Lam Research Corporation — LRCX

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $233.89 | $293.77B | 47.9 | 34.0 | 20.9% | 17.0% | $1.04 0.4% | 28.8 |

Latest Headlines

- · Lam Research (LRCX) Down 3.7% Since Last Earnings Report: Can It Rebound?

- · Lam Research Resets Around Micron Partnership And Specialty Chip Expansion

- · Lam Research (LRCX) Falls More Steeply Than Broader Market: What Investors Need to Know

- · Applied Materials, Broadcom, Lam Research, Western Digital, and Allegro MicroSystems Shares Are Falling, What You Need To Know

- · Nishant Sinha Joins Atomera as Head of Marketing to Drive Strategy and Growth in Advanced Semiconductor Materials

- · The AI spending boom is creating winners beyond the 'Mag 7.' Why one sector could see big gains.

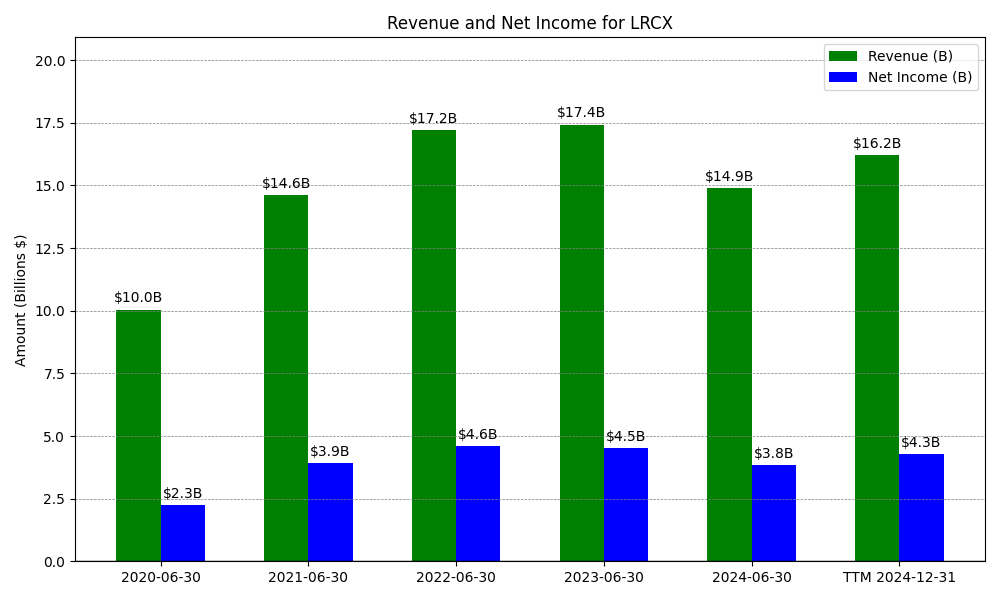

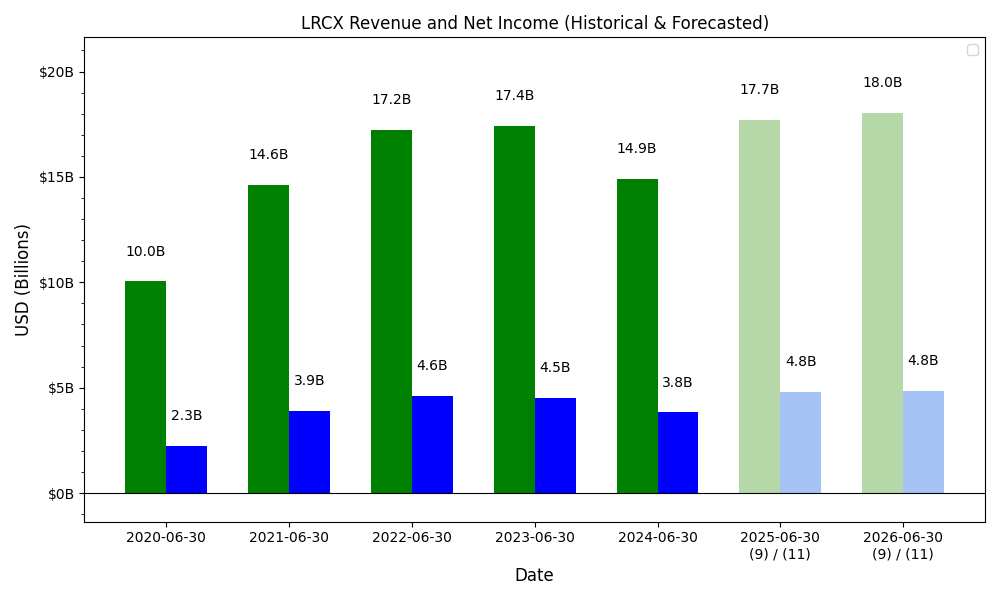

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

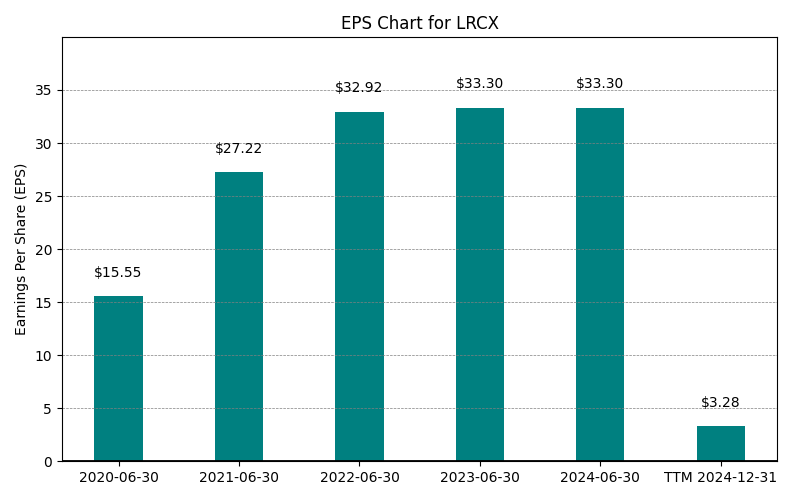

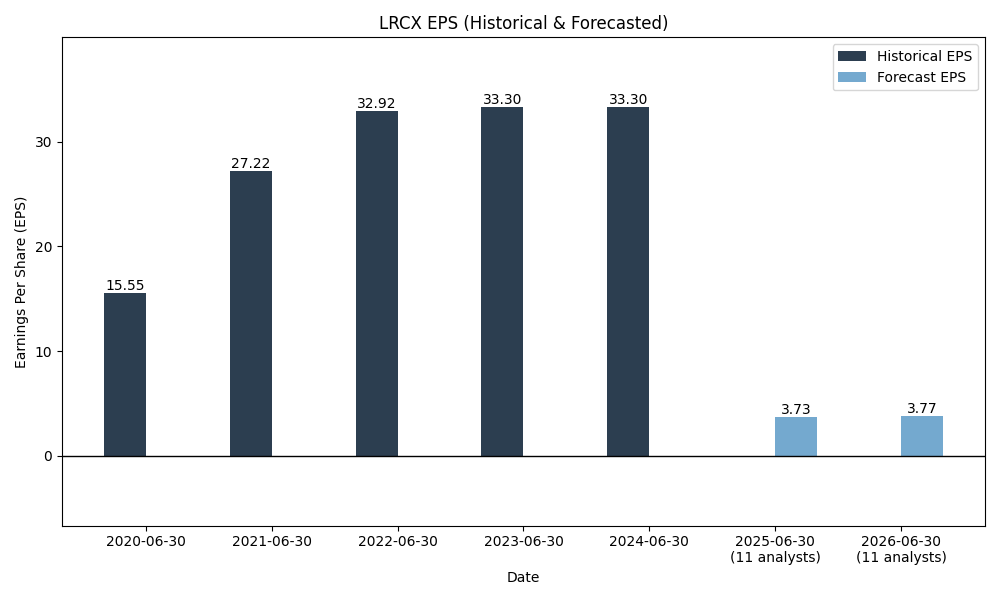

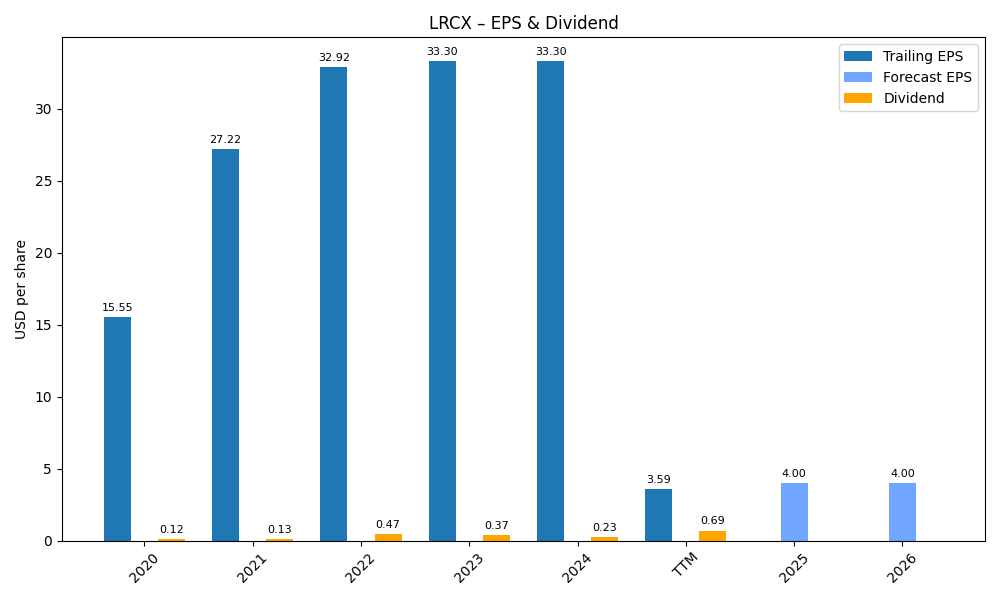

| 0 | 2020-06-30 | $10,045M | $2,252M | $15.55 | 2024-02-04 04:18:33 | N/A | N/A | N/A |

| 1 | 2021-06-30 | $14,626M | $3,908M | $27.22 | 2024-02-04 04:18:33 | 45.6% | 73.6% | 75.0% |

| 2 | 2022-06-30 | $17,227M | $4,605M | $3.29 | 2026-02-27 22:00:56 | 17.8% | 17.8% | -87.9% |

| 3 | 2023-06-30 | $17,429M | $4,511M | $3.33 | 2026-02-27 22:00:56 | 1.2% | -2.0% | 1.2% |

