American Airlines Group, Inc. — AAL

| Close Price | Market Cap | P/E Ratio | Forward P/E Ratio | Implied Growth* | Implied Forward Growth* | Dividend | P/B Ratio |

|---|---|---|---|---|---|---|---|

| $13.07 | $8.63B | 76.9 | 4.8 | 26.6% | -3.1% | - | -2.3 |

Latest Headlines

- · United Airlines, Delta Stocks Fall. Why Airlines Are Getting Crushed.

- · BC-Most Active Stocks

- · Here's Why American Airlines (AAL) is a Strong Momentum Stock

- · 3 of Wall Street’s Favorite Stocks We’re Skeptical Of

- · What Does the Street Think About American Airlines Group Inc. (AAL)?

- · Airline Stock Bounces Off Key Level As It Sets $1 Billion Miami Expansion

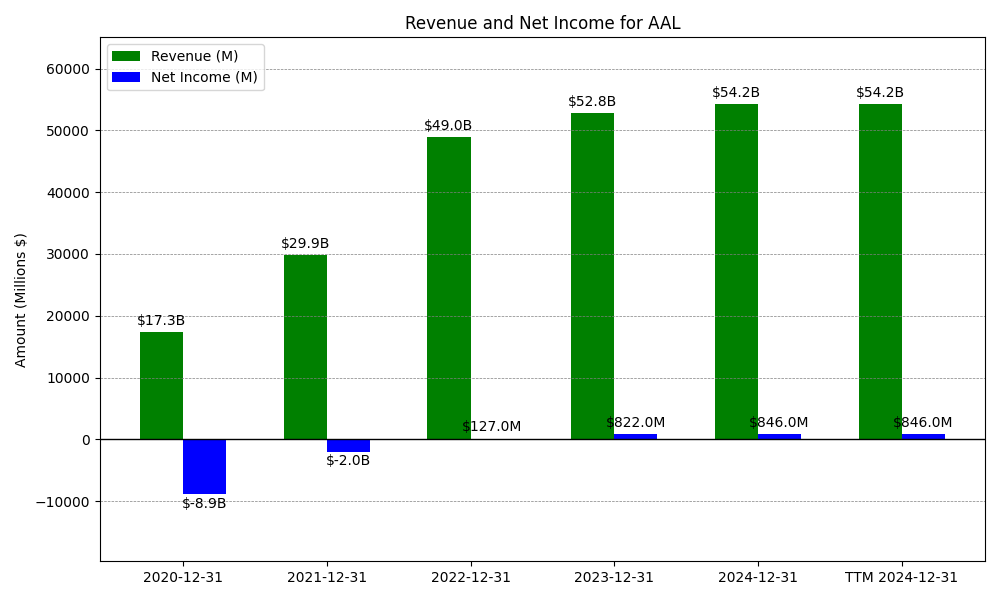

Revenue & Net Income

| Date | Revenue | Net_Income | EPS | Last_Updated | Revenue_Change | Net_Income_Change | EPS_Change | |

