Bank of America Corporation — BAC

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $49.83 | $363.88B | 13.1 | 10.0 | 6.7% | 4.0% | $1.10 2.2% | 1.3 |

Latest Headlines

- · Bank, Brokerage Stocks Suffer Their Worst Day in Months. Here’s Why.

- · How The Story Is Shifting For S&P Global (SPGI) As Targets And AI Risks Reset

- · Celsius double upgraded by Bank of America following strong fourth quarter earnings report

- · 3 internet stocks that are least disrupted by Agentic AI, according to BofA

- · A look at Warren Buffett's final moves as Berkshire CEO

- · Bank of America revamps Amazon stock price target

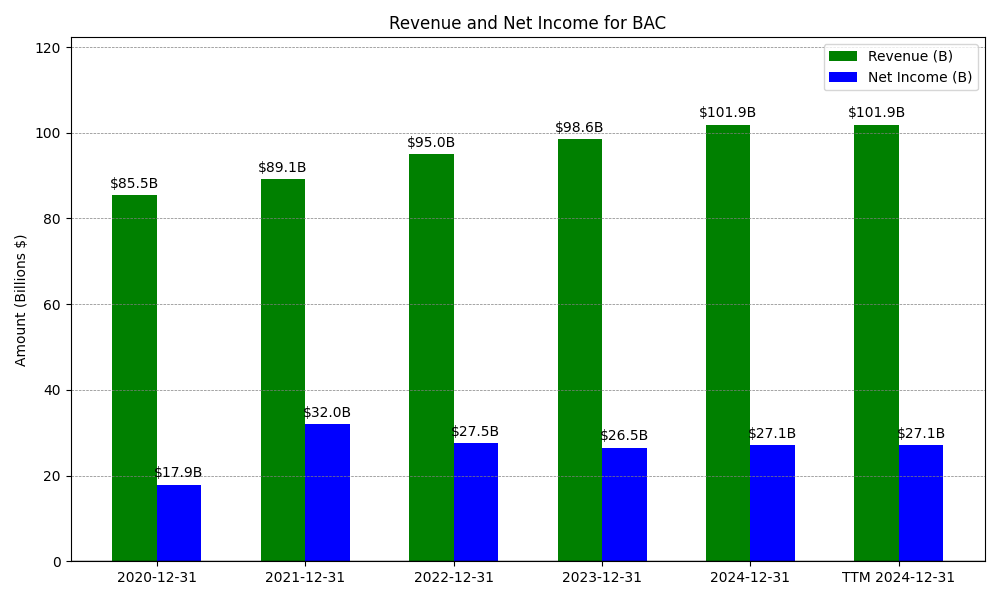