| 4 | 2024-06-30 | $14,905M | $3,828M | $2.91 | 2026-02-27 22:00:56 | -14.5% | -15.1% | -12.6% |

| 5 | 2025-06-30 | $18,436M | $5,358M | $4.17 | 2026-02-27 22:00:56 | 23.7% | 40.0% | 43.3% |

| 6 | TTM 2025-12-31 | $20,561M | $6,213M | $4.88 | 2026-02-02 08:32:53 | 11.5% | 16.0% | 17.0% |

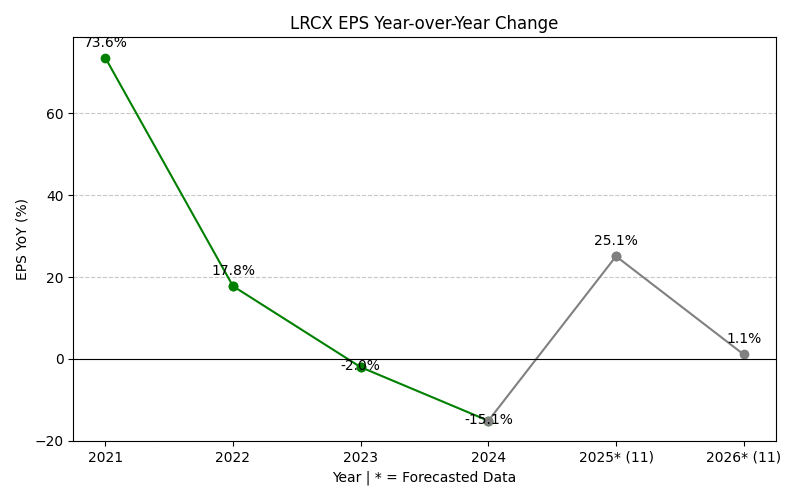

EPS

Forecasts

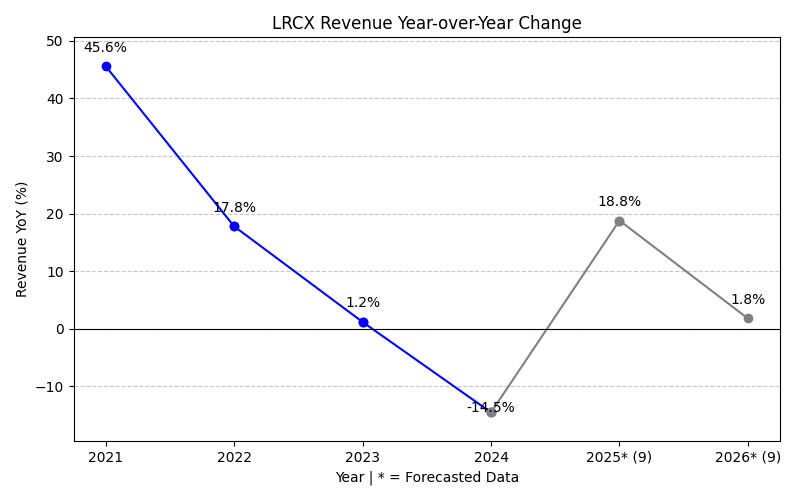

Y/Y % Change

LRCX Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 45.6% | 17.8% | 1.2% | -14.5% | 23.7% | 20.0% | 21.4% | 16.5% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 7 | 7 | |

| EPS Growth (%) | 73.6% | 17.8% | -2.0% | -15.1% | 40.0% | 22.8% | 26.9% | 23.4% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 10 | 10 |