|---|---|---|---|---|---|---|---|---|

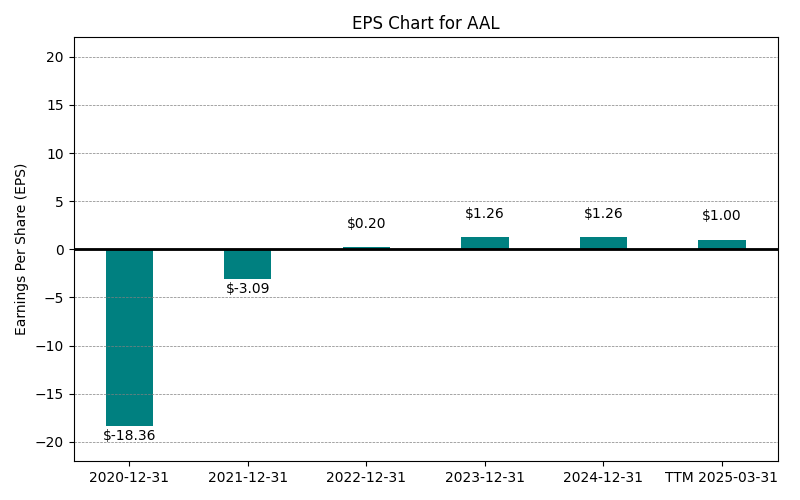

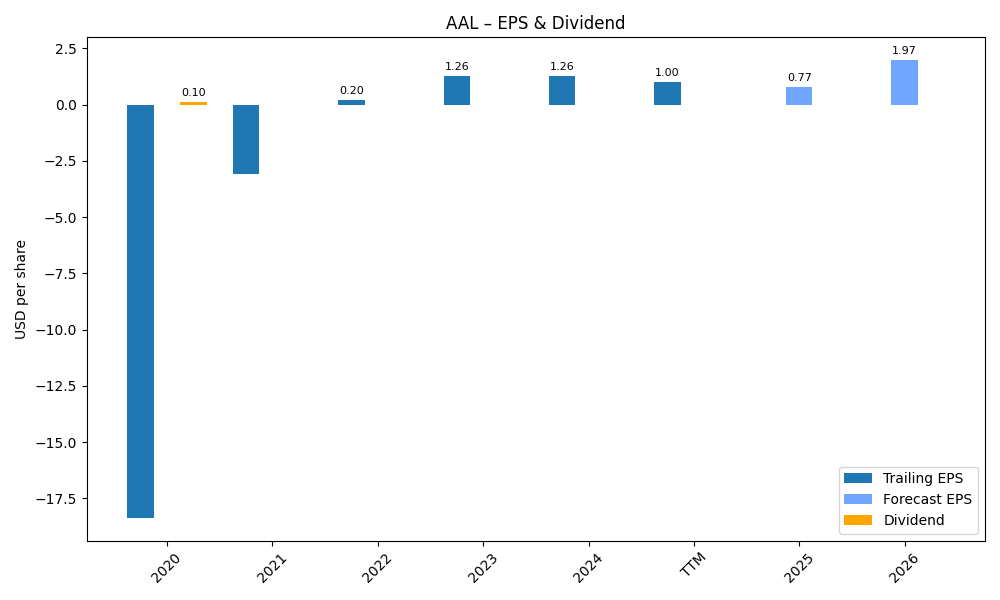

| 0 | 2020-12-31 | $17,337M | $-8,885M | $-18.36 | 2024-02-09 03:58:57 | N/A | N/A | N/A |

| 1 | 2021-12-31 | $29,882M | $-1,993M | $0.20 | 2026-02-27 08:30:36 | 72.4% | -77.6% | -101.1% |

| 2 | 2022-12-31 | $48,971M | $127M | $0.20 | 2026-02-27 21:52:38 | 63.9% | -106.4% | 0.0% |

