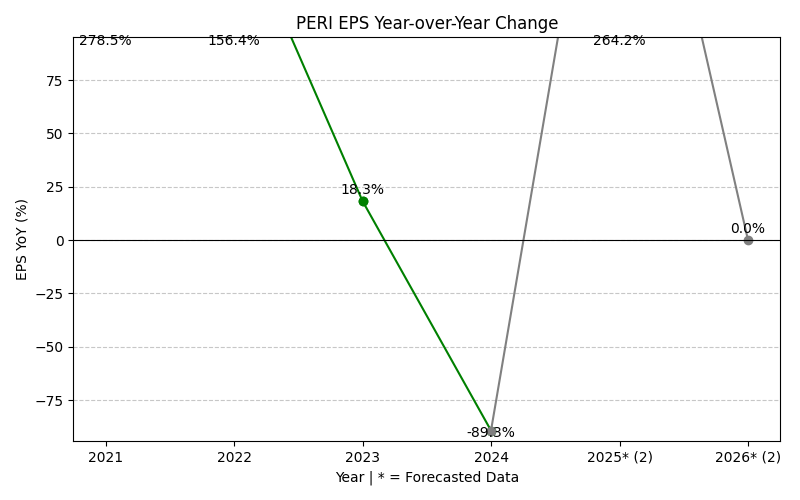

PERI Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 45.9% | 33.8% | 16.1% | -32.9% | -4.7% | 10.4% | 11.4% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 3 | 3 | |

| EPS Growth (%) | 278.5% | 151.8% | 17.9% | -89.0% | 280.9% | 18.1% | 109.7% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 2 | 2 |

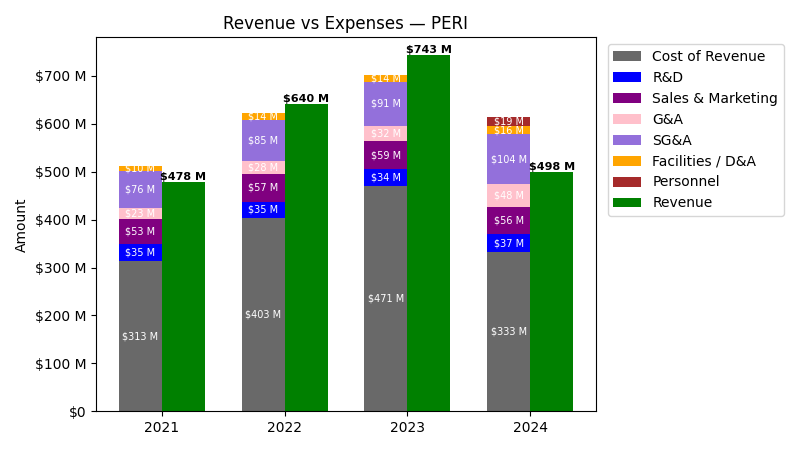

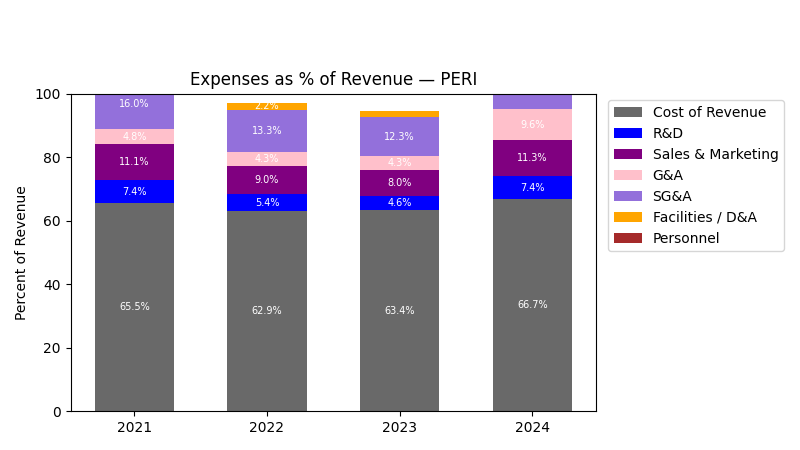

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | R&D ($) | Sales & Marketing ($) | G&A ($) | SG&A ($) | Facilities / D&A ($) | Personnel ($) |

