Goldman Sachs Group, Inc. (The) — GS

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $859.57 | $260.21B | 16.8 | 13.2 | 9.3% | 6.8% | $18.00 2.1% | 2.4 |

Latest Headlines

- · Bank, Brokerage Stocks Suffer Their Worst Day in Months. Here’s Why.

- · Goldman Sachs has stark message for investors in AI stocks

- · Goldman bucks private credit redemption trend as AI disruption fears mount

- · Goldman Sachs Says Fund's Software Exposure Near Bottom of Peer Range

- · Bank Stocks Head for Worst Day Since April

- · All Eyes on Goldman Sachs as Key Support Wobbles

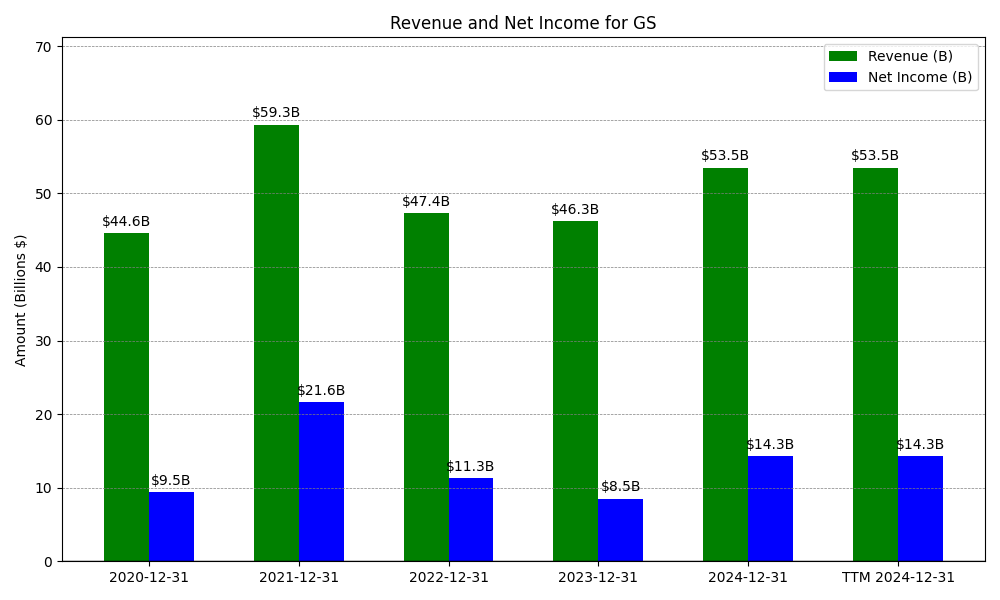

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

