Carnival Corporation — CCL

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $31.55 | $43.61B | 15.6 | 11.1 | 8.5% | 5.1% | $0.15 0.5% | 3.4 |

Latest Headlines

- · Is Royal Caribbean Stock a Buy, Sell, or Hold in 2026?

- · Marcus (MCS) Reports Q4 Loss, Tops Revenue Estimates

- · CCL Sees Record Pricing Despite Weak Sentiment: What's Driving Demand?

- · Carnival Corporation (CCL) is Attracting Investor Attention: Here is What You Should Know

- · Carnival Corporation (CCL) Valuation Check After Recent Share Price Momentum Cools

- · SEABOURN ELEVATES ITS CULINARY PROGRAM WITH ENHANCED SEABOURN SQUARE MENUS AND REVITALIZED COLONNADE OFFERINGS FLEETWIDE

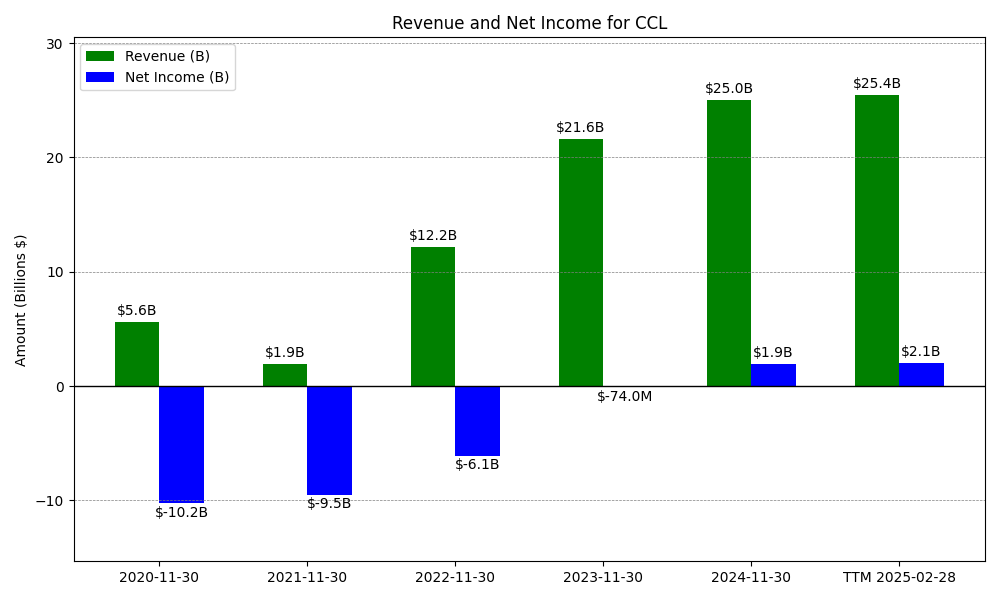

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

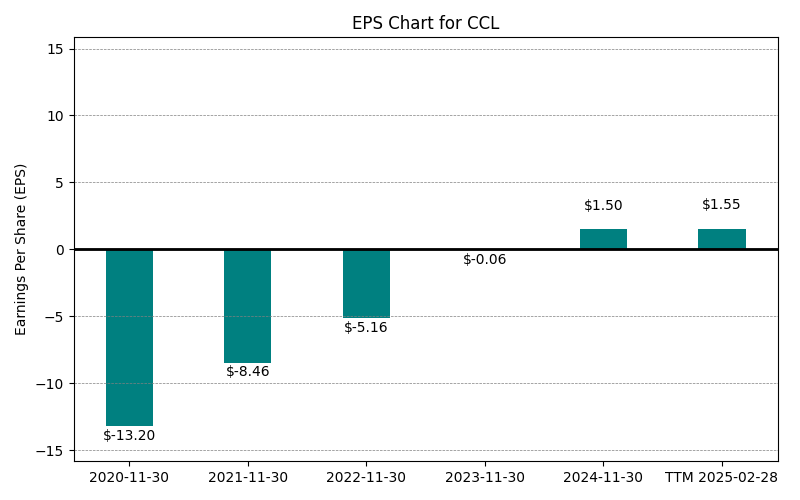

| 0 | 2020-11-30 | $5,594M | $-10,236M | $-13.20 | 2024-02-04 04:18:28 | N/A | N/A | N/A |

| 1 | 2021-11-30 | $1,908M | $-9,501M | $-8.46 | 2024-02-04 04:18:28 | -65.9% | -7.2% | -35.9% |

| 2 | 2022-11-30 | $12,169M | $-6,093M | $-5.16 | 2026-02-27 21:55:35 | 537.8% | -35.9% | -39.0% |

| 3 | 2023-11-30 | $21,593M | $-74M | $-0.06 | 2026-02-27 21:55:35 | 77.4% | -98.8% | -98.8% |

| 4 | 2024-11-30 | $25,021M | $1,916M | $1.50 | 2026-02-27 21:55:35 | 15.9% | -2689.2% | -2600.0% |

