Cloudflare, Inc. — NET

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $172.19 | $60.59B | - | 119.2 | N/A | 32.1% | - | 41.5 |

Latest Headlines

- · Investors Heavily Search Cloudflare, Inc. (NET): Here is What You Need to Know

- · Zscaler posts wider quarterly loss on higher spending; shares down 9%

- · Mastercard Crypto Card And Fintech Deals Reshape Long Term Earnings Story

- · Whetstone Capital Exits GitLab as Enterprises Rethink AI-Driven Software Development Tools

- · Tech Stocks Rally in Front of Nvidia Results

- · Cloudflare’s Post Quantum Security Moves Tested Against Rich Valuation Concerns

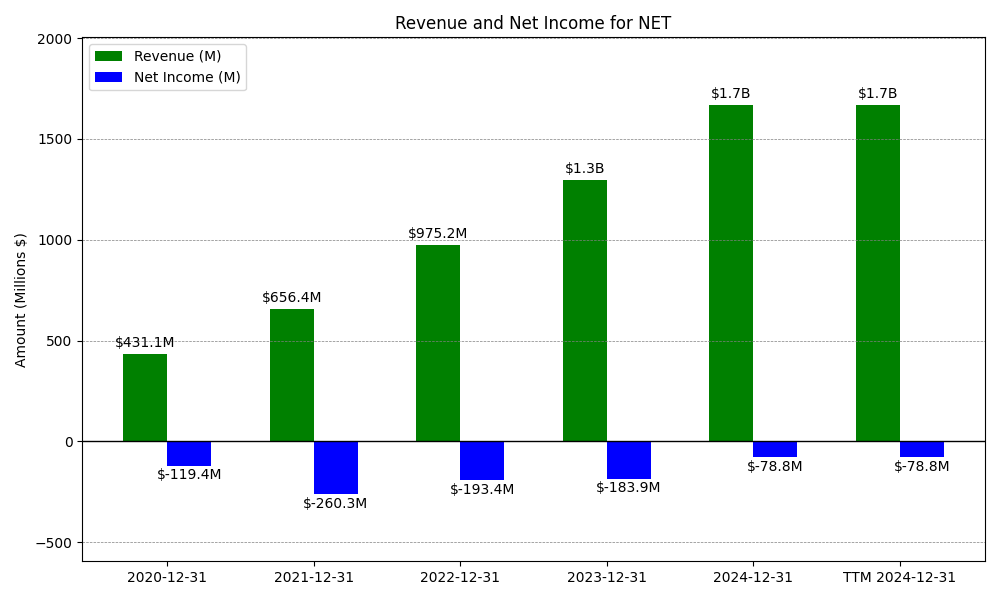

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

