Costco Wholesale Corporation — COST

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $875.74 | $388.79B | 47.0 | 39.5 | 20.9% | 18.9% | $5.20 0.6% | 12.8 |

Latest Headlines

- · Earnings live: Block mass layoffs earn Wall Street's approval, Duolingo shares plunge

- · Costco could soon have a new type of member

- · Stocks to watch next week: Broadcom, Costco, Adidas, Aviva and Greggs

- · Zacks Industry Outlook Highlights Costco Wholesale, Ross Stores, Target and Dollar General

- · Block upgraded, Duolingo downgraded: Wall Street's top analyst calls

- · Should You Buy Costco Stock Ahead of Q2 Earnings Report?

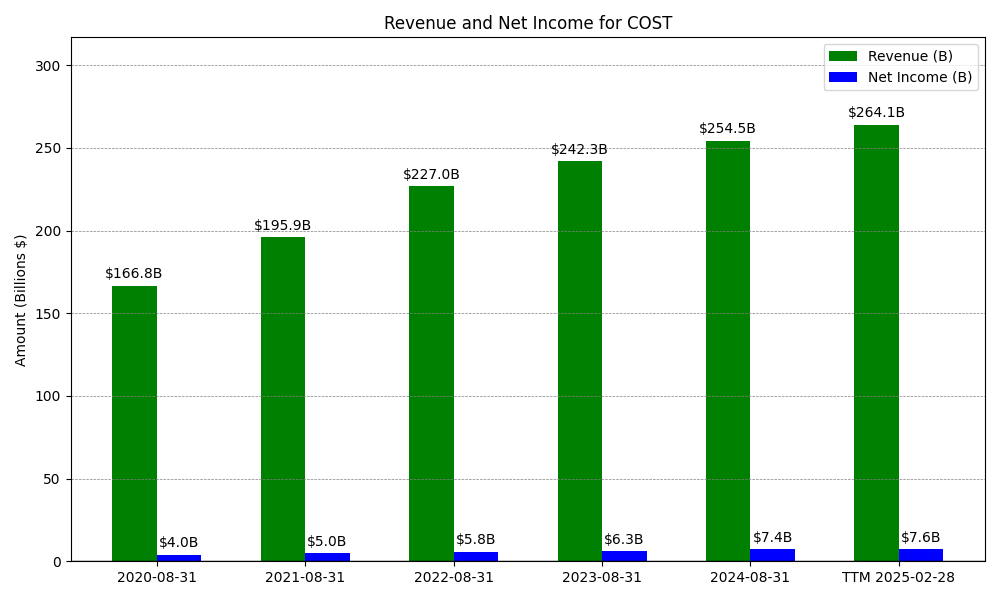