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

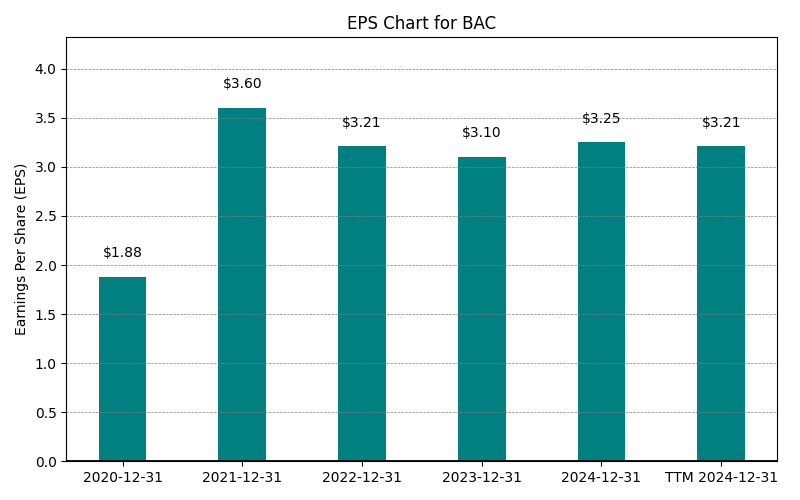

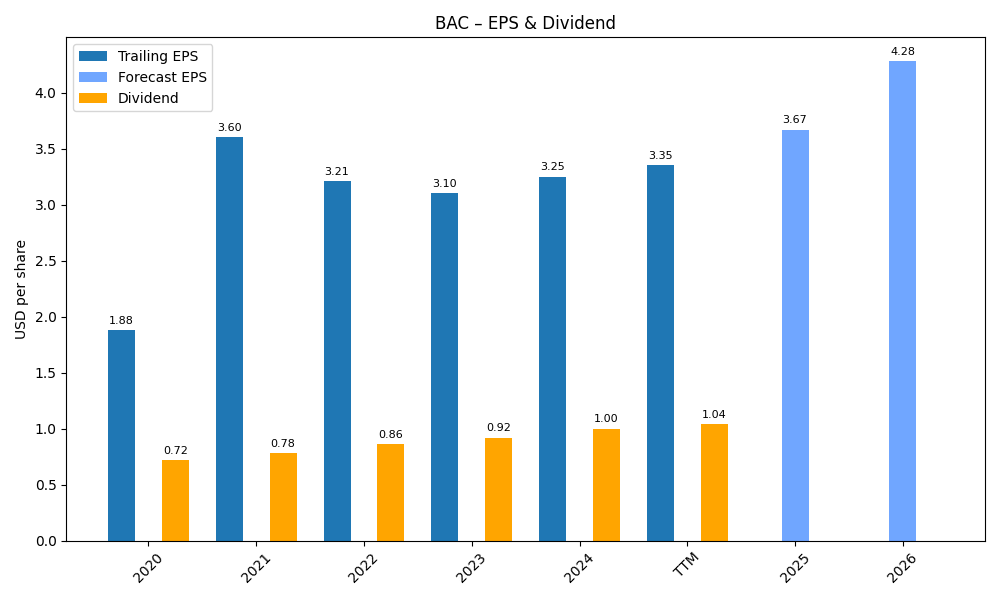

| 0 | 2020-12-31 | $85,528M | $17,894M | $1.88 | 2024-02-09 04:06:51 | N/A | N/A | N/A |

| 1 | 2021-12-31 | $89,113M | $31,978M | $3.21 | 2026-02-27 21:54:10 | 4.2% | 78.7% | 70.7% |

| 2 | 2022-12-31 | $94,950M | $27,528M | $3.21 | 2026-02-27 21:54:10 | 6.6% | -13.9% | 0.0% |

| 3 | 2023-12-31 | $98,581M | $26,515M | $3.10 | 2026-02-27 21:54:10 | 3.8% | -3.7% | -3.4% |

| 4 | 2024-12-31 | $101,887M | $27,132M | $3.25 | 2026-02-27 21:54:10 | 3.4% | 2.3% | 4.8% |

| 5 | 2025-12-31 | $101,887M | $27,132M | $3.86 | 2026-02-27 21:54:10 | 0.0% | 0.0% | 18.8% |