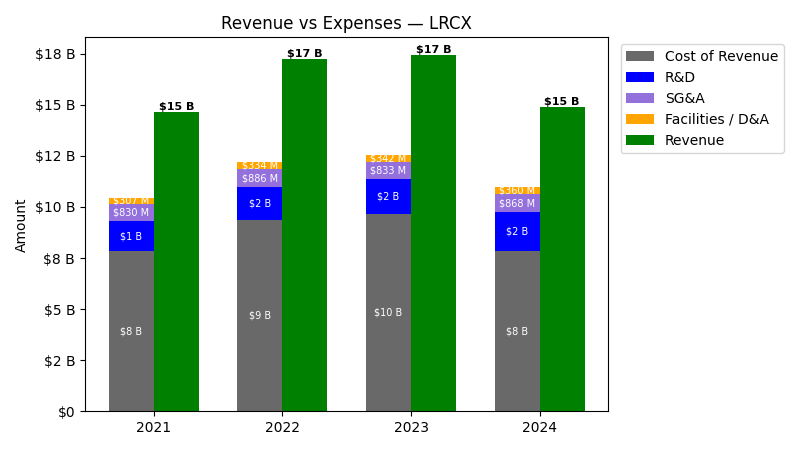

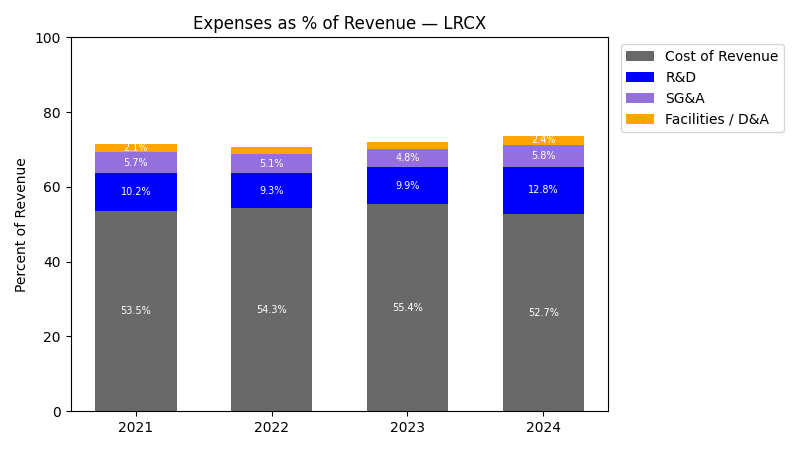

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | R&D ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|---|

| 2021 | $14.6B | $7.5B | $1.5B | $829.9M | $307.2M |

| 2022 | $17.2B | $9.0B | $1.6B | $885.7M | $333.7M |

| 2023 | $17.4B | $9.3B | $1.7B | $832.8M | $342.4M |

| 2024 | $14.9B | $7.5B | $1.9B | $868.2M | $359.7M |

| 2025 | $18.4B | $9.1B | $2.1B | $981.7M | $386.3M |

| TTM | $20.6B | $9.9B | $2.3B | $1.0B | $401.4M |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | R&D Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|---|

