Alibaba Group Holding Limited — BABA

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $144.11 | $344.04B | 19.0 | 16.3 | 10.6% | 8.9% | $1.05 0.7% | 2.2 |

Latest Headlines

- · Earnings live: Block mass layoffs earn Wall Street's approval, Duolingo shares plunge

- · Contrarian Capital Scales Back on Core Natural Resources as Coal Markets Normalize

- · Will Heavy Capex Spending Weigh on Amazon's AI Ambitions?

- · Alibaba Group Holding Limited (BABA) is Attracting Investor Attention: Here is What You Should Know

- · Payoneer Global Inc (PAYO) Q4 2025 Earnings Call Highlights: Record Revenue Growth and ...

- · Why Baidu Stock Is Falling Today

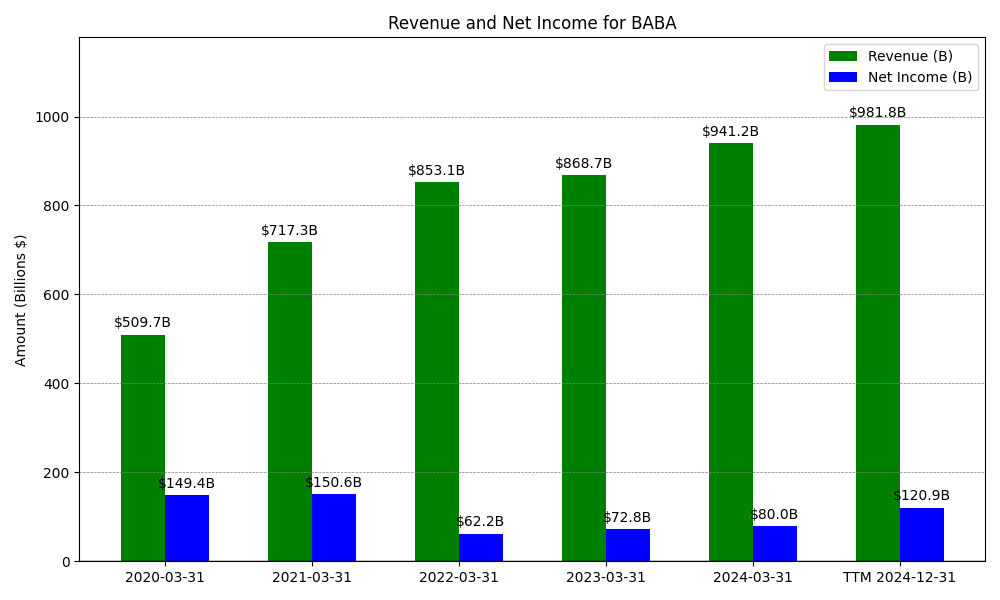

