Mama's Creations, Inc. — MAMA

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $17.14 | $696.80M | 142.8 | 57.1 | 34.4% | 23.0% | - | 14.0 |

Latest Headlines

- · Mama’s Creations price target raised to $24 from $20 at Maxim

- · Is Mama's Creations, Inc. (MAMA) a Solid Growth Stock? 3 Reasons to Think "Yes"

- · Is Mama's Creations, Inc. (MAMA) Outperforming Other Consumer Staples Stocks This Year?

- · Mama's Creations, Inc. (MAMA) Moves 8.3% Higher: Will This Strength Last?

- · Mama’s Creations Investor Day: NAE Chicken Shift, Walmart/Target Wins, 2027 Margin Targets

- · How The Mama’s Creations (MAMA) Narrative Is Evolving With New Growth And Valuation Assumptions

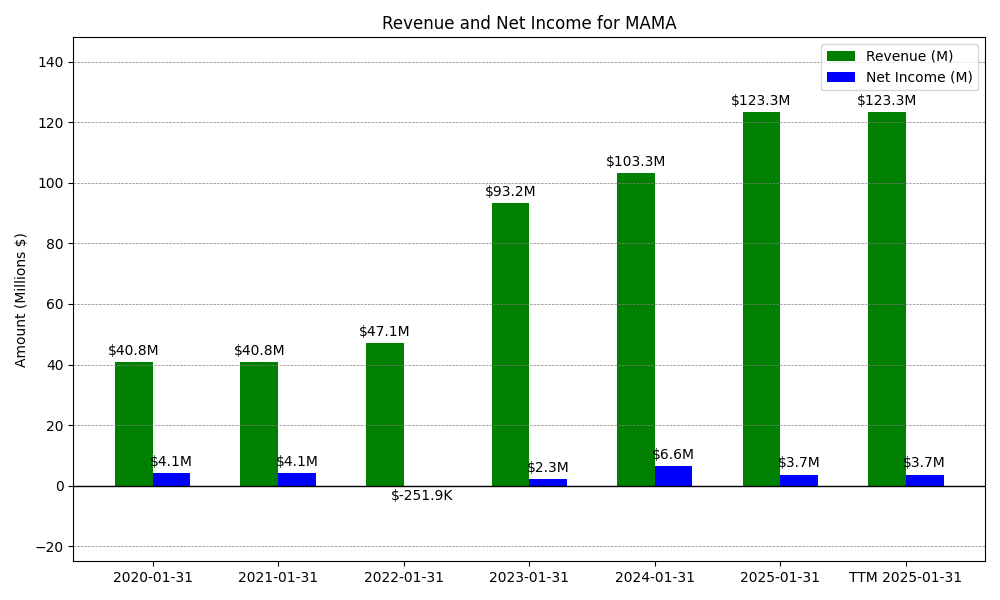

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

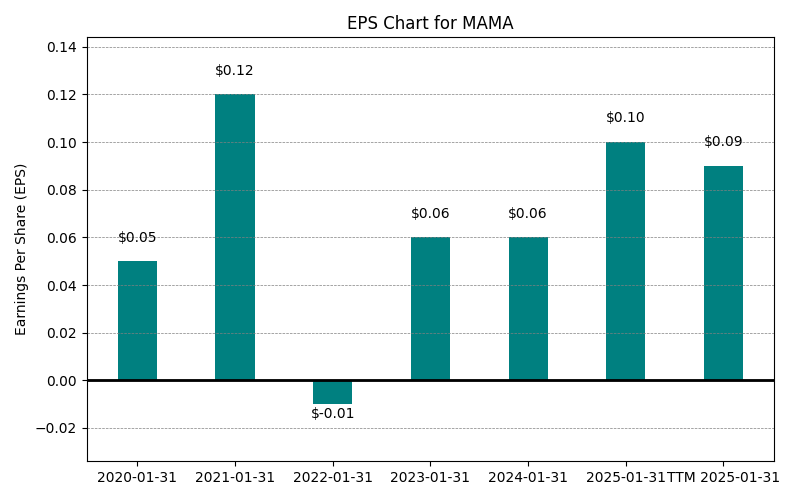

| 0 | 2020-01-31 | $41M | $4M | $0.05 | 2024-05-25 13:11:34 | N/A | N/A | N/A |

| 1 | 2021-01-31 | $41M | $4M | $0.12 | 2024-04-27 14:48:59 | 0.0% | 0.0% | 140.0% |

| 2 | 2022-01-31 | $47M | $-0M | $-0.01 | 2026-02-27 22:01:29 | 15.5% | -106.2% | -108.3% |

| 3 | 2023-01-31 | $93M | $2M | $0.06 | 2026-02-27 22:01:29 | 97.9% | -1014.6% | -700.0% |

| 4 | 2024-01-31 | $103M | $7M | $0.18 | 2026-02-27 22:01:29 | 10.8% | 184.8% | 200.0% |