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

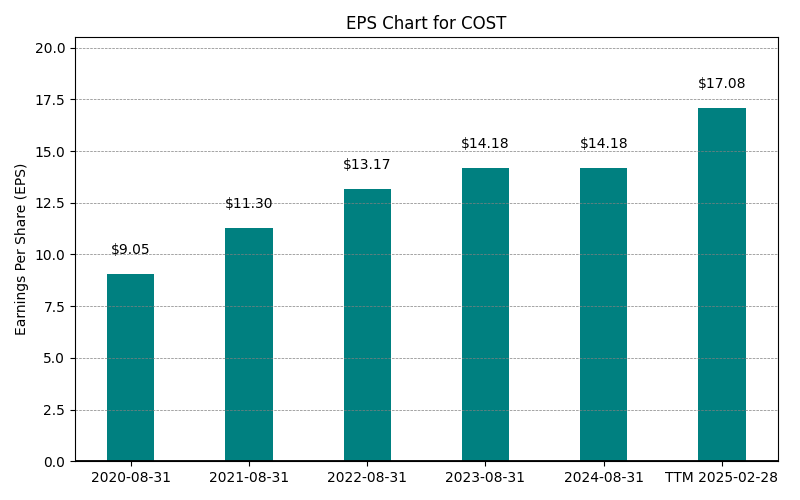

| 0 | 2020-08-31 | $166,761M | $4,002M | $9.05 | 2024-02-04 04:18:28 | N/A | N/A | N/A |

| 1 | 2021-08-31 | $195,929M | $5,007M | $11.30 | 2024-02-04 04:18:28 | 17.5% | 25.1% | 24.9% |

| 2 | 2022-08-31 | $226,954M | $5,844M | $13.17 | 2026-02-27 21:56:07 | 15.8% | 16.7% | 16.5% |

| 3 | 2023-08-31 | $242,290M | $6,292M | $14.18 | 2026-02-27 21:56:07 | 6.8% | 7.7% | 7.7% |

| 4 | 2024-08-31 | $254,453M | $7,367M | $16.59 | 2026-02-27 21:56:07 | 5.0% | 17.1% | 17.0% |

| 5 | 2025-08-31 | $275,235M | $8,099M | $18.24 | 2026-02-27 21:56:07 | 8.2% | 9.9% | 9.9% |