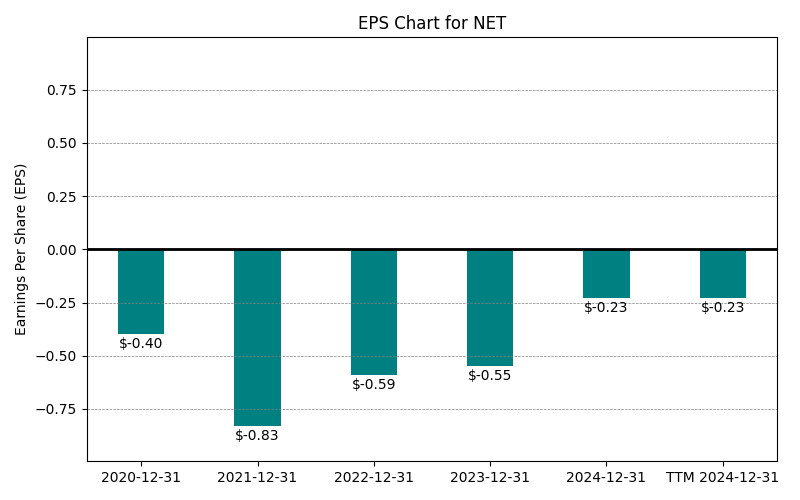

| 0 | 2020-12-31 | $431M | $-119M | $-0.40 | 2024-02-08 22:12:17 | N/A | N/A | N/A |

| 1 | 2021-12-31 | $656M | $-260M | $-0.59 | 2026-02-27 22:02:59 | 52.3% | 118.1% | 47.5% |

| 2 | 2022-12-31 | $975M | $-193M | $-0.59 | 2026-02-27 22:02:59 | 48.6% | -25.7% | 0.0% |

| 3 | 2023-12-31 | $1,297M | $-184M | $-0.55 | 2026-02-27 22:02:59 | 33.0% | -4.9% | -6.8% |

| 4 | 2024-12-31 | $1,670M | $-79M | $-0.23 | 2026-02-27 22:02:59 | 28.8% | -57.2% | -58.2% |

| 5 | 2025-12-31 | $1,670M | $-79M | $-0.29 | 2026-02-27 22:02:59 | 0.0% | 0.0% | 26.1% |

| 6 | TTM 2025-12-31 | $1,553M | $-90M | $-0.30 | 2026-02-12 08:44:05 | -7.0% | 14.5% | 3.4% |

EPS