| 6 | TTM 2025-12-31 | $81,917M | $22,981M | $3.81 | 2026-01-17 15:24:30 | -19.6% | -15.3% | -1.3% |

EPS

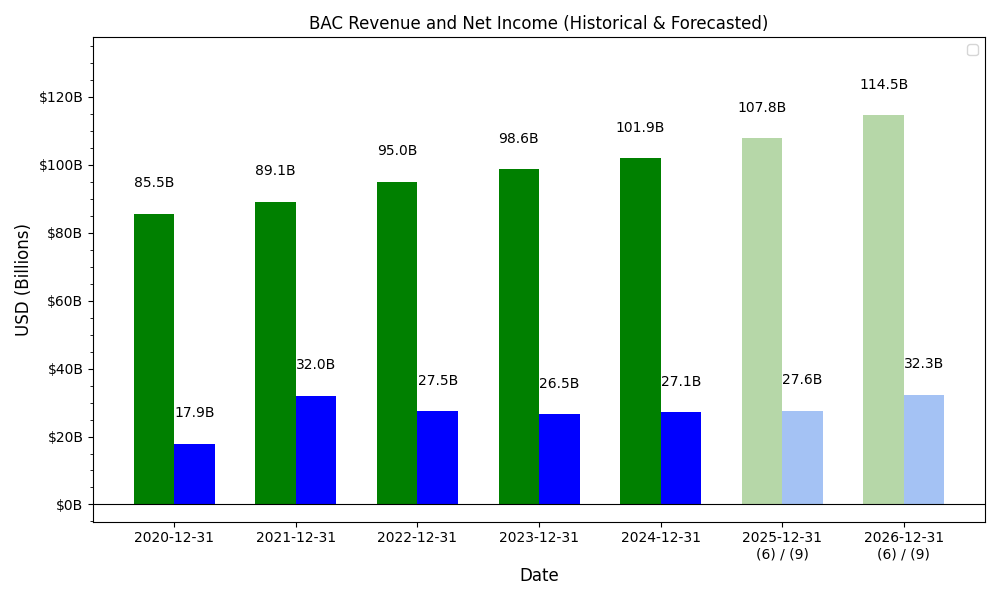

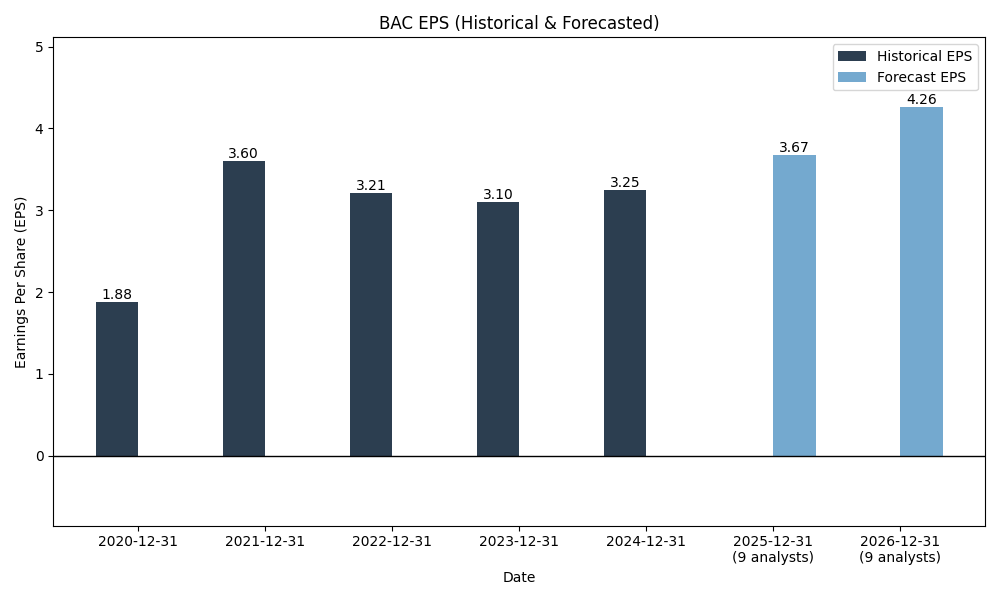

Forecasts

Y/Y % Change

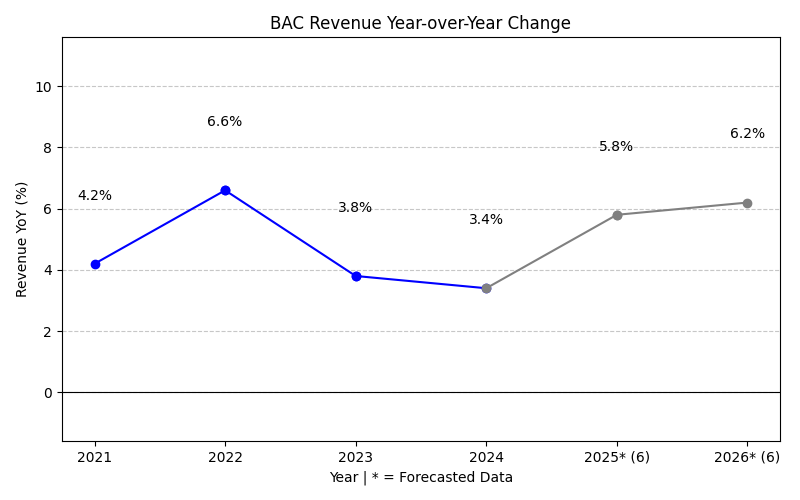

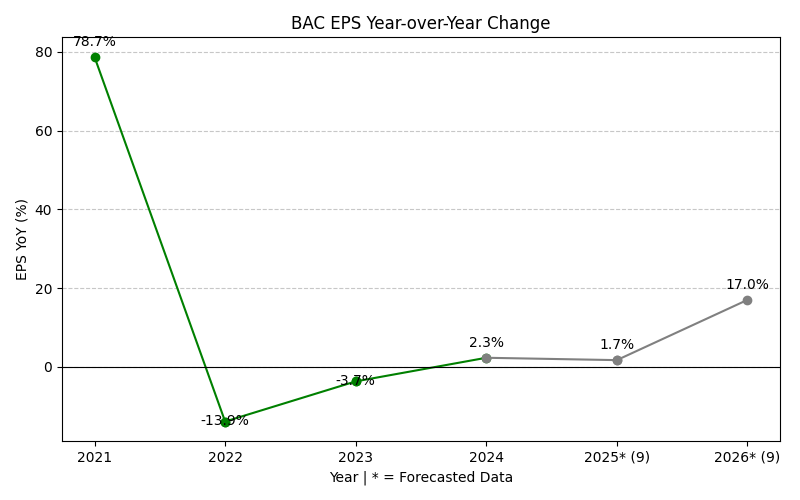

BAC Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 4.2% | 6.6% | 3.8% | 3.4% | 0.0% | 16.3% | 5.1% | 5.6% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 6 | 6 | |

| EPS Growth (%) | 78.7% | -13.9% | -3.7% | 2.3% | 0.0% | 16.3% | 14.6% | 13.5% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 10 | 10 |

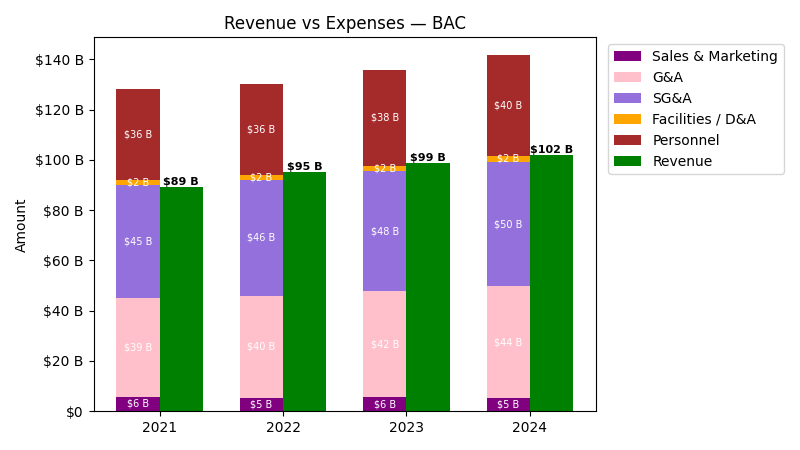