| 6 | TTM 2025-11-30 | $280,391M | $8,302M | $18.65 | 2026-02-05 08:32:11 | 1.9% | 2.5% | 2.2% |

EPS

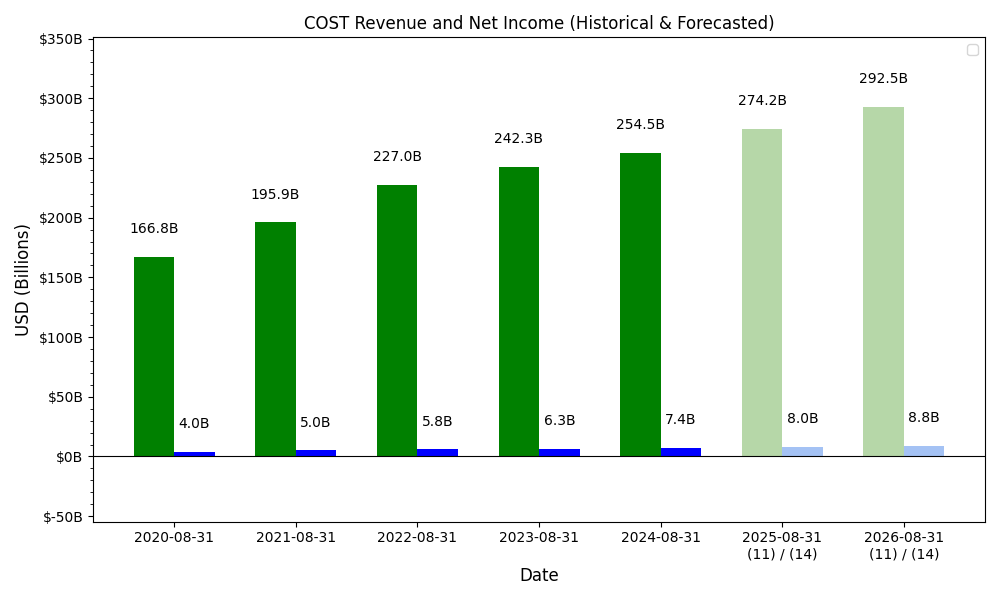

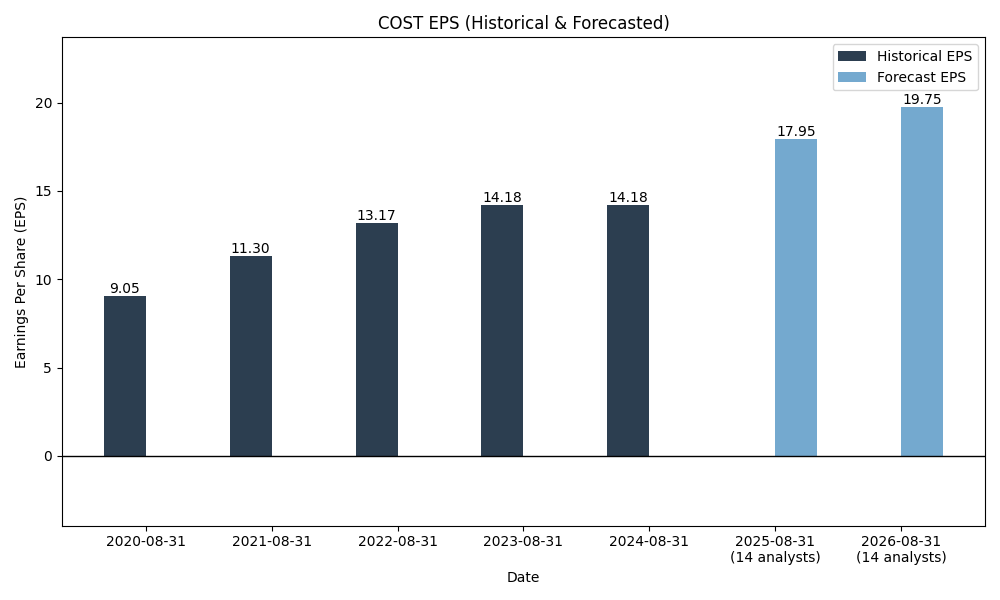

Forecasts

Y/Y % Change

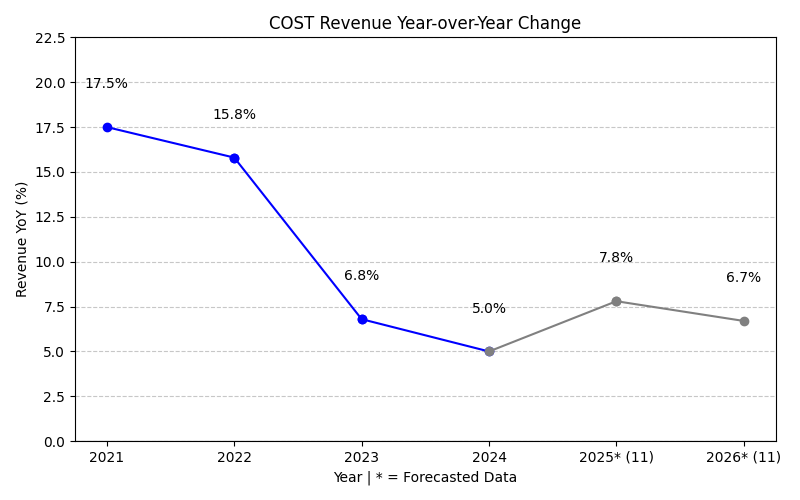

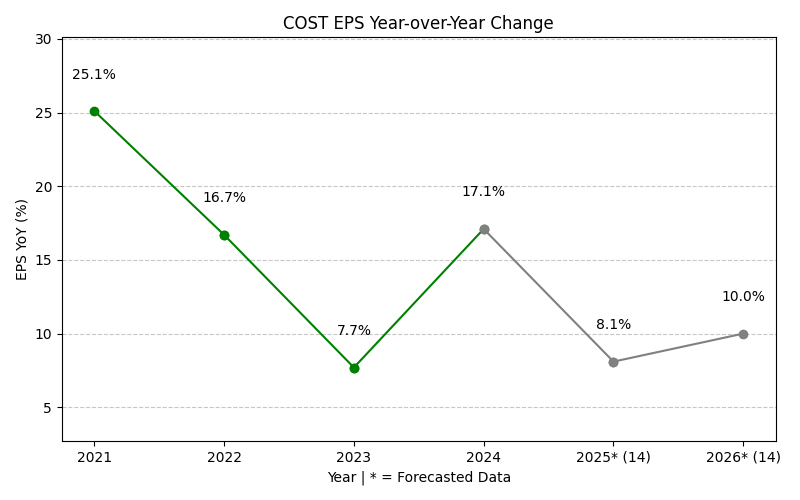

COST Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 17.5% | 15.8% | 6.8% | 5.0% | 8.2% | 8.0% | 7.3% | 9.8% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 11 | 11 | |

| EPS Growth (%) | 25.1% | 16.7% | 7.7% | 17.1% | 9.9% | 10.9% | 9.4% | 13.8% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 12 | 12 |