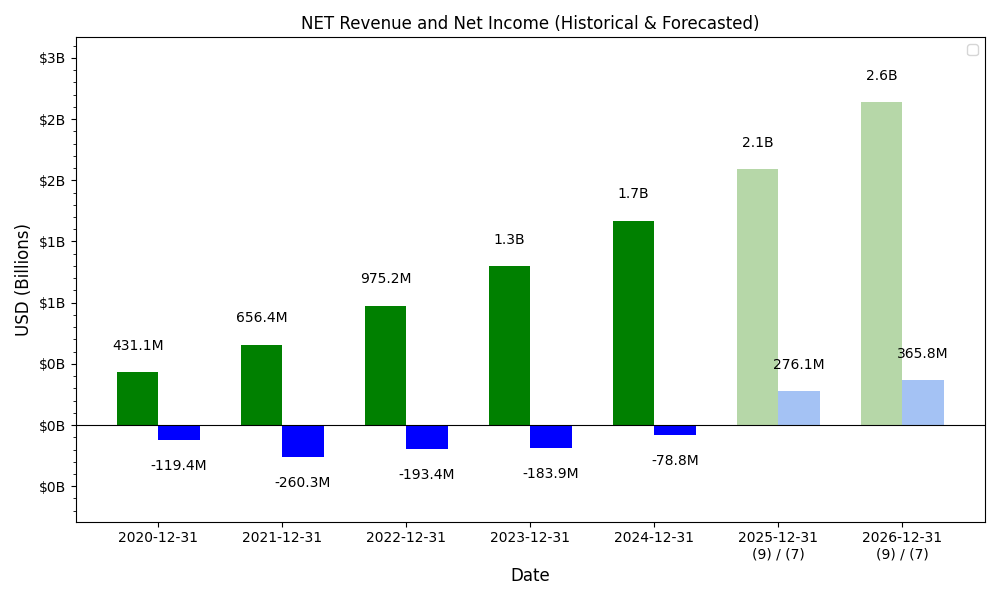

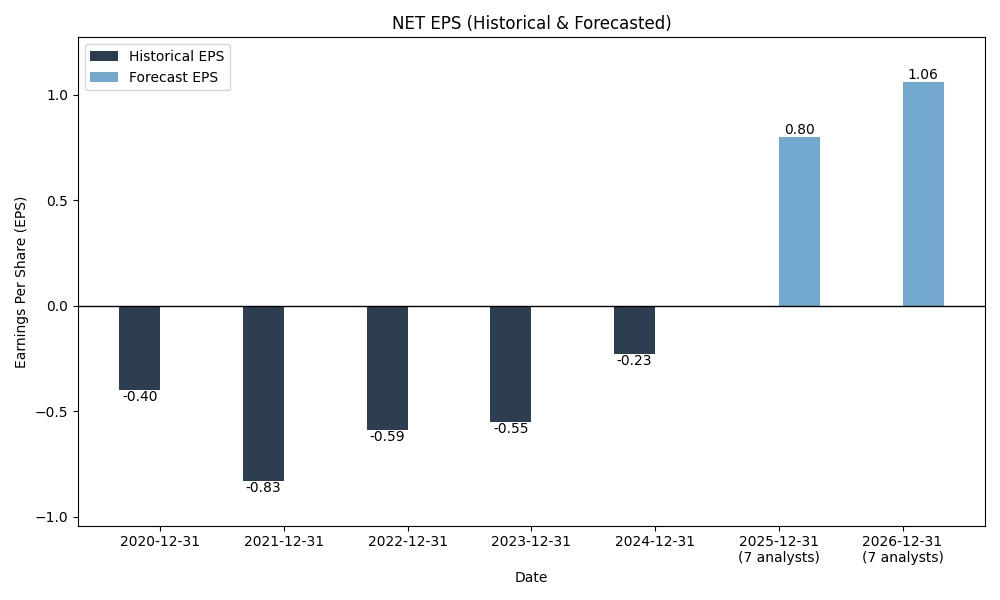

Forecasts

Y/Y % Change

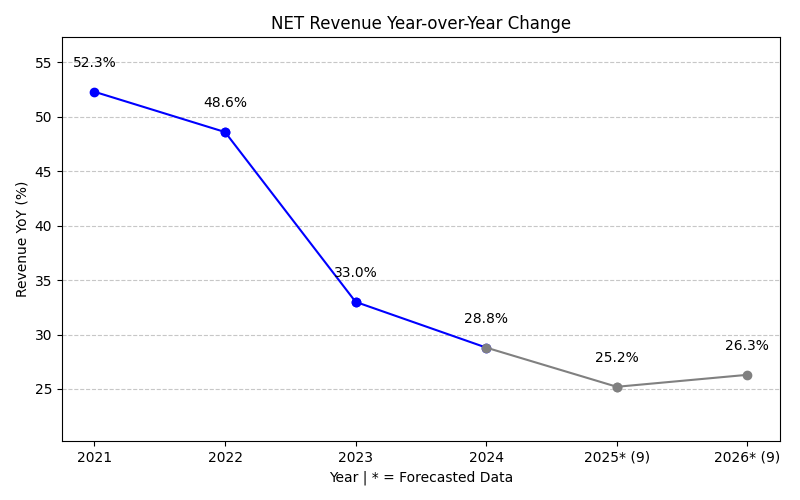

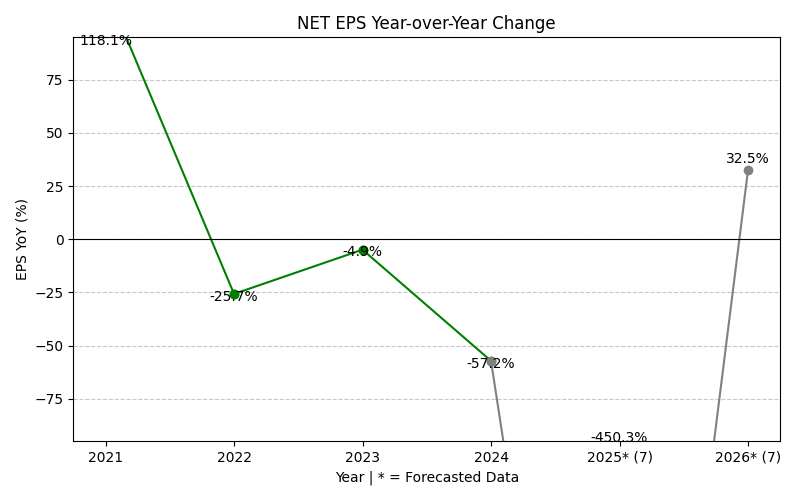

NET Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 52.3% | 48.6% | 33.0% | 28.8% | 0.0% | 67.7% | 27.5% | 36.8% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 9 | 9 | |

| EPS Growth (%) | 118.1% | -25.7% | -4.9% | -57.2% | 0.0% | -595.7% | 28.8% | -76.7% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 9 | 9 |

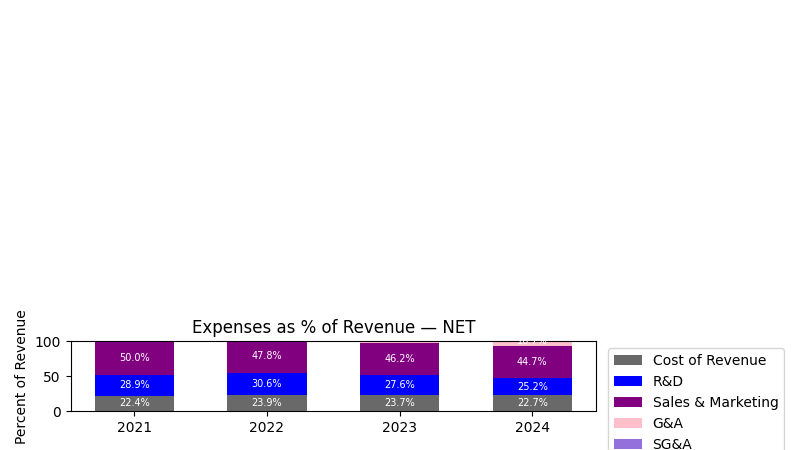

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | R&D ($) | Sales & Marketing ($) | G&A ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|---|---|---|

