GE Aerospace — GE

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $324.32 | $343.92B | 43.3 | 45.1 | 19.9% | 20.4% | $1.44 0.4% | 18.2 |

Latest Headlines

- · GE Stock Jets To A New High. A Natural Gas Name Joins It.

- · General Dynamics (GD) Up 0.2% Since Last Earnings Report: Can It Continue?

- · 2 Nasdaq 100 Stocks with Exciting Potential and 1 We Question

- · AM Applications (Metal and Polymer Parts) Industry Research Report 2025-2034: Expanding Deployment, Production-Scale Activity and Emerging Commercial Trends

- · Palantir AI Partnerships And Defense Work Weighed Against Rich Valuation

- · One Fund Bet $5 Million on Enovis Stock Last Quarter. Shares Surged 14% Post-Earnings

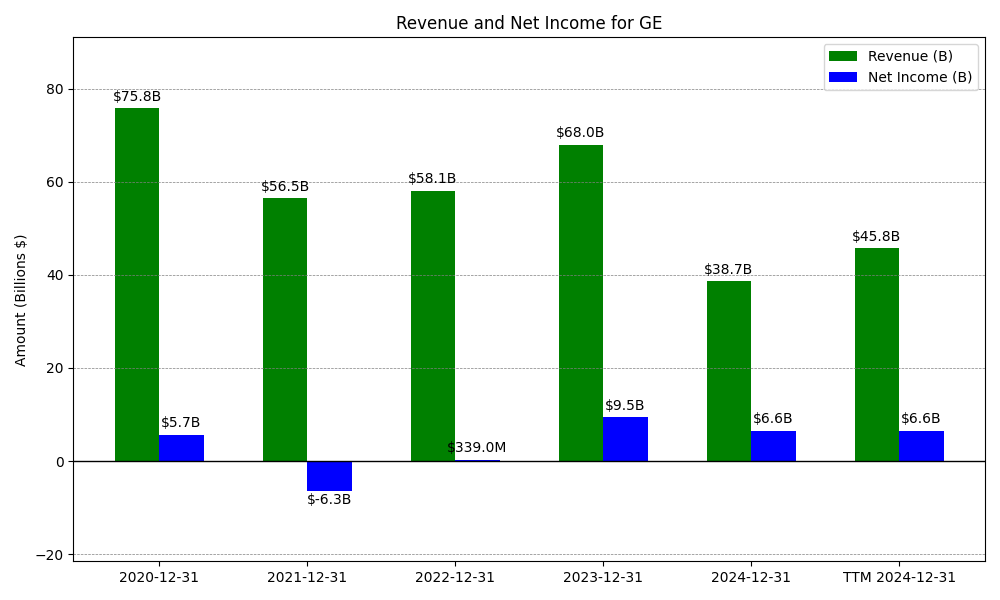

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

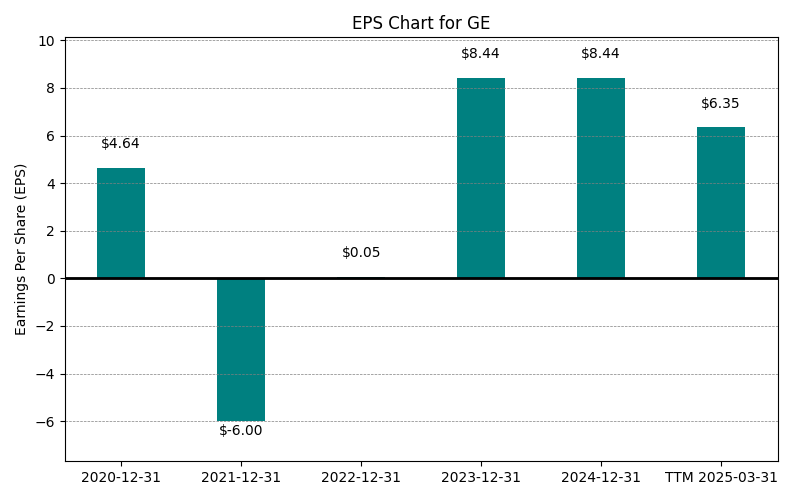

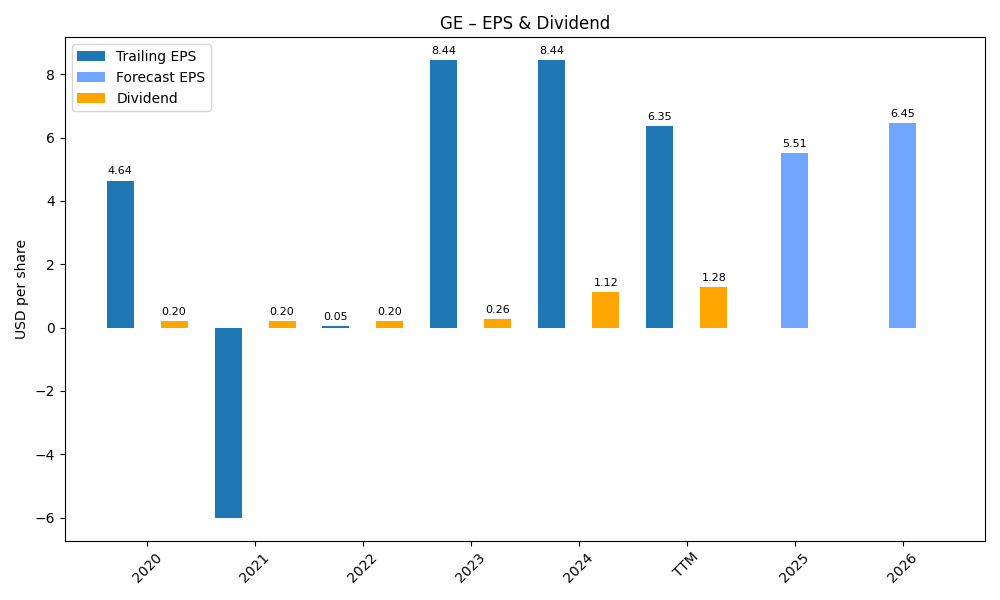

| 0 | 2020-12-31 | $75,834M | $5,704M | $4.64 | 2024-02-03 03:17:10 | N/A | N/A | N/A |

| 1 | 2021-12-31 | $56,469M | $-6,337M | $-6.00 | 2024-04-16 21:20:15 | -25.5% | -211.1% | -229.3% |