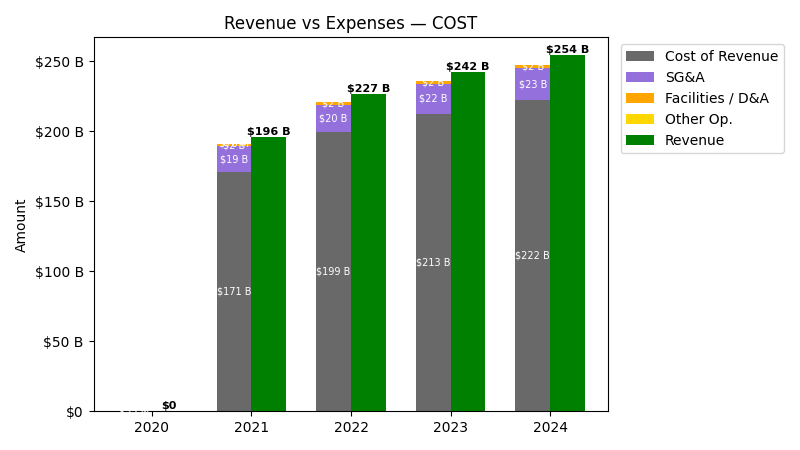

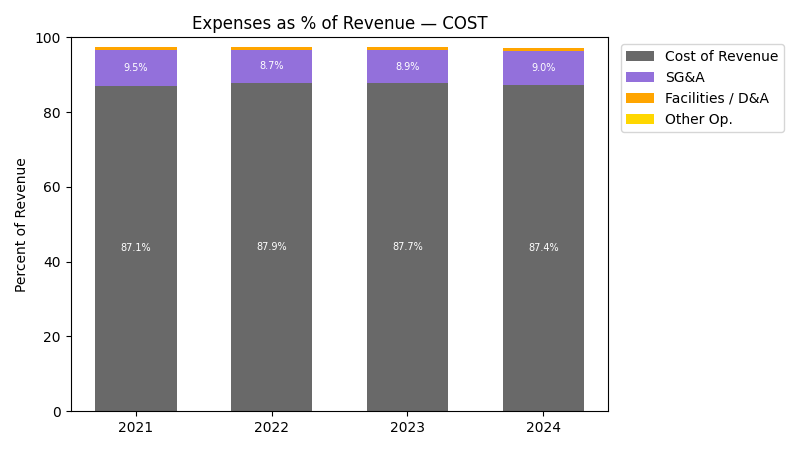

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|

| 2022 | $227.0B | $197.5B | $19.8B | $1.9B |

| 2023 | $242.3B | $210.5B | $21.6B | $2.1B |

| 2024 | $254.5B | $220.1B | $22.8B | $2.2B |

| 2025 | $275.2B | $237.5B | $25.0B | $2.4B |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|

| 2023 | 6.76 | 6.60 | 9.16 | 9.32 |

| 2024 | 5.02 | 4.57 | 5.65 | 7.70 |

| 2025 | 8.17 | 7.88 | 9.45 | 8.45 |

No unmapped expenses.

