Applied Materials, Inc. — AMAT

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $372.30 | $295.46B | 38.1 | 27.0 | 18.3% | 14.4% | $1.84 0.5% | 13.6 |

Latest Headlines

- · A Look At Applied Materials (AMAT) Valuation After Sector Sell Off On AI Spending Concerns

- · Applied Materials, Broadcom, Lam Research, Western Digital, and Allegro MicroSystems Shares Are Falling, What You Need To Know

- · Nasdaq, S&P 500 Snap Two-Day Advance Amid Nvidia-Led Tech Pullback

- · US Equity Indexes Mixed as Financials Help Partially Offset Sell-Off in Chipmakers

- · Nasdaq, S&P 500 Drop as Semiconductor Stocks Slide After Nvidia Results

- · Nishant Sinha Joins Atomera as Head of Marketing to Drive Strategy and Growth in Advanced Semiconductor Materials

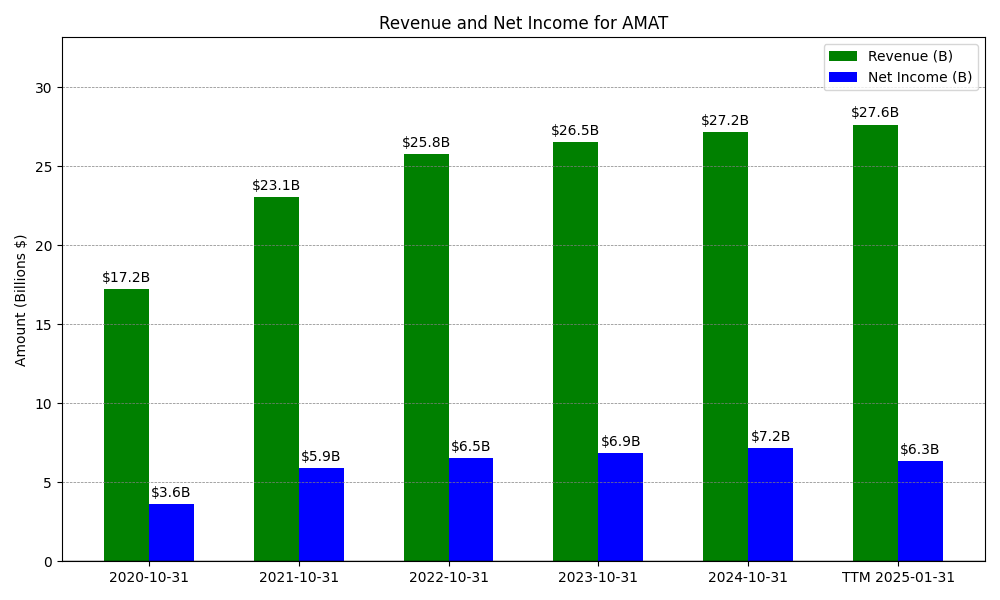

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

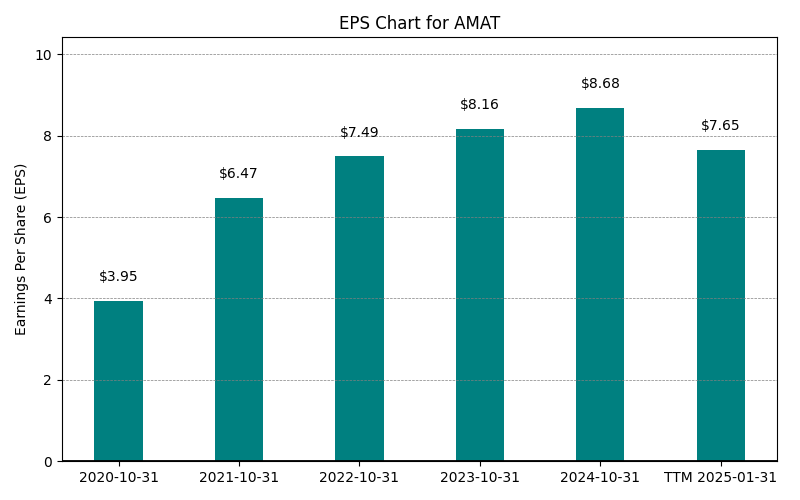

| 0 | 2020-10-31 | $17,202M | $3,619M | $3.95 | 2024-02-04 04:16:33 | N/A | N/A | N/A |

| 1 | 2021-10-31 | $23,063M | $5,888M | $6.47 | 2024-02-04 04:16:33 | 34.1% | 62.7% | 63.8% |