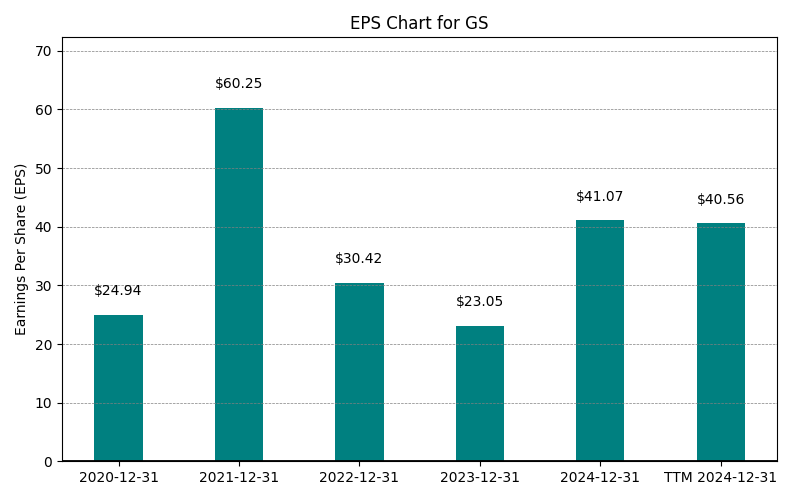

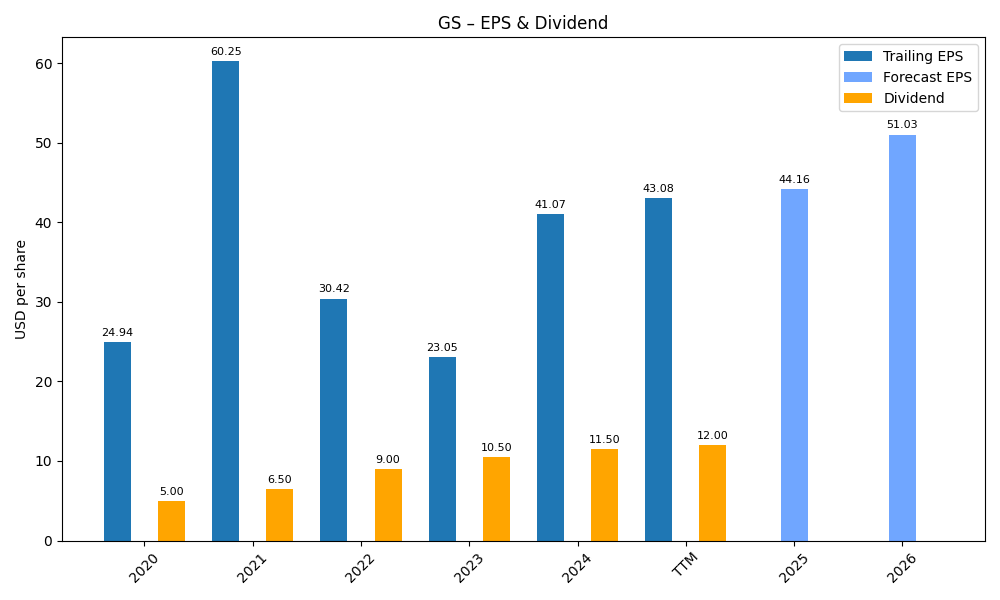

| 0 | 2020-12-31 | $44,559M | $9,459M | $24.94 | 2024-02-09 04:07:07 | N/A | N/A | N/A |

| 1 | 2021-12-31 | $59,339M | $21,635M | $30.42 | 2026-02-27 21:58:42 | 33.2% | 128.7% | 22.0% |

| 2 | 2022-12-31 | $47,365M | $11,261M | $30.42 | 2026-02-27 21:58:42 | -20.2% | -48.0% | 0.0% |

| 3 | 2023-12-31 | $46,254M | $8,516M | $23.05 | 2026-02-27 21:58:42 | -2.3% | -24.4% | -24.2% |

| 4 | 2024-12-31 | $53,512M | $14,276M | $41.07 | 2026-02-27 21:58:42 | 15.7% | 67.6% | 78.2% |

| 5 | 2025-12-31 | $53,512M | $14,276M | $51.95 | 2026-02-27 21:58:42 | 0.0% | 0.0% | 26.5% |