| 3 | 2023-12-31 | $52,788M | $822M | $1.26 | 2026-02-27 21:52:38 | 7.8% | 547.2% | 530.0% |

| 4 | 2024-12-31 | $54,211M | $846M | $1.29 | 2026-02-27 21:52:38 | 2.7% | 2.9% | 2.4% |

| 5 | 2025-12-31 | $54,633M | $111M | $0.17 | 2026-02-27 21:52:38 | 0.8% | -86.9% | -86.8% |

| 6 | TTM 2025-12-31 | $54,633M | $111M | $0.17 | 2026-01-29 02:31:27 | 0.0% | 0.0% | 0.0% |

EPS

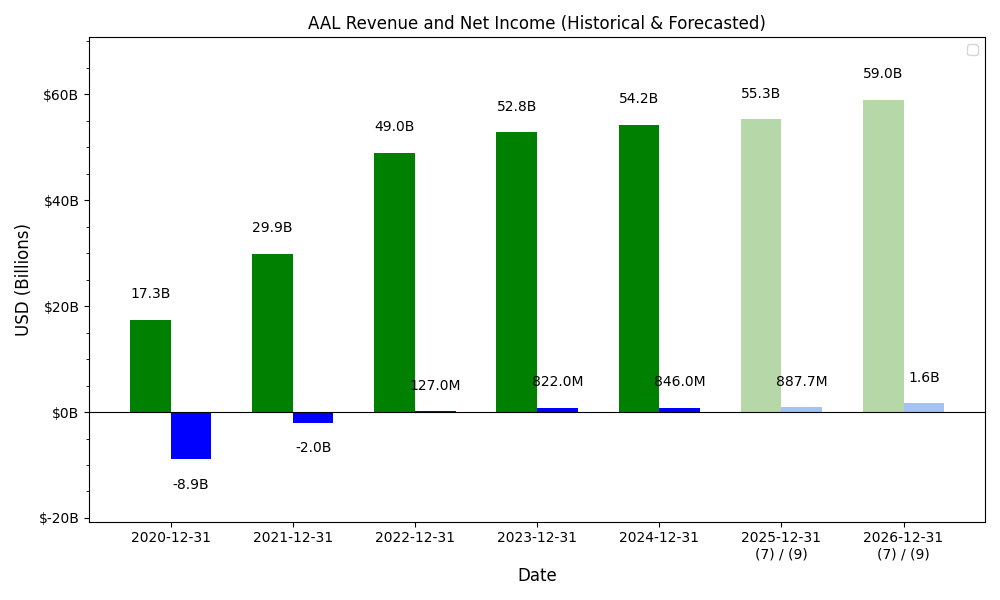

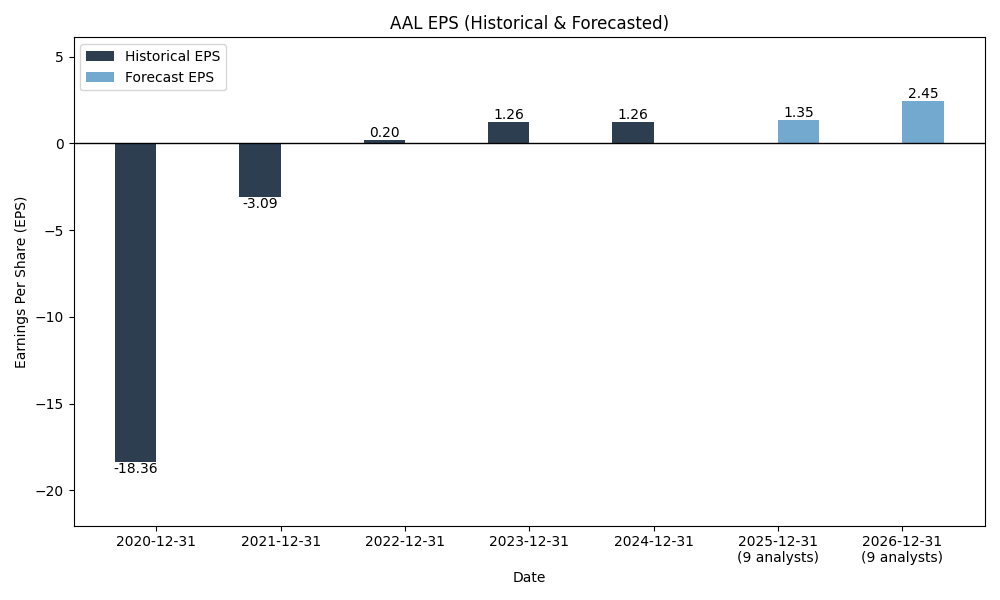