| 2 | 2022-10-31 | $25,785M | $6,525M | $7.49 | 2026-02-27 21:53:12 | 11.8% | 10.8% | 15.8% |

| 3 | 2023-10-31 | $26,517M | $6,856M | $8.16 | 2026-02-27 21:53:12 | 2.8% | 5.1% | 8.9% |

| 4 | 2024-10-31 | $27,176M | $7,177M | $8.68 | 2026-02-27 21:53:12 | 2.5% | 4.7% | 6.4% |

| 5 | 2025-10-31 | $28,368M | $6,998M | $8.71 | 2026-02-27 21:53:12 | 4.4% | -2.5% | 0.3% |

| 6 | TTM 2026-01-31 | $21,202M | $5,813M | $9.77 | 2026-02-16 08:36:05 | -25.3% | -16.9% | 12.2% |

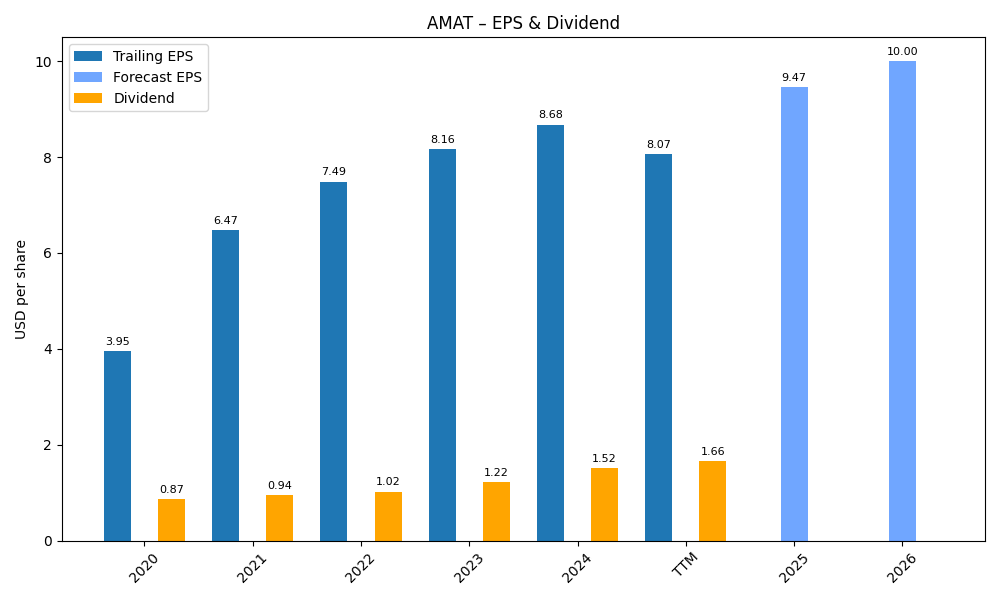