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

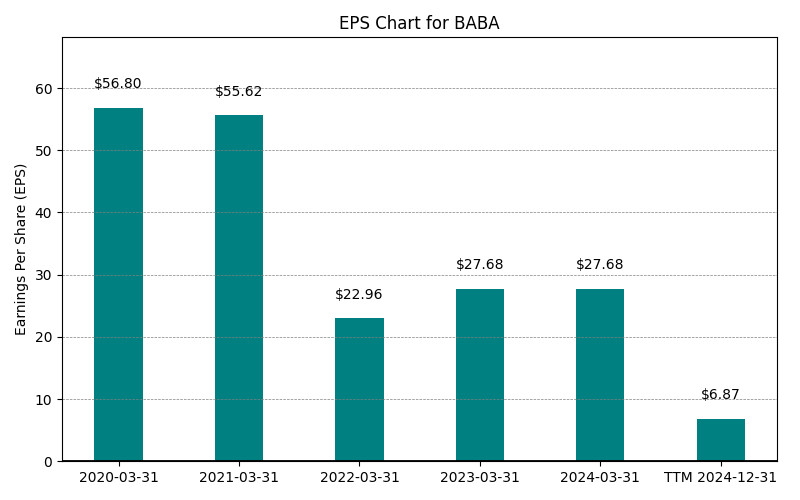

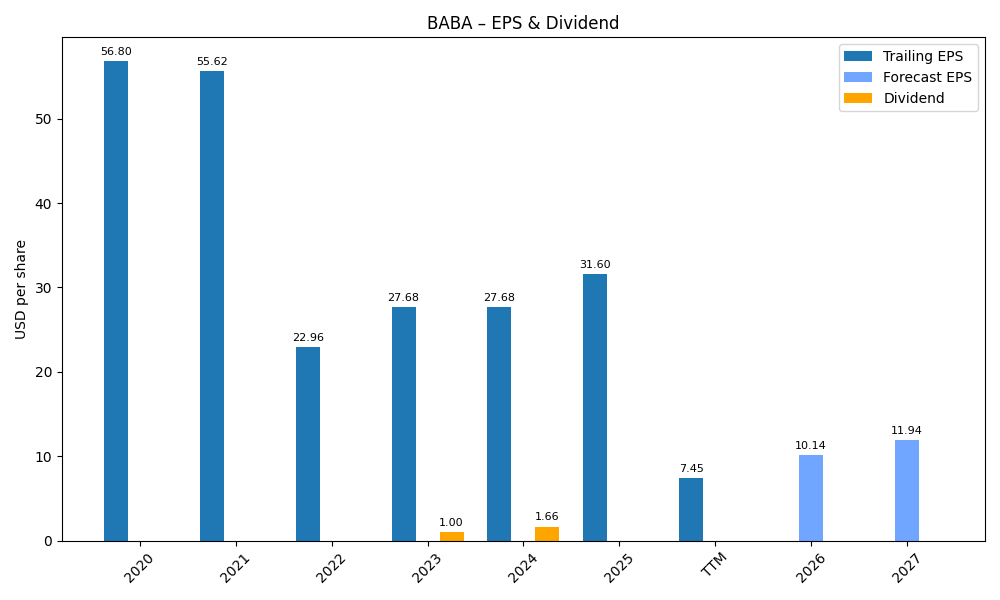

| 0 | 2020-03-31 | $509,711M | $149,433M | $56.80 | 2024-02-04 04:18:27 | N/A | N/A | N/A |

| 1 | 2021-03-31 | $717,289M | $150,578M | $55.62 | 2024-02-04 04:18:27 | 40.7% | 0.8% | -2.1% |

| 2 | 2022-03-31 | $853,062M | $62,249M | $22.96 | 2026-02-27 21:54:06 | 18.9% | -58.7% | -58.7% |

| 3 | 2023-03-31 | $868,687M | $72,783M | $27.68 | 2026-02-27 21:54:06 | 1.8% | 16.9% | 20.6% |

| 4 | 2024-03-31 | $941,168M | $80,009M | $31.60 | 2026-02-27 21:54:06 | 8.3% | 9.9% | 14.2% |

| 5 | 2025-03-31 | $996,347M | $130,109M | $55.12 | 2026-02-27 21:54:06 | 5.9% | 62.6% | 74.4% |