| 5 | 2025-01-31 | $123M | $4M | $0.10 | 2026-02-27 22:01:29 | 19.4% | -43.4% | -44.4% |

| 6 | TTM 2025-10-31 | $151M | $5M | $0.12 | 2026-02-05 08:32:54 | 22.7% | 25.4% | 20.0% |

EPS

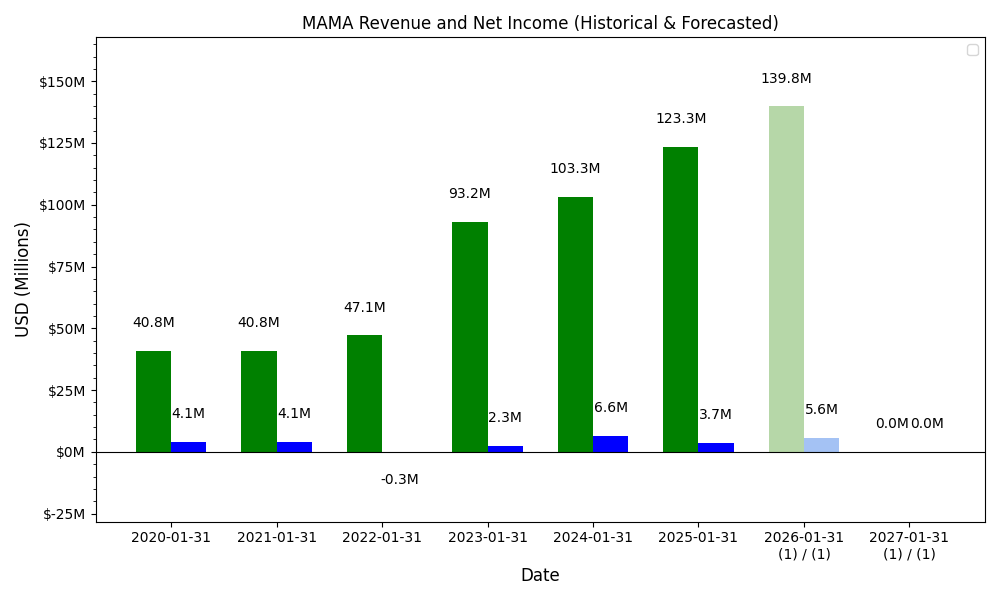

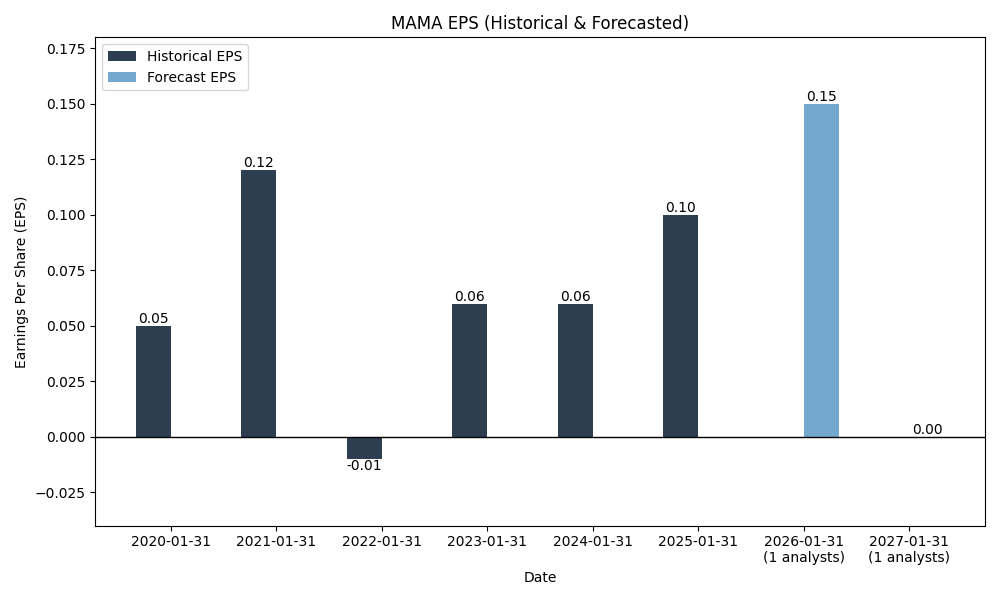

Forecasts

Y/Y % Change

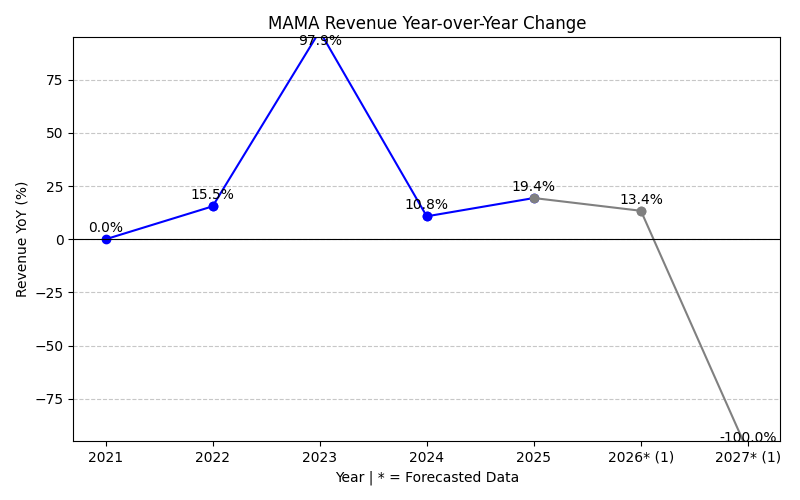

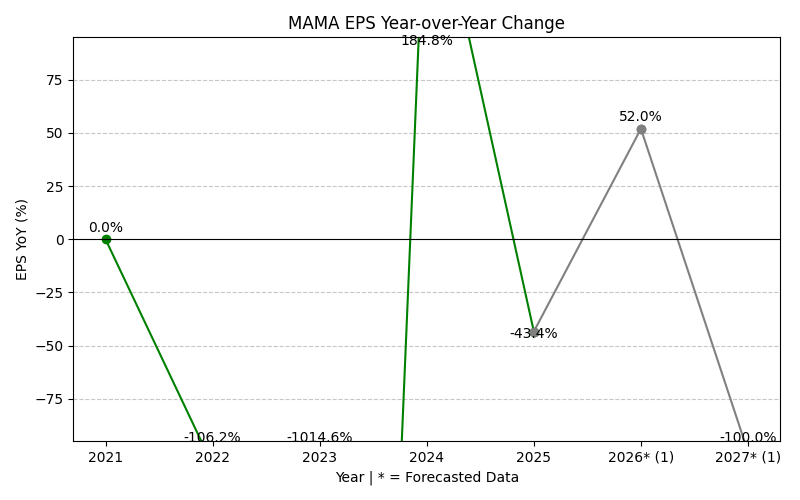

MAMA Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 0.0% | 15.5% | 97.9% | 10.8% | 19.4% | 39.9% | 29.2% | 30.4% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | |

| EPS Growth (%) | 0.0% | -106.2% | -1014.6% | 184.8% | -43.4% | 42.4% | 107.7% | -118.5% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