Forecasts

Y/Y % Change

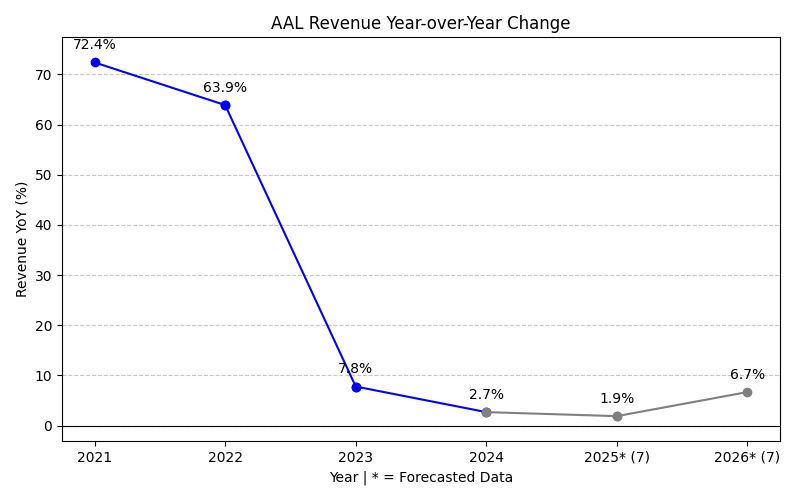

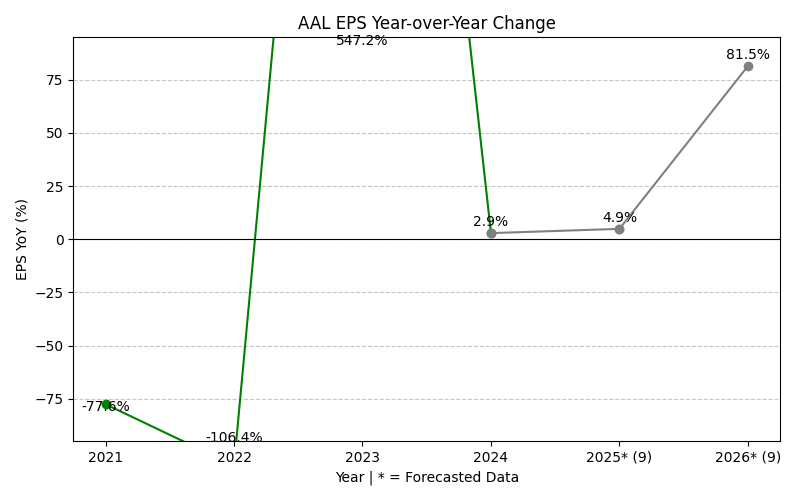

AAL Year-over-Year Growth

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Revenue Growth (%) | 72.4% | 63.9% | 7.8% | 2.7% | 0.8% | 8.8% | 5.0% | 23.1% | |

| Revenue Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 7 | 7 | |

| EPS Growth (%) | -77.6% | -106.4% | 547.2% | 2.9% | -86.9% | 1196.8% | 24.8% | 214.4% | |