| 6 | TTM 2025-09-30 | $1,012,055M | $123,354M | $7.59 | 2026-02-05 08:31:56 | 1.6% | -5.2% | -86.2% |

EPS

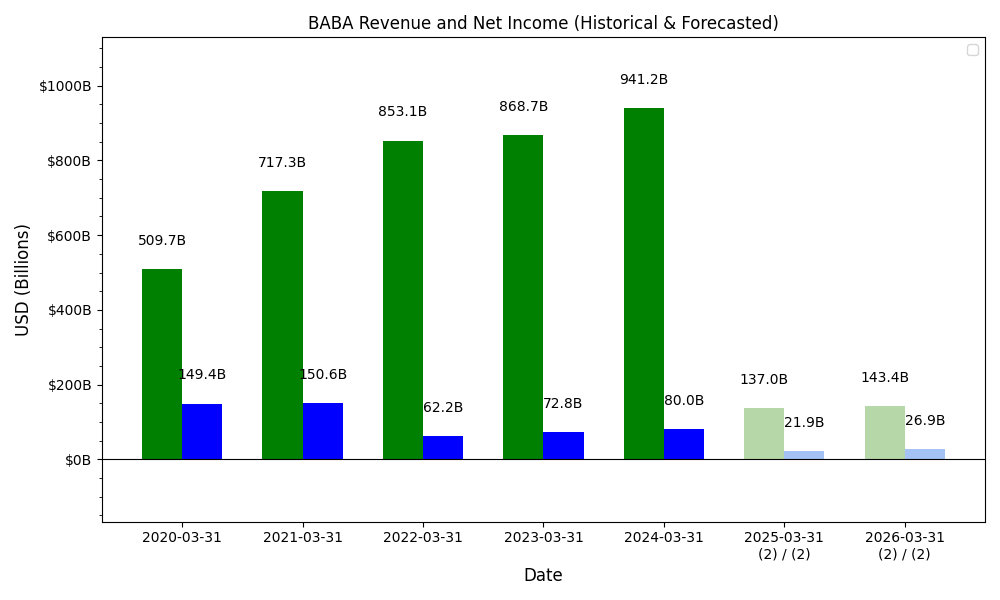

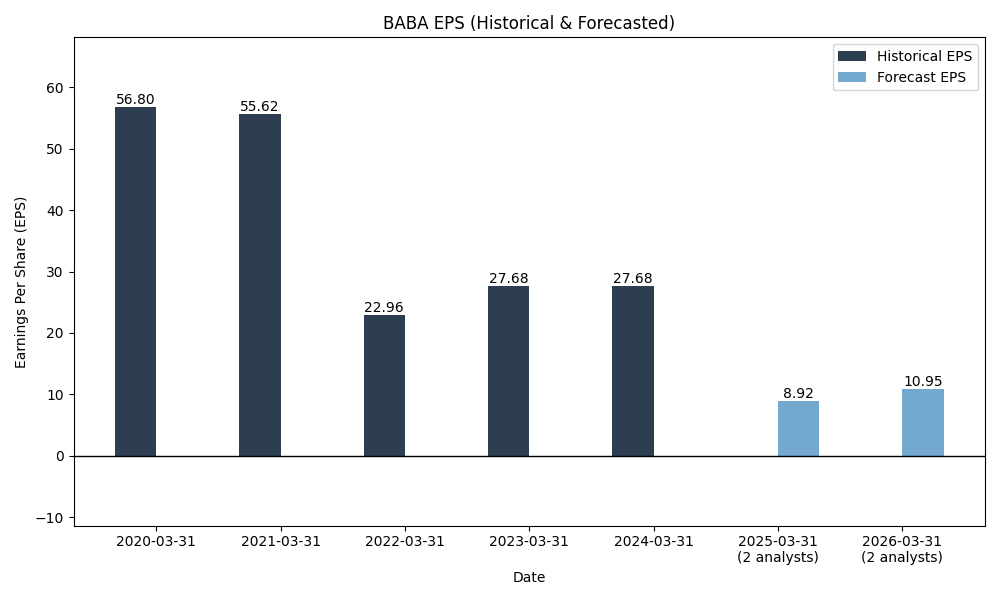

Forecasts

Y/Y % Change

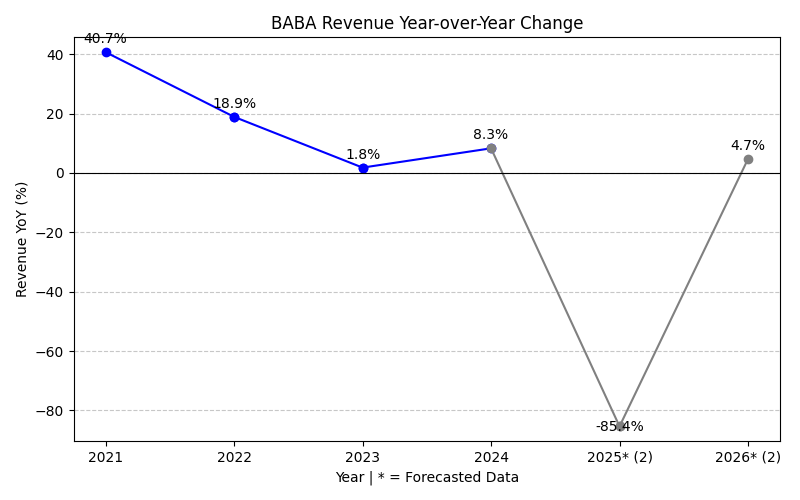

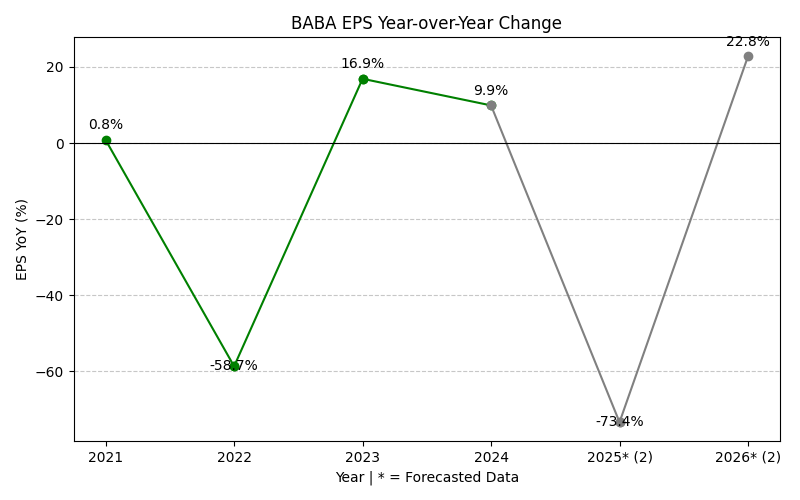

BABA Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 40.7% | 18.9% | 1.8% | 8.3% | 5.9% | -85.2% | 11.2% | 0.2% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 2 | |

| EPS Growth (%) | 0.8% | -58.7% | 16.9% | 9.9% | 62.6% | -89.1% | 46.3% | -1.6% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 2 |

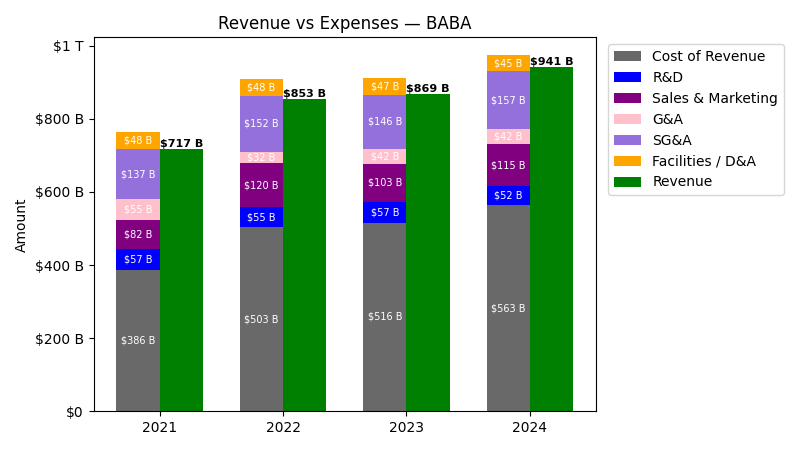

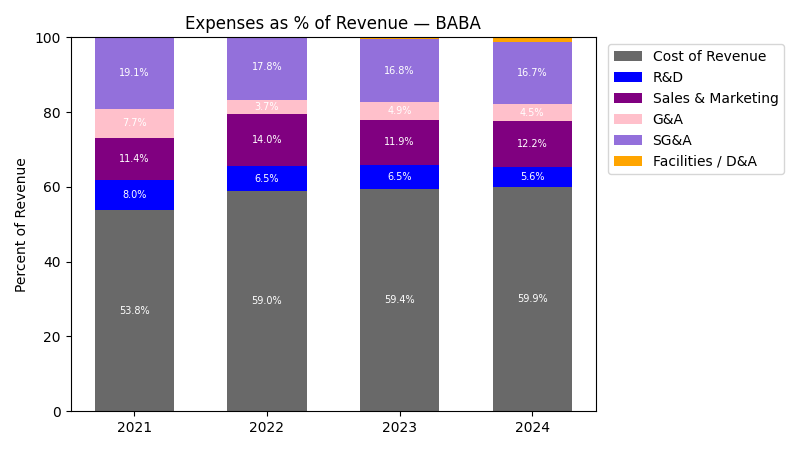

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | R&D ($) | Sales & Marketing ($) | G&A ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|---|---|---|

| 2022 | $853.1B | $455.0B | $55.5B | $119.8B | $31.9B | $151.7B | $48.1B |

| 2023 | $868.7B | $469.3B | $56.7B | $103.5B | $42.2B | $145.7B | $46.9B |

| 2024 | $941.2B | $518.9B | $52.3B | $115.1B | $42.0B | $157.1B | $44.5B |

| 2025 | $996.3B | $519.7B | $57.2B | $144.0B | $44.2B | $188.3B | $42.5B |

| TTM | $1.0T | $590.8B | $61.7B | $198.5B | $36.0B | $234.5B | $4.5B |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | R&D Change (%) | Sales & Marketing Change (%) | G&A Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|---|---|---|