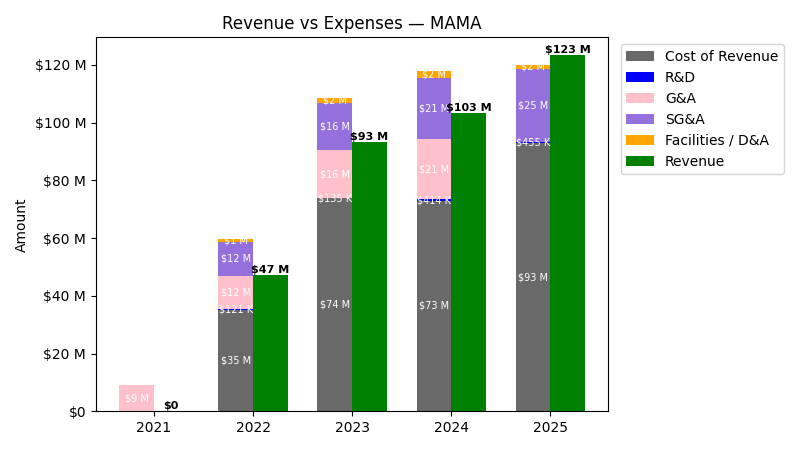

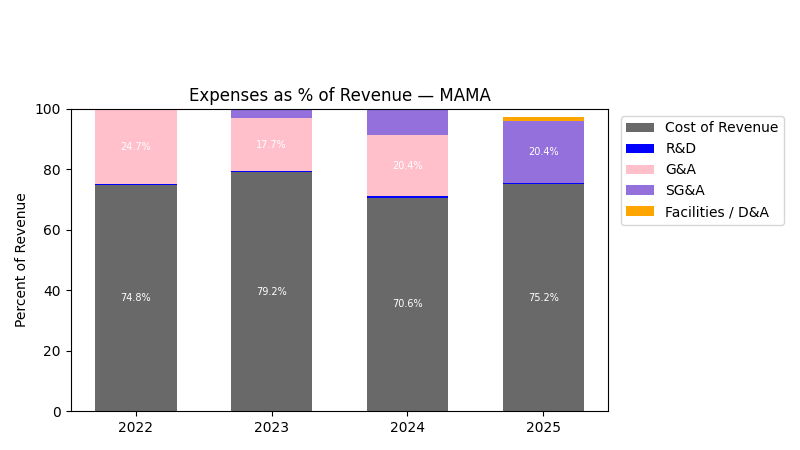

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | R&D ($) | G&A ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|---|---|

| 2022 | $47.1M | $34.2M | $120.7K | $11.7M | $11.7M | $1.0M |

| 2023 | $93.2M | $72.0M | $135.0K | $16.5M | $16.5M | $1.8M |

| 2024 | $103.3M | $70.5M | $414.0K | $21.0M | $21.0M | $2.5M |

| 2025 | $123.3M | $91.2M | $455.0K | $0.0 | $25.2M | $1.6M |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | R&D Change (%) | G&A Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|---|---|

| 2023 | 97.92 | 110.45 | 11.85 | 41.30 | 41.28 | 73.78 |

| 2024 | 10.83 | -2.12 | 206.67 | 27.75 | 27.76 | 40.24 |

| 2025 | 19.41 | 29.46 | 9.90 | -100.00 | 19.84 | -37.27 |

No unmapped expenses.