| 2 | 2022-12-31 | $29,139M | $336M | $0.05 | 2026-02-27 21:57:54 | -48.4% | -105.3% | -100.8% |

| 3 | 2023-12-31 | $35,348M | $9,482M | $8.44 | 2026-02-27 21:57:54 | 21.3% | 2722.0% | 16780.0% |

| 4 | 2024-12-31 | $38,702M | $6,556M | $6.04 | 2026-02-27 21:57:54 | 9.5% | -30.9% | -28.4% |

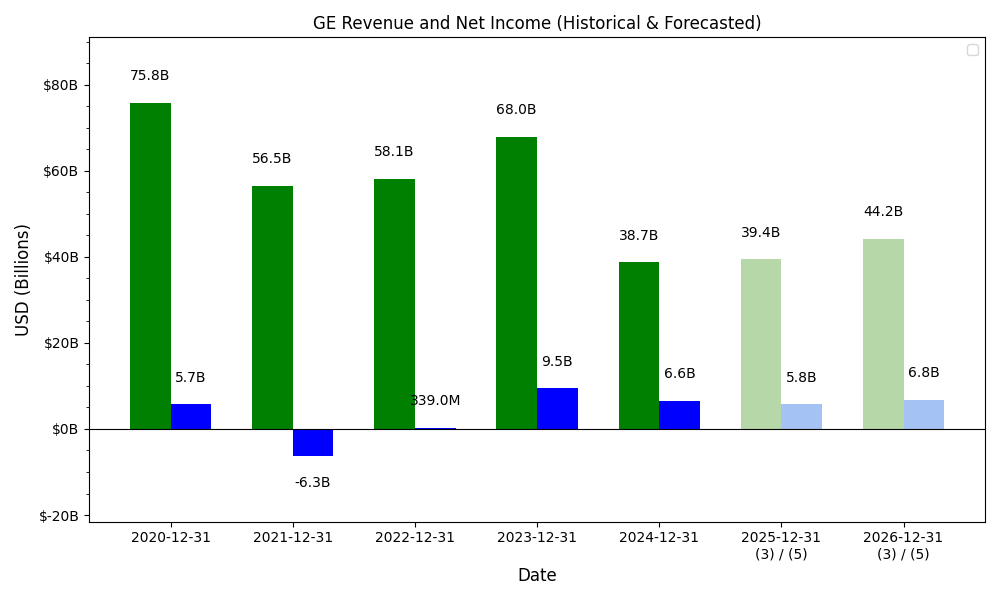

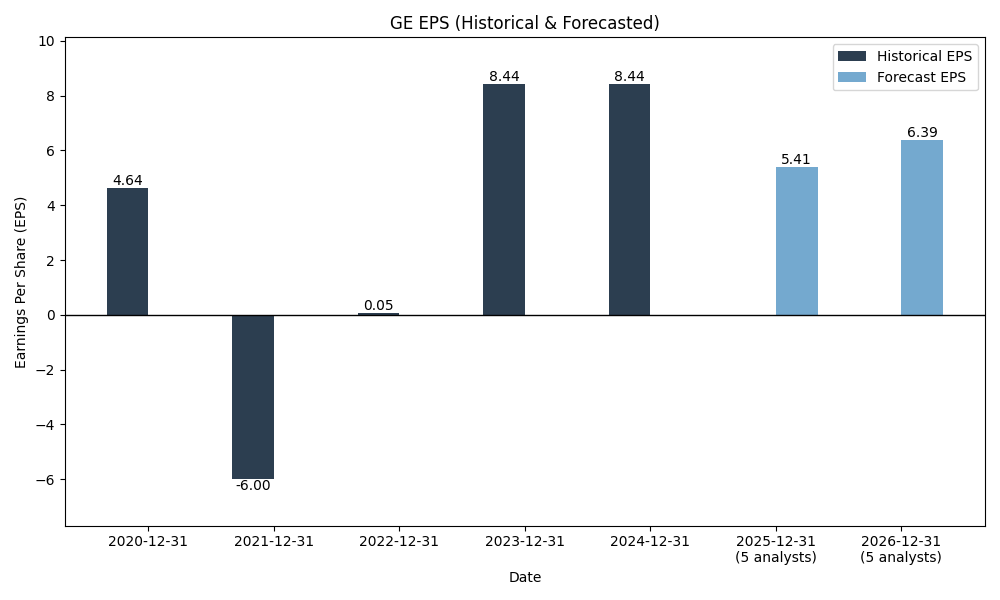

| 5 | 2025-12-31 | $45,855M | $8,704M | $8.20 | 2026-02-27 21:57:54 | 18.5% | 32.8% | 35.8% |