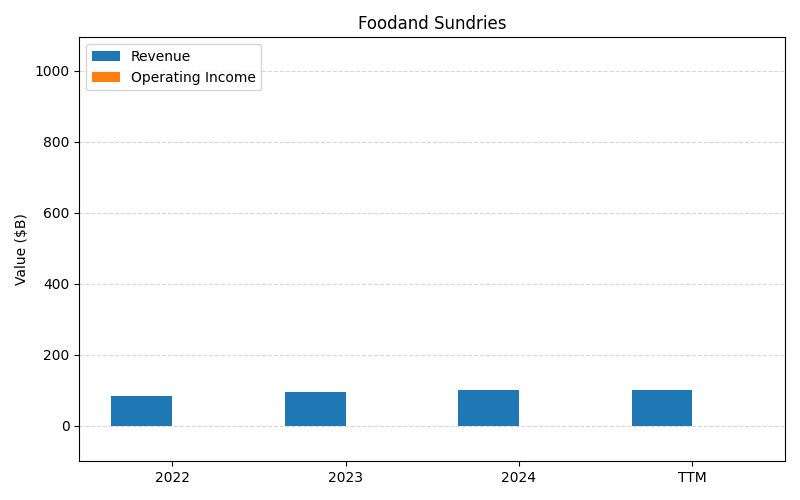

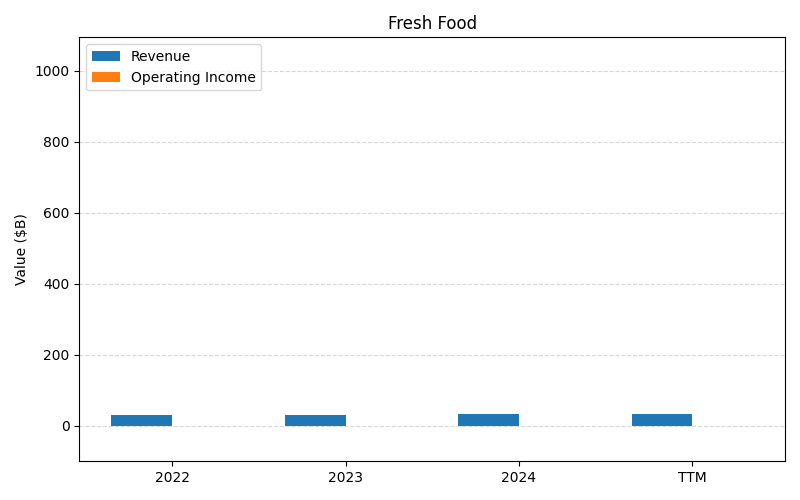

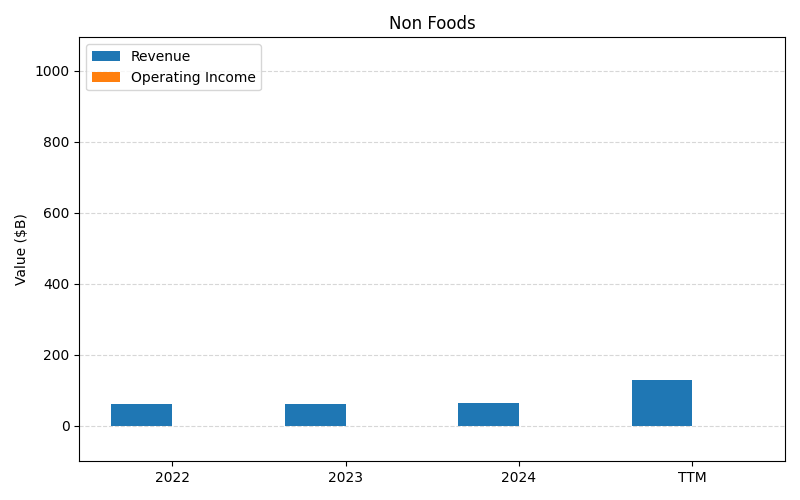

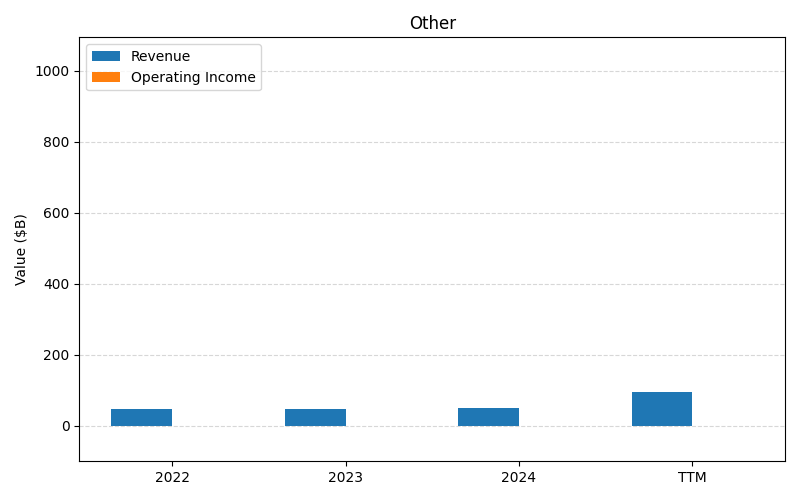

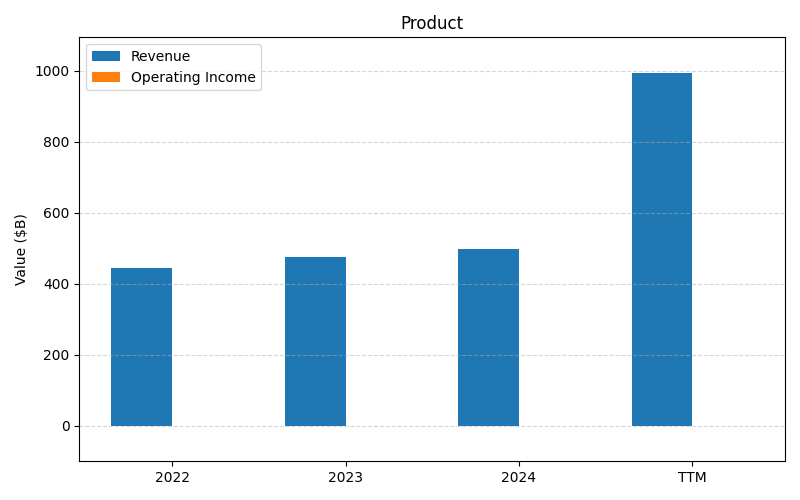

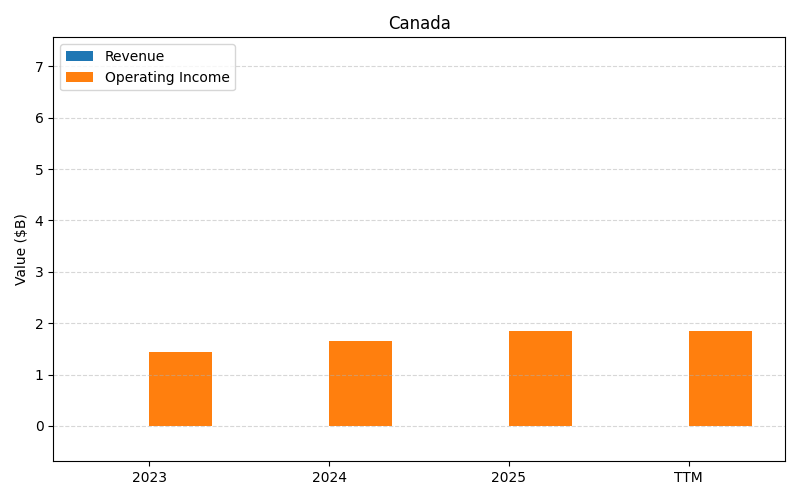

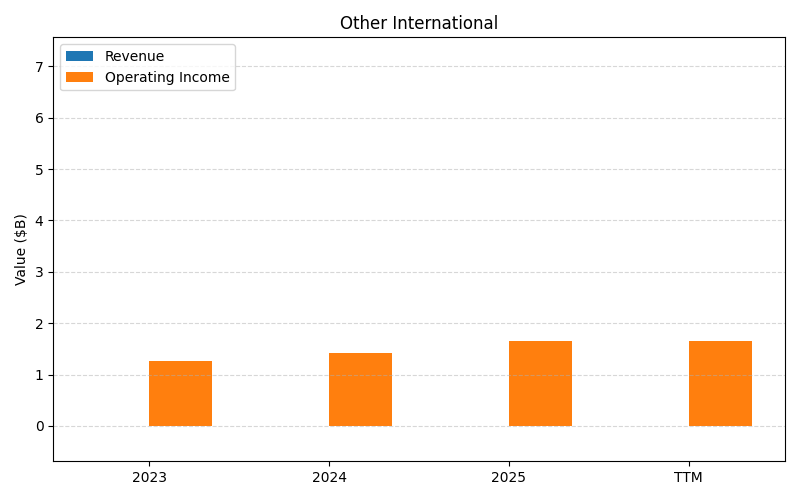