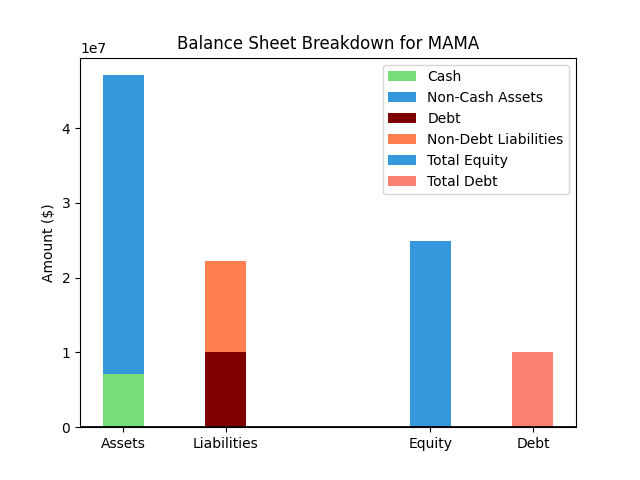

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $84M |

| 1 | Cash | $18M |

| 2 | Total Liabilities | $34M |

| 3 | Total Debt | $16M |

| 4 | Total Equity | $50M |

| 5 | Debt to Equity Ratio | 0.32 |

EPS & Dividend

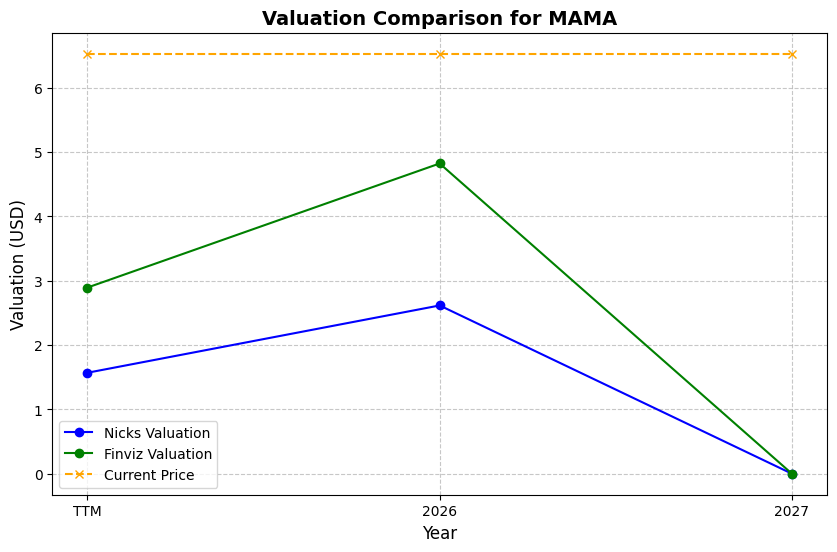

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $17.14 | 4.0% | Nicks Growth: 10% Nick's Expected Margin: 5% FINVIZ Growth: 71% |

Nicks: 18 Finviz: 1691 |

Nick's: 0.899 | 4.6 | 142.8 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $0.12 EPS | TTM | $2.16 | -87.4% | $202.92 | 1083.9% |