| EPS Analysts (#) | 0 | 0 | 0 | 0 | 0 | 0 | 8 | 8 |

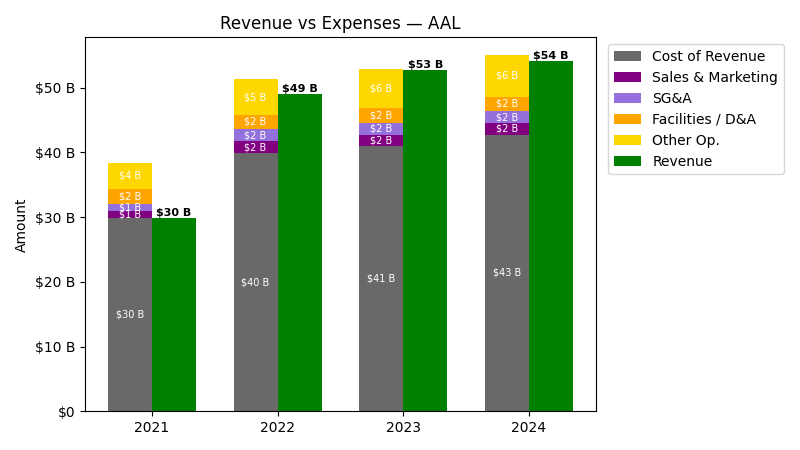

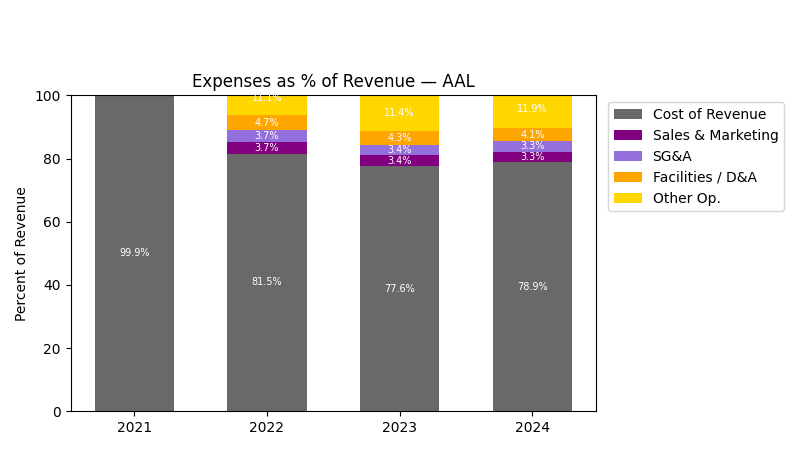

Expenses

| Year | Revenue ($) | Cost of Revenue ($) | Sales & Marketing ($) | SG&A ($) | Facilities / D&A ($) |

|---|---|---|---|---|---|

| 2021 | $29.9B | $27.5B | $1.1B | $1.1B | $2.3B |

| 2022 | $49.0B | $37.6B | $1.8B | $1.8B | $2.3B |

| 2023 | $52.8B | $38.8B | $1.8B | $1.8B | $2.2B |

| 2024 | $54.2B | $40.5B | $1.8B | $1.8B | $2.2B |

| 2025 | $54.6B | $42.0B | $2.0B | $2.0B | $2.2B |

| TTM | $54.6B | $39.5B | $2.0B | $2.0B | $4.7B |

| Year | Revenue Change (%) | Cost of Revenue Change (%) | Sales & Marketing Change (%) | SG&A Change (%) | Facilities / D&A Change (%) |

|---|---|---|---|---|---|

| 2022 | 63.88 | 36.76 | 65.30 | 65.30 | -1.58 |

| 2023 | 7.79 | 3.04 | -0.88 | -0.88 | -4.35 |

| 2024 | 2.70 | 4.56 | 0.72 | 0.72 | 0.00 |

| 2025 | 0.78 | 3.54 | 10.21 | 10.21 | -0.96 |

| TTM | 0.00 | -6.00 | 0.05 | 0.05 | 115.66 |

No unmapped expenses.