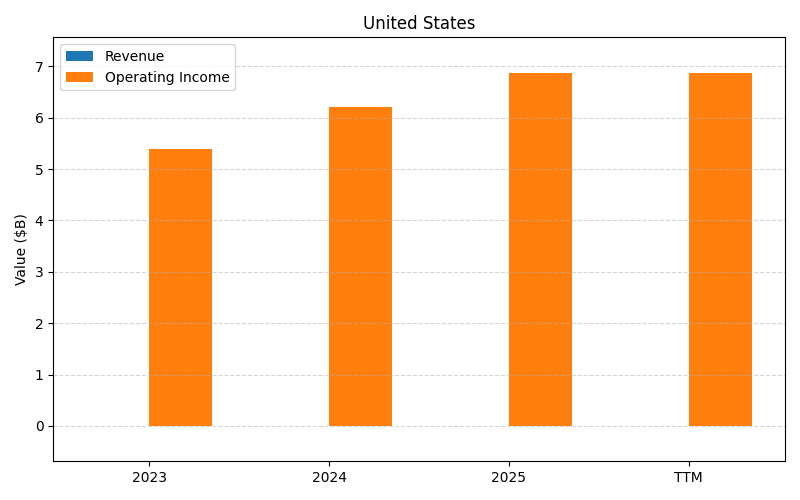

Segment Performance

SEGMENTS v2025-09-09 · 2026-02-27 21:56 UTC — Units: $T. Rows list fiscal years (last 3 + TTM) with revenue for each segment; the final row shows the TTM revenue mix (operating income columns display “—” where mix is not applicable).