| 6 | TTM 2025-12-31 | $44,829M | $12,559M | $51.28 | 2026-01-17 15:29:06 | -16.2% | -12.0% | -1.3% |

EPS

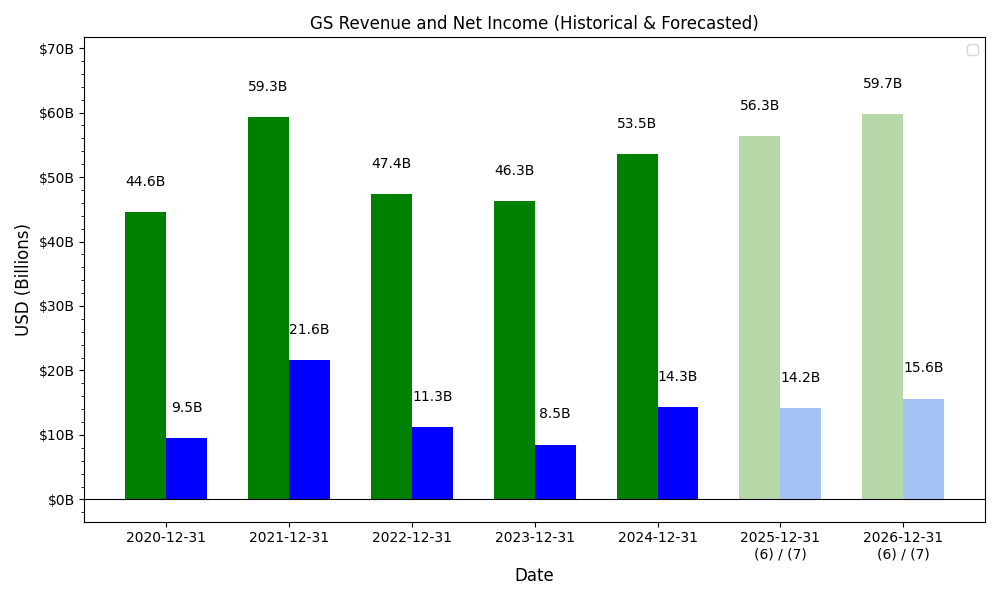

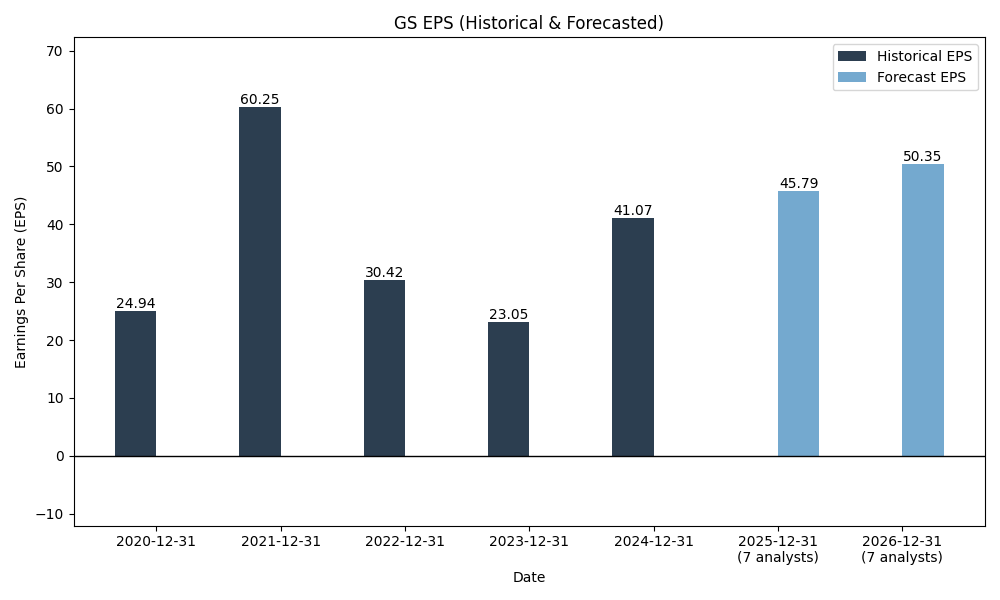

Forecasts

Y/Y % Change

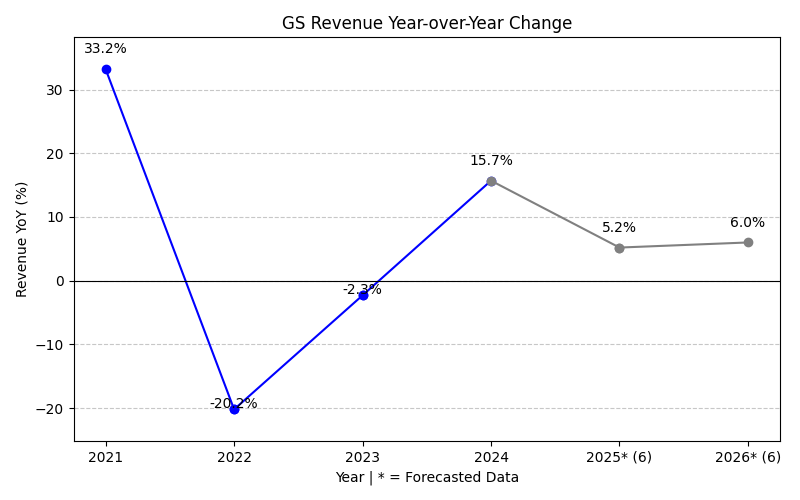

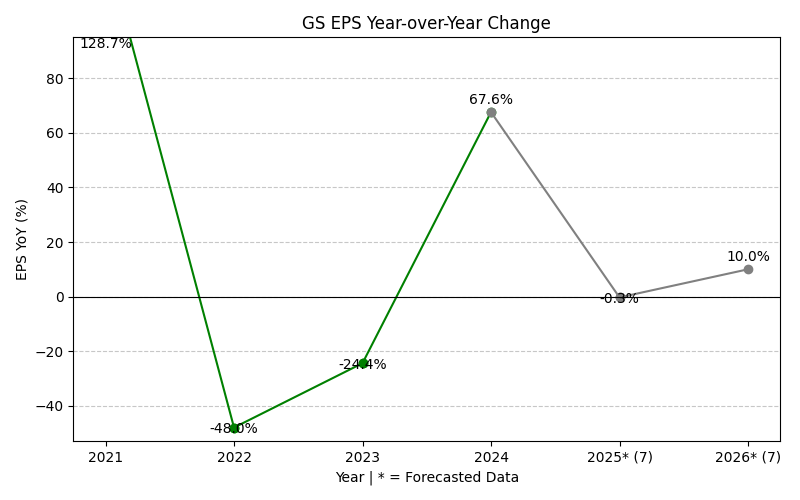

GS Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 33.2% | -20.2% | -2.3% | 15.7% | 0.0% | 18.2% | 3.2% | 6.8% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 6 | 6 | |

| EPS Growth (%) | 128.7% | -48.0% | -24.4% | 67.6% | 0.0% | 20.0% | 10.7% | 22.1% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 7 | 7 |

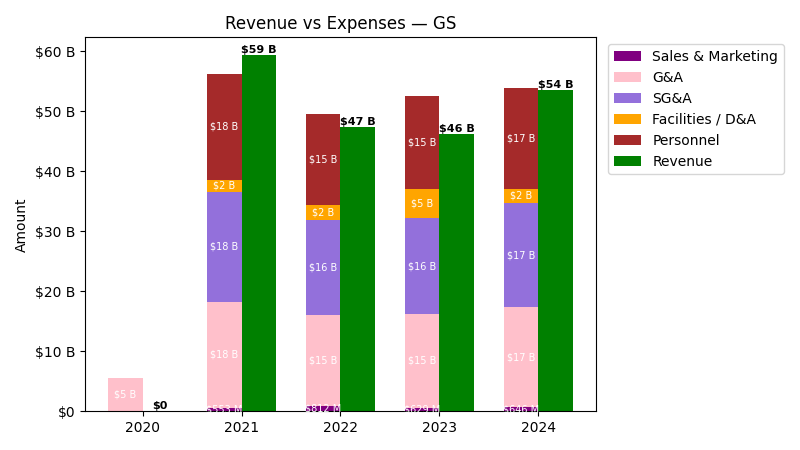