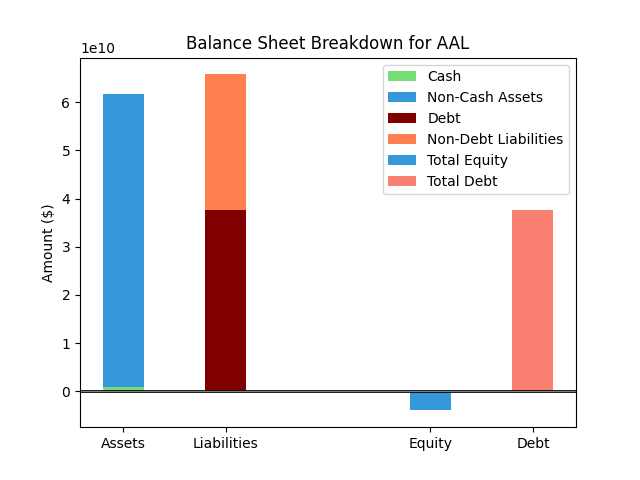

Balance Sheet

| Metric | Value | |

|---|---|---|

| 0 | Total Assets | $62,141M |

| 1 | Cash | $835M |

| 2 | Total Liabilities | $66,103M |

| 3 | Total Debt | $36,064M |

| 4 | Total Equity | $-3,962M |

| 5 | Debt to Equity Ratio | -9.10 |

EPS & Dividend

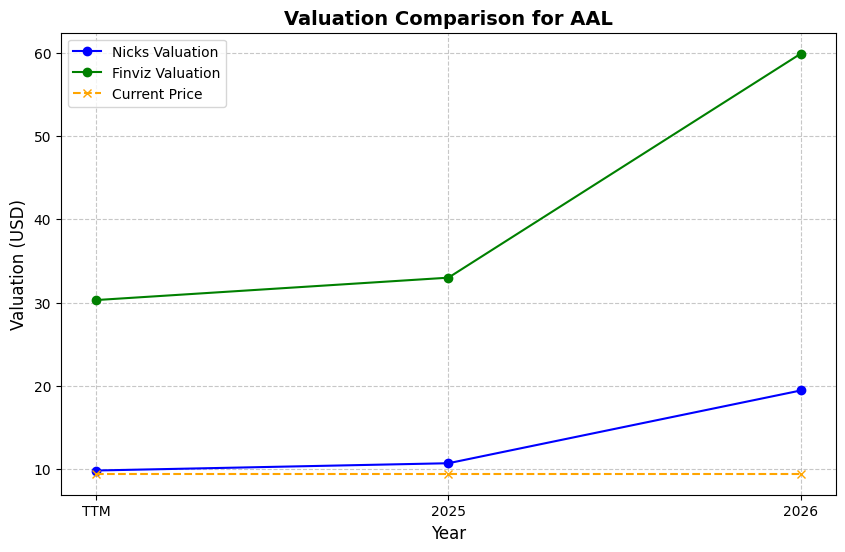

Valuation

| Share Price | Treasury Yield | Estimates | Fair Value (P/E) | Fair Value (P/S) | Current P/S | Current P/E |

|---|---|---|---|---|---|---|

| $13.07 | 4.0% | Nicks Growth: 2% Nick's Expected Margin: 2% FINVIZ Growth: 109% |

Nicks: 8 Finviz: 13287 |

Nick's: 0.164 | 0.2 | 76.9 |

| Basis | Year | Nicks Valuation | Nicks vs Share Price | Finviz Valuation | Finviz vs Share Price |