|---|---|---|---|---|---|---|---|---|

| 2021 | $478.5M | $303.3M | $35.3M | $53.2M | $23.2M | $76.4M | $9.9M | $0.0 |

| 2022 | $640.3M | $389.2M | $34.6M | $57.4M | $27.7M | $85.2M | $13.8M | $0.0 |

| 2023 | $743.2M | $456.7M | $33.9M | $59.3M | $32.1M | $91.4M | $14.1M | $0.0 |

| 2024 | $498.3M | $316.2M | $36.7M | $56.4M | $48.0M | $104.4M | $16.4M | $19.0M |

| TTM | $432.4M | $274.7M | $34.4M | $61.4M | $46.4M | $107.9M | $16.2M | $0.0 |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | R&D Change (%) | Sales & Marketing Change (%) | G&A Change (%) | SG&A Change (%) | Facilities / D&A Change (%) | Personnel Change (%) |

|---|---|---|---|---|---|---|---|---|

| 2022 | 33.81 | 28.30 | -2.05 | 7.97 | 19.70 | 11.53 | 39.82 | NaN |

| 2023 | 16.07 | 17.36 | -2.14 | 3.29 | 15.56 | 7.29 | 1.84 | NaN |

| 2024 | -32.95 | -30.77 | 8.19 | -4.97 | 49.84 | 14.25 | 16.62 | inf |

| TTM | -13.23 | -13.13 | -6.05 | 8.93 | -3.34 | 3.28 | -1.25 | -100.0 |

No unmapped expenses.

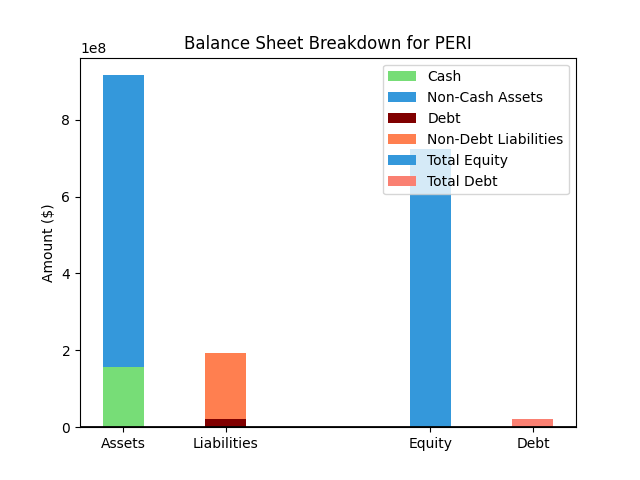

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $916M |

| 1 | Cash | $124M |

| 2 | Total Liabilities | $229M |

| 3 | Total Debt | $22M |

| 4 | Total Equity | $686M |

| 5 | Debt to Equity Ratio | 0.03 |

EPS & Dividend

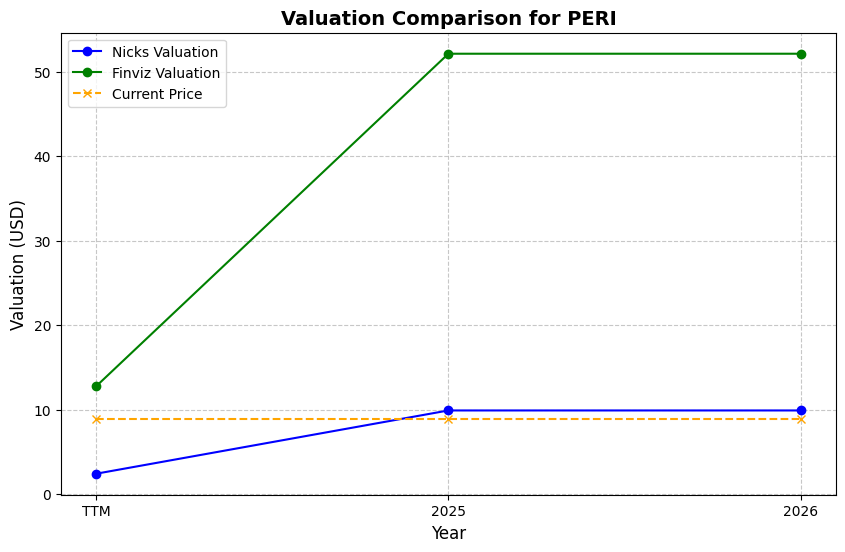

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $8.57 | 4.1% | Nicks Growth: 4% Nick's Expected Margin: 15% FINVIZ Growth: 6% |