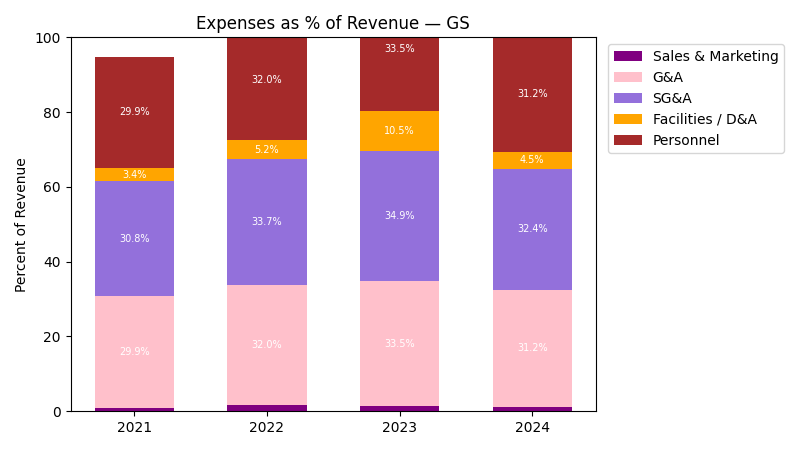

Expenses

| Year | Revenue ($) | Sales & Marketing ($) | G&A ($) | SG&A ($) | Facilities / D&A ($) | Personnel ($) |

|---|---|---|---|---|---|---|

| 2021 | $59.3B | $553.0M | $17.7B | $18.3B | $2.0B | $17.7B |

| 2022 | $47.4B | $812.0M | $15.1B | $16.0B | $2.5B | $15.1B |

| 2023 | $46.3B | $629.0M | $15.5B | $16.1B | $4.9B | $15.5B |

| 2024 | $53.5B | $646.0M | $16.7B | $17.4B | $2.4B | $16.7B |

| TTM | $44.8B | $494.0M | $14.2B | $14.7B | $1.7B | $14.2B |

| Year | Revenue Change (%) | Sales & Marketing Change (%) | G&A Change (%) | SG&A Change (%) | Facilities / D&A Change (%) | Personnel Change (%) |