| 6 | TTM 2025-12-31 | $45,854M | $8,704M | $8.04 | 2026-01-26 08:24:09 | -0.0% | 0.0% | -2.0% |

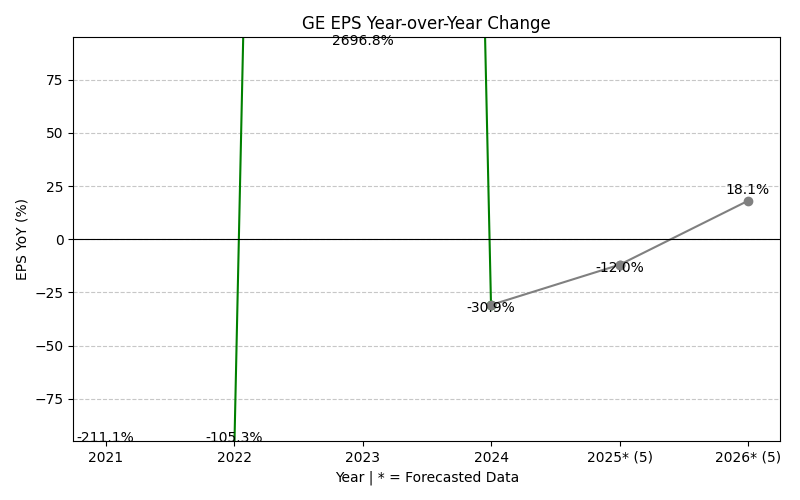

EPS

Forecasts

Y/Y % Change

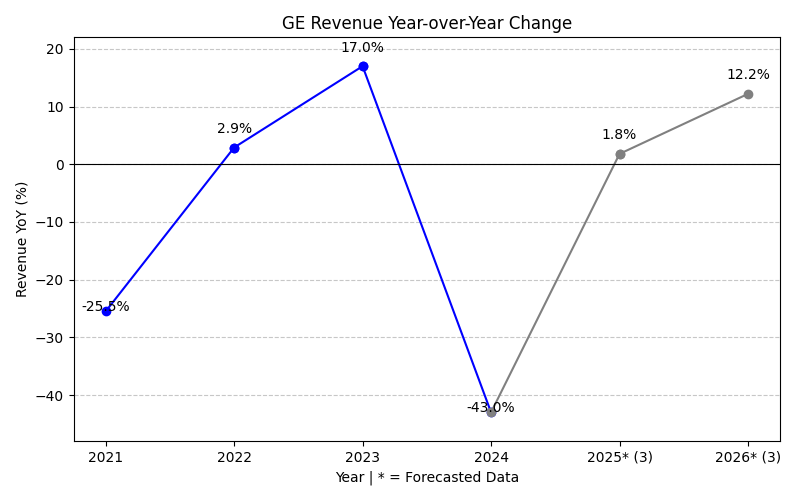

GE Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | -25.5% | -48.4% | 21.3% | 9.5% | 18.5% | 5.2% | 9.8% | -1.4% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 4 | 4 | |

| EPS Growth (%) | -211.1% | -105.3% | 2722.0% | -30.9% | 32.8% | -9.8% | 15.7% | 344.8% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 6 | 6 |