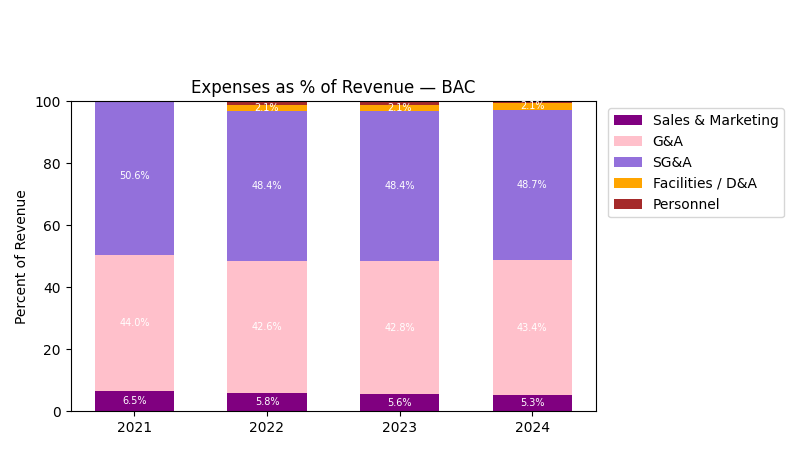

Expenses

| Year | Revenue ($) | Sales & Marketing ($) | G&A ($) | SG&A ($) | Facilities / D&A ($) | Personnel ($) |

|---|---|---|---|---|---|---|

| 2021 | $89.1B | $5.8B | $39.2B | $45.0B | $1.9B | $36.1B |

| 2022 | $95.0B | $5.5B | $40.5B | $45.9B | $2.0B | $36.4B |

| 2023 | $98.6B | $5.5B | $42.2B | $47.7B | $2.1B | $38.3B |

| 2024 | $101.9B | $5.5B | $44.2B | $49.6B | $2.2B | $40.2B |

| TTM | $81.9B | $4.6B | $34.7B | $39.3B | $1.7B | $31.7B |

| Year | Revenue Change (%) | Sales & Marketing Change (%) | G&A Change (%) | SG&A Change (%) | Facilities / D&A Change (%) | Personnel Change (%) |