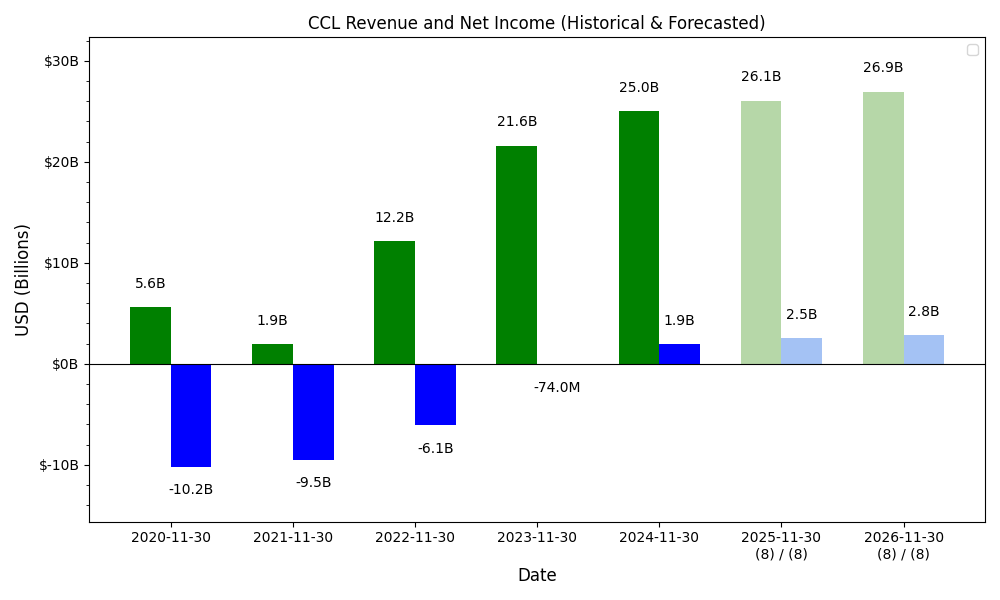

| 5 | 2025-11-30 | $26,621M | $2,760M | $2.10 | 2026-02-27 21:55:35 | 6.4% | 44.1% | 40.0% |

| 6 | TTM 2025-11-30 | $26,621M | $2,761M | $2.02 | 2026-02-05 08:32:06 | 0.0% | 0.0% | -3.8% |

EPS

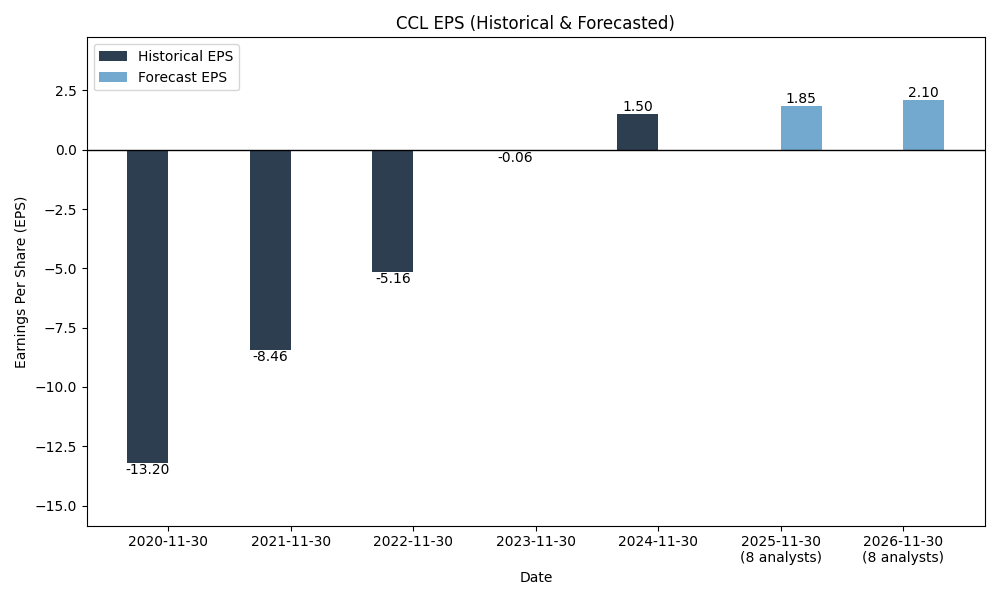

Forecasts

Y/Y % Change

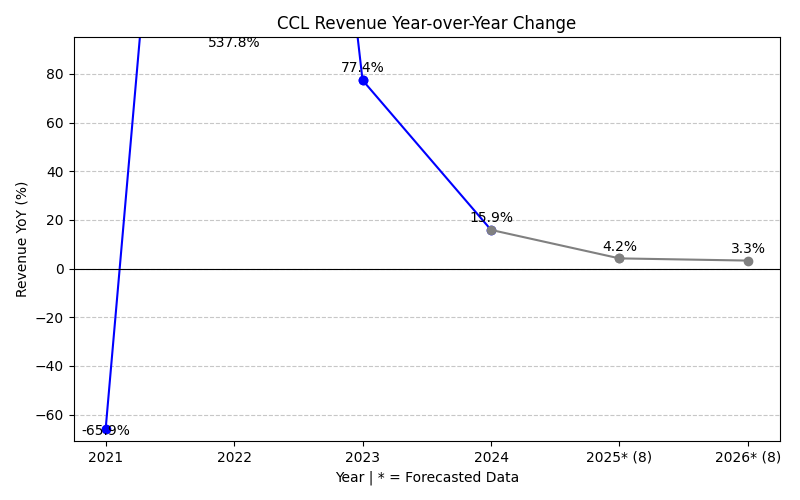

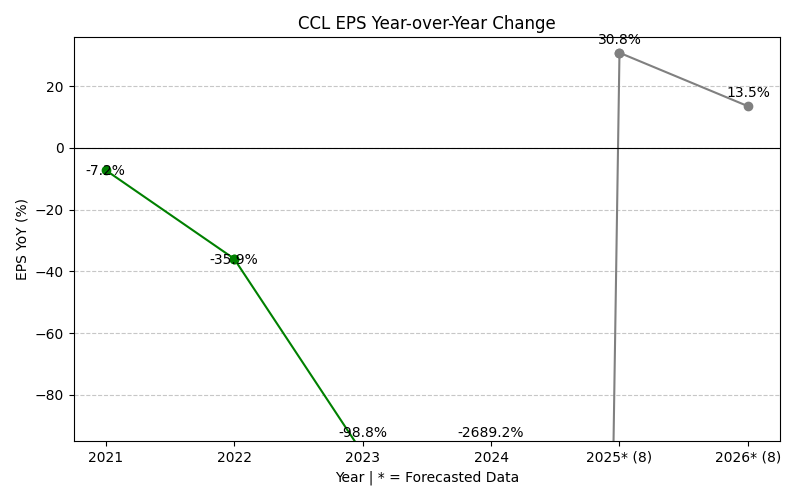

CCL Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | -65.9% | 537.8% | 77.4% | 15.9% | 6.4% | 4.6% | 3.5% | 82.8% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 7 | 7 | |