| 2022 | 17.78 | 20.07 | 7.42 | 6.73 | 8.66 |

| 2023 | 1.17 | 3.19 | 7.66 | -5.98 | 2.60 |

| 2024 | -14.48 | -19.51 | 10.15 | 4.26 | 5.04 |

| 2025 | 23.68 | 21.05 | 10.19 | 13.07 | 7.39 |

| TTM | 11.53 | 9.37 | 7.61 | 6.08 | 3.90 |

No unmapped expenses.

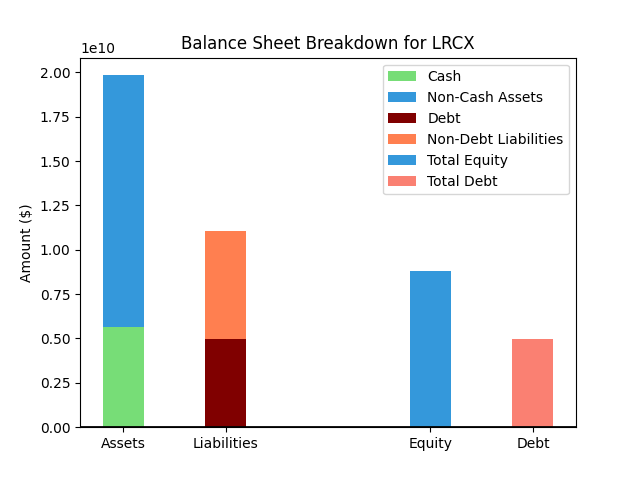

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $21,391M |

| 1 | Cash | $6,180M |

| 2 | Total Liabilities | $11,246M |

| 3 | Total Debt | $4,484M |

| 4 | Total Equity | $10,145M |

| 5 | Debt to Equity Ratio | 0.44 |

EPS & Dividend

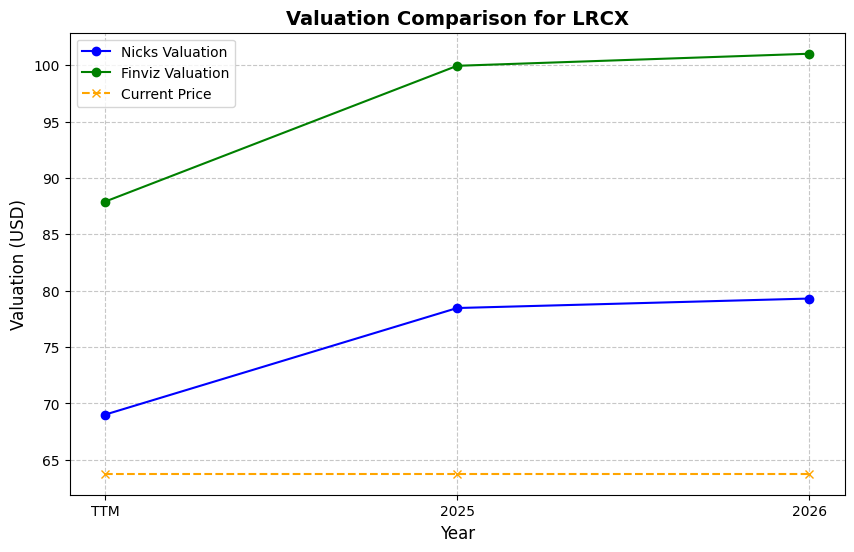

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $233.89 | 4.0% | Nicks Growth: 12% Nick's Expected Margin: 25% FINVIZ Growth: 25% |