|---|---|---|---|---|---|---|

| 2022 | 6.55 | -5.88 | 3.16 | 1.99 | 4.21 | 0.85 |

| 2023 | 3.82 | 1.04 | 4.23 | 3.85 | 3.99 | 5.17 |

| 2024 | 3.35 | -1.54 | 4.72 | 4.00 | 6.42 | 4.83 |

| TTM | -19.60 | -16.44 | -21.37 | -20.83 | -21.43 | -21.00 |

No unmapped expenses.

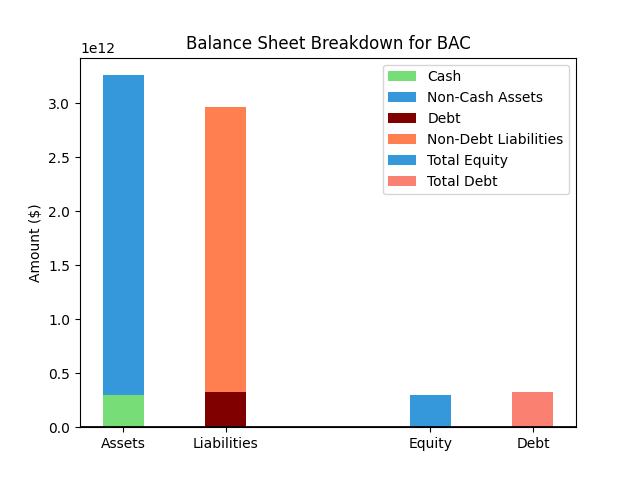

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $3,403,716M |

| 1 | Cash | $254,719M |

| 2 | Total Liabilities | $3,099,564M |

| 3 | Total Debt | $365,684M |

| 4 | Total Equity | $304,152M |

| 5 | Debt to Equity Ratio | 1.20 |

EPS & Dividend

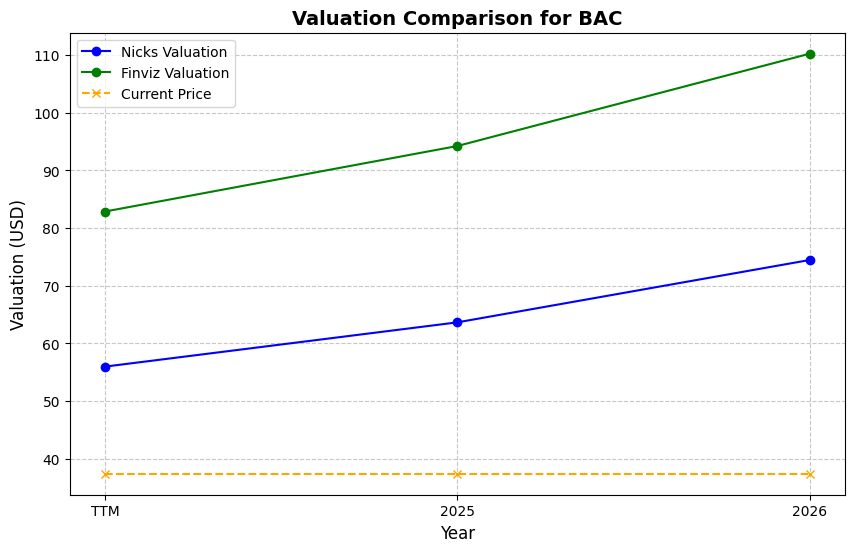

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $49.83 | 4.0% | Nicks Growth: 10% Nick's Expected Margin: 25% FINVIZ Growth: 14% |