| EPS Growth (%) | -7.2% | -35.9% | -98.8% | -2689.2% | 44.1% | 27.2% | 9.8% | -392.9% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 6 | 6 |

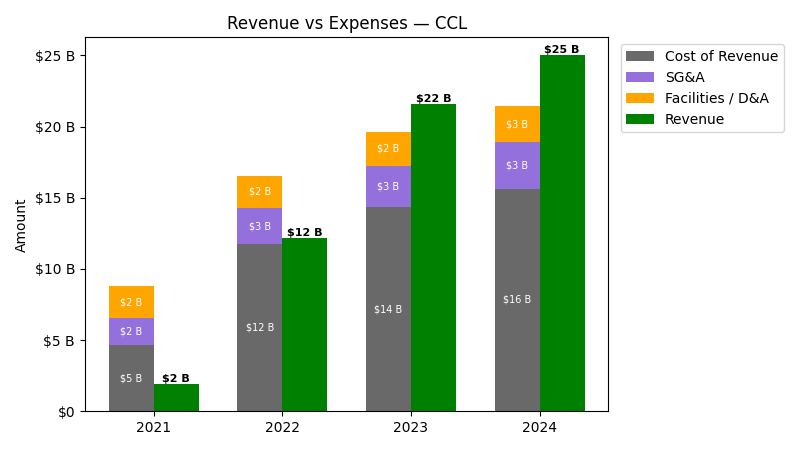

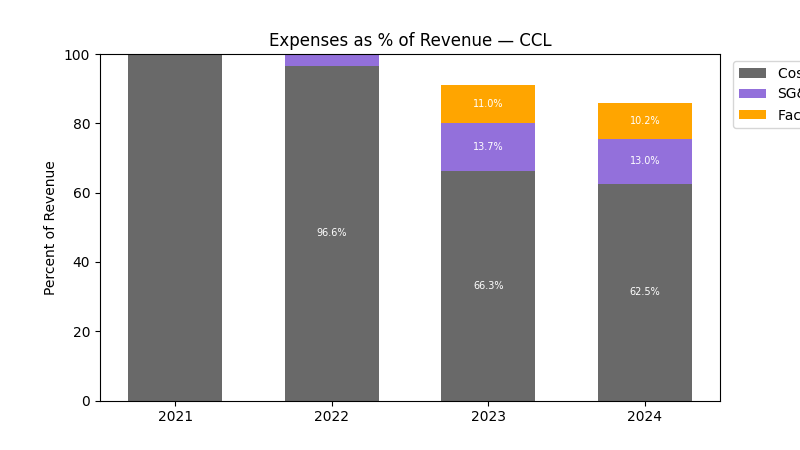

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|

| 2022 | $12.2B | $9.5B | $2.5B | $2.3B |

| 2023 | $21.6B | $11.9B | $3.0B | $2.4B |

| 2024 | $25.0B | $13.1B | $3.3B | $2.6B |

| 2025 | $26.6B | $13.2B | $3.4B | $2.8B |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|

| 2023 | 77.44 | 26.00 | 17.30 | 4.18 |

| 2024 | 15.88 | 9.49 | 10.24 | 7.89 |

| 2025 | 6.39 | 0.58 | 4.61 | 9.11 |

No unmapped expenses.