| $0.13 EPS | 2026 | $2.34 | -86.4% | $219.83 | 1182.6% |

| $0.27 EPS | 2027 | $4.85 | -71.7% | $456.58 | 2563.8% |

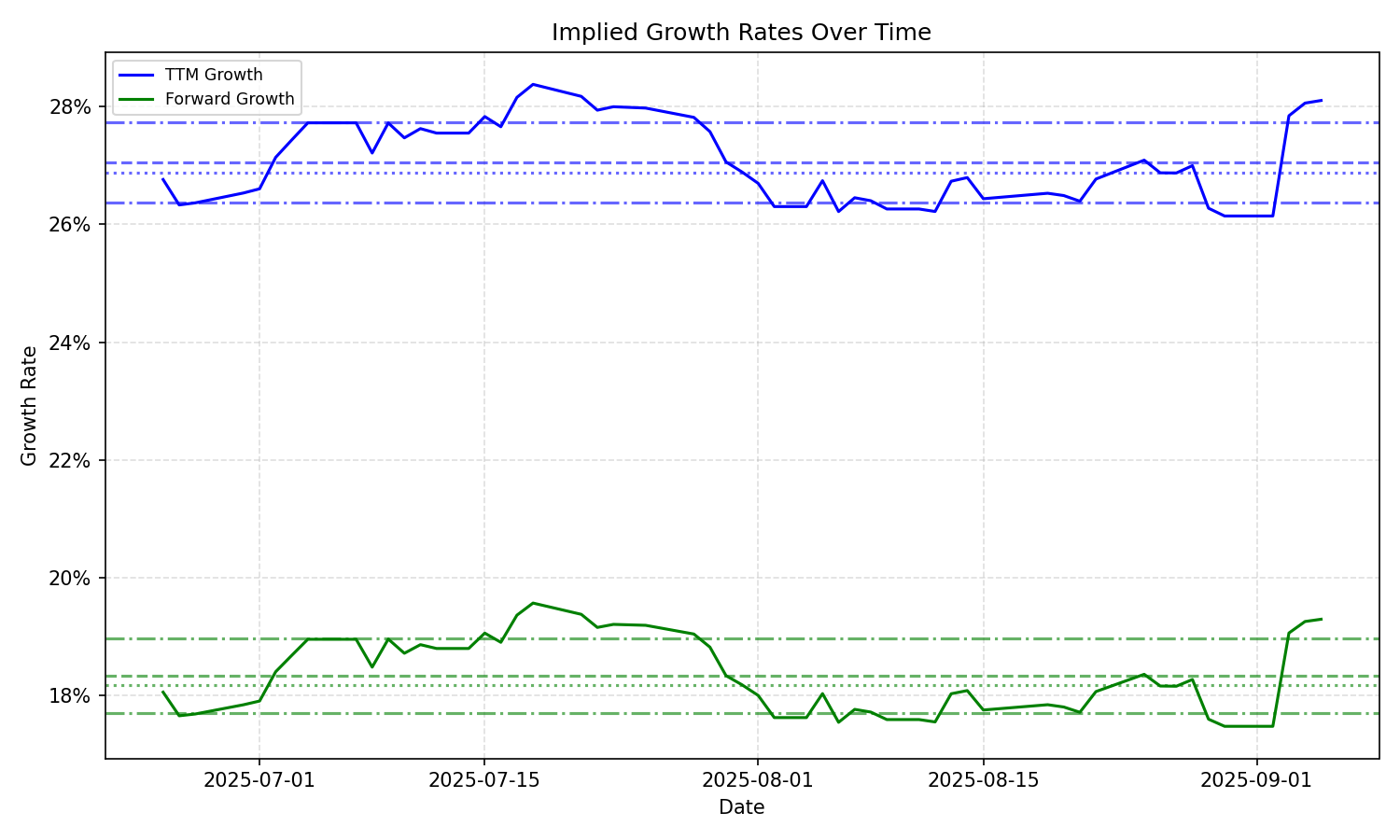

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 29.44% | 19.99% | 29.41% | 20.29% | 2.19% | 1.42% | 34.39% | 22.98% | 98.9% | 98.3% |

| 3 Years | 29.44% | 19.99% | 29.41% | 20.29% | 2.19% | 1.42% | 34.39% | 22.98% | 98.9% | 98.3% |

| 5 Years | 29.44% | 19.99% | 29.41% | 20.29% | 2.19% | 1.42% | 34.39% | 22.98% | 98.9% | 98.3% |

| 10 Years | 29.44% | 19.99% | 29.41% | 20.29% | 2.19% | 1.42% | 34.39% | 22.98% | 98.9% | 98.3% |