Beyond Meat, Inc. — BYND

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $0.95 | $428.90M | - | -2.0 | N/A | - | - | -0.1 |

Latest Headlines

- · BC-Most Active Stocks

- · Beyond Meat expands protein drinks after promising test launch

- · Beyond Meat® Expands New Line of Protein Drinks with Four Additional Flavors

- · Zacks Industry Outlook Highlights Tyson Foods, Hormel Foods, Smithfield Foods and Beyond Meat

- · 4 Meat Stocks to Monitor Amid a Volatile and Uncertain Market

- · Beyond Meat's Odds of Beating Earnings Just Hit 21% -- Is This the Quarter the Stock Finally Breaks?

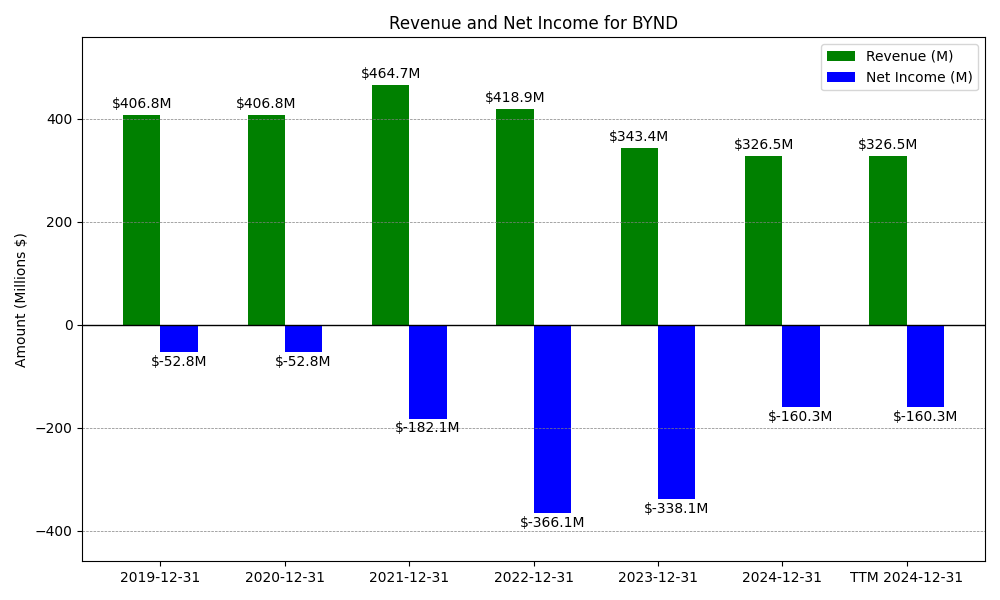

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