|---|---|---|---|---|---|---|

| 2022 | -20.18 | 46.84 | -14.51 | -12.65 | 21.84 | -14.51 |

| 2023 | -2.35 | -22.54 | 2.32 | 1.05 | 97.80 | 2.32 |

| 2024 | 15.69 | 2.70 | 7.79 | 7.59 | -50.74 | 7.79 |

| TTM | -16.23 | -23.53 | -14.76 | -15.08 | -30.81 | -14.76 |

No unmapped expenses.

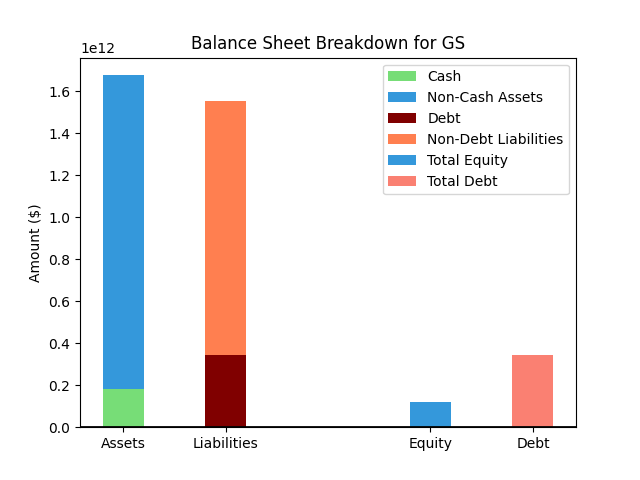

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $1,807,982M |

| 1 | Cash | $169,577M |

| 2 | Total Liabilities | $1,683,580M |

| 3 | Total Debt | $376,267M |

| 4 | Total Equity | $124,402M |

| 5 | Debt to Equity Ratio | 3.02 |

EPS & Dividend

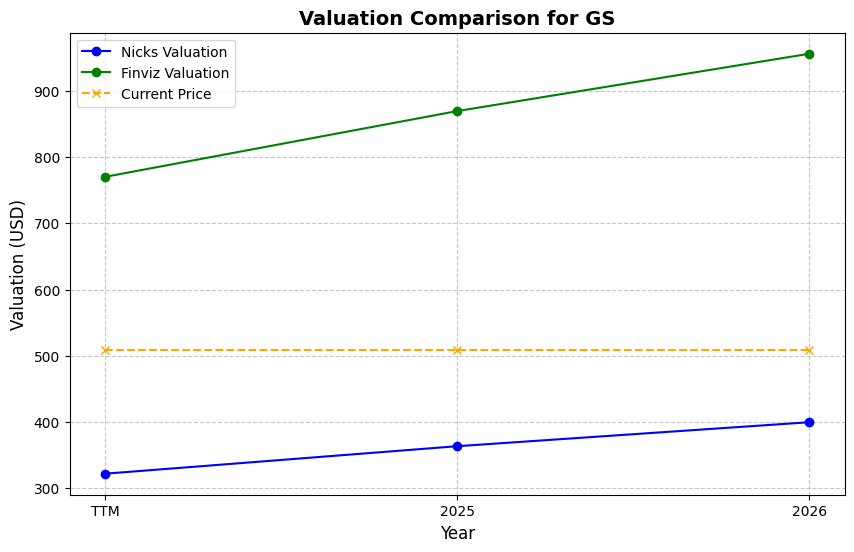

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $859.57 | 4.0% | Nicks Growth: 2% Nick's Expected Margin: 10% FINVIZ Growth: 11% |