|---|---|---|---|---|---|

| $0.17 EPS | TTM | $1.39 | -89.3% | $2258.78 | 17182.1% |

| $2.18 EPS | 2026 | $17.88 | 36.8% | $28965.47 | 221518.0% |

| $2.72 EPS | 2027 | $22.31 | 70.7% | $36140.40 | 276414.2% |

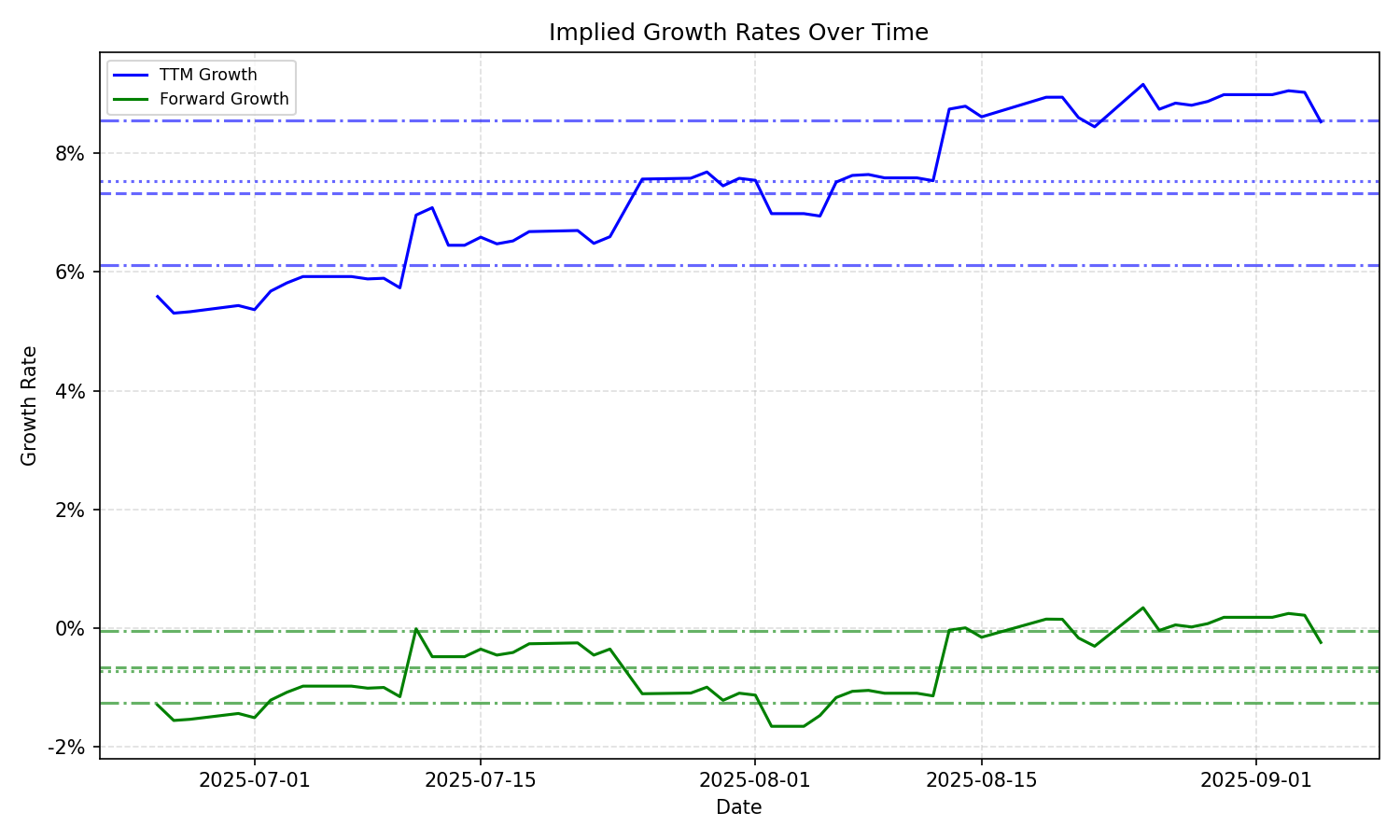

Implied Growth

| Average | Median | Std Dev | Current | Percentile | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | TTM | Forward | |

| Timeframe | ||||||||||

| 1 Year | 9.96% | -0.28% | 8.35% | -0.41% | 5.74% | 1.30% | 27.44% | -2.48% | 95.4% | 3.4% |

| 3 Years | 9.96% | -0.28% | 8.35% | -0.41% | 5.74% | 1.30% | 27.44% | -2.48% | 95.4% | 3.4% |

| 5 Years | 9.96% | -0.28% | 8.35% | -0.41% | 5.74% | 1.30% | 27.44% | -2.48% | 95.4% | 3.4% |

| 10 Years | 9.96% | -0.28% | 8.35% | -0.41% | 5.74% | 1.30% | 27.44% | -2.48% | 95.4% | 3.4% |