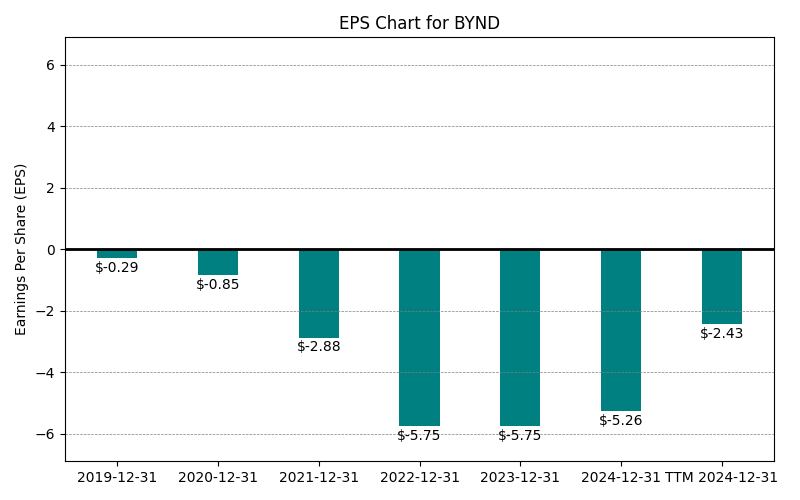

| 0 | 2019-12-31 | $407M | $-53M | $-0.29 | 2024-05-25 13:10:31 | N/A | N/A | N/A |

| 1 | 2020-12-31 | $407M | $-53M | $-0.85 | 2024-03-02 14:54:42 | 0.0% | 0.0% | 193.1% |

| 2 | 2021-12-31 | $465M | $-182M | $-2.88 | 2026-02-27 21:55:03 | 14.2% | 245.2% | 238.8% |

| 3 | 2022-12-31 | $419M | $-366M | $-5.75 | 2026-02-27 21:55:03 | -9.8% | 101.1% | 99.7% |

| 4 | 2023-12-31 | $343M | $-338M | $-5.26 | 2026-02-27 21:55:03 | -18.0% | -7.6% | -8.5% |

| 5 | 2024-12-31 | $326M | $-160M | $-2.43 | 2026-02-27 21:55:03 | -4.9% | -52.6% | -53.8% |

| 6 | TTM 2025-09-30 | $291M | $-238M | $-3.17 | 2026-02-05 08:32:03 | -11.0% | 48.3% | 30.5% |