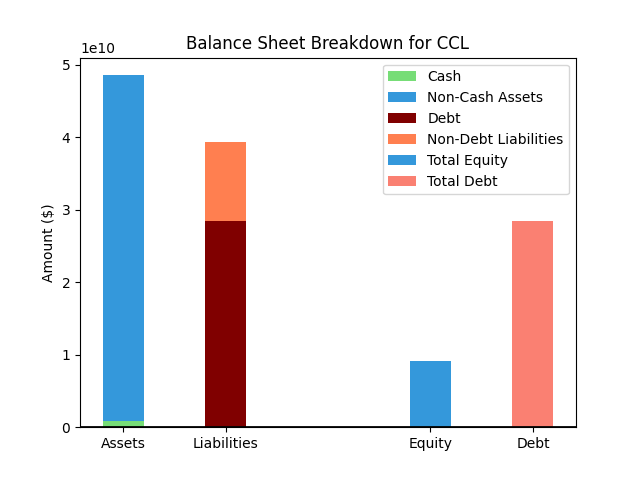

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $51,687M |

| 1 | Cash | $1,928M |

| 2 | Total Liabilities | $39,403M |

| 3 | Total Debt | $27,993M |

| 4 | Total Equity | $12,284M |

| 5 | Debt to Equity Ratio | 2.28 |

EPS & Dividend

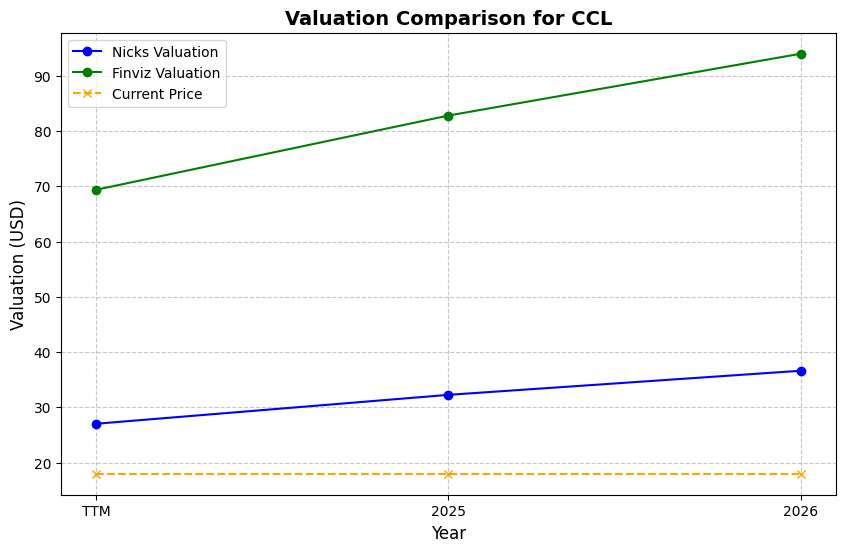

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $31.55 | 4.0% | Nicks Growth: 10% Nick's Expected Margin: 2% FINVIZ Growth: 13% |

Nicks: 18 Finviz: 23 |

Nick's: 0.359 | 1.6 | 15.6 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $2.02 EPS | TTM | $36.31 | 15.1% | $46.68 | 48.0% |