| 2023 | 1.83 | 3.16 | 2.31 | -13.61 | 32.14 | -3.98 | -2.34 |

| 2024 | 8.34 | 10.57 | -7.91 | 11.25 | -0.47 | 7.86 | -5.19 |

| 2025 | 5.86 | 0.15 | 9.37 | 25.08 | 5.37 | 19.81 | -4.60 |

| TTM | 1.58 | 13.69 | 7.95 | 37.85 | -18.71 | 24.56 | -89.34 |

No unmapped expenses.

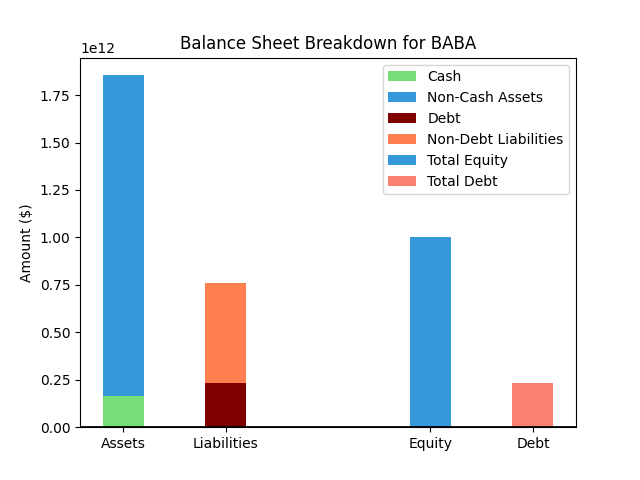

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $1,883,880M |

| 1 | Cash | $135,069M |

| 2 | Total Liabilities | $772,095M |

| 3 | Total Debt | $281,594M |

| 4 | Total Equity | $1,032,495M |

| 5 | Debt to Equity Ratio | 0.27 |

EPS & Dividend

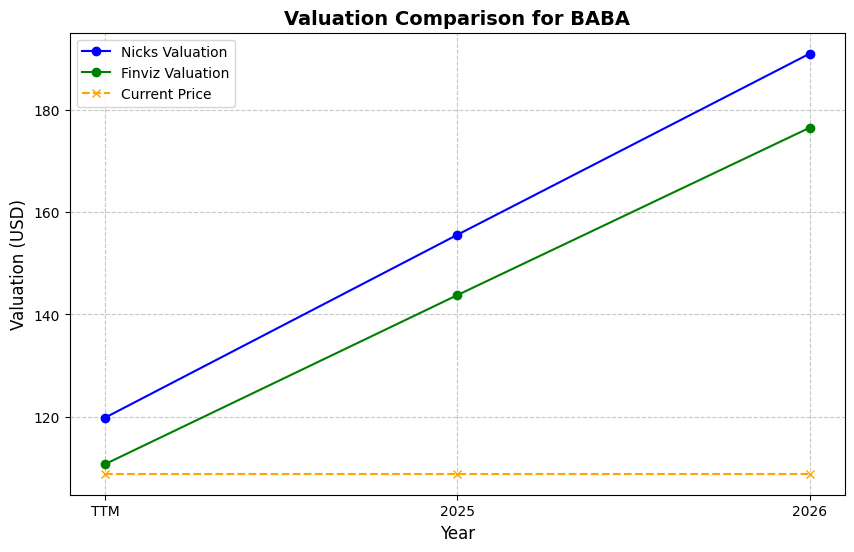

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $144.11 | 4.0% | Nicks Growth: 10% Nick's Expected Margin: 8% FINVIZ Growth: 5% |