Nicks: 18 Finviz: 26 |

Nick's: 4.493 | 4.4 | 13.1 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $3.81 EPS | TTM | $68.48 | 37.4% | $99.25 | 99.2% |

| $4.32 EPS | 2026 | $77.64 | 55.8% | $112.54 | 125.8% |

| $4.95 EPS | 2027 | $88.97 | 78.5% | $128.95 | 158.8% |

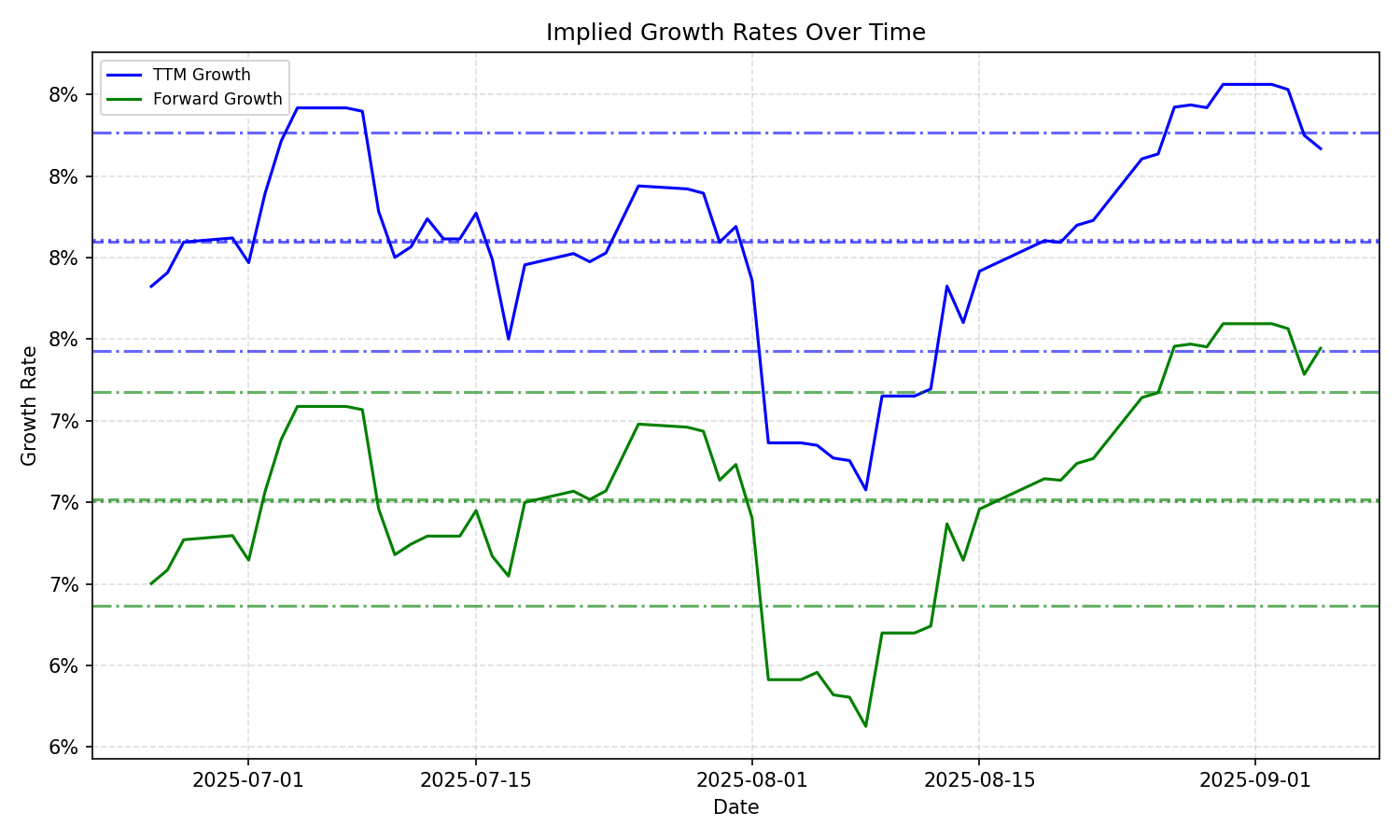

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 7.88% | 6.89% | 7.89% | 7.19% | 0.38% | 0.98% | 7.24% | 4.53% | 6.3% | 2.3% |

| 3 Years | 7.88% | 6.89% | 7.89% | 7.19% | 0.38% | 0.98% | 7.24% | 4.53% | 6.3% | 2.3% |

| 5 Years | 7.88% | 6.89% | 7.89% | 7.19% | 0.38% | 0.98% | 7.24% | 4.53% | 6.3% | 2.3% |

| 10 Years | 7.88% | 6.89% | 7.89% | 7.19% | 0.38% | 0.98% | 7.24% | 4.53% | 6.3% | 2.3% |