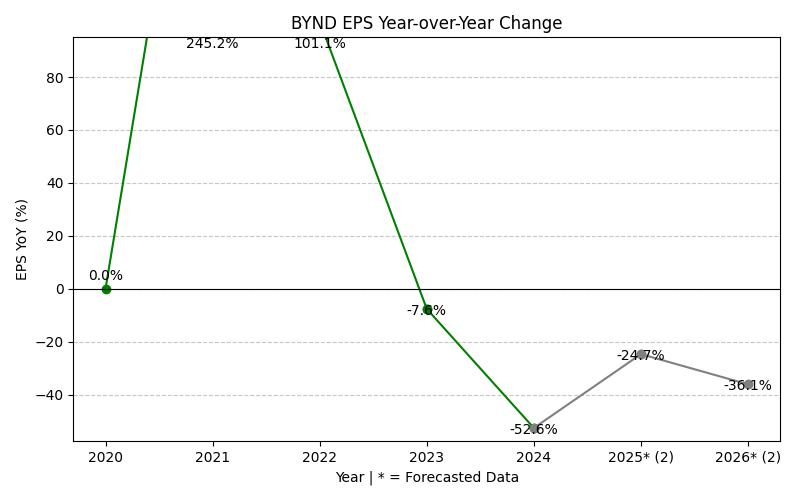

EPS

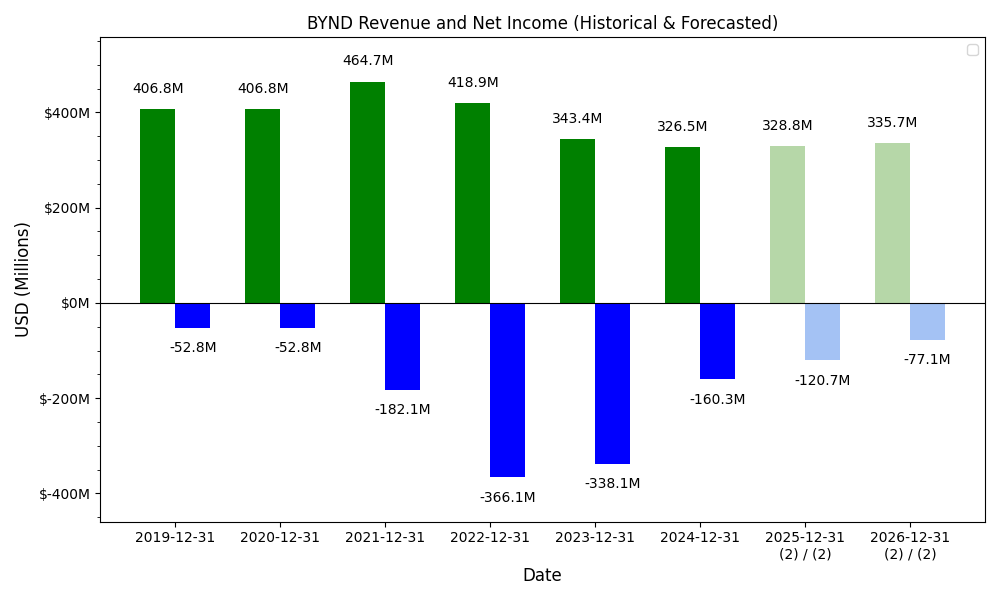

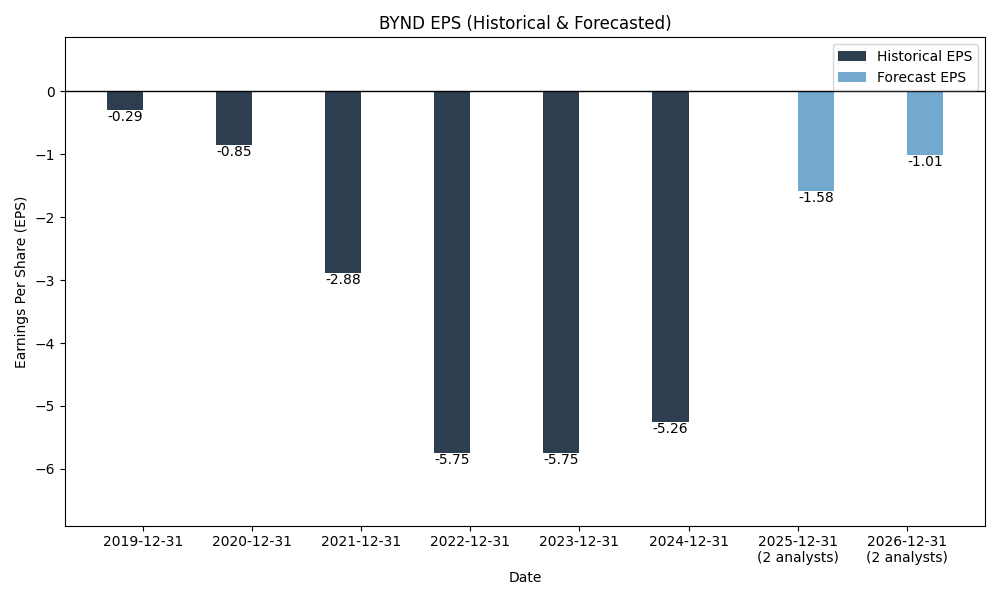

Forecasts

Y/Y % Change

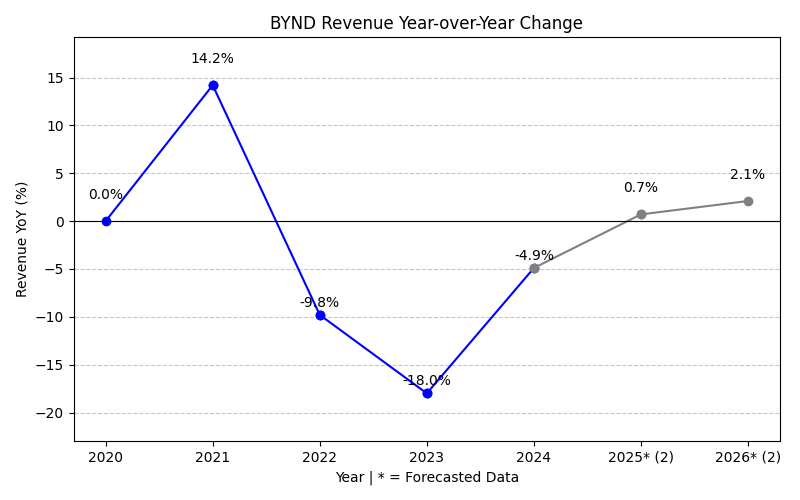

BYND Year-over-Year Growth

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 0.0% | 14.2% | -9.8% | -18.0% | -4.9% | -15.5% | -1.5% | -5.1% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | |

| EPS Growth (%) | 0.0% | 245.2% | 101.1% | -7.6% | -52.6% | 216.9% | -69.6% | 61.9% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

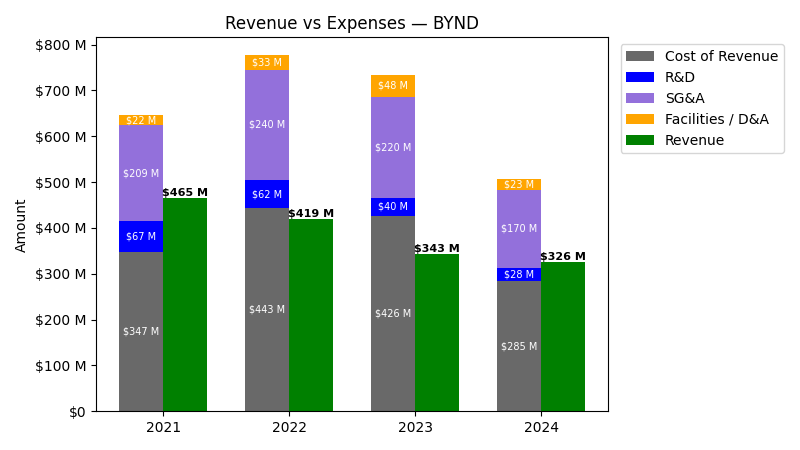

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | R&D ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|---|