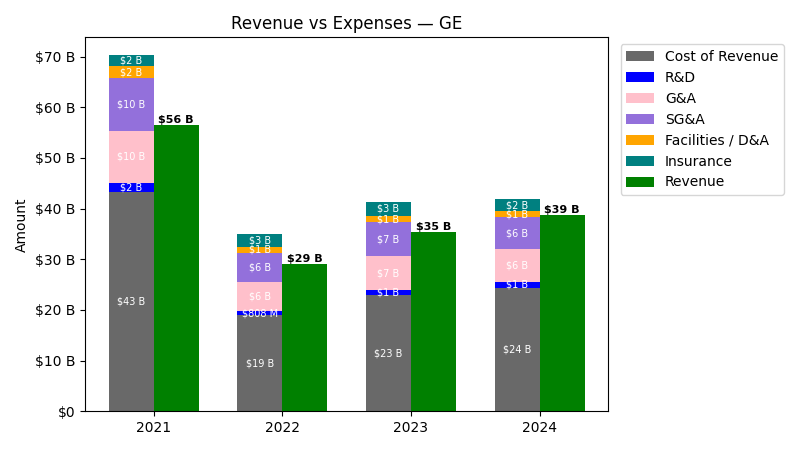

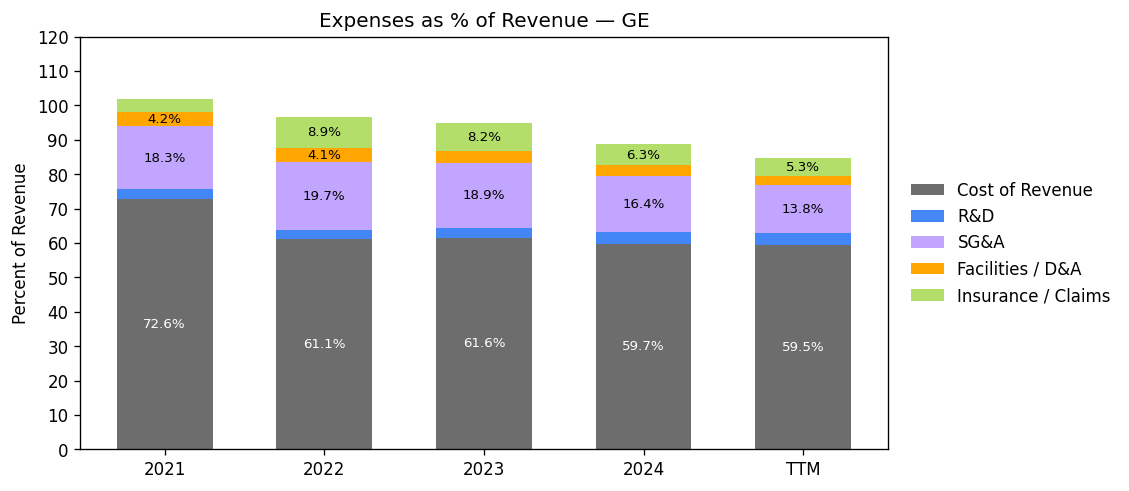

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | R&D ($) | Sales & Marketing ($) | G&A ($) | SG&A ($) | Facilities / D&A ($) | Insurance / Claims ($) |

|---|---|---|---|---|---|---|---|---|

| 2021 | $56.5B | $41.0B | $1.7B | $10.4B | $10.4B | $2.4B | $2.2B | |

| 2022 | $29.1B | $17.8B | $808.0M | $5.7B | $5.7B | $1.2B | $2.6B | |

| 2023 | $35.3B | $21.8B | $1.0B | $6.7B | $6.7B | $1.2B | $2.9B | |

| 2024 | $38.7B | $23.1B | $1.3B | $6.3B | $6.3B | $1.2B | $2.4B | |

| TTM | $43.9B | $26.2B | $1.5B | $1.2B | $8.1B | $6.0B | $1.2B | $2.3B |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | R&D Change (%) | G&A Change (%) | SG&A Change (%) | Facilities / D&A Change (%) | Insurance / Claims Change (%) |

|---|---|---|---|---|---|---|---|

| 2022 | -48.40 | -56.60 | -51.96 | -44.47 | -44.47 | -49.83 | 19.23 |

| 2023 | 21.31 | 22.23 | 25.12 | 16.23 | 16.23 | -0.42 | 11.34 |

| 2024 | 9.49 | 6.27 | 27.20 | -5.00 | -5.00 | 0.42 | -15.84 |

| TTM | 13.55 | 13.10 | 18.04 | 28.16 | -4.70 | 2.28 | -4.49 |

No unmapped expenses.