EPS

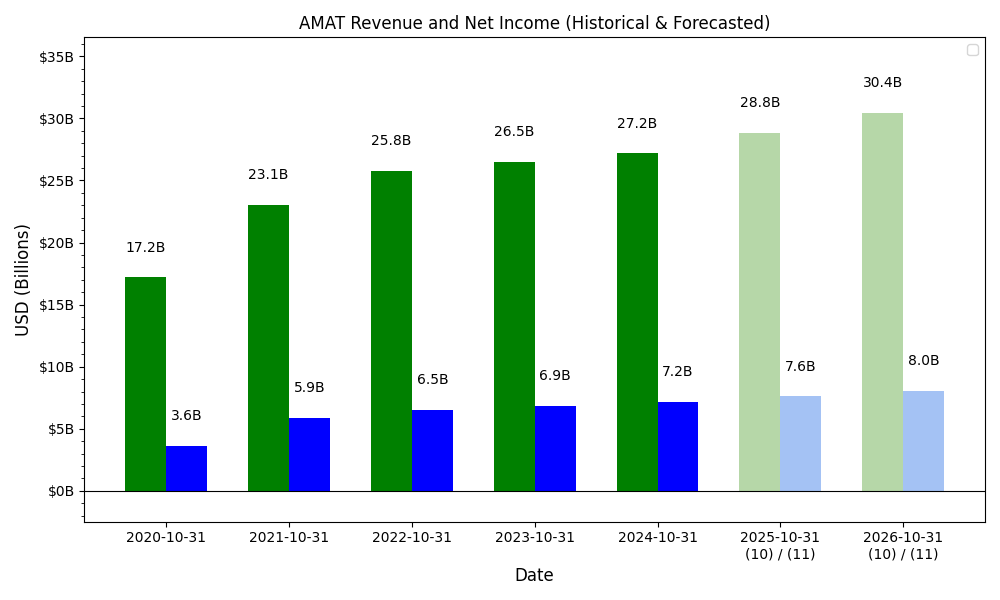

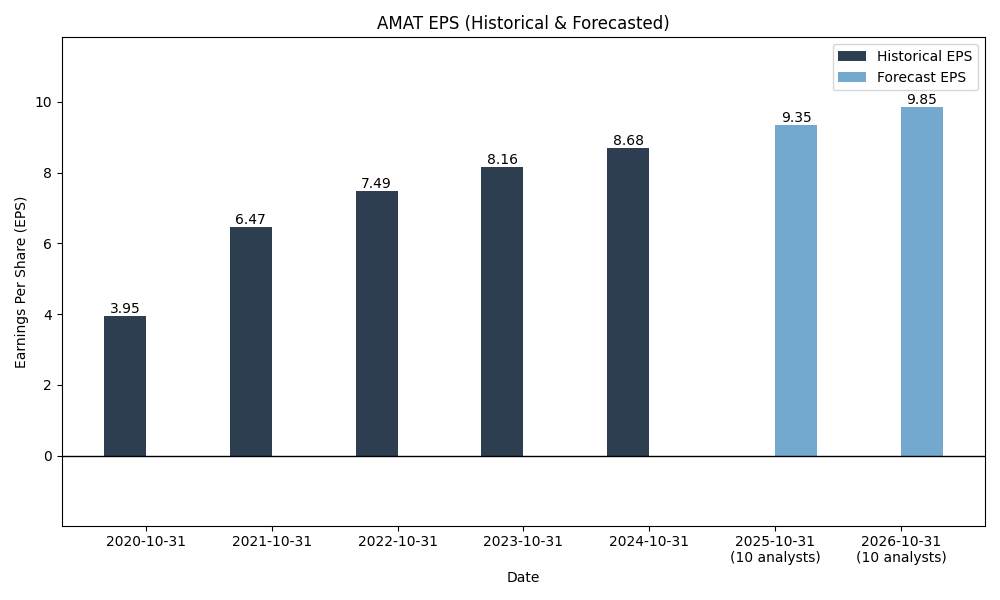

Forecasts

Y/Y % Change

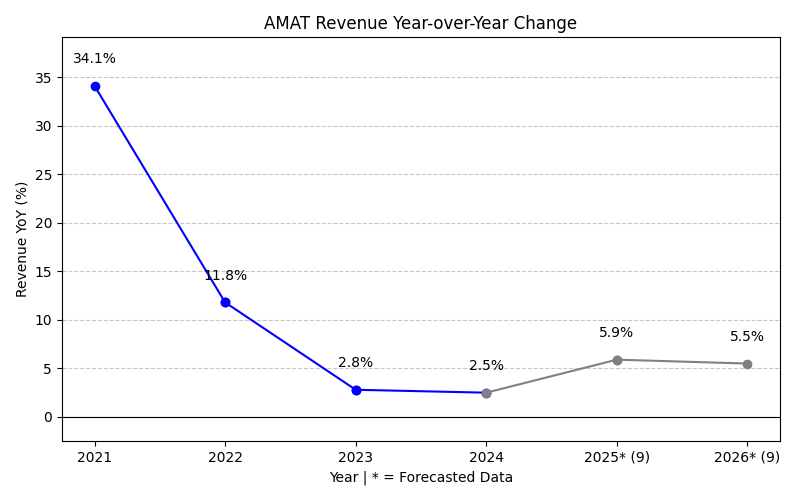

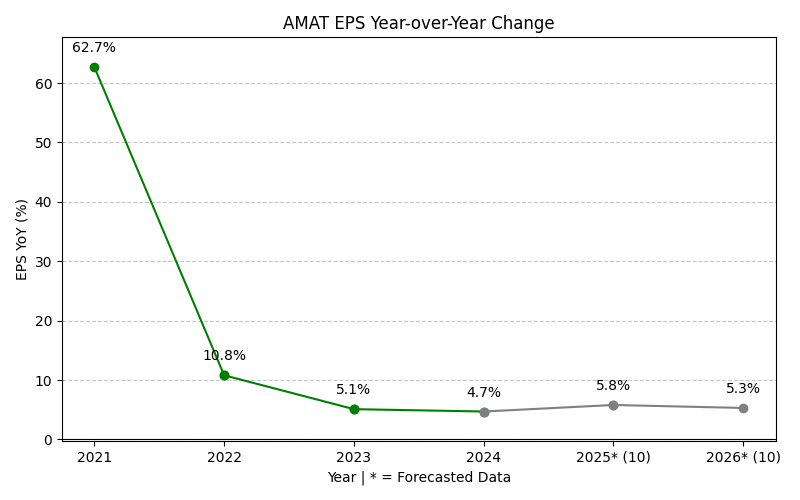

AMAT Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 34.1% | 11.8% | 2.8% | 2.5% | 4.4% | 8.9% | 18.3% | 11.8% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 7 | 7 | |

| EPS Growth (%) | 62.7% | 10.8% | 5.1% | 4.7% | -2.5% | 24.4% | 24.8% | 18.6% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 10 | 10 |