| 2021 | $656.4M | $80.5M | $189.4M | $328.1M | $119.5M | $447.6M | $66.6M |

| 2022 | $975.2M | $130.3M | $298.3M | $465.8M | $179.8M | $645.5M | $102.3M |

| 2023 | $1.3B | $171.2M | $358.1M | $599.1M | $218.0M | $817.1M | $135.8M |

| 2024 | $1.7B | $251.0M | $421.4M | $745.8M | $278.5M | $1.0B | $127.7M |

| TTM | $1.6B | $253.4M | $370.6M | $669.7M | $280.6M | $950.2M | $137.2M |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | R&D Change (%) | Sales & Marketing Change (%) | G&A Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|---|---|---|

| 2022 | 48.57 | 61.78 | 57.49 | 41.97 | 50.43 | 44.23 | 53.64 |

| 2023 | 32.97 | 31.40 | 20.06 | 28.63 | 21.25 | 26.58 | 32.72 |

| 2024 | 28.76 | 46.61 | 17.66 | 24.48 | 27.78 | 25.36 | -5.96 |

| TTM | -6.96 | 0.97 | -12.05 | -10.21 | 0.73 | -7.23 | 7.39 |

No unmapped expenses.

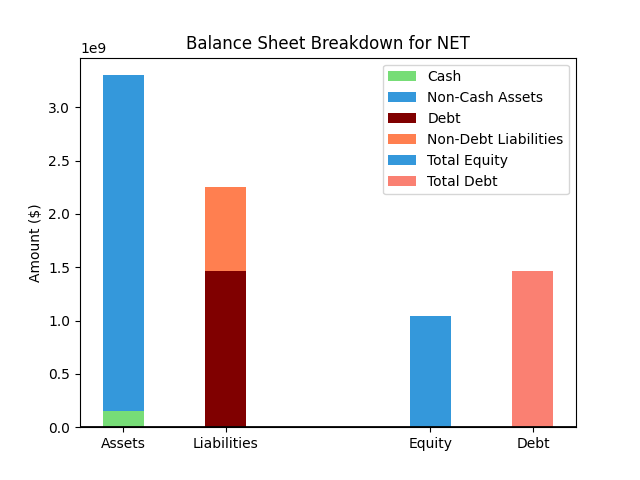

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $5,786M |

| 1 | Cash | $1,053M |

| 2 | Total Liabilities | $4,439M |

| 3 | Total Debt | $3,502M |

| 4 | Total Equity | $1,347M |

| 5 | Debt to Equity Ratio | 2.60 |

EPS & Dividend

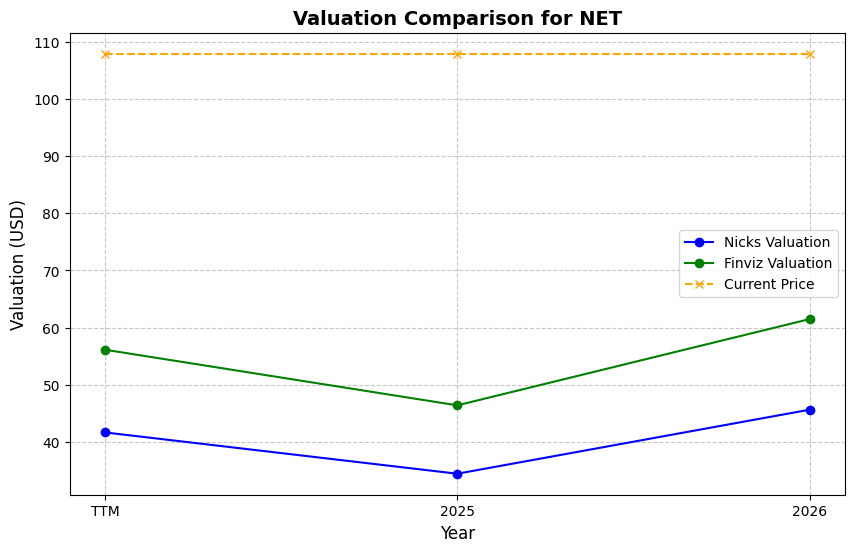

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $172.19 | 4.0% | Nicks Growth: 20% Nick's Expected Margin: 20% FINVIZ Growth: 26% |