| 2021 | $464.7M | $325.8M | $66.9M | $209.5M | $21.7M |

| 2022 | $418.9M | $410.1M | $62.3M | $239.5M | $32.6M |

| 2023 | $343.4M | $377.9M | $39.5M | $220.3M | $48.1M |

| 2024 | $326.5M | $261.6M | $28.1M | $169.7M | $23.1M |

| TTM | $290.6M | $235.1M | $24.9M | $163.7M | $30.7M |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | R&D Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|---|

| 2022 | -9.85 | 25.89 | -6.99 | 14.34 | 50.40 |

| 2023 | -18.04 | -7.84 | -36.51 | -8.00 | 47.61 |

| 2024 | -4.93 | -30.77 | -28.79 | -23.00 | -51.93 |

| TTM | -10.99 | -10.14 | -11.69 | -3.50 | 32.78 |

No unmapped expenses.

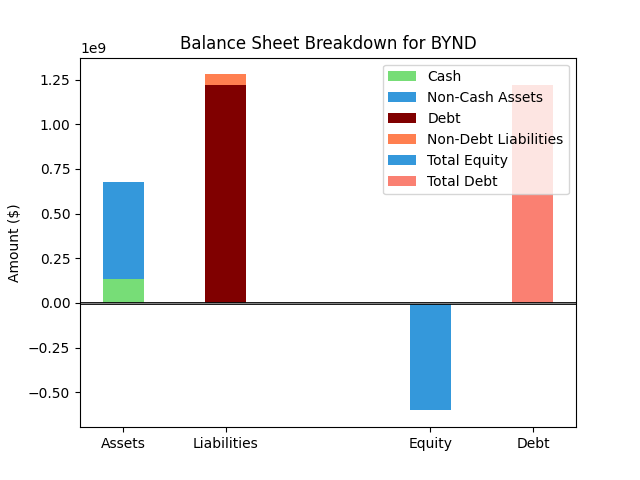

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $600M |

| 1 | Cash | $117M |

| 2 | Total Liabilities | $1,384M |

| 3 | Total Debt | $1,326M |

| 4 | Total Equity | $-784M |

| 5 | Debt to Equity Ratio | -1.69 |

EPS & Dividend

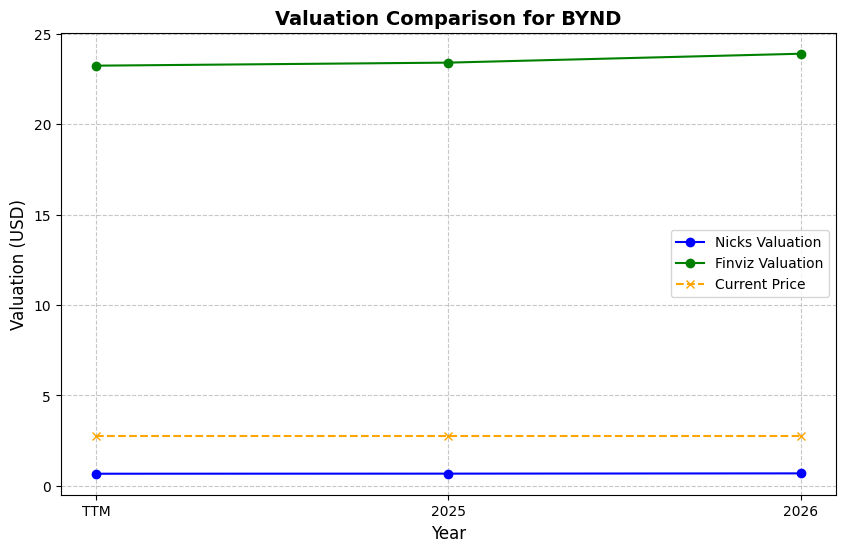

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $0.95 | 4.0% | Nicks Growth: -2% Nick's Expected Margin: 3% FINVIZ Growth: 53% |

Nicks: 5 Finviz: 533 |

Nick's: 0.162 | 1.5 | - |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $0.64 Revenue | TTM | $0.10 | -89.0% | $10.24 | 982.8% |

| $0.61 Revenue | 2025 | $0.10 | -89.6% | $9.72 | 928.0% |

| $0.60 Revenue | 2026 | $0.10 | -89.7% | $9.57 | 912.2% |

Implied Growth

No implied growth data available.