Nicks: 8 Finviz: 21 |

Nick's: 0.820 | 5.8 | 16.8 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $51.28 EPS | TTM | $420.62 | -51.1% | $1059.65 | 23.3% |

| $56.61 EPS | 2026 | $464.34 | -46.0% | $1169.79 | 36.1% |

| $62.65 EPS | 2027 | $513.88 | -40.2% | $1294.60 | 50.6% |

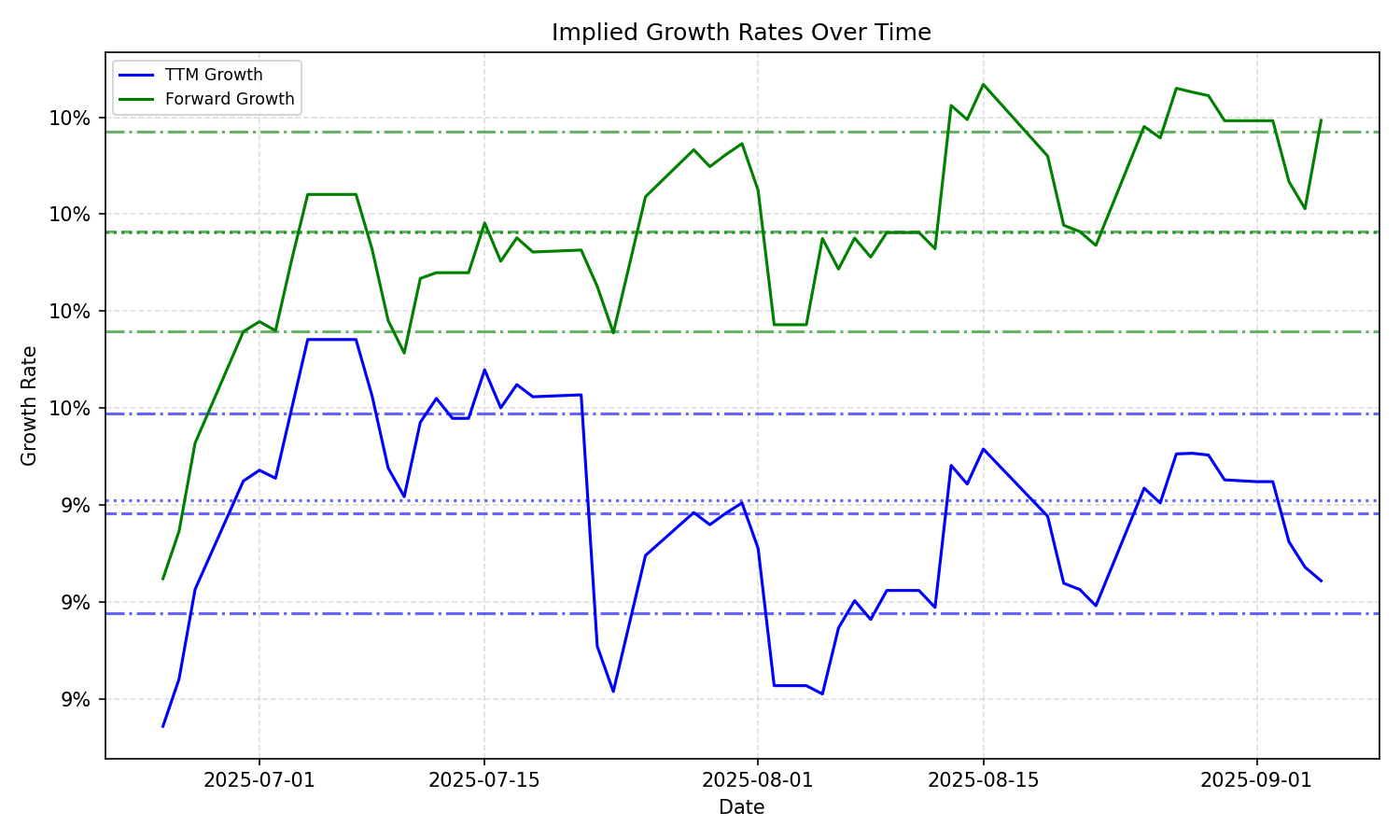

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 9.55% | 9.88% | 9.46% | 10.05% | 0.65% | 1.02% | 10.14% | 7.65% | 82.5% | 6.2% |

| 3 Years | 9.55% | 9.88% | 9.46% | 10.05% | 0.65% | 1.02% | 10.14% | 7.65% | 82.5% | 6.2% |

| 5 Years | 9.55% | 9.88% | 9.46% | 10.05% | 0.65% | 1.02% | 10.14% | 7.65% | 82.5% | 6.2% |

| 10 Years | 9.55% | 9.88% | 9.46% | 10.05% | 0.65% | 1.02% | 10.14% | 7.65% | 82.5% | 6.2% |