Nicks: 44 Finviz: 75 |

Nick's: 8.852 | 39.0 | - |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $4.41 Revenue | TTM | $39.08 | -77.3% | $65.98 | -61.7% |

| $1.11 EPS | 2026 | $49.13 | -71.5% | $82.95 | -51.8% |

| $1.43 EPS | 2027 | $63.29 | -63.2% | $106.86 | -37.9% |

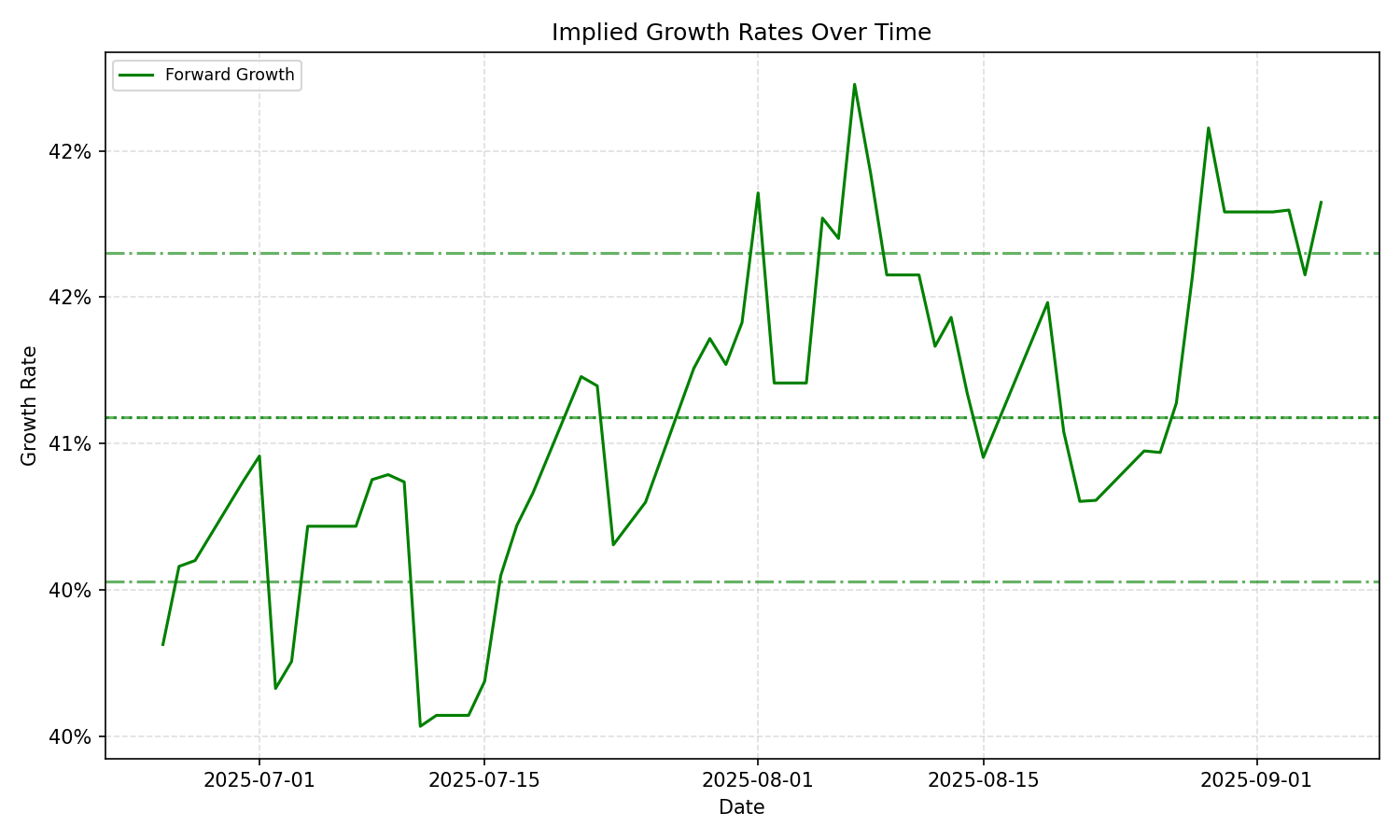

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | – | 39.96% | – | 41.17% | – | 3.05% | – | 32.32% | – | 2.3% |

| 3 Years | – | 39.96% | – | 41.17% | – | 3.05% | – | 32.32% | – | 2.3% |

| 5 Years | – | 39.96% | – | 41.17% | – | 3.05% | – | 32.32% | – | 2.3% |

| 10 Years | – | 39.96% | – | 41.17% | – | 3.05% | – | 32.32% | – | 2.3% |