| $2.54 EPS | 2026 | $45.65 | 44.7% | $58.70 | 86.1% |

| $2.79 EPS | 2027 | $50.14 | 58.9% | $64.48 | 104.4% |

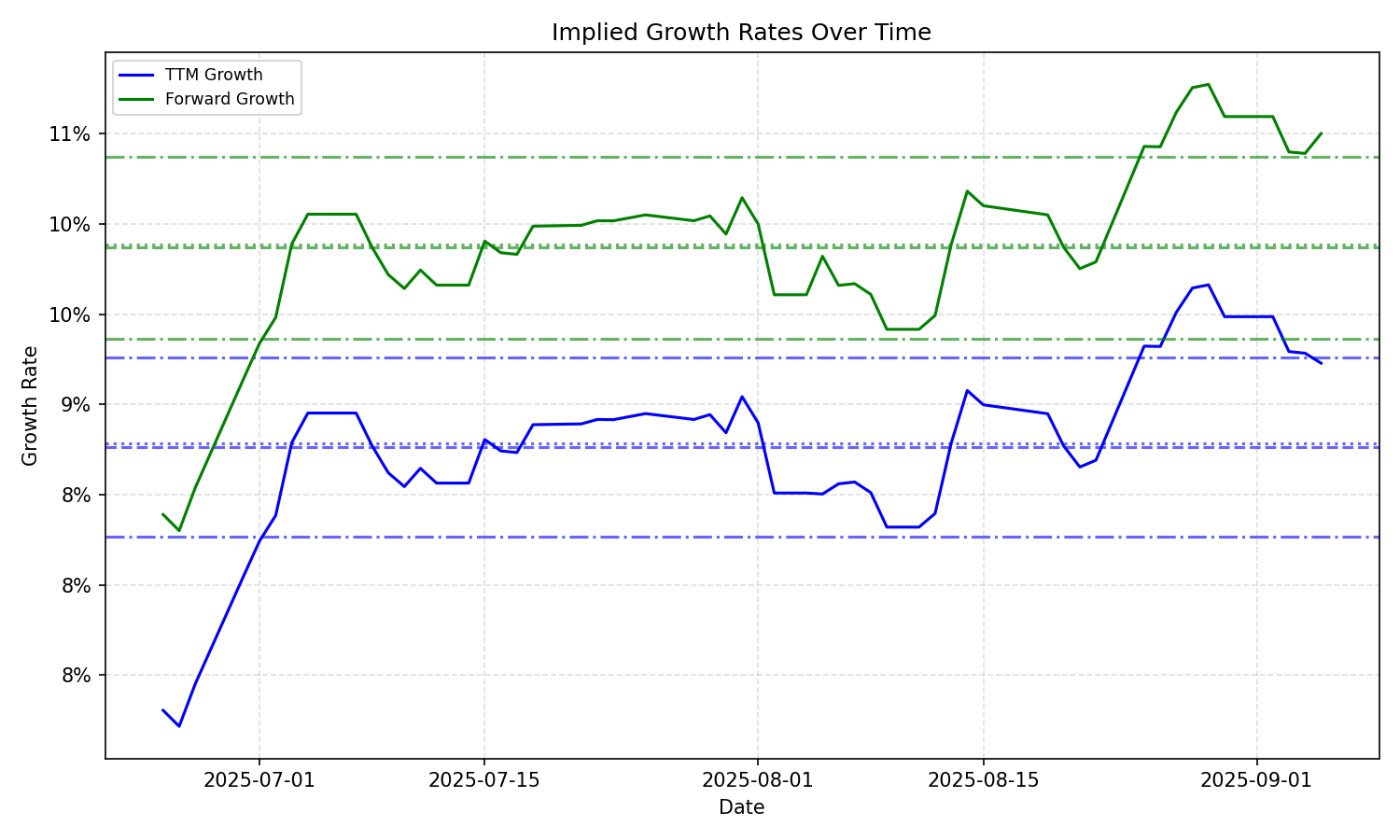

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 8.38% | 8.39% | 8.54% | 9.34% | 0.74% | 2.02% | 8.95% | 5.47% | 75.4% | 19.4% |

| 3 Years | 8.38% | 8.39% | 8.54% | 9.34% | 0.74% | 2.02% | 8.95% | 5.47% | 75.4% | 19.4% |

| 5 Years | 8.38% | 8.39% | 8.54% | 9.34% | 0.74% | 2.02% | 8.95% | 5.47% | 75.4% | 19.4% |

| 10 Years | 8.38% | 8.39% | 8.54% | 9.34% | 0.74% | 2.02% | 8.95% | 5.47% | 75.4% | 19.4% |