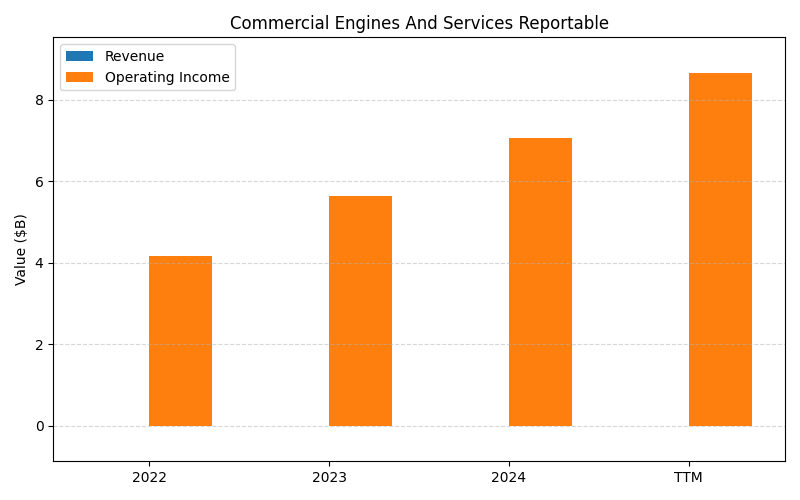

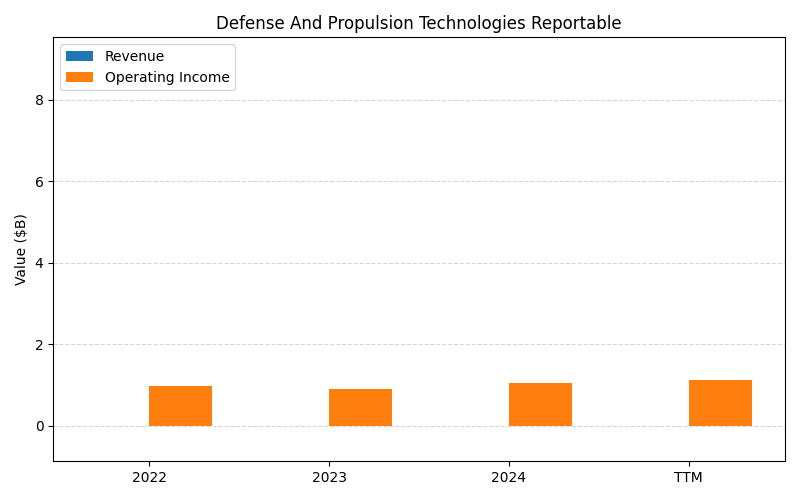

Segment Performance

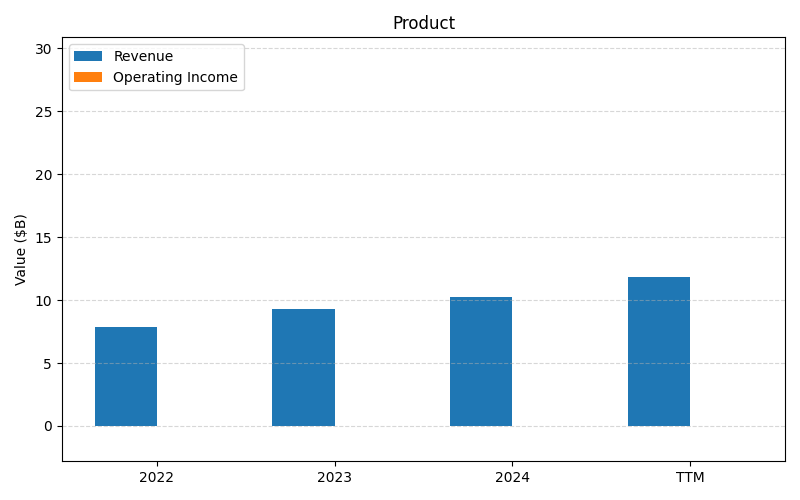

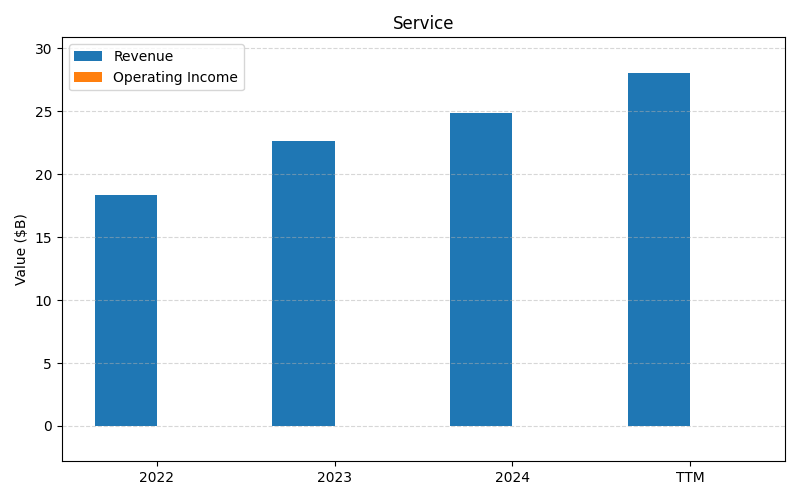

SEGMENTS v2025-09-09 · 2026-02-27 21:58 UTC — Units: $B. Rows list fiscal years (last 3 + TTM) with revenue for each segment; the final row shows the TTM revenue mix (operating income columns display “—” where mix is not applicable).

| Year | Services Rev | Prod Rev | Total Rev |

|---|---|---|---|

| 2023 | 22.6B | 9.32B | 32B |

| 2024 | 24.8B | 10.3B | 35.1B |

| 2025 | 30.2B | 12.2B | 42.3B |

| TTM | 109.6B | 43.7B | 153.4B |

| % of Total (TTM) | 71.5% | 28.5% | 100% |

Segment Performance (Axis 2)

No segment data available.