Nicks: 18 Finviz: 12 |

Nick's: 1.438 | 0.3 | 19.0 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $7.59 EPS | TTM | $136.41 | -5.3% | $87.98 | -38.9% |

| $5.96 EPS | 2026 | $107.12 | -25.7% | $69.09 | -52.1% |

| $8.72 EPS | 2027 | $156.72 | 8.8% | $101.08 | -29.9% |

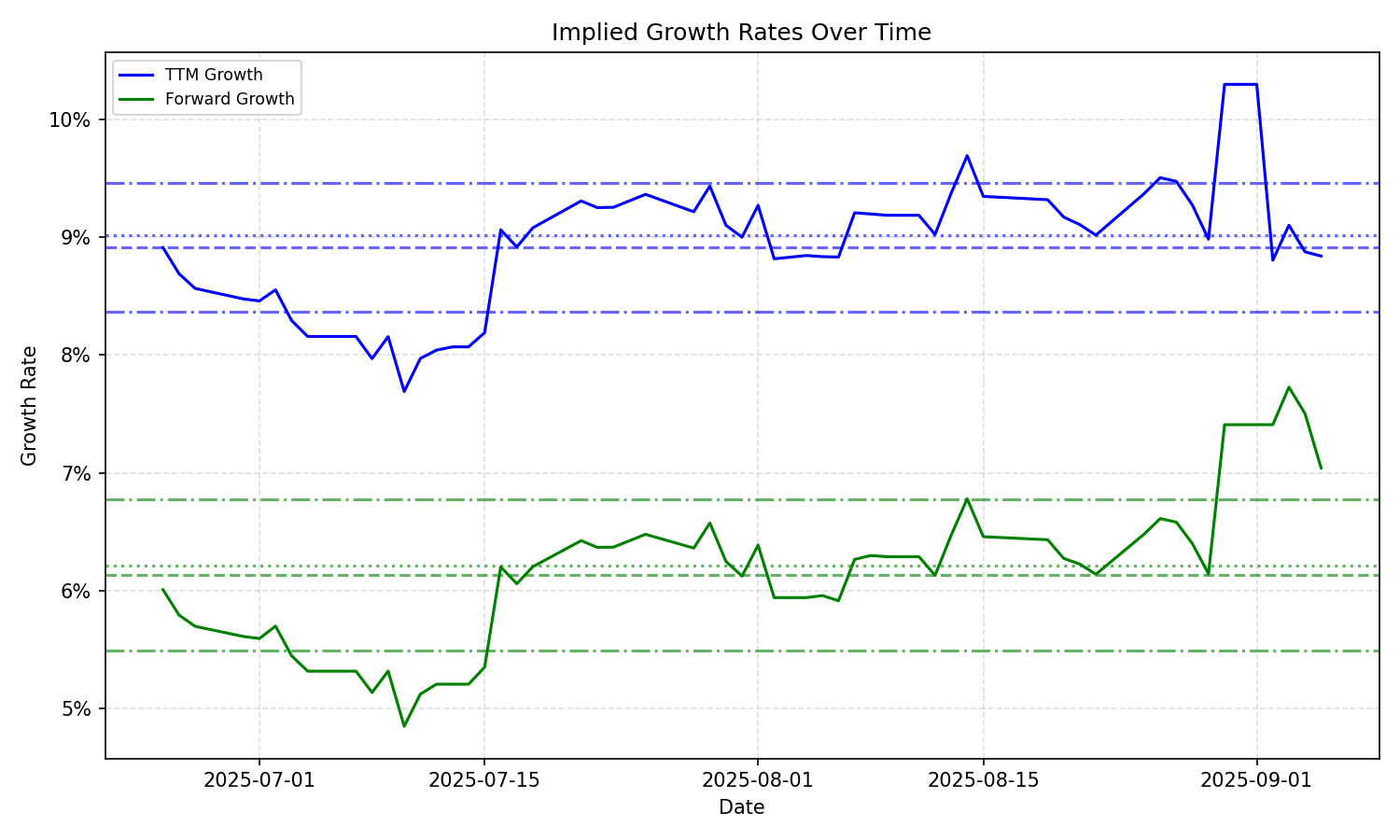

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 10.48% | 8.38% | 10.68% | 8.93% | 1.36% | 1.75% | 10.93% | 9.28% | 56.8% | 61.9% |

| 3 Years | 10.48% | 8.38% | 10.68% | 8.93% | 1.36% | 1.75% | 10.93% | 9.28% | 56.8% | 61.9% |

| 5 Years | 10.48% | 8.38% | 10.68% | 8.93% | 1.36% | 1.75% | 10.93% | 9.28% | 56.8% | 61.9% |

| 10 Years | 10.48% | 8.38% | 10.68% | 8.93% | 1.36% | 1.75% | 10.93% | 9.28% | 56.8% | 61.9% |