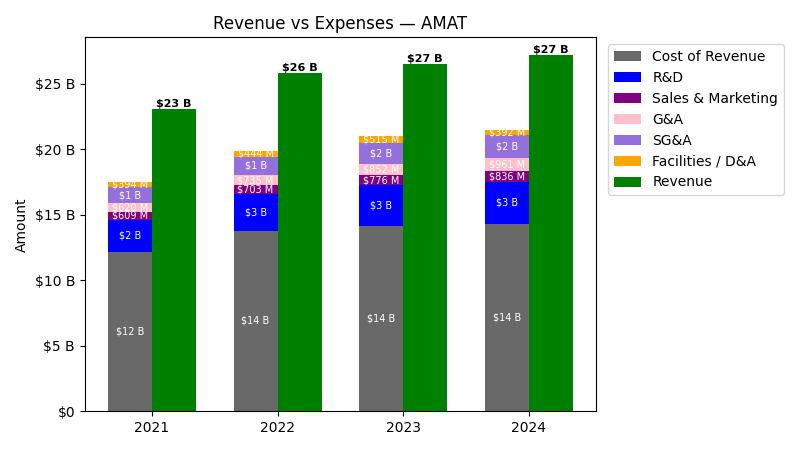

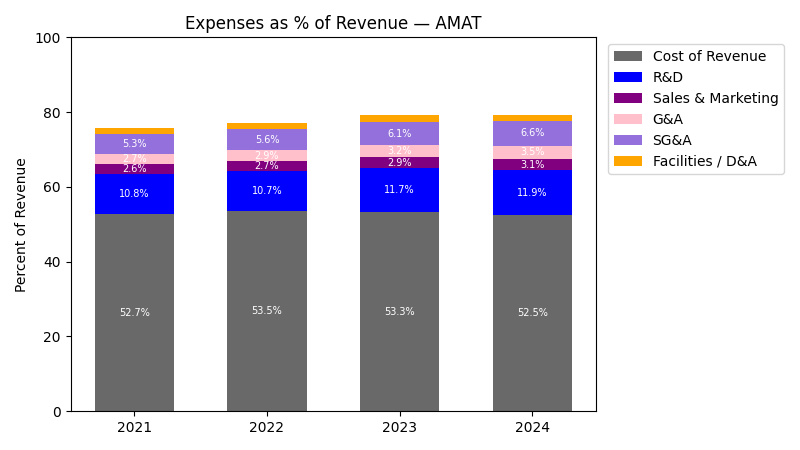

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | R&D ($) | Sales & Marketing ($) | G&A ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|---|---|---|

| 2022 | $25.8B | $13.3B | $2.8B | $703.0M | $735.0M | $1.4B | $444.0M |

| 2023 | $26.5B | $13.6B | $3.1B | $776.0M | $852.0M | $1.6B | $515.0M |

| 2024 | $27.2B | $13.9B | $3.2B | $836.0M | $961.0M | $1.8B | $392.0M |

| 2025 | $28.4B | $14.1B | $3.6B | $858.0M | $910.0M | $1.8B | $435.0M |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | R&D Change (%) | Sales & Marketing Change (%) | G&A Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|---|---|---|

| 2023 | 2.84 | 2.02 | 11.95 | 10.38 | 15.92 | 13.21 | 15.99 |

| 2024 | 2.49 | 1.98 | 4.22 | 7.73 | 12.79 | 10.38 | -23.88 |

| 2025 | 4.39 | 1.71 | 10.42 | 2.63 | -5.31 | -1.61 | 10.97 |

No unmapped expenses.

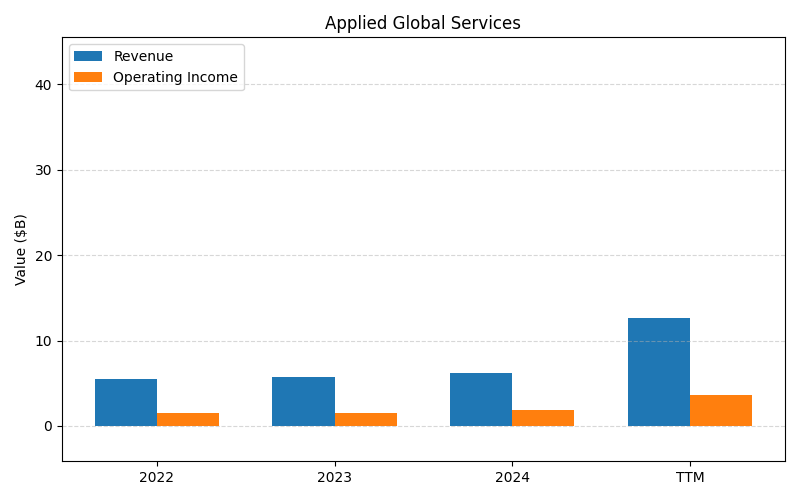

Segment Performance

SEGMENTS v2025-09-09 · 2026-02-27 21:53 UTC — Units: $B. Rows list fiscal years (last 3 + TTM) with revenue and operating income for each segment; the final row shows the TTM revenue mix (operating income columns display “—” where mix is not applicable).