Nicks: 10 Finviz: 12 |

Nick's: 1.492 | 0.8 | - |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $10.44 Revenue | TTM | $15.58 | 81.8% | $19.31 | 125.3% |

| $1.08 EPS | 2025 | $10.74 | 25.4% | $13.32 | 55.4% |

| $1.27 EPS | 2026 | $12.63 | 47.4% | $15.66 | 82.7% |

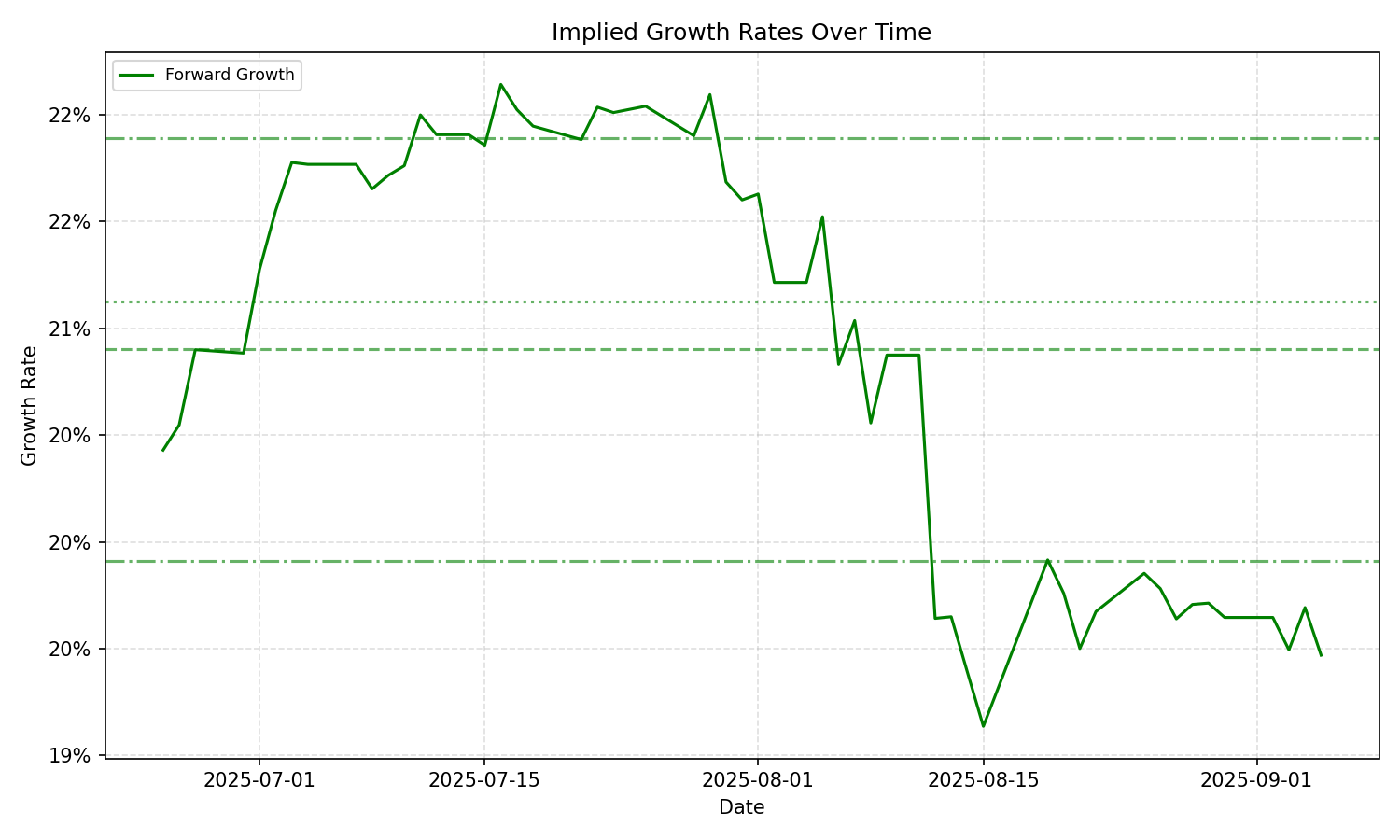

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | – | 16.02% | – | 19.81% | – | 8.02% | – | 0.55% | – | 2.4% |

| 3 Years | – | 16.02% | – | 19.81% | – | 8.02% | – | 0.55% | – | 2.4% |

| 5 Years | – | 16.02% | – | 19.81% | – | 8.02% | – | 0.55% | – | 2.4% |

| 10 Years | – | 16.02% | – | 19.81% | – | 8.02% | – | 0.55% | – | 2.4% |