Nicks: 22 Finviz: 67 |

Nick's: 5.416 | 14.3 | 47.9 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $4.88 EPS | TTM | $105.73 | -54.8% | $327.98 | 40.2% |

| $5.24 EPS | 2026 | $113.53 | -51.5% | $352.17 | 50.6% |

| $6.65 EPS | 2027 | $144.07 | -38.4% | $446.94 | 91.1% |

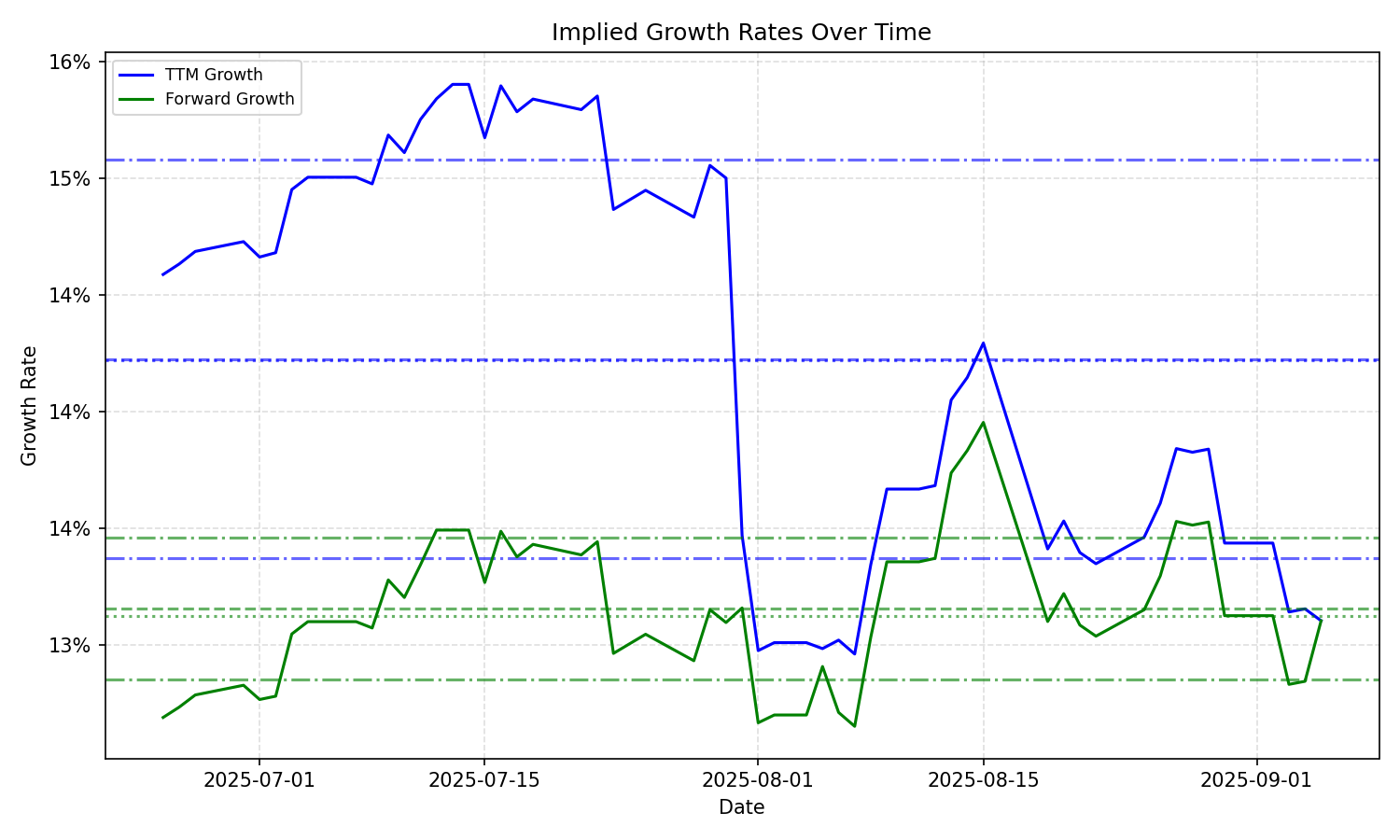

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 16.81% | 15.73% | 16.66% | 16.32% | 2.64% | 2.11% | 21.24% | 17.27% | 91.5% | 68.9% |

| 3 Years | 16.81% | 15.73% | 16.66% | 16.32% | 2.64% | 2.11% | 21.24% | 17.27% | 91.5% | 68.9% |

| 5 Years | 16.81% | 15.73% | 16.66% | 16.32% | 2.64% | 2.11% | 21.24% | 17.27% | 91.5% | 68.9% |

| 10 Years | 16.81% | 15.73% | 16.66% | 16.32% | 2.64% | 2.11% | 21.24% | 17.27% | 91.5% | 68.9% |