| Year | Semiconductor Systems Rev | Semiconductor Systems OI | Applied Global Services Rev | Applied Global Services OI | Total Rev | Total OI |

|---|---|---|---|---|---|---|

| 2023 | 19.7B | 6.88B | 5.73B | 1.53B | 25.4B | 8.41B |

| 2024 | 19.9B | 6.98B | 6.22B | 1.81B | 26.1B | 8.79B |

| 2025 | 20.8B | 7.38B | 6.38B | 1.79B | 27.2B | 9.17B |

| TTM | 51.4B | 17.7B | 15.5B | 4.38B | 67B | 22B |

| % of Total (TTM) | 76.8% | — | 23.2% | — | 100% | — |

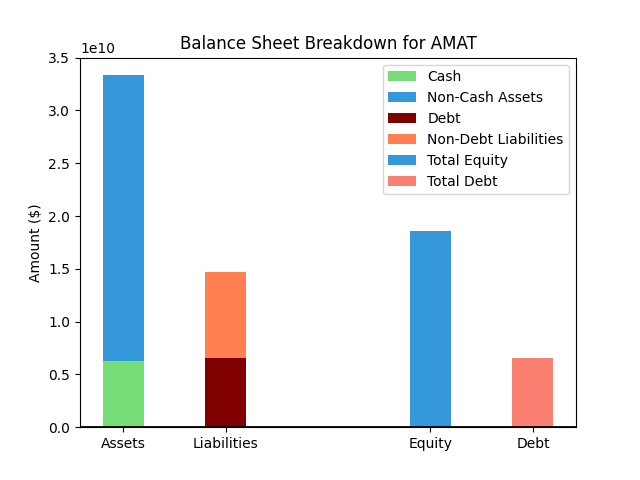

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $36,299M |

| 1 | Cash | $7,241M |

| 2 | Total Liabilities | $15,884M |

| 3 | Total Debt | $7,050M |

| 4 | Total Equity | $20,415M |

| 5 | Debt to Equity Ratio | 0.35 |

EPS & Dividend

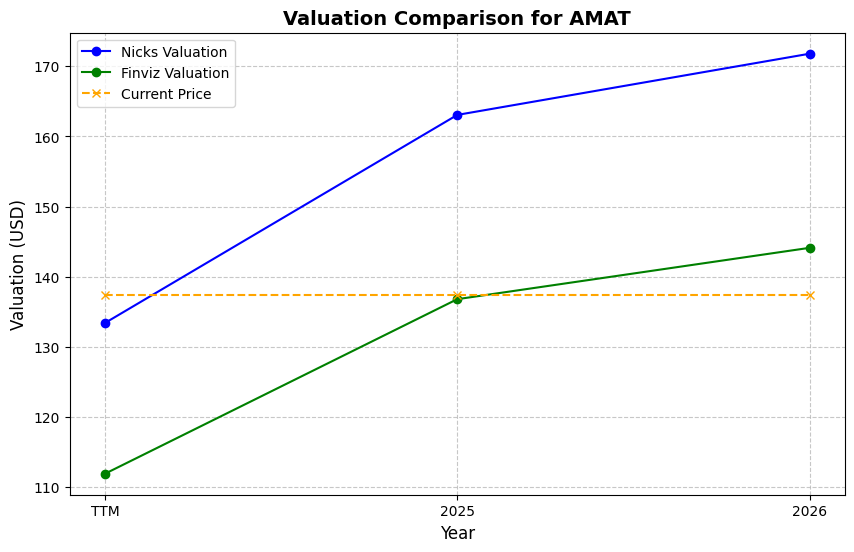

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $372.30 | 4.0% | Nicks Growth: 10% Nick's Expected Margin: 25% FINVIZ Growth: 17% |

Nicks: 18 Finviz: 36 |

Nick's: 4.493 | 13.9 | 38.1 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $9.77 EPS | TTM | $175.59 | -52.8% | $347.17 | -6.8% |