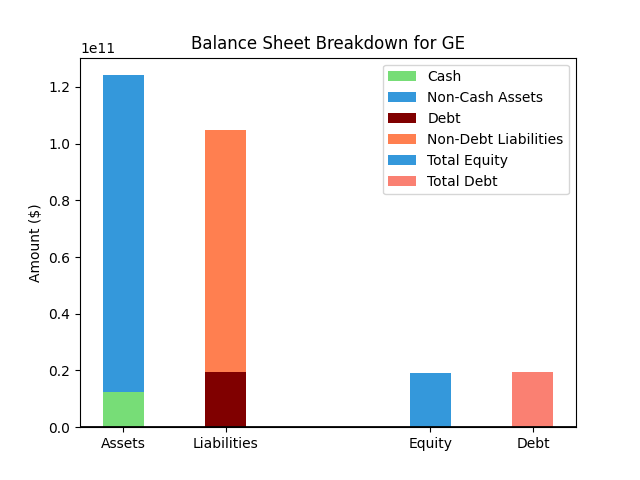

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $130,169M |

| 1 | Cash | $12,392M |

| 2 | Total Liabilities | $111,271M |

| 3 | Total Debt | $20,495M |

| 4 | Total Equity | $18,677M |

| 5 | Debt to Equity Ratio | 1.10 |

EPS & Dividend

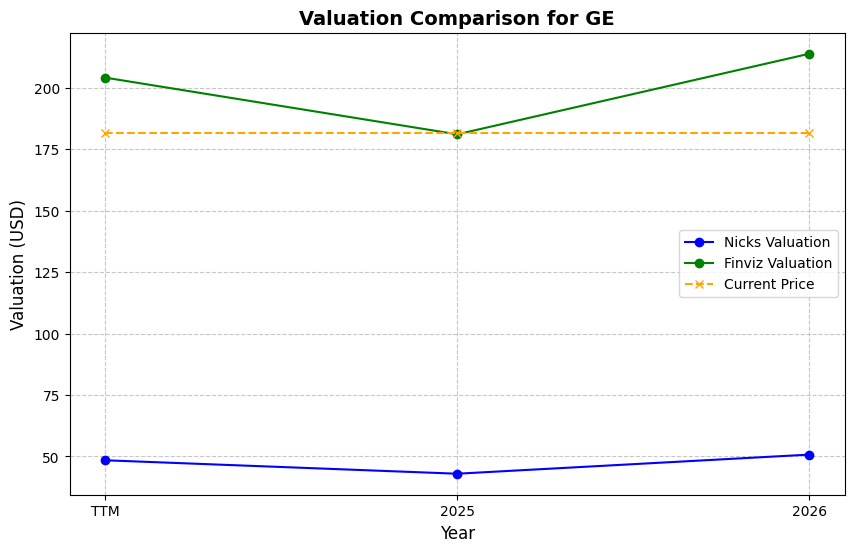

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $324.32 | 4.2% | Nicks Growth: 2% Nick's Expected Margin: 14% FINVIZ Growth: 22% |

Nicks: 8 Finviz: 52 |

Nick's: 1.125 | 7.8 | 43.3 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $7.49 EPS | TTM | $60.18 | -81.4% | $392.51 | 21.0% |