| Year | Prod Rev | Non Foods Rev | Other Rev | Membership Rev | Foodand Sundries Rev | Fresh Food Rev | Total Rev |

|---|---|---|---|---|---|---|---|

| 2023 | 0.48T | 0.06T | 0.05T | 0.00T | 0.10T | 0.03T | 0.72T |

| 2024 | 0.50T | 0.06T | 0.05T | 0.00T | 0.10T | 0.03T | 0.75T |

| 2025 | 0.54T | 0.07T | 0.05T | 0.01T | 0.11T | 0.04T | 0.82T |

| TTM | 1.29T | 0.17T | 0.13T | 0.01T | – | – | 1.60T |

| % of Total (TTM) | 80.8% | 10.6% | 7.8% | 0.8% | – | – | 100% |

Segment Performance (Axis 2)

No segment data available.

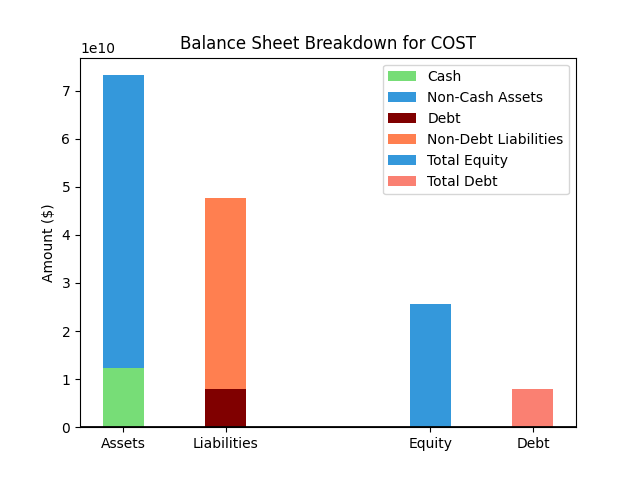

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $82,790M |

| 1 | Cash | $16,217M |

| 2 | Total Liabilities | $52,487M |

| 3 | Total Debt | $8,102M |

| 4 | Total Equity | $30,303M |

| 5 | Debt to Equity Ratio | 0.27 |

EPS & Dividend

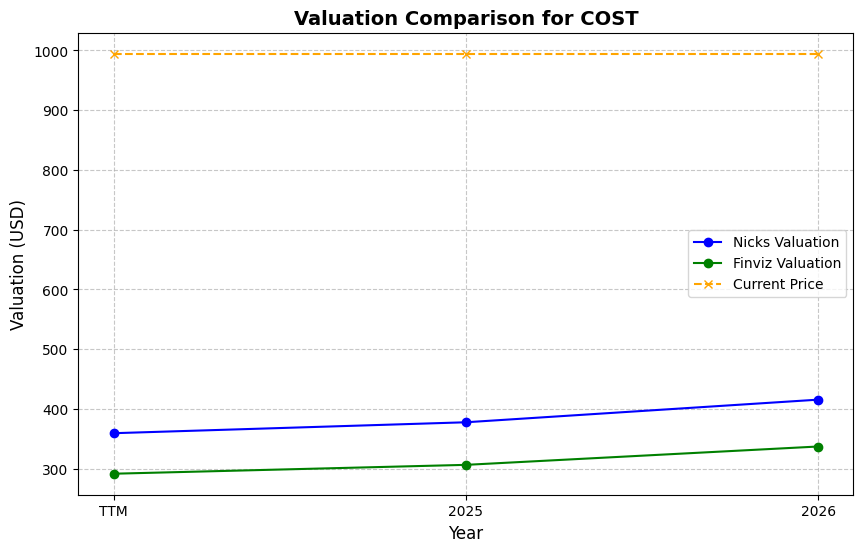

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $875.74 | 4.2% | Nicks Growth: 12% Nick's Expected Margin: 3% FINVIZ Growth: 11% |