| $10.97 EPS | 2026 | $197.16 | -47.0% | $389.81 | 4.7% |

| $13.69 EPS | 2027 | $246.05 | -33.9% | $486.46 | 30.7% |

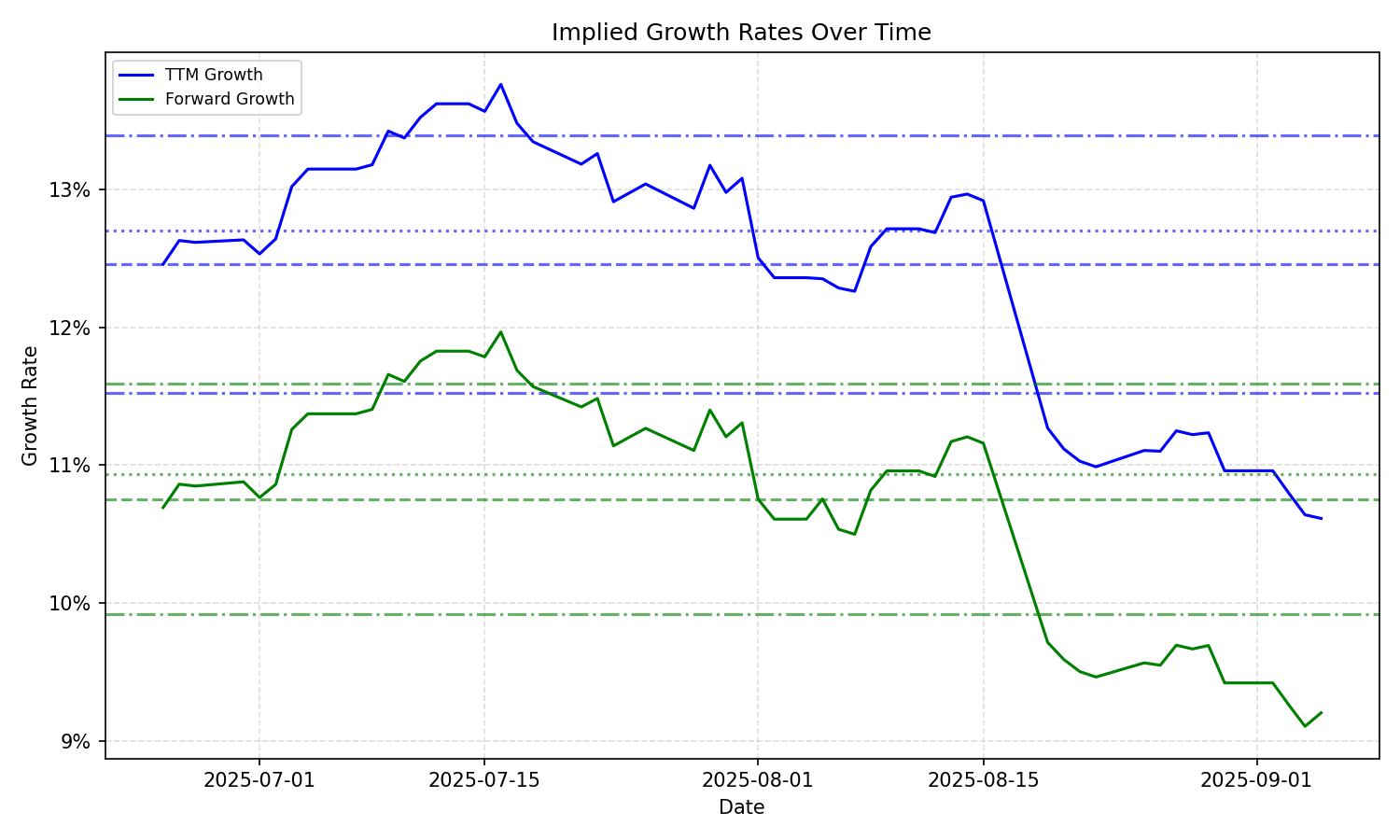

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 14.33% | 12.27% | 14.11% | 12.53% | 2.28% | 1.69% | 18.44% | 14.56% | 96.6% | 88.6% |

| 3 Years | 14.33% | 12.27% | 14.11% | 12.53% | 2.28% | 1.69% | 18.44% | 14.56% | 96.6% | 88.6% |

| 5 Years | 14.33% | 12.27% | 14.11% | 12.53% | 2.28% | 1.69% | 18.44% | 14.56% | 96.6% | 88.6% |

| 10 Years | 14.33% | 12.27% | 14.11% | 12.53% | 2.28% | 1.69% | 18.44% | 14.56% | 96.6% | 88.6% |