| $6.20 EPS | 2025 | $49.81 | -84.6% | $324.91 | 0.2% |

| $7.01 EPS | 2026 | $56.32 | -82.6% | $367.36 | 13.3% |

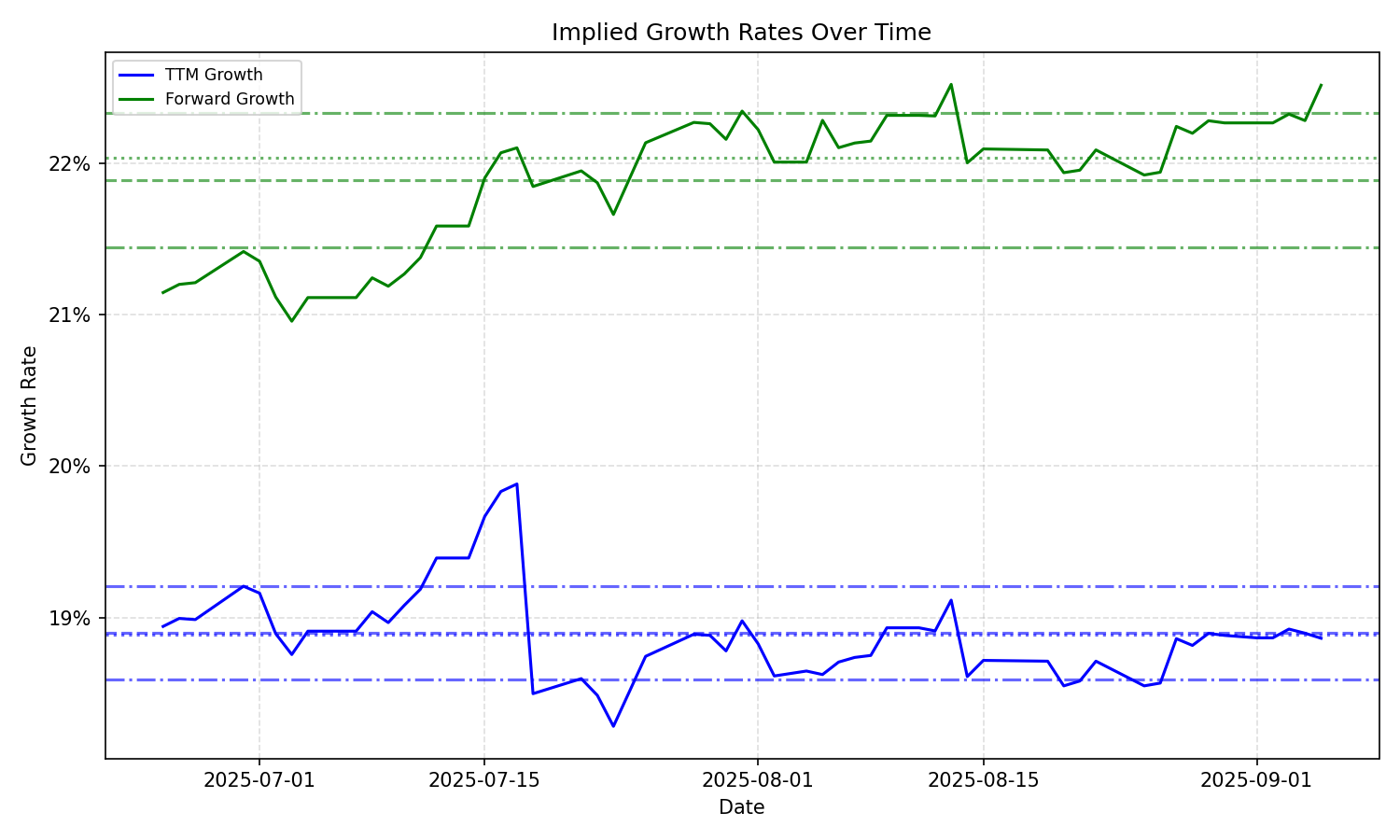

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 19.12% | 22.29% | 19.04% | 22.32% | 0.42% | 0.99% | 19.95% | 20.41% | 99.3% | 8.4% |

| 3 Years | 19.12% | 22.29% | 19.04% | 22.32% | 0.42% | 0.99% | 19.95% | 20.41% | 99.3% | 8.4% |

| 5 Years | 19.12% | 22.29% | 19.04% | 22.32% | 0.42% | 0.99% | 19.95% | 20.41% | 99.3% | 8.4% |

| 10 Years | 19.12% | 22.29% | 19.04% | 22.32% | 0.42% | 0.99% | 19.95% | 20.41% | 99.3% | 8.4% |