Nicks: 21 Finviz: 19 |

Nick's: 0.638 | 1.4 | 47.0 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $18.65 EPS | TTM | $396.53 | -54.7% | $351.57 | -59.9% |

| $20.09 EPS | 2026 | $427.15 | -51.2% | $378.71 | -56.8% |

| $21.94 EPS | 2027 | $466.48 | -46.7% | $413.59 | -52.8% |

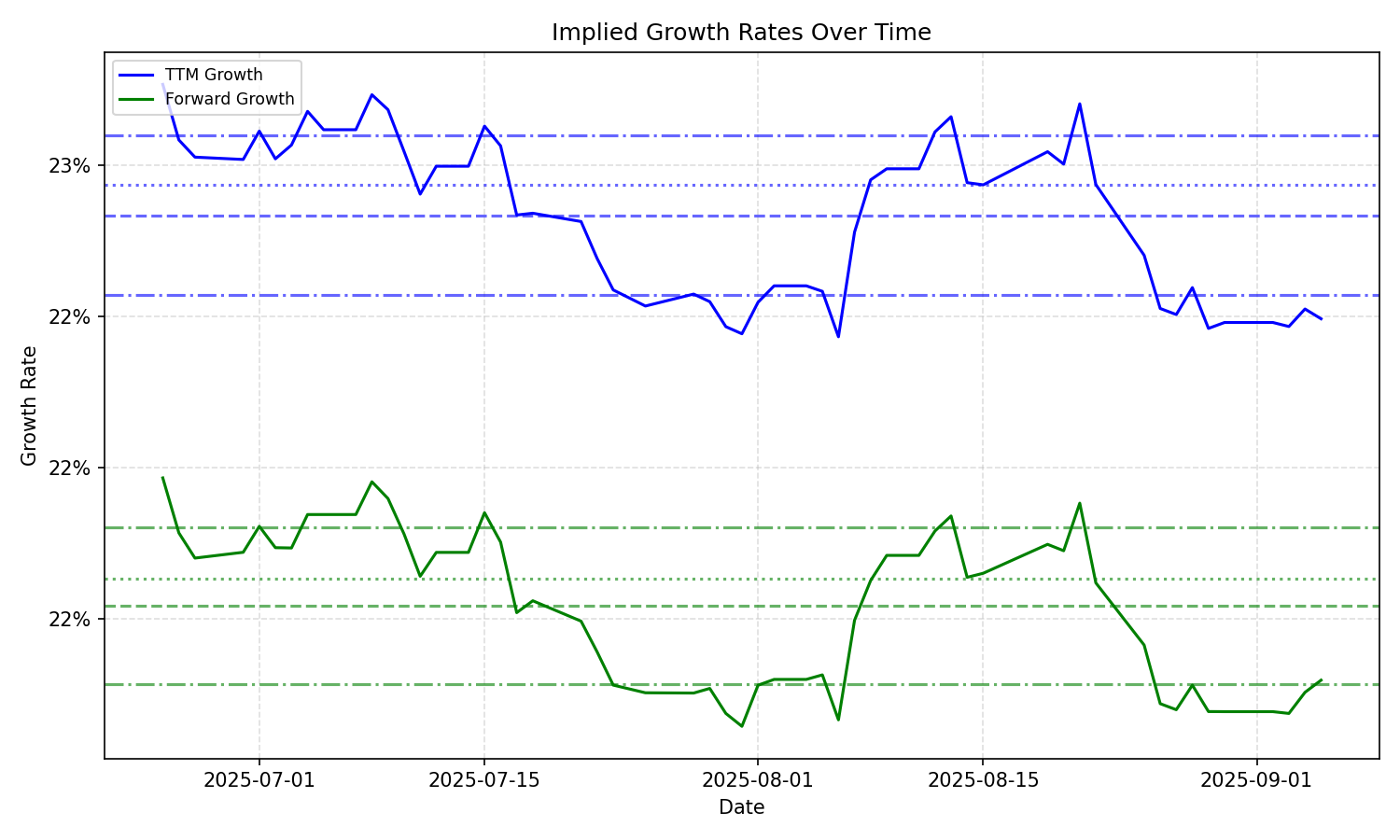

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 22.17% | 20.97% | 22.42% | 21.15% | 0.72% | 0.78% | 20.89% | 18.88% | 7.7% | 7.7% |

| 3 Years | 22.17% | 20.97% | 22.42% | 21.15% | 0.72% | 0.78% | 20.89% | 18.88% | 7.7% | 7.7% |

| 5 Years | 22.17% | 20.97% | 22.42% | 21.15% | 0.72% | 0.78% | 20.89% | 18.88% | 7.7% | 7.7% |

| 10 Years | 22.17% | 20.97% | 22.42% | 21.15% | 0.72% | 0.78% | 20.89% | 18.88% | 